The Week Ahead 8/3/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful remainder 2H of ‘25.

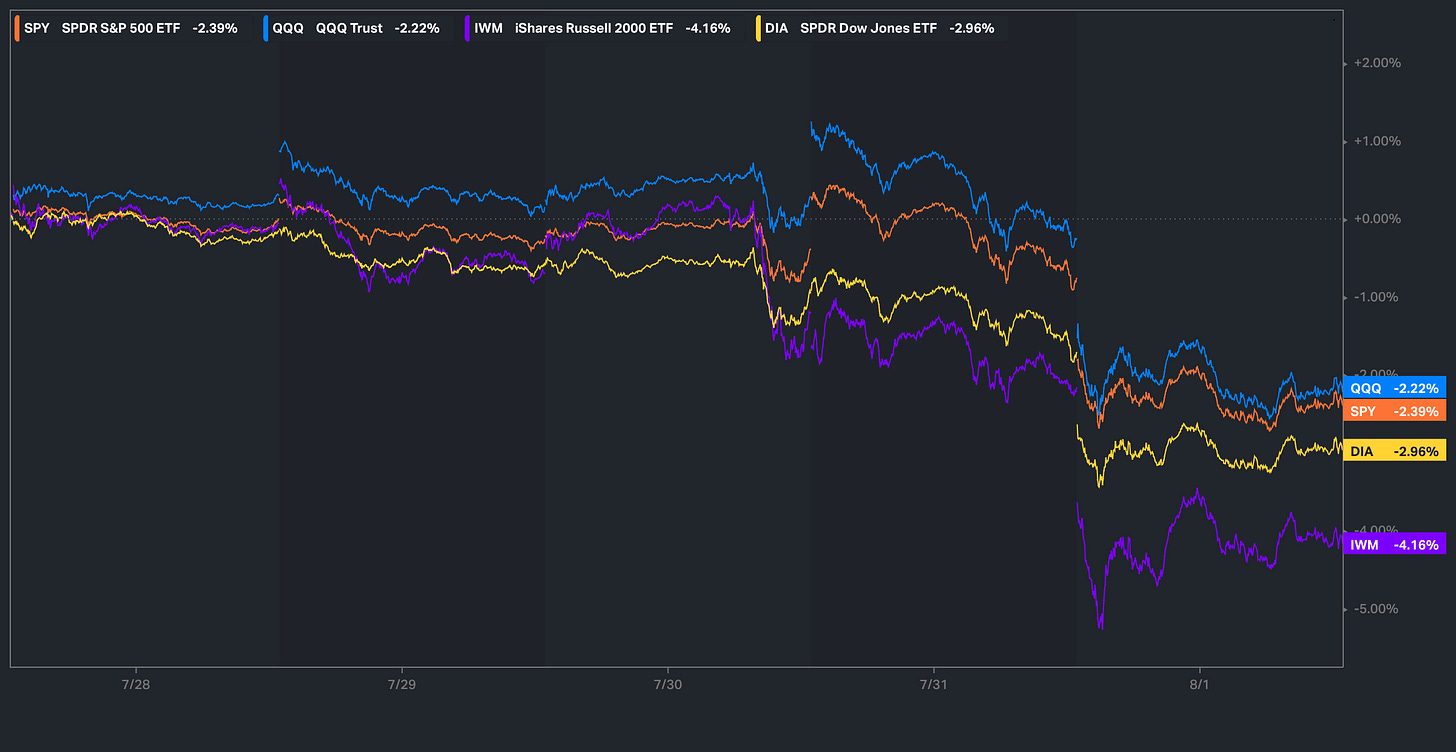

This past week was a fairly jam-packed week in respect to economic data & events, yet it was mostly a quiet week as the indices traded relatively flat with Small-caps & the Dow being the relative laggards but volatility picked up into Friday following the payrolls report which came in slightly softer than expected but the bigger story came from the larger revisions for both the May & June jobs reports which essentially were revised 90% lower hence a bit of panic was created & just as individuals were making the case for no rate-cuts to be made for ‘25, we’re right back to 2-cuts being priced in.

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a fairly quiet week ahead as we come off a jam-packed week from the prior week, but nevertheless, focus will likely continue to shift towards Fed speakers potentially continuing to lay the groundwork following Friday’s jobs data along with the large revisions for a September cut & the next bigger datapoint isn’t until the following week which is when we’ll get more insight on CPI & whether or not if we’re continuing to see a pickup in goods inflation as tariffs start to show a more meaningful impact & or if the impacts continue to remain relatively muted.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 137.14% return whilst in the same period, the Q's have returned 56.80% / Spooz has returned 47.94% / Dow has returned 33.82% & Small-caps have returned 21.92%, so nice outperformance against all the indices whilst having a 82.1% win rate, averaging a 23.68% return on realized gains / winners & a 14.48% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

To jump right into it, this past week was a relatively quieter one up until Friday following the large payroll revisions, but prior to that, the bigger underlying theme within the indices was the continued weakening of breadth despite the slow churn / grind higher driven by a select few names / mostly the Mag-7. And surprisingly enough, following the Friday decline which led Spooz specifically to close out the week lower by just over 230bps & now down just over 300bps from ATHs, the % of stocks above the 20D finished off near 25% (oversold territory) whereas the April bottom was near 10% with Spooz in a 20% correction off the highs… the wide-gap / discrepancy more so shows how narrow the recent rally has become & overall upside participation has been quite lackluster & this past Friday’s rinse out may have been what was needed for breadth to finally reach & or at least get close to finally making a bottom.

And again, the recent issue has been the extreme crowding within the Mag-7 and a handful of mega-cap names & whilst the crowding has made the market *look strong on the surface, in reality, it’s siphoned liquidity from the broader S&P 493 & the result has led to the general weak participation within the indices, and the Mag-7 can only carry so much weight & Friday & maybe into this week is where exhaustion may finally set in before we can start to see capital rotate elsewhere & gradual improvement of breadth (potentially driven by rate-cut fever).

Into the upcoming week, it’s a fairly quiet week in respect to economic data / earnings season ahead & the bigger factors to likely pay attention to will be the upcoming Fed speakers, because as of now, there is an 80% chance of the Fed cutting in September after being under 40% post-FOMC… oh how quick the pendulum swings yet again. And we’ve already seen some comments from the Fed highlighting the shift to a dovish tone:

- New York Fed President John Williams: Open to Interest Rate Cut Ahead of September Meeting - WSJ