Trump's Puppet or Political?

Hello All,

Quite the kick off in the markets this week as the hysteria of Deepseek caused a “grey swan” event within the indices yesterday & majority of the AI names whether it be semiconductors / power-generation / picks & shovels were all down in the 15-30%+ range yesterday… the Q’s have been the worst performing index on the week, for obvious reasons, but have had quite the snapback off the lows & the Dow has been the best performing index on the week as we’ve more so seen rotationary forces underway which has led to a general broadening of breadth / rally as the week has kicked off.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, earlier this week, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

I’m not going to waste much more time & am going to jump right into the recap below.

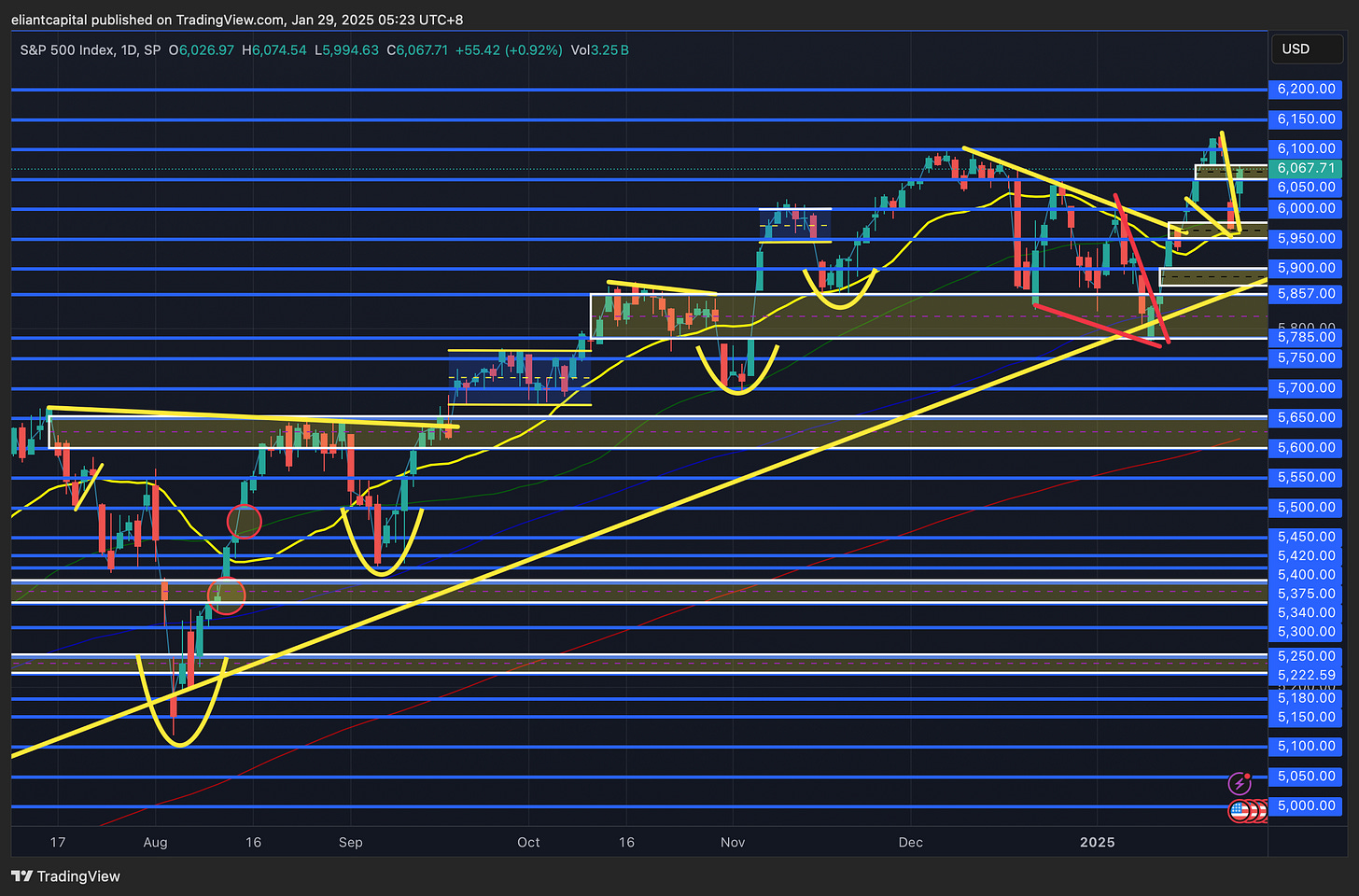

- SPY

It’s been quite the week in the indices thus far as the week has kicked off as markets essentially were dealt a “grey swan.” The news about Deepseek really heightened over the weekend & as a result, anything involved with AI in the U.S. got taken to the woodshed… Semiconductors / Power-Generation / Picks & Shovels… you name it, it was likely down 15-30%.

Today, we ended up seeing quite the snapback in Spooz / General indices which more so was led by an overall bounce by Tech & Spooz nearly ended up filling the island-top gap that was made yesterday… when island-top gaps get filled quickly, it tends to be bullish, but we still do have FOMC tomorrow along with PCE’s on Friday for the remainder of the week.

Plan to talk about expectations for FOMC later, but in regard to Spooz, we did end up monetizing half our March puts we bought last week, which ended up being quite timely, but booked the 80ish % gain to monetize & take some gains given the size of the drop / ramp in vol that we saw (also turned out to be a great decision). In respect to Spooz, again, we nearly filled the island-top gap that was established yesterday which is quite bullish, but I do still think we need to see bulls firm up above 6100ish & flip that resistance to support, as otherwise, I think bears can continue to have some lean / edge in the interim given 6100ish has now marked two prior interim tops (even-though this interim top was catalyst-news driven, sellers still emerged rather aggressively). We did end up finding support right at the 20d near 5950ish & I think in general, markets will remain supported as long as the bull-gap below remains / bulls maintain above the 20d (5950ish)… essentially a ping-ping for now in the interim until one side ends up giving, but if we were to see these recent local lows falter (potentially from a more hawkish Powell / hot PCE / further developments from deepseek), I think we likely go on to fill the next bull-gap below near 5900 - 5850ish which also happens to coincide with a support TL dating back to the late ‘23 lows, so in general, do expect it to be a firm support if tested.

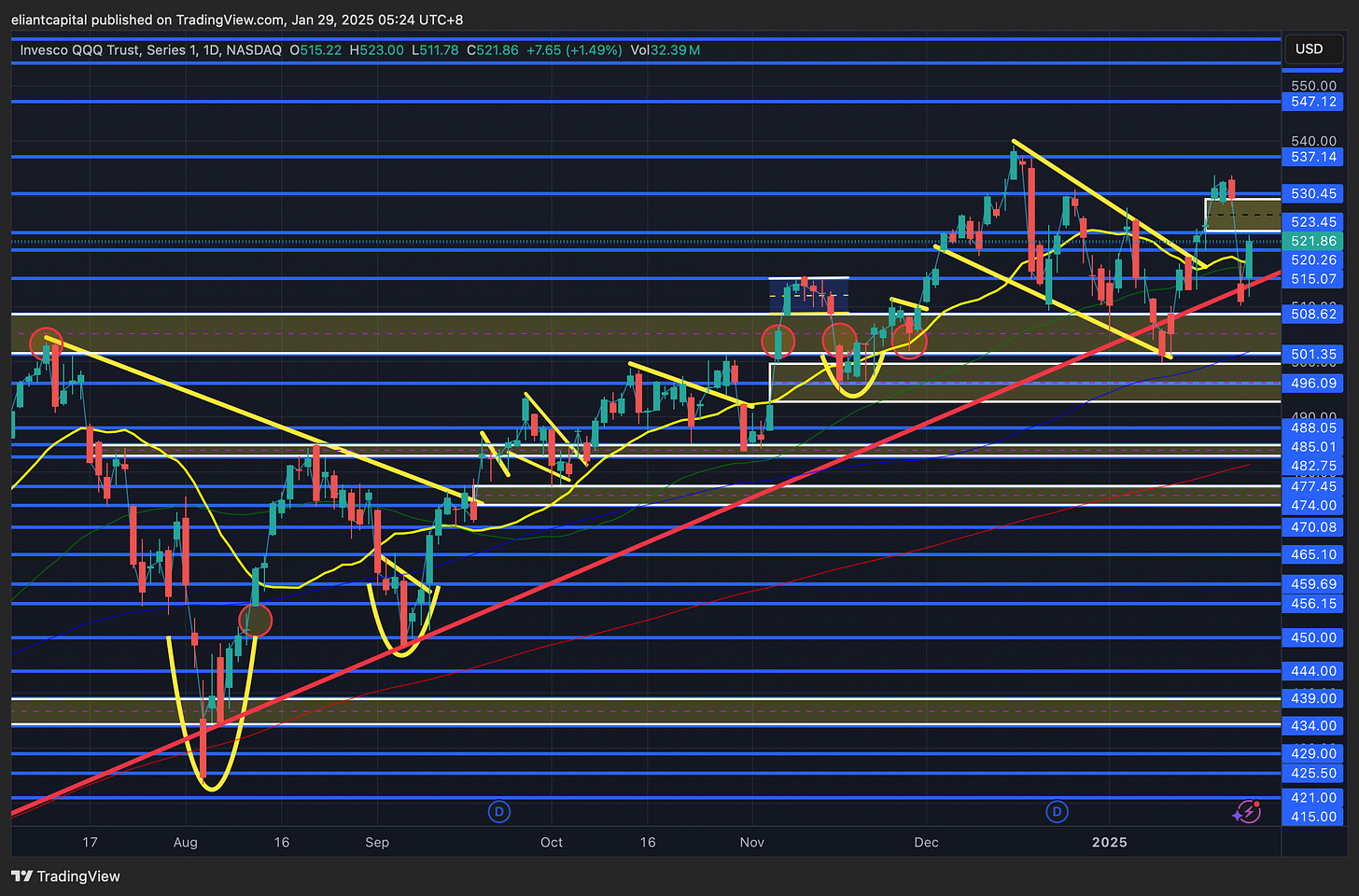

- QQQ

As we mentioned above, but thus far, the week kicked off with a “shoot first , ask questions later” vibe as anything correlated to AI in any way possible got sold off hard yesterday… Nvidia ended up setting a record for most recorded loss of market cap in a single day, believe it was north of 500B. Today, we did see a snapback in the Q’s which in part was actually led by Nvidia as it recovered some of yesterday's losses, but it’s also been led by a large rally within SaaS names as the Agentic-Ai phase has more so shifted in full-focus… Cheaper AI = More $$$ for Software names to keep it simple. We’ve talked about this phase greatly back in December as we believed CRM was the inflection point with its prior quarter, and it took some time to shape up, but SaaS names have been on an absolute tear this week and people can’t get enough of them… CRM / FRSH / DDOG / GTLB / NET / TEAM etc… We’ve done pretty damn well taking advantage of this theme and were positioned for this software rotation ahead of time, so pretty happy about how thats gone. META / AMZN / AAPL / MSFT have all also shifted into focus given the recent negative rout within Semiconductors / AI names & it wouldn’t all surprise me if the outperformance from those names continued.

In respect to the Q’s, similar to Spooz, but they as well ended up establishing an island-top gap yesterday & thus far, it has not been filled… island-top gaps that aren’t filled quickly majority of the time do end up playing out in a bearish way, and not all the times in regard to price, but we could even just see that shift to general underperformance as the market rotates capital elsewhere which is exactly what has happened thus far.

The Q’s did end up finding support on the TL dating back to the August ‘24 lows & thus far, it looks like a higher low has been established, but I do still think we need to see the Q’s firm up above 530ish, as otherwise, could be in for a bit more downside volatility. If we see the Q’s firm back up above 530ish, there isn’t much stopping the Q’s from heading towards 537ish / ATHs, but otherwise, if these recent local lows falter near 510-515ish, I think we could see the Q’s retrace lower & retest the local lows made earlier on in January near 500ish.

BUT, before jumping to any major conclusions in respect to tech, I do think we will have a lot more color following these mega-cap earnings this week in regard to outlook / spending / capex in reference to the AI trade etc…