The Week Ahead 9/7/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful remainder 2H of ‘25 as we nearly round off into Q4.

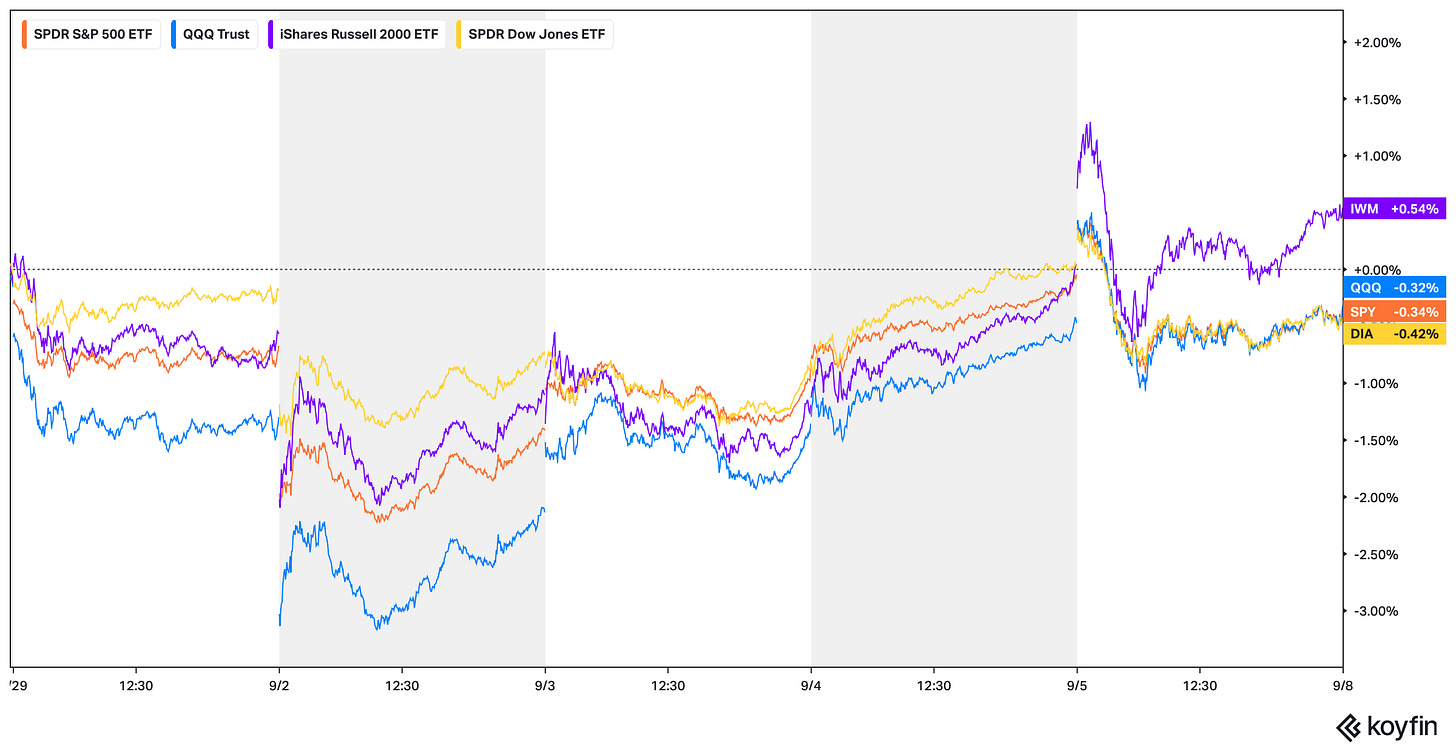

This past week ended up being a relatively quieter one despite the plethora of jobs / economic data & initially coming into the week, there was ‘worries’ & or global fiscal concerns following the rise within global yields which more so felt like a ‘narrative chase’ as we had called out for earlier on in the week & that instead proved to be a nothing-burger & more so marked the low for the week & rounding off into the end of the week, jobs ended up coming in softer than expected although not TOO soft which allowed for IWM / Small-caps & Cyclicals to more so be the best performing of the indices closing higher by just over 50bps whereas the remainder of the indices closed slightly lower within the 30-40bps range, but all around, it was a generally quieter week all things considered.

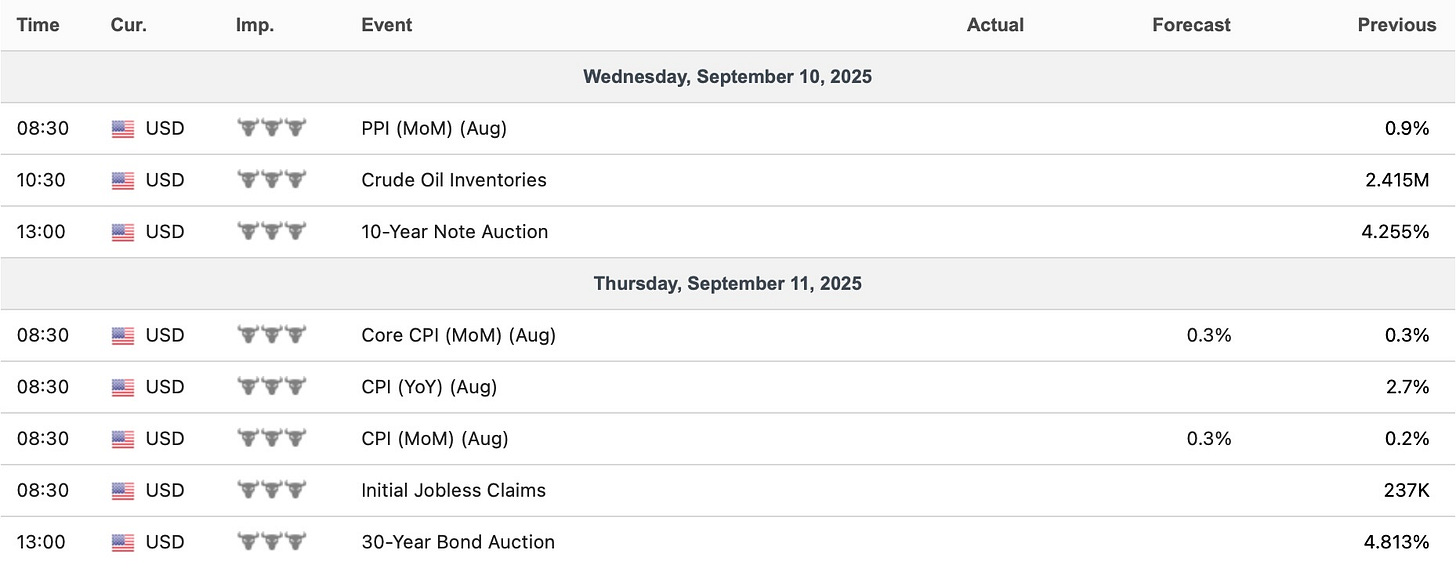

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a fairly quieter week ahead with just PPI & CPI #’s taking place & with recent focus instead shifting to worries & or concerns about slowing growth along with inflation generally being expected but rather a one-time price shock rather than persistent per Powell, the data likely won’t be of too much concern barring a BIG upside surprise / shock.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 150.23% return whilst in the same period, the Q's have returned 60.89% / Spooz has returned 53.38% / Dow has returned 39.82% & Small-caps have returned 35.02%, so nice outperformance against all the indices whilst having a 82.2% win rate, averaging a 24.97% return on realized gains / winners & a 14.44% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.