The Week Ahead 9/14/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful remainder 2H of ‘25 as we nearly round off into Q4.

This past week ended up being a relatively quieter one with no specific surprises out of PPI & or CPI #’s & with majority of the important economic data now being within the rearview mirror, that just leaves us with FOMC ahead into the upcoming week along with PCE #’s into the remainder of September but for the indices, the same story has continued on as the recent slow churn / general grind higher has led both Spooz & the Q’s to achieve continued new ATHs with yet another new ATH being reached this past Friday along with the Dow as well whereas Small-caps are within 250bps of achieving a new ATH & finally for a change given Small-caps have dominated as of late, the Q’s went on to be the best performing of the indices, closing higher by 200bps, whereas Small-caps were the ‘worst’ performing although still closed higher by just over 30bps.

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a fairly quieter week ahead with just Retail Sales taking place earlier on in the week along with FOMC on Wednesday & lastly, just the standard Jobless Claims report on Thursday which will be interesting in terms of a potential confirmation of the rise in last weeks claims & or a retreat right back lower due to the distortion of the rise in Texas / with it being Labor Day weekend as well.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 153.97% return whilst in the same period, the Q's have returned 63.89% / Spooz has returned 55.79% / Dow has returned 41.15% & Small-caps have returned 35.34%, so nice outperformance against all the indices whilst having a 82.3% win rate, averaging a 25.08% return on realized gains / winners & a 14.44% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into the week ahead, to look back at this past week, there were initial concerns about inflation data with both PPI & CPI #’s being reported given the general worries of tariffs having a potential more meaningful impact on inflation, thus leading to an uptick, but that just wasn’t the case… PPI #’s earlier on in the week ended up coming in softer than expected which wasn’t TOO much of a surprise given the prior report had been distorted due to the surge in portfolio mgmt. fees, but this print instead was the complete opposite as portfolio mgmt. fees retreated lower along with energy being another big downside contributor as well, & in terms of the PCE components, they were all relatively tame too which should be a generally good read-through for PCE as well:

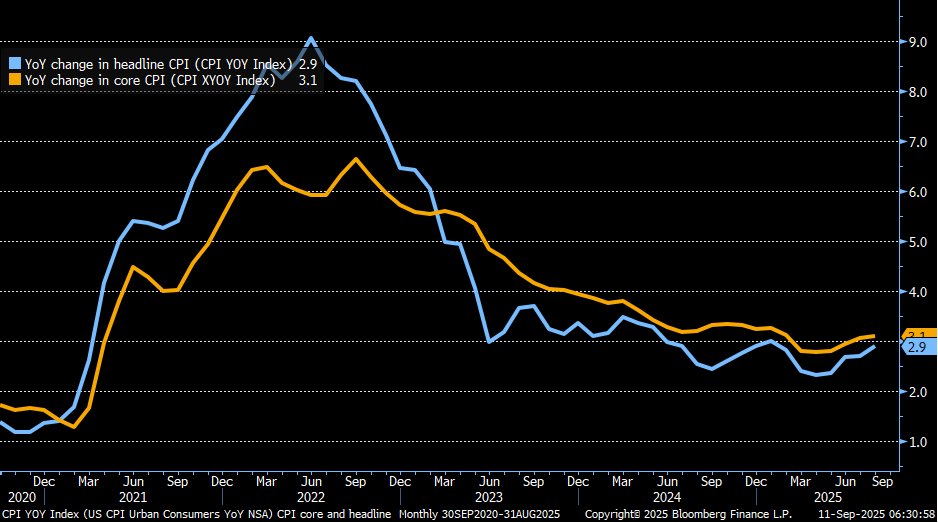

In terms of CPI, the print came inline with Headline coming in at 2.9% along with Core having came in at 3.1% & once again, although we did see headline tick up from the prior month, it was generally expected & overall, both PPI & CPI #’s turned out to be much better than what was initially anticipated heading into this past week as the general tariff passthroughs continue to be muted which more so points to the signal that firms are likely still eating costs rather than passing through to the consumer.

And with overall inflation data having been much better than feared, the other side of the equation in which continues to amplify with worries is the economy continues to look like it’s slowing partly due to a normalization within the labor market due to the administration’s immigration policies but nevertheless, those concerns have continued to amplify into slowing growth concerns although not quite recessionary & heading into the upcoming week, given inflation remained tame enough with growth / labor market generally continuing to point signs toward deterioration, it should lead Powell to keep the same tone in which he had at Jackson Hole: Prioritizing growth > inflation whilst acknowledging for inflation to likely be a one-time price shock rather than a persistent rebound (Given recent jobs data, a hawkish cut is likely off the table / 3-cuts as of now remain expected into EOY).

And again, with recent inflation data having been better than feared along with an accommodative Fed to recent slowing growth concerns, as we’ve reiterated several times in the past but financial conditions have loosened drastically which has been additional upside fuel for equities as dips in general have continued to remain very shallow & bought & rounding off into this past week, both Spooz / Q’s / Dow all finished at new ATHs & Small-caps aren’t too far behind either & sit just over 200bps below the prior ATHs made in November of this past year following Trump having won the election.

And yes, financial conditions are nearly as loose as they were in December ‘21… (Very stimulative for assets in general).