Trump Frenzy Underway

Hello All,

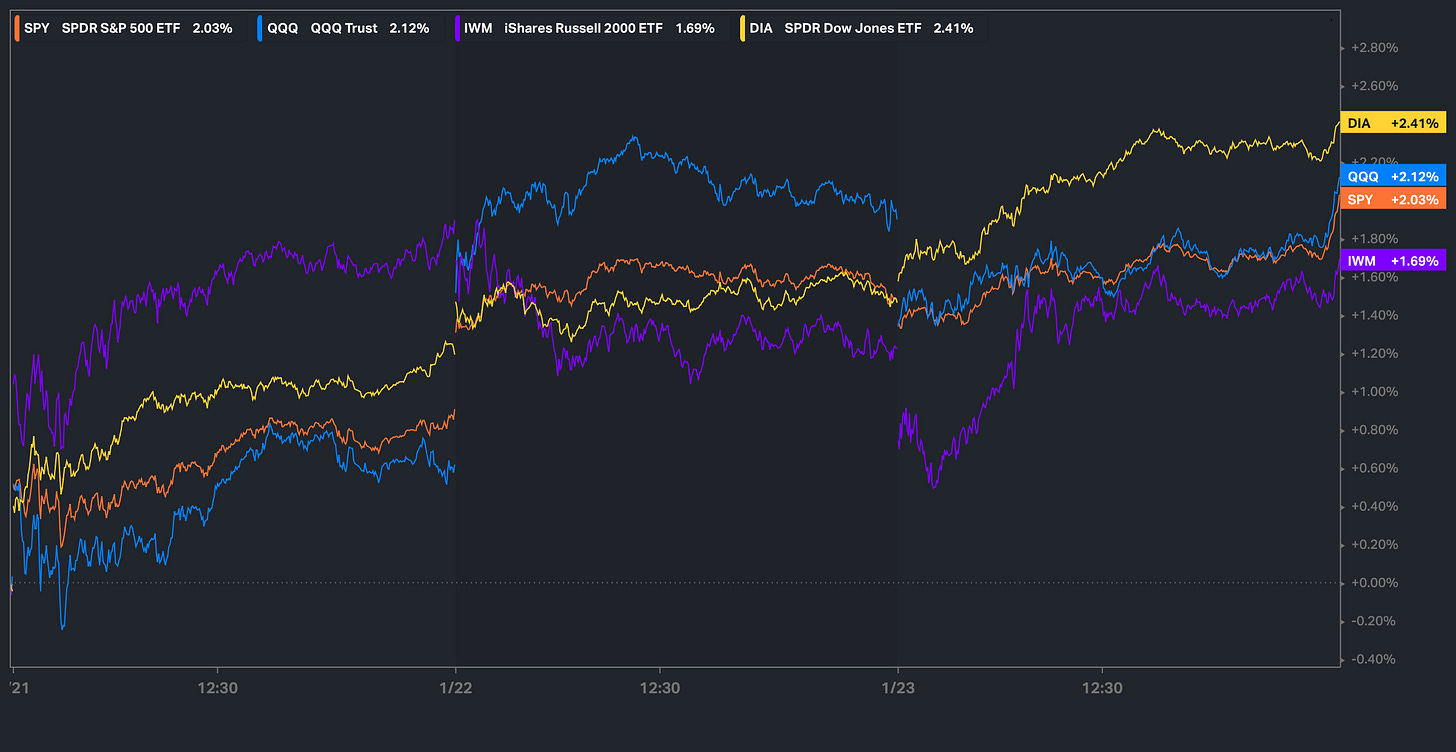

As the week has progressed, Spooz has finally worked its way to new highs as it closed out the day above 6100+ & is now up over 350+ handles off the lows & its been a fairly good week for the indices across the board with the Dow leading the way as it currently sits up just under 250bps & Small-caps thus far being the under-performer on the week, but they still remain higher by around 170bps on the week.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, earlier this week, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

I’m not going to waste much more time & am going to jump right into the recap below.

- SPY

It’s been a fairly quiet week in respect to economic data given its been a shortened week as markets were closed Monday & majority of the more important economic data is next week with FOMC along with PCE #’s… heading into the remainder of the week, we do have a BOJ meeting tonight, which is raising a few eyebrows given the deja vu from July / August of ‘24, but as we spoke about within the week ahead, its a much different setup & arguably not very comparable as the BOJ hike was then followed by a growth scare in the U.S. & as of now, U.S. economic data continues to hum along / we continue to have blowout job reports along with the UER ticking lower this past report, so I don’t think there is too much worries in that aspect… still wouldn’t surprise me if BOJ does hike but poses a more dovish stance, as again, BOJ even said themselves that they do not want a repeat of Summer of ‘24.

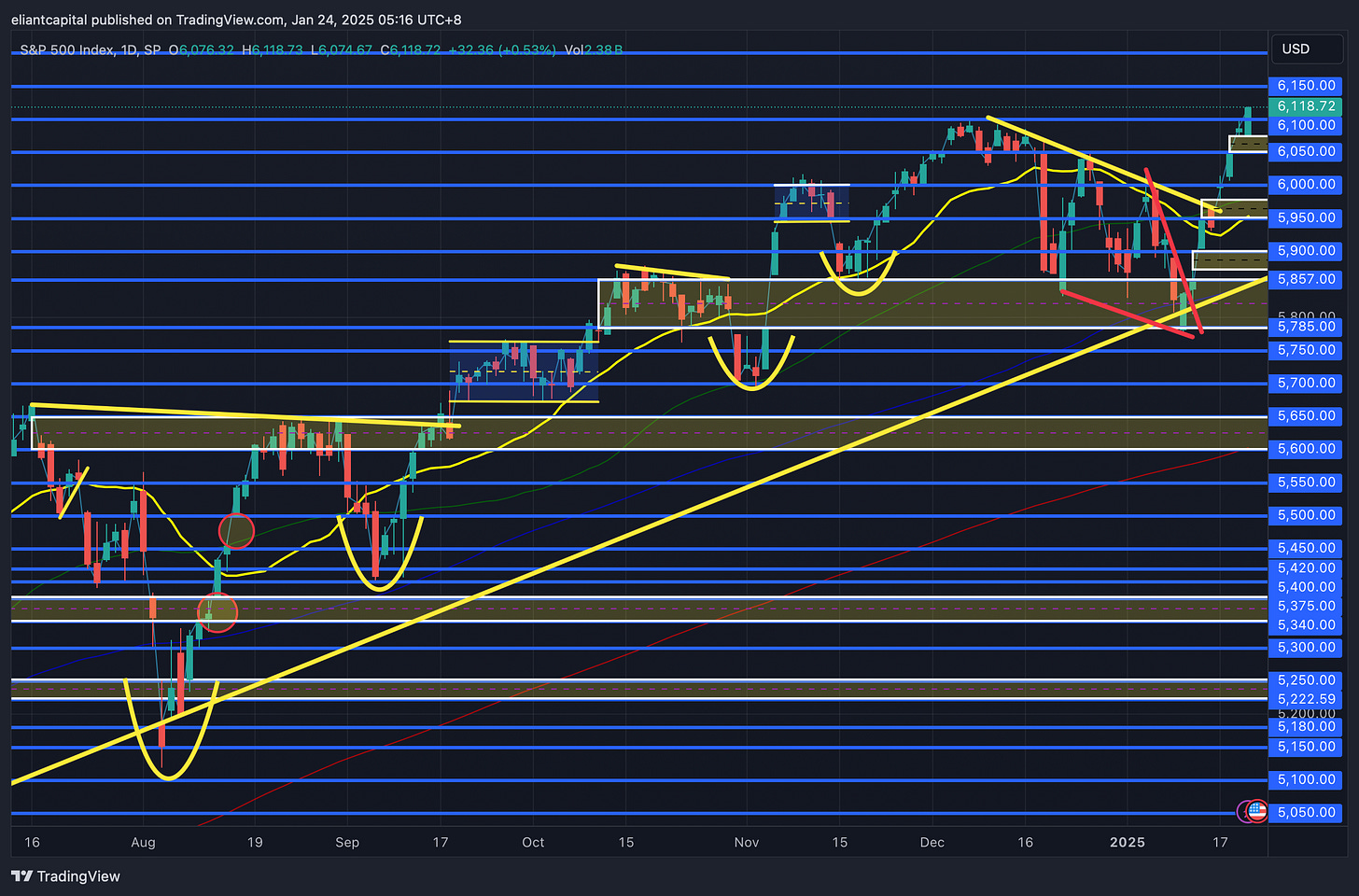

In regard to Spooz, there isn’t too much to talk about… we had a spike towards the end of day today as Spooz finally broke out to the upside above 6100+ & it closed out the day at fresh new ATHs. We’ve now had 3 fresh bull-gaps established below which typically signals some short-term exhaustion on the upside, & yesterday, given the event risks shaping up with BOJ (just in case, but not expecting anything major), and more so FOMC next week along with PCE #’s & Trump still fresh in office, it felt time to buy some protection, March put spreads ( 3/21 SPX 5950/5650P spreads are sufficient & or SPY 595/565P spreads), as protection is MUCH cheaper up here comparably to where we were just a couple weeks ago over 350 handles lower on Spooz. We still remain long as we have, but again, big run off the lows / cheap protection… it only felt right to put something on (50bps for now but would make it 100bps).

Having said that, again, Spooz closed at fresh ATHs & sellers haven’t tried to make any stances at all… if we were to see some reversion, I would look for 6070 / 6050 to come in as supportive, but if that were to falter, we likely will work lower to backtest 6000 flat below which also coincides with the 50d & nearly the 20d as well, so that should generally be a supportive area for bulls… in the meantime, until Spooz does find some sellers that try to make a stance, maybe comes with data or FOMC next week, I don’t see why this grind can’t continue given all of the positive new flows / goldilocks data / pro-everything (not literally, but you get the point) administration etc…

- QQQ

In regard to the Q’s, yesterday, we had the “500B AI Infrastructure” headline take over every news outlet which created a big bull-gap in the Q’s below & the Q’s are now just around 150bps from fresh ATHs. I don’t have too much to comment on the “500b” headline… there’s lots of speculation suggesting that SoftBank doesn’t even have the money to fund this spending, which at the end of the day, I don’t think that matters… its more so the matter that the Trump administration is very pro-AI / Infrastructure & they likely will back that & money will continue to flow that general direction… who’s to say SoftBank won’t just yolo 35B on calls to pay for it either (half-kidding).

Nevertheless, the Q’s have firmly broke to the upside, but still haven’t quite filled the FOMC gap above near 535ish… I think if the Q’s hold this bull-gap firmly below (call it 530ish), we should continue to see the Q’s work to fresh highs & a measured move likely propels the Q’s towards upper-540s / 550s range if it were to materialize & we were to see firm followthrough on the upside… on the contrary, if the bull-gap below were to falter, we likely will see the Q’s revert lower to the lower-520s & potentially go on to backtest the 50d / 20d around 518ish before finding / establishing a more firm support below.

- IWM

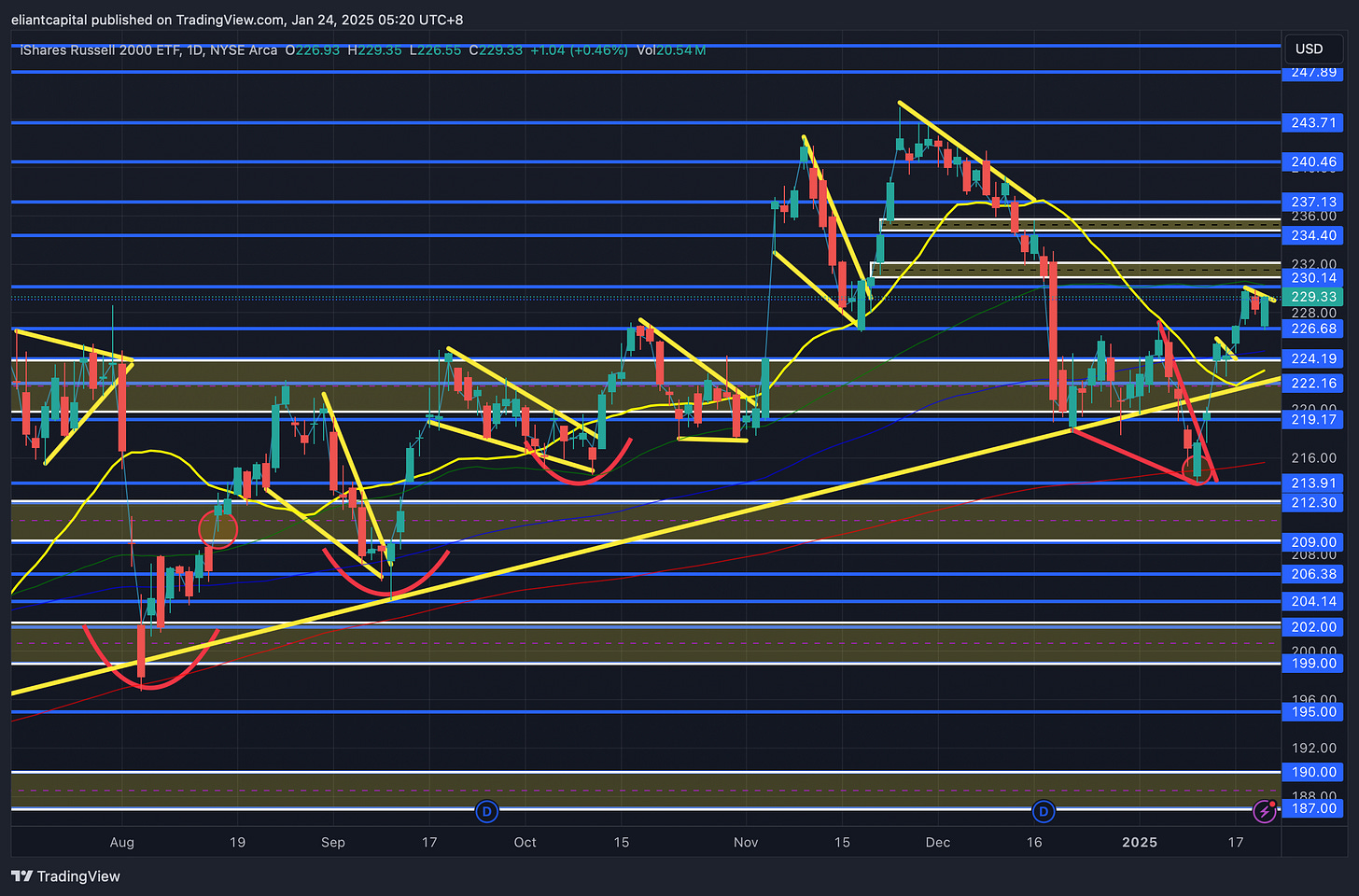

As the week has kicked off, we’ve seen further followthrough in small-caps to the upside as they currently are up just shy of 170bps on the week. As of now, IWM is basing / flagging above 226ish (breakout zone out of range) & a measured move should propel IWM higher to the 234 / 237ish range above… likely would need to see bond yields come in again along with potential for a more dovish fed next week / softer PCE #’s to really get the next leg going to the upside in small-caps… otherwise, if we were to see this flag fail to materialize & or IWM starts to resolve lower & this breakout above 226ish proves to be a false one, we likely will see IWM work lower to test the CPI bull-gap below near 222ish which also happens to coincide with the 20d as well and should be generally stronger support… if it does falter, we likely will completely fill the bull-gap into 219ish before finding a more firm support & it also sets up for a potential higher low as well.

I’ll save commentary on FOMC & PCE #’s for the week ahead, but in general, expecting a quieter wrap up to end the week whereas next week will be more important for markets in general but small-caps more specifically as the hawkish FOMC meeting in December is what initially kicked off the exaggerated downside in small-caps, & since, data has continued to improve / come in goldilocks, so that should be generally positive for the upcoming FOMC meeting, but we do also have PCE #’s as well, & if those were to come in softer than expected, that would REALLY get the small-caps trade going again & vice-versa if they were to come in hotter than expected… typically, soft PPI & CPI prints lead to soft PCE prints, but we’ll see if that holds true into next week.

- DIA

The Dow has been the best performing index on the week thus far, & has made it back to the distributive top crime scene from November / December ‘24… fairly simple, but for DIA to have further upside from here, would like to see 445ish firmly reclaimed to get DIA back into the prior range above, but ultimately, we need to see DIA firm up above 450ish / prior highs made towards the end of ‘24 to get further followthrough on the upside, as otherwise, DIA could be due for a bit of consolidation & or potentially even rangebound action to digest this most recent move off the lows.

If we were to see some reversion in DIA, would look for 435 / 432ish below to come in as a more firm support & ultimately, the bigger LIS is 430ish which coincides with the big CPI bull-gap highlighted below & more so should act as a bull / bear LIS… faltering below should lead to a gap-fill into the 425s, but as long as the bull-gaps remain supportive, bulls will continue to remain with edge.

/DXY

As the week has kicked off, we’ve seen a bit of a character change in the dollar… from dips getting bought to pops getting sold (on technically BULLISH news for the dollar / tariff talk), so what’s the main takeaway? Down on supposedly bullish news is typically a bearish signal & vice-versa if something is up on bearish news, it is typically a bullish signal. In this instance, again, the dollar has been running rampant since the end of September into October of ‘24 and encroached 110 just the other week & as of now, it’s undergoing a parabolic blowoff & it seems like we’re more so seeing the case of “priced in” being factored into the dollar as tariff news / pops in the dollar have been sold thus far. Given the reaction in the dollar to the tariff headlines / pops getting sold, it seems pretty clear that tariff fears were indeed overdone / Trump is more so likely to use tariffs as negotiating tactics rather then actually taking significant action… let’s not forget that in ‘17 after Trump was inaugurated, the dollar made a major interim peak before declining 14%+ that same year as well… potentially a repeat but maybe not to the same extent % wise?

In regard to event risk into the remainder of the week, we don’t have much economic data of significance, but we do have a BOJ meeting… as we talked about within the week ahead & earlier, but do think the current situation is much harder to compare to the July / August surprise of ‘24, mostly given the fact that U.S. economic data has continued to hum along / be better than expected which more so relieves the growth fear aspect which is what played a big contributing factor into the carry-trade unwind in USDJPY back in July / August of ‘24, again, given it was so out of consensus and unexpected at the time… Japan even said themselves that they do not want a repeat of summer ‘24, so despite them likely hiking this week (90%+ chance), they’re only doing so as they have confidence in U.S. economic data, as if they didn't , they likely would be holding off.

More importantly in regard to next week, we do have FOMC & PCE #’s as well, which I think is much more important… especially given the change of tune this past meeting from a dovish stance to a more hawkish stance & the reasons outlined were mostly due to fears of a resurgence in inflation along with the economy generally being stronger than expected & lastly, trying to account for the incoming administrations policies. Since that meeting, inflation prints have generally been better than expected (we’ll have further confirmation with PCE #’s next week as well) & Fed members have even come out suggesting 3-4+ rate-cuts is still very much so in the cards & tariffs aren’t likely to be a worry / contributing factor towards inflation… essentially a complete 180 from what Powell said back in December. Maybe Powell sticks to the same script & or maybe he lets his foot off the gas a bit as he’s gained some confidence with recent inflation prints / tariff fears likely being overdone as well… more so where I am leaning at this given moment.

And just briefly while on the note of inflation resurgence fears, something we talked about a couple weeks back is we expected base effects along with OER / Shelter resuming lower to kick back off disinflation & well, below is an image of “New” rents vs. “All” rents & New tends to lead all & New rents just printed -2.43%… a previous laggard now turning into a contributor of disinflation… certainly a tailwind for the Fed / disinflation.

In regard to the dollar, as we mentioned earlier, but as of now, the dollar has undergone a character change of pops getting sold instead of dips getting bought… thus far at least. The dollar did go on and backtest the 20d after Trump initially spoke about tariffs being enacted on February 1st earlier on in the week, but again, it has since sold that pop and resides right near the lows. I do think for further downside, we need to see some continued pressure below 108 / 107.75ish to start to see a further unwind towards 106.85s / 106.5s to completely fill the December gap below (FOMC gap)… otherwise, as long as the 50d / 108 - 107.75ish area remains supported, the dollar may have reached some interim support & I would argue this general area is the Bull / Bear LIS… below produces further positioning unwind whereas remaining above likely keeps the dollar generally bifurcated… for now at least.

Besides potential for Powell to maybe lean back next week off the hawkish tone given data has been fairly goldilocks / Trump inflation fears seem generally overdone & or at least priced-in to some extent, if we were to get a softer than expected PCE print this upcoming week, that likely really gets the downside shift / momentum unwind going in the dollar & it wouldn’t surprise me at all to see it in the mid-106s… potentially even lower if Powell backs off the same hawkish tone that he had in December as well.

/TNX

Coming into the week, the big question was whether or not if we finally did indeed reach a blowoff in the 10Y & or if an interim peak had finally been established. We saw quite the decline in the 10Y this past week from 4.8s to mid-4.5s, & thus far, we have seen a slight rebound on the week, but nothing of too much significance. Again, not much event risk besides BOJ meeting into the remainder of the week, but again, next week we do have FOMC along with PCE #’s which will likely provide a lot of clarity on where the Fed currently is at in regard to their thinking given inflation prints have been better than expected along with thoughts in regard to Trump’s “inflationary” policies as the fears seem to be generally overdone as well which should be supportive of bonds as a result.

I still think the question for bonds & really the dollar into the remainder of the week & into next week is whether or not the bonds can get followthrough to the upside / and or both the 10Y & Dollar get followthrough to the downside as pops continue to get sold… if that were to be the case with the 10Y, it wouldn’t surprise me to see a 4.4ish / 4.35 handle IF Powell backs off the hawkish tone next week / PCE #’s are better than expected, but in general, it seems like we may carve out a range in the 10Y between 4.8s / 4.35s until one side ends up giving… likely cause being either disinflation resumes / inflation fears subside (10Y resolves lower) & or inflation resurgence fears heat up / commodities continue to inflect higher thus putting upward pressure on inflation along with the 10Y as well… likely could see another retest of 4.8s & maybe even 5.00 / ‘23 highs if 4.8s were to get blown through.