The Week Ahead 9/28/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 into Q4.

This past week ended up being a relatively quieter one all things considered as it was mostly a light week free of economic data / general event risks with more so just a plethora of Fed speakers of mixed Dovish / Hawkish commentary along with just PCE #’s in the latter part of the week in which had no specific surprises & all around, the indices mostly performed inline / closed slightly lower on the week with the Dow being the ‘best’ performing of the indices although still closed lower by 14bps whereas Small-caps were the ‘worst’ performing of the indices although only closed lower by 67bps & thus far as we round off into the remainder of September, the feared ‘weak’ seasonality has yet to materialize & has mostly been a dud as the indices in general have continued to maintain the pattern of dips being shallow & bought as the indices continue their slow churn / grind higher.

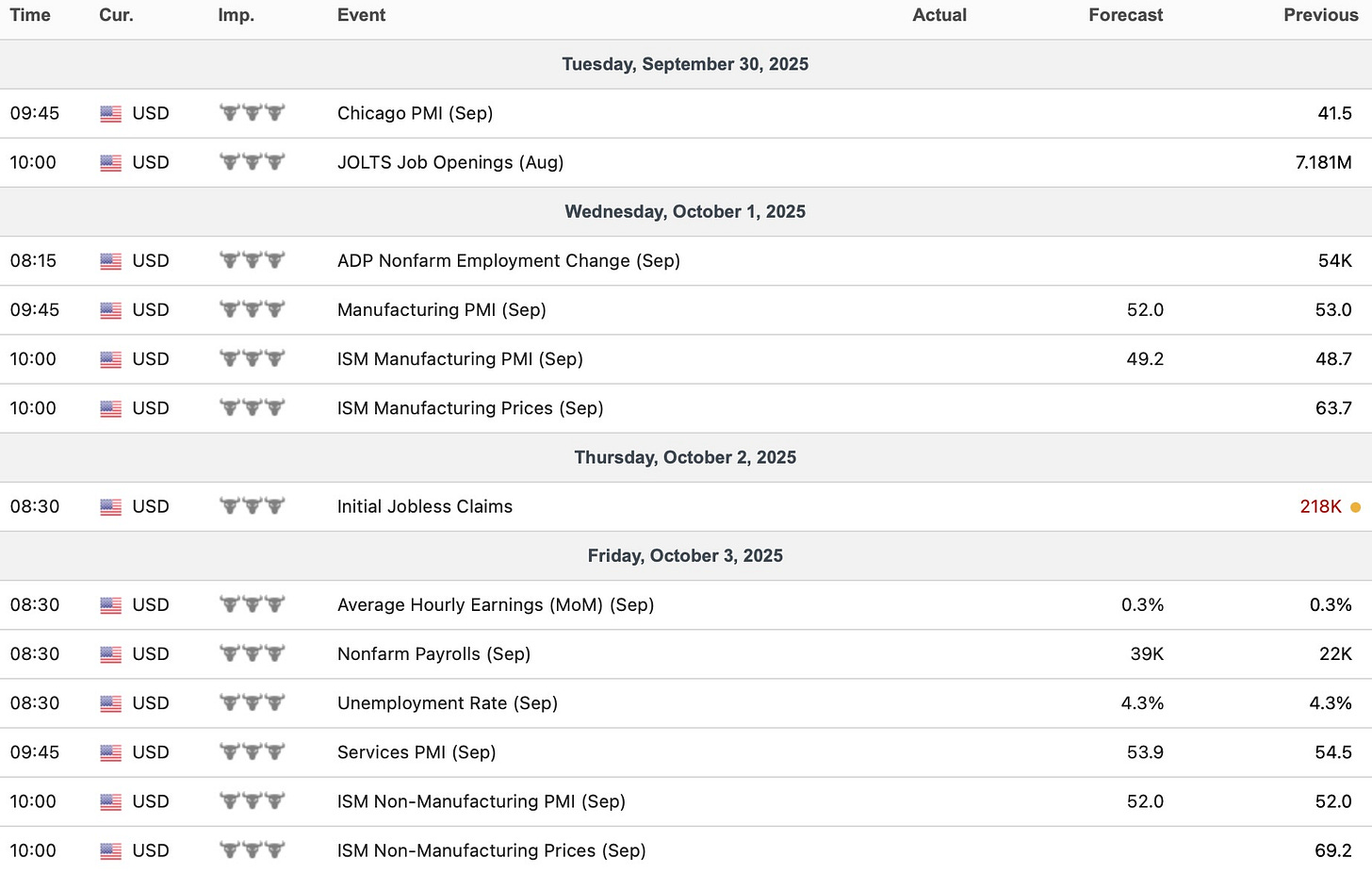

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a bit of an interesting one given recent slowing growth concerns as we have a good chunk of labor market / jobs data with the most important # being on Friday with NFP as jobs are expected to come in at 39k vs. 22k the prior month whereas the UER is expected to remain unchanged at 4.3%.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 160.73% return whilst in the same period, the Q’s have returned 66.25% / Spooz has returned 57.27% / Dow has returned 42.46% & Small-caps have returned 37.43%, so nice outperformance against all the indices whilst having a 82.7% win rate, averaging a 25.97% return on realized gains / winners & a 14.44% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into the week ahead, looking back at this past week, as we had mentioned earlier on but it ended up being a fairly quiet week all around as there wasn't necessarily much economic data of significance reported & it more so was just a plethora of Fed speakers with mixed dovish / hawkish signals (Arguably a bit of a political war), but nevertheless, one of the more interesting datapoints on the week was the surge within New home sales as August sales jumped 20.5% m/m compared with expectations for a slight decline (-0.3%)… as we stated this past week, maybe this # will ultimately end up getting revised back lower, BUT don’t necessarily think the #’s are too far fetched given mortgage rates did ultimately make 1-year lows & a plethora of individuals whom have been flushed with cash have been waiting for lower rates rather than lower prices (Wealth Effect) & one would expect this general trend to continue on if mortgage rates can steadily inch lower (5-handle would likely spur a lot more demand & so on).

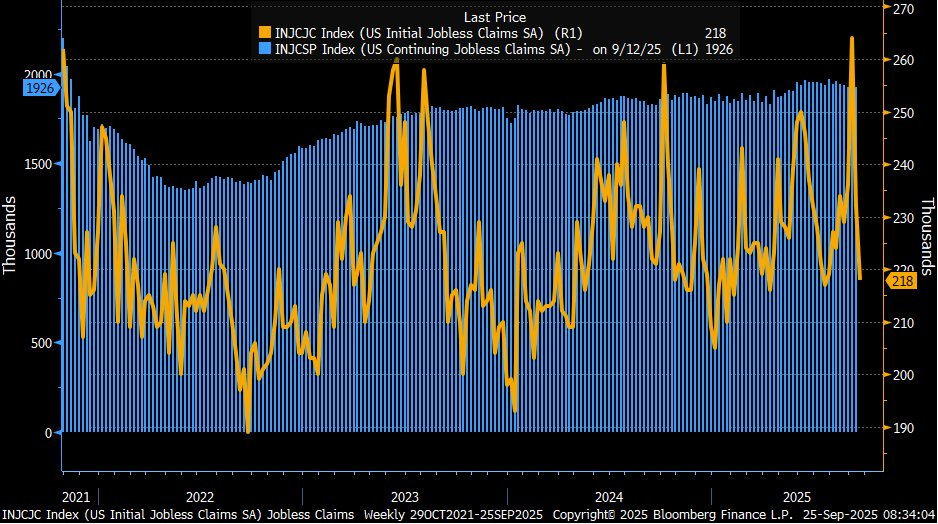

Another interesting datapoint on the week was Jobless Claims snapping right back lower coming in at 218k after initially having spiked higher above 260k earlier on in September which some individuals interpreted as underlying labor market weakness whereas we instead pointed out the spike to likely have been a false signal given the distortion due to Texas along with it having been Labor Day weekend as well & sure enough, claims have reverted right back lower although it does still continue to be a slow to hire / fire market.

And rounding off this past week in regard to PCE #’s, there were no specific surprises as headline came in at 2.7% vs. 2.7 expected & core came inline as well at 2.9%… the indices ended up rallying following the report as it was more so viewed better than feared & with the Fed continuing to emphasize that the general expectations toward inflation are expected to be a one-time price shock, it makes the viewpoint on recent slowing growth concerns that much more important… especially as we head into the upcoming week with NFP #’s along with other specific job / labor market datapoints as well.

And as we get ready to head into the upcoming week, there are looming concerns of a potential government shutdown but more importantly in regard to economic data, again, we have NFP #’s on this upcoming Friday which as of now, jobs are expected to come in at 39k vs. 22k the prior month whereas the UER is expected to remain unchanged at 4.3%. We’ve covered several times on how big of a role immigration has played on the labor market in terms of the administration’s policies which has inherently lowered the breakeven rate substantially from 150k prior earlier on in the year whereas Powell now thinks the breakeven rate is within the 0-50k range (Even the breakeven estimates below were higher than Powell stated)… general point being, we continue to emphasize the labor market is undergoing a normalization period (although certainly is signs of slowing as well) which arguably makes the UER that much more to pay attention too, especially into the upcoming week, but as the Fed has stated, further weakness / deterioration of the labor market from current levels still remains unwanted (Any signal of softness within labor data this week will solidify an October cut) & as long as the recent slowing growth concerns remain, emphasis on jobs data rather than inflation data will likely remain.

Moving along into the indices, again, this past week was a relatively quieter one all around but one of the more interesting factors is despite the indices being just off ATHs, due to the continued underlying rotations within the markets (Small-caps & Cyclicals → Tech → Small-caps & Cyclicals), conditions in the shorter-term aren’t necessarily ‘overbought’ as the % of stocks above the 20D still sits just at 49% which is essentially within neutral territory as again, the distortion is more so due to the continued dispersion / underlying rotation within the indices rather than ‘everything’ rallying all at once.