The Week Ahead 9/21/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & and I wish you all a successful remainder of the year as we nearly round off ‘25 into Q4.

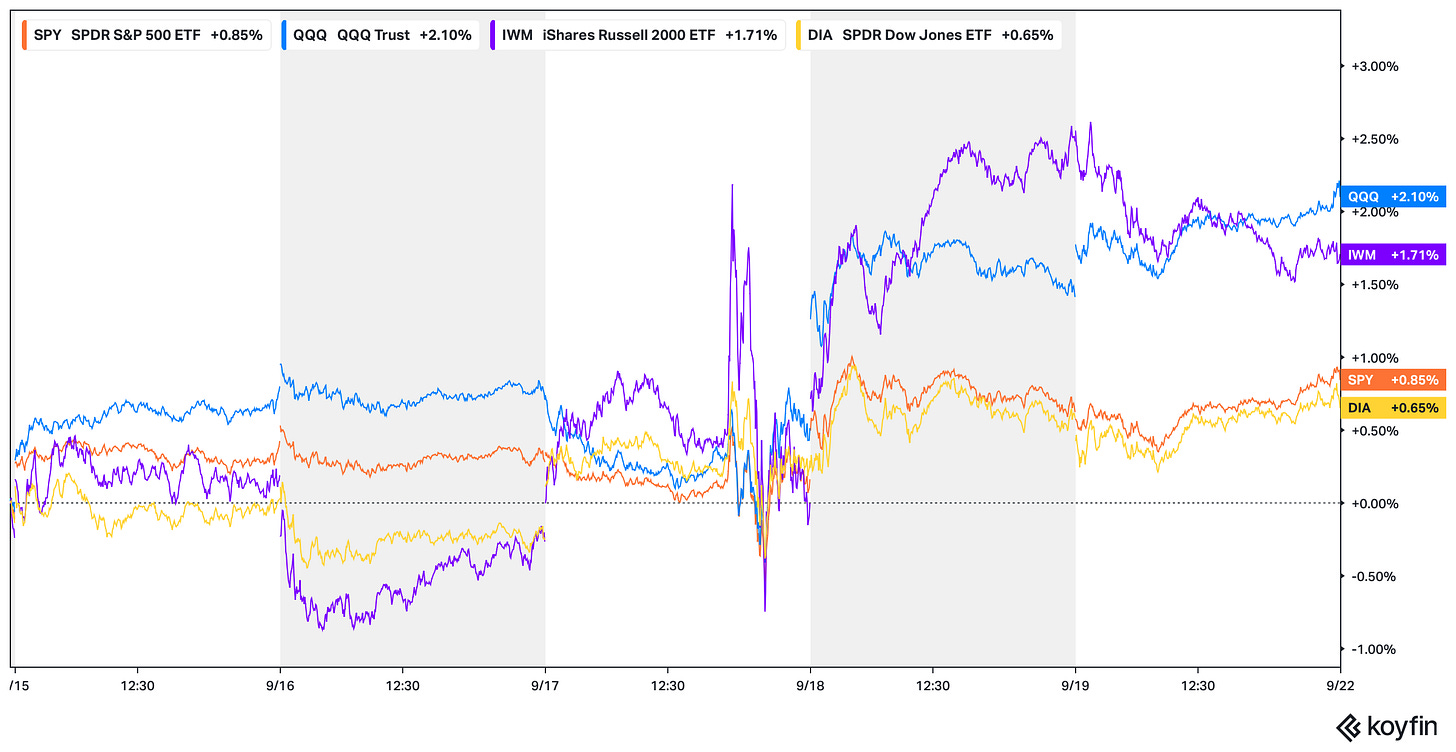

This past week, we finally made it through the long awaited FOMC meeting (No surprises, 25bps cut & guided for an additional 50bps of cuts into year-end), but besides that, it was a relatively tame week in regard to vol as the recent & continued slow churn higher within the indices persists as all of the indices have now officially made a new ATH but the Q’s ended up being the best performing of the indices on the week, closing higher by 210bps, whereas the Dow was the ‘worst’ performing of the indices although still closed higher by 65bps on the week.

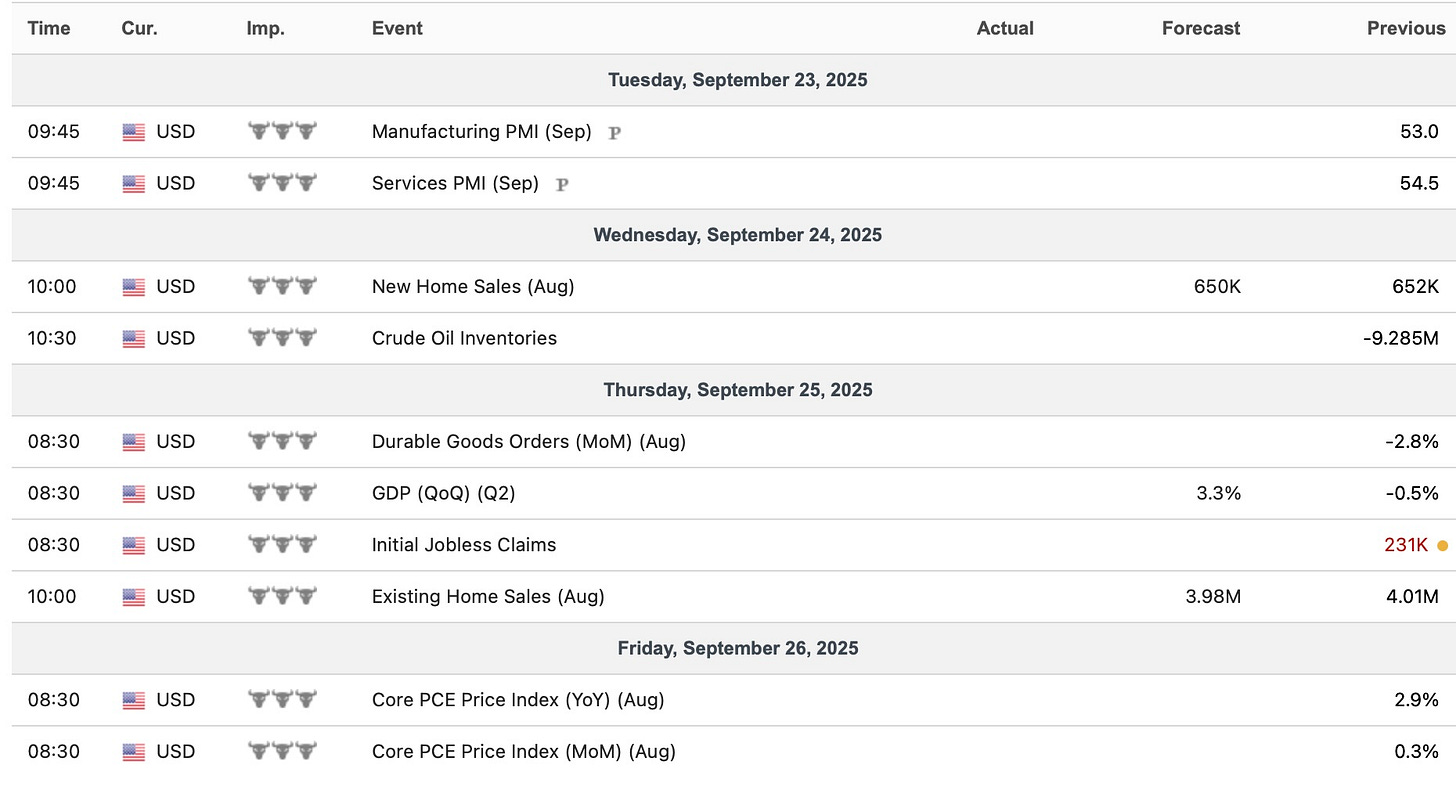

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a fairly quieter week ahead with just PCE #’s on Friday as the ‘biggest’ event of the week along with some minor sporadic datapoints in between as well.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 160.65% return whilst in the same period, the Q's have returned 67.40% / Spooz has returned 57.28% / Dow has returned 42.26% & Small-caps have returned 38.37%, so nice outperformance against all the indices whilst having a 82.6% win rate, averaging a 25.73% return on realized gains / winners & a 14.44% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into it, looking back at this past week, we finally had the long-awaited FOMC meeting in which the Fed finally resumed the rate-cut cycle & to no surprise given it was a relatively telegraphed meeting (25bps cut / Guide for an additional 50bps of cuts into year-end), Spooz ended up closing lower by 9bps whereas the straddle for the day was 70bps & even on the week, the straddle was 110bps yet Spooz closed higher by just 85bps… the slow churn / grind higher with relatively lower-vol continues.

In terms of the Federal Reserve’s updated forecasts following FOMC this past week, growth was revised higher for ‘26 (1.6% to 1.8%) / Core PCE was revised higher (3% in ‘25 / 2.6% in ‘26 & 2.1% in ‘27, essentially meaning inflation will have remained above target for 7-years) / The UER is expected to rise to 4.5% but then after the short-term blip, it's expected to head back lower & FINALLY, the projected rate path was all revised lower as well with 3.6% expected by year-end / 3.4% by end of ‘26 & 3.1% by end of ‘27… this is despite having revised both growth & inflation higher. We know the administration wants to ‘run it hot’ & Miran objectively made that clear by dissenting for a 50bps cut (Of course stated no political influence but…) & on that note, what’s going to happen when Trump goes ahead & selects Powell’s replacement? It’s fairly clear he’s going to pick an individual whom wants to lower rates & Miran’s dissent was arguably a ‘sneak peak’ of the administration’s influence on the Fed (Maybe the next Fed Chair)?

Looking back at Powell’s speech, there was several debates on whether or not the speech was perceived as ‘hawkish’ & I included a few standout quotes below from the speech:

- Fed's Powell: Labor market is softening, don't need it to soften more, don't want it to

To rephrase, Powell is essentially stating there is a ‘Fed Put’ in the labor market as further softening from current levels (UER 4.3%) remains unwanted. Powell made it fairly clear within his speech that the Fed is generally concerned about the labor market here.

- Fed's Powell: Base case is tariff impact on inflation short-lived

Similar acknowledgment as to Jackson Hole, but in general, Powell is still expecting the recent bump in inflation to be short-lived rather than persistent.

- Fed's Powell: Could think of today's cut as a risk management cut

This was the statement that stirred up quite a bit of controversy in terms of being received as hawkish but I’d argue last weeks cut is similar to the cut made at the September FOMC this past year in terms of an insurance cut to account for recent growing downside risks to the labor market.

And on that note, if the Fed is cutting depsite the recent re-acceleration within inflation, nothing about that makes it ‘hawkish’ & if anything, you can argue it could be percieved as even more dovish as the Fed is essentially trying to ignore & look past inflation re-accelerating in order to be accomodative for the labor market as further deterioration remains unwanted.

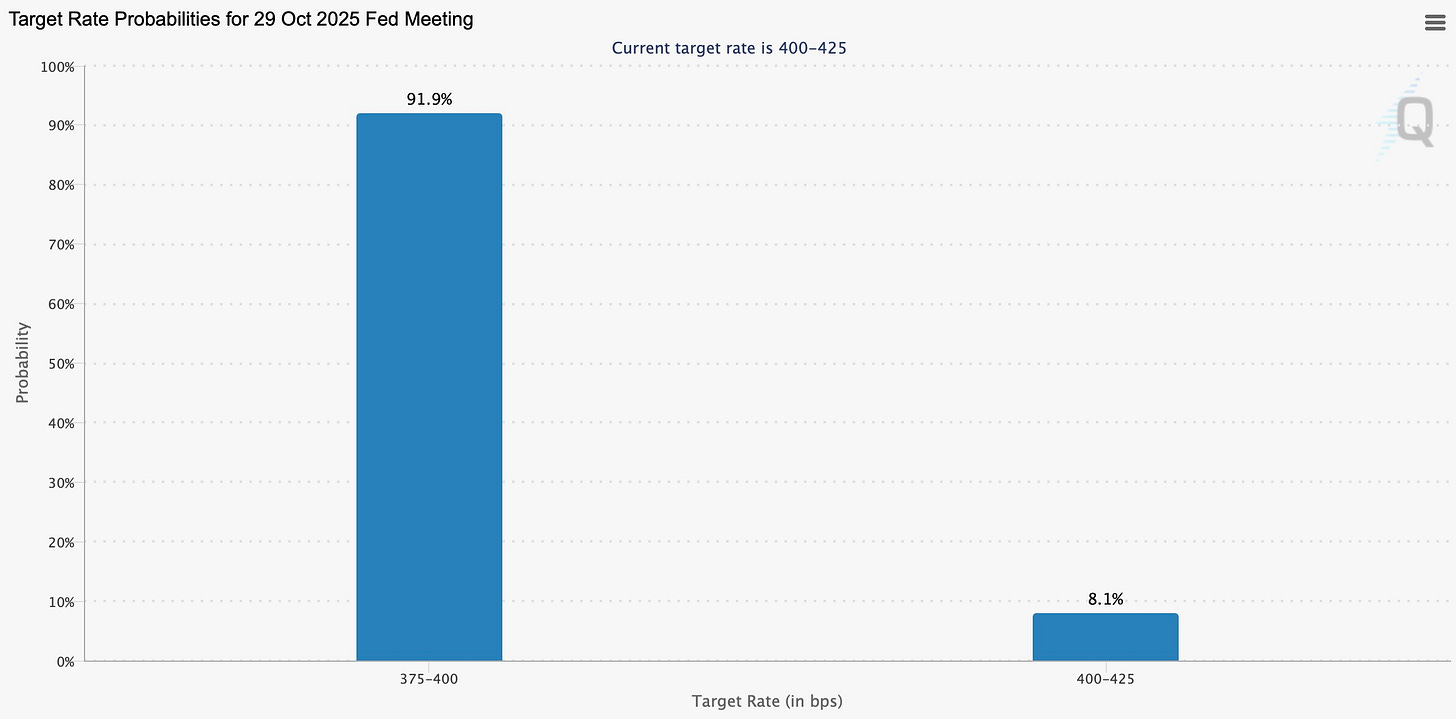

Following the FOMC meeting from this past week, current odds for a 25bps cut at the October meeting sit near 92% whereas odds for the Fed remaining on pause sit at just 8%. With the Fed’s focus continuing to shift toward growth concerns rather than inflation, the incoming jobs data in the beginning of October will likely be quite important given recent reports have been soft although partially distorted given immigration effects as the actual breakeven rate is much lower (Powell stated 0-50k) whereas I’d still argue inflation is kind of in the rearview mirror for now at least (Looking through data as one-time price shock is expected & the Fed’s bet is inflation won’t prove to be persistent).