Under-performers to Potential Out-performers?

2023 has been a fascinating year to be long tech… most specifically AI-beneficiaries, given the recent emerging trend that continues to accelerate given the future demand. On the other side of the spectrum, unrelated stocks to AI have tarnished and have severely underperformed due to the dispersion in the overall markets, with money mostly being allocated to MAG 7 along with AI-related stocks taking the sunshine away from other names that have continued to selloff given the recent pressure from interest rates along with the relative underperformance in general either due to deceleration in earnings, PE inflated, pressure to sell losers and the upcoming tax-loss selling that is likely to take place as we approach the end of the year. Now, some of the under-performers this year absolutely deserved the selloff, but other stocks seem to be potentially flashing an opportunity given the recent valuation contraction in many names in which some have become much more reasonable and even cheap given the continued selling / pressure of losers and dispersion we have seen excluding MAG 7 / AI-related names & lastly Ozempic related names which has seemingly continued to emerge just as the AI-trend has this year.

MAG 7 / RSP , SCHD , VTV , EEM , XLU , IWM , XLF

MAG 7 has done fantastic this year, whilst other counterparts in the market have significantly underperformed as shown below.

Now, with the end of the year approaching, some individual names are still likely to remain under pressure due to the upcoming tax-loss selling.

For those who don’t understand and or aren’t familiar with tax-loss selling, I included a brief synopsis below to familiarize yourself:

What is Tax-Loss Selling?

Tax-loss selling, also known as "tax loss harvesting," is an investment strategy where investors sell securities at a loss to offset a capital gains tax liability. This strategy is typically used near the end of a calendar year. The primary purpose is to limit the recognition of short-term capital gains, which are generally taxed at a higher federal income tax rate than long-term capital gains.

Here's a simple breakdown of how it works:

Realizing Capital Losses: Investors identify investments in their portfolio that have declined in value since the purchase. By selling these investments, they can "realize" a capital loss.

Offsetting Capital Gains: Capital gains are profits from the sale of assets. In many tax jurisdictions, capital gains are subject to taxation. By realizing capital losses, an investor can offset these gains, thus reducing their tax liability. If an investor's capital losses exceed their capital gains, they can use the excess loss to offset up to a certain amount of ordinary income.

Buying Back: After selling a security to realize a loss, investors might want to repurchase the same security because they believe in its long-term potential. However, to avoid what's called a "wash sale" (which would invalidate the tax loss), in the U.S., there is a rule that the investor must wait at least 30 days before buying back the same security or a security that's substantially identical.

While tax-loss selling is likely to provide some opportunities into the end of the year as we head into 2024, some names that rightfully sold off still may not be the best opportunity, given many names have become value traps. Distinguishing good deals / cheap names / value traps isn’t the easiest thing to do and is all subjective, but I have included some names below who may potentially transform from recent under-performers to potential out-performers as we head into 2024.

Before I jump into the basket of names below, I have included a synopsis of what exactly a value trap is, as opportunities that may seem great may also be in the category of a value trap. Not to say money can’t be made, but it is always best to look for names that can continue to grow with potentially increasing fundamentals and or a trough in fundamentals where the company, along with the stock price, is likely to benefit given the selloffs we have seen in some names and the opportunities that are potentially being presented.

What is a value trap?

A value trap is a stock or other investment that appears to be cheaply priced because it has been trading at low valuation metrics, such as price-to-earnings ratios, price-to-book ratios, or dividend yields. An investor may be attracted to such an investment under the belief that it's undervalued and offers a good buying opportunity. However, the trap occurs when the investment's price doesn't recover, and the reasons for its cheap valuation become apparent—typically because of fundamental issues with the company or its industry.

Characteristics of a value trap include:

Stagnant Growth: The company may show little to no growth in revenues, earnings, or other key financial metrics.

Deteriorating Fundamentals: This could be declining profit margins, increasing debt levels, or other deteriorating financial health indicators.

Industry Challenges: The entire industry might be facing headwinds, whether from technological disruption, changing consumer preferences, or regulatory challenges, which could impede the company's growth potential.

Dividend Issues: A high dividend yield might look attractive, but it's essential to check if the company can sustain its dividend payments. If a company cuts or eliminates its dividend, it can be a sign of financial stress.

No Catalyst for Growth: Even if a company is trading at a low valuation, there may be no clear catalyst on the horizon to drive the stock price higher.

Value traps can lure investors who are looking for bargain-priced stocks, especially those who follow a value investing approach. The key is to differentiate between a company that is genuinely undervalued and one that's cheap for a reason. Thorough research and due diligence, looking beyond just valuation metrics and into the company's and industry's fundamentals, can help investors avoid falling into value traps.

Now, lets examine some names whom have drastically underperformed in 2023 that have the potential to rebound into 2024 and or potentially even outperform.

To kick this basket off, figured there was no better name to start with than Disney. Disney has sold off a fair bit YTD and is nearly back to Covid levels with the economy continuing to run hot. Disney has been accused of becoming "too woke" recently this year in 2023 by incorporating these themes more prominently in their content or business practices. This perception has led to both praise and criticism, but the stock price suffering has been the end result.

- Disney (DIS)

A look at potential bull and bear theses below.

Bull Thesis:

Diverse Revenue Streams: Disney operates across various sectors, including theme parks, film and television entertainment, merchandise, and streaming services. This diversification allows Disney to hedge against downturns in any one particular sector.

Streaming Growth: Disney's streaming service, Disney+, has experienced rapid growth since its launch, quickly accumulating millions of subscribers. The company's ability to bundle Disney+ with other streaming offerings like Hulu and ESPN+ offers a compelling package for consumers and represents significant potential for recurring revenue.

Content Library: Disney owns a vast library of beloved content, from classic animated features to the Marvel Cinematic Universe, Star Wars franchise, and much more. This content is both evergreen and can be monetized repeatedly through various channels (theatrical releases, merchandise, theme park attractions, and streaming).

Theme Parks and Experiences: While the theme park sector was heavily affected by the COVID-19 pandemic, there's potential for a significant rebound as global travel resumes and consumers seek out experiences. Disney's parks are iconic and have a loyal fanbase.

Strong Brand Equity: Disney's brand is one of the most recognized and beloved worldwide. This brand strength can drive consumer loyalty and premium pricing power.

Strategic Acquisitions: Disney's track record of strategic acquisitions, such as Pixar, Marvel, Lucasfilm, and 21st Century Fox, has significantly expanded its content offerings and market reach. Future acquisitions might further enhance its portfolio.

Resilient Management: Disney's management has demonstrated resilience and adaptability, navigating various challenges over the years, and positioning the company for growth.

Bear Thesis:

Pandemic Aftereffects: Disney's theme parks and cruise line businesses were heavily impacted by the COVID-19 pandemic. While there's potential for recovery, any prolonged global health concerns or new pandemic-related disruptions could further impact these sectors.

Increasing Streaming Competition: Disney+ faces stiff competition from well-established and emerging streaming services like Netflix, Amazon Prime Video, Apple TV+, and others. The streaming landscape is becoming increasingly saturated, which could limit growth.

High Content Creation Costs: To remain competitive in the streaming space, Disney needs to consistently produce high-quality content, which is expensive. The costs of creating and acquiring content might weigh on profitability.

Cord-cutting and TV Network Challenges: Disney's traditional TV networks, especially ESPN, face challenges from cord-cutting as consumers shift away from traditional cable packages in favor of streaming.

Global Economic Concerns: Economic downturns or uncertainties in key markets could impact consumer spending on discretionary items like theme park visits, movie tickets, and merchandise.

Woke Bear Thesis:

Potential for Controversy: By taking positions on divisive social or political issues, Disney opens itself up to backlash, boycotts, and public relations challenges. This can be distracting and potentially harm the brand.

Overemphasis Can Seem Inauthentic: If audiences perceive Disney's efforts to be "woke" as mere corporate pandering or virtue signaling without genuine intent, it could backfire, leading to mistrust and skepticism among viewers.

Financial Impact: Any significant boycotts, decreased merchandise sales, or reduced viewership tied to perceptions of "wokeness" could have a tangible impact on Disney's bottom line.

Reputational Risk: If Disney is perceived as being inconsistent in its "woke" stance—such as advocating for certain values in its content while not upholding them in its corporate practices—it could face accusations of hypocrisy, further damaging its reputation.

With that being said, let’s take a look at Disney’s financials / valuation below.

Both EPS & Revenue are expected to increase YoY. Looking ahead as we wrap up Q4 with both EPS & Revenue for 2023 looking to be stagnant / slightly increase, as we look ahead all the way up to 2026 forecasts, earnings are expected to continue to grow even with the recent headwinds that Disney has recently been categorized in the “woke” basket.

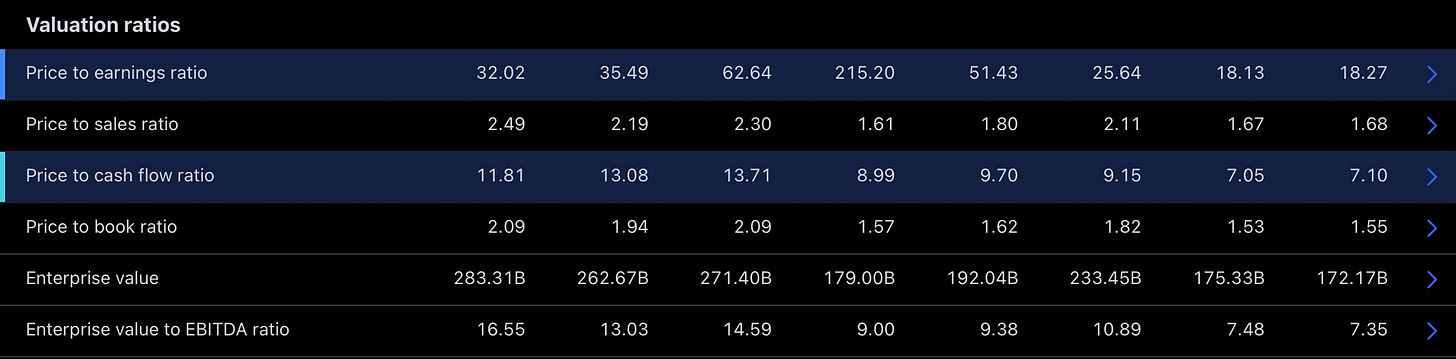

Valuation metrics:

Technicals:

Has formed this longer term wedge into a demand zone dating back to covid-crash levels along with 2013/2014 levels between 67.50 - 78.50. Assuming support is found give or take the demand zone below, a breakout of this wedge may potentially support a move higher into the 200d on the weekly timeframe which is around 130. Sentiment is very poor and with expectations quite low along with the potential for Igor to turn it around and or even potential activists looking to step in, Disney from current levels may be a potential out-performer into 2024 and a name to watch with the upcoming pressure from potential tax-loss selling.

- Qualcomm (QCOM)

Bull Thesis:

5G Revolution: Qualcomm is at the forefront of the 5G technology wave. As global networks transition from 4G to 5G, Qualcomm's technology and intellectual property portfolio position it as a key beneficiary of this shift.

IoT and Automotive Opportunities: Beyond smartphones, Qualcomm is positioning itself in the growing Internet of Things (IoT) and automotive sectors. As vehicles become more connected and autonomous driving technology progresses, Qualcomm's expertise in wireless communication will be crucial.

Robust Financial Position: Historically, Qualcomm has maintained a strong balance sheet, allowing it flexibility in its operations and the capacity to weather economic downturns.

Return to Shareholders: Qualcomm has a track record of returning capital to shareholders through dividends and share buybacks, which can be appealing to income-oriented investors.

Potential in Wearables and AR/VR: With wearables and augmented/virtual reality devices gaining traction, Qualcomm's chipsets and communication solutions could find growing demand in these markets.

Expansion in Computing: Qualcomm's efforts to expand into the PC market with ARM-based processors for laptops can open new revenue streams if they manage to secure a significant market share.

Strong Partnership History: Qualcomm's advanced modems have been a key component in many iPhone models. As 5G and future technologies roll out, Apple may continue to rely on Qualcomm's leading-edge technology to maintain the iPhone's premium connectivity standards.

5G Adoption: As Apple integrates 5G into more of its devices, the demand for Qualcomm's 5G modems and technology is likely to grow. This could result in increased sales and royalties for Qualcomm.

Tech Ecosystem Synergy: Qualcomm's capabilities in wireless connectivity can help enhance Apple's broader ecosystem, including wearables, iPads, and potentially even Macs. This interconnectedness could drive mutual growth.

Bear Thesis:

Apple's Self-reliance: Apple, one of Qualcomm's major customers, has been investing heavily in its chip design capabilities. If Apple decides to develop its own modems or reduce its dependence on Qualcomm for other components, it could significantly impact Qualcomm's revenue.

Intense Competition: The semiconductor and mobile chipset industries are fiercely competitive. Qualcomm faces competition from companies like MediaTek, Samsung, and others, which can lead to pricing pressures and reduced market share.

Technological Disruption: Rapid advances in technology mean that Qualcomm must continuously innovate to stay ahead. Failure to keep pace with technological changes can impact its market position.

Cyclicality of Semiconductor Industry: The semiconductor industry is known for its cyclical nature, with periods of oversupply leading to pricing pressures and profitability challenges.

Geopolitical Risks: Trade tensions, especially between the U.S. and key markets like China, can impact Qualcomm's operations, sales, and supply chain.

Economic Downturns: Economic recessions or slowdowns can lead to reduced consumer spending on devices, which in turn can lead to decreased demand for Qualcomm's products.

A look at QCOM valuation metrics below:

Future EPS / Revenue outlook:

Technicals:

Similar to Disney, has built out and consolidated within this bigger wedge into a demand zone with a gap that has yet to be filled but should potentially act as a bigger demand zone if 108.50 support were to give down into 96 which would fill that gap from summer of 2020.

- The Geo Group (GEO)

Private prison company, The Geo Group, has operated detention facilities under contracts with government agencies, including U.S. Immigration and Customs Enforcement (ICE). These facilities are used to detain individuals who are awaiting immigration hearings, asylum determinations, or deportation.

Potential Tailwinds / Bull Thesis

Increased Demand for Detention Services

Recent influx of migrants is at a record high under the Biden Administration

Long-Term Government Contracts

Government Partnerships

Partnerships with government agencies, such as U.S. Immigration and Customs Enforcement (ICE) and the Federal Bureau of Prisons (BOP)

Efficiency Argument: Proponents of private prisons argue that they can operate more efficiently than their public counterparts, potentially leading to cost savings for governments and profitability for companies like The GEO Group.

Diverse Portfolio: The company doesn't just operate prisons; they also have a range of correctional and community reentry services, which could provide diversification in revenue streams.

Valuation

Histroically trading the cheapest it has been these past years dating most recently back to 2016

Bear thesis:

Ethical Concerns: The private prison industry is controversial. Critics argue that profiting from incarceration can lead to perverse incentives, such as emphasizing inmate volume over rehabilitation.

Regulatory Risks: There's a political movement, especially in the U.S., against private prisons. For example, the U.S. Department of Justice announced plans under the Obama administration to phase out its use of private prisons, though the decision was later reversed under the Trump administration. Changes in government policy or regulations could significantly impact The GEO Group's operations.

Contract Dependence: A significant portion of The GEO Group's revenue comes from a few government contracts. If they lose a major contract or if there's a reduction in contract rates, it could substantially impact their financial performance.

Reputation Risk: Due to the controversial nature of the private prison industry, The GEO Group may face reputation challenges, which can affect partnerships, contracts, and investor relations.

Economic Conditions: A decline in economic conditions could lead to reduced government budgets and spending, which might impact contracts with private prison providers.

Technicals:

Nearing a longer term DT TL on the verge of a multi-year breakout of a trend that it has established of higher lows since bottoming back in 2021.

- Crocs (CROX)

Bull Thesis:

Brand Resurgence: Over the past few years, Crocs has seen a resurgence in popularity, driven by celebrity endorsements, collaborations, and a general trend towards casual and comfortable footwear.

Diverse Product Line: While Crocs is best known for its classic clogs, the company has expanded its product lineup to include sandals, boots, and even apparel, broadening its appeal and target market.

E-commerce Growth: Crocs has been investing in its digital and e-commerce platforms, enabling it to tap into the growing trend of online shopping. Direct-to-consumer channels often come with higher margins than sales through third-party retailers.

Global Expansion: Crocs has a global presence and continues to expand in emerging markets where there's a growing middle class and an appetite for global brands.

Efficient Supply Chain: Crocs' unique manufacturing process allows for relatively quick production cycles, enabling the company to respond swiftly to changing fashion trends.

Sustainability Initiatives: Crocs has initiatives aimed at becoming a more sustainable company, including plans to become a net zero company by 2030. Such initiatives can be attractive to environmentally-conscious consumers and investors.

Strategic Collaborations: Collaborations with celebrities and popular brands have helped elevate Crocs' brand image and attract new customers. These partnerships often result in limited-edition products that generate buzz and demand.

Casualization Trend: The global trend towards casual and comfortable dressing, accelerated by the work-from-home environment during the COVID-19 pandemic, plays to Crocs' strengths as a provider of comfortable footwear.

Loyal Customer Base: Many Crocs wearers are loyal to the brand and often buy multiple pairs or styles, providing a stable customer base and repeat business.

Bear Thesis:

Fashion Volatility: The footwear industry is notoriously fickle, with trends coming and going. Crocs has seen peaks and valleys in its popularity before, and there's a risk that the brand could fall out of favor again.

Over-reliance on a Single Product: While Crocs has diversified its product range, the brand is still heavily associated with its classic clog. If demand for this product decreases significantly, it could impact the company's overall performance.

Competition: The footwear market is saturated with numerous players, ranging from luxury brands to more affordable options. This intense competition can put pressure on prices, profit margins, and market share.

Economic Downturns: In economic recessions or downturns, consumers might cut back on discretionary spending, which includes fashion and footwear purchases.

Regulatory and Tariff Concerns: Changes in trade policies, tariffs, and regulations can increase the cost of producing or importing goods, impacting profit margins.

Brand Perception: Despite recent gains in popularity and acceptance, some segments of consumers still view Crocs as unattractive or unfashionable, potentially limiting broader market appeal.

Currency Fluctuations: As an international company, Crocs is exposed to currency exchange rate fluctuations, which can impact reported earnings and profitability.

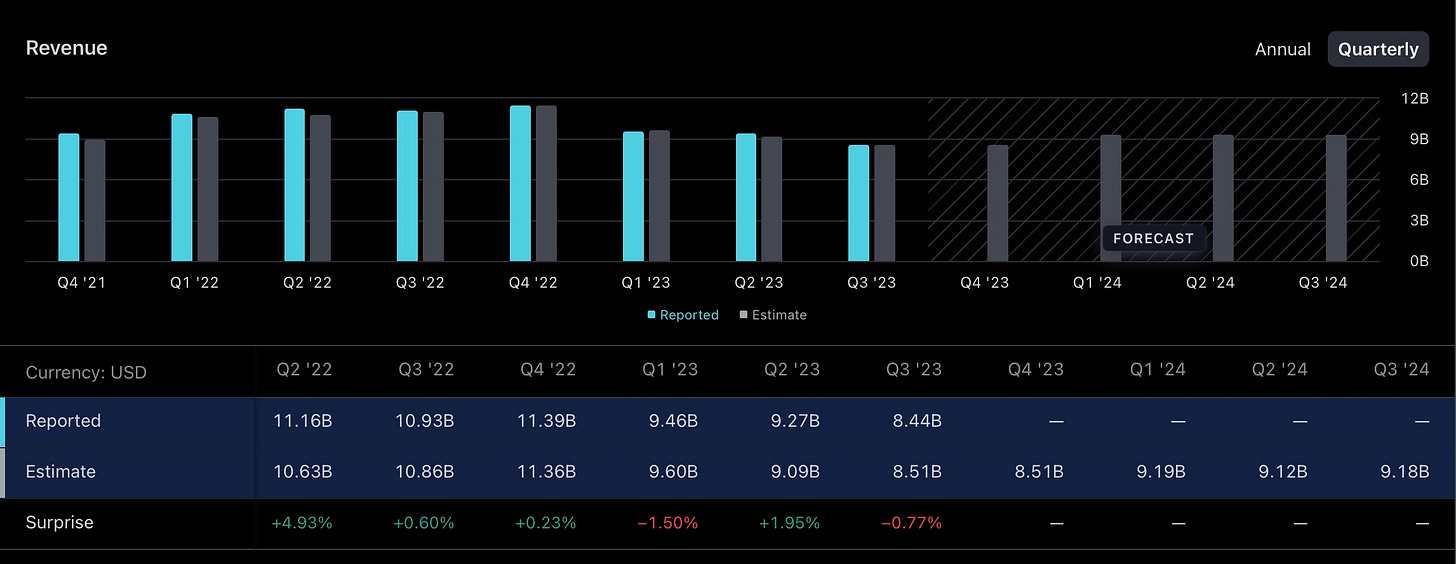

Future EPS / Revenue Expectations:

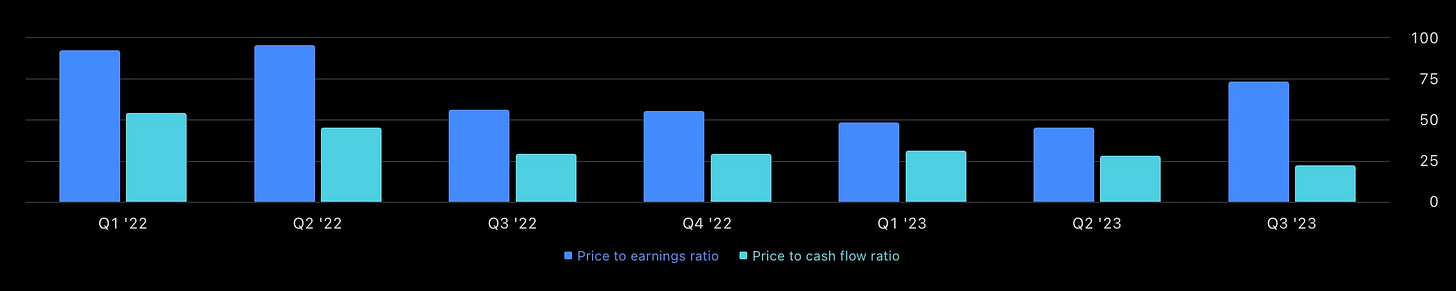

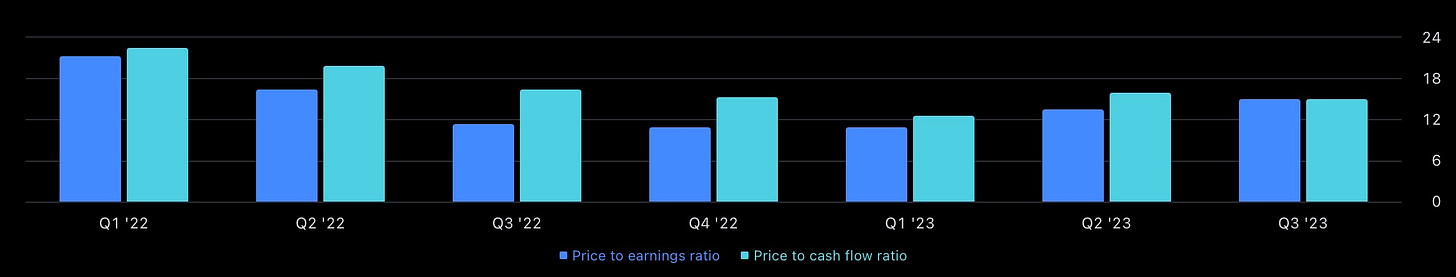

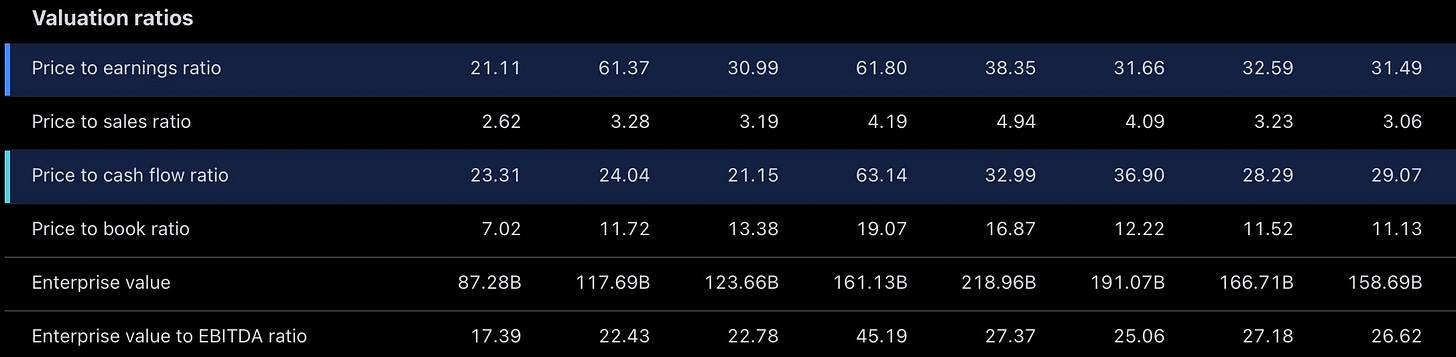

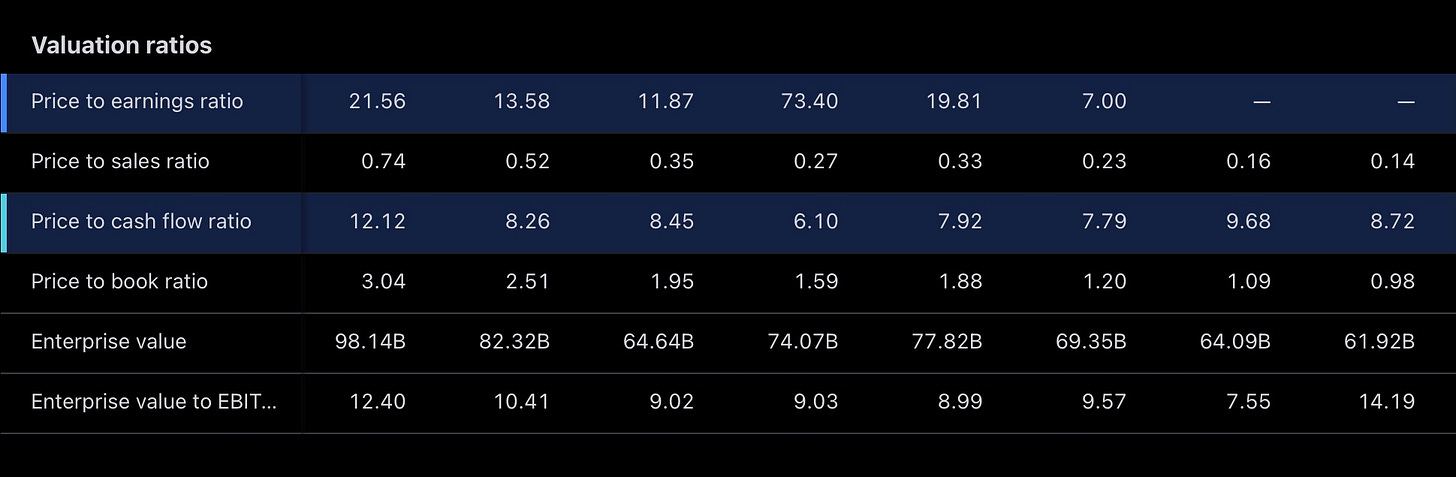

Valuation ratios:

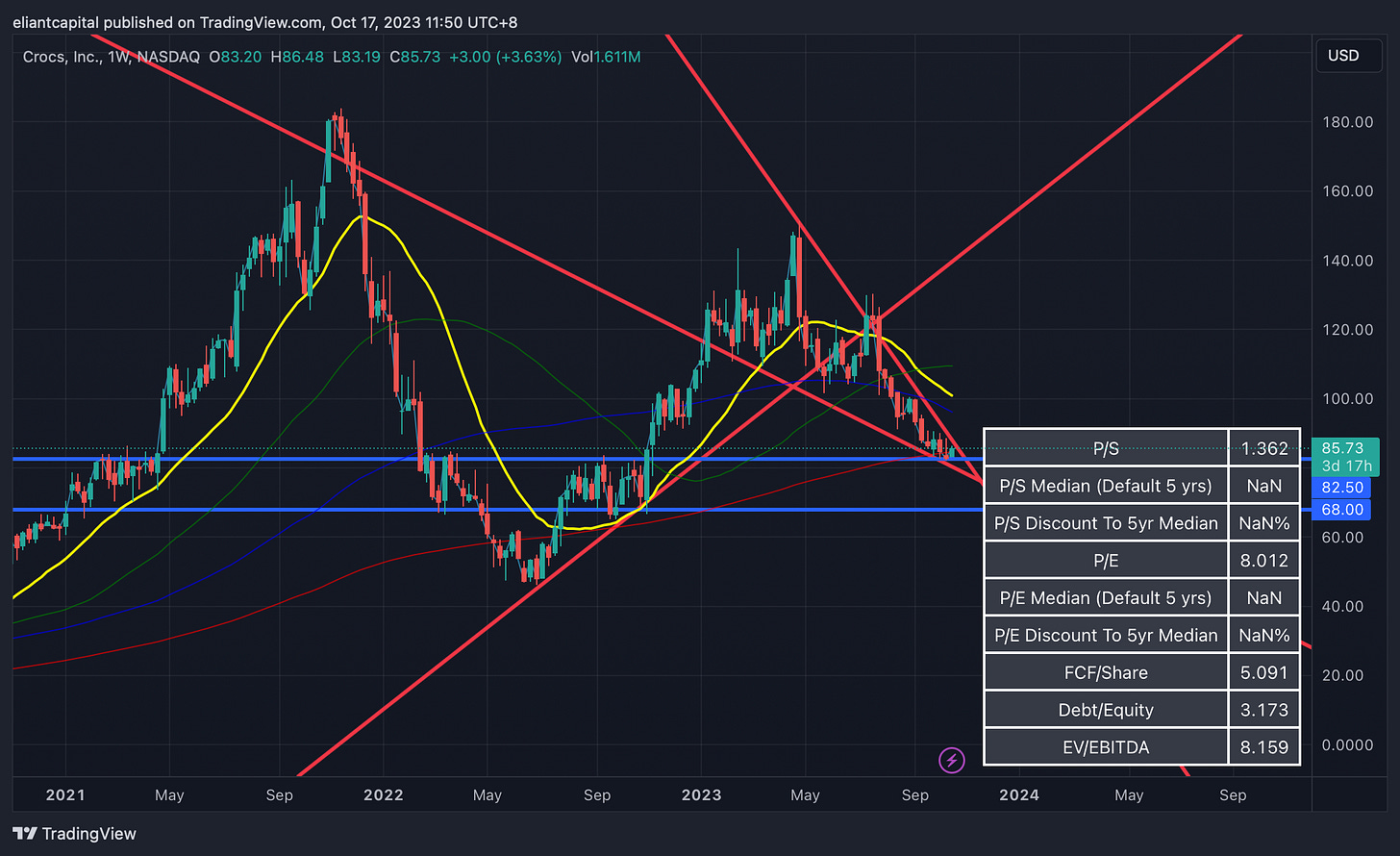

Technicals:

Coming into a demand zone that has held since 2021 besides the brief dip last year before 68/82.50 zone was quickly reclaimed and led to a rally almost back near 2021 highs and has since formed this wedge right into this demand zone as it encloses on the 200d.

- Alibaba (BABA)

Bull Thesis:

Dominant Position in China: Alibaba holds a dominant position in China's e-commerce market through its platforms like Taobao and Tmall, serving hundreds of millions of consumers and businesses.

Huge Addressable Market: With the largest population in the world and a rapidly growing middle class, China represents a massive addressable market for online shopping and digital services.

Diverse Ecosystem: Beyond e-commerce, Alibaba's ecosystem includes digital entertainment (Youku Tudou), cloud computing (Alibaba Cloud), digital payments (Alipay through Ant Group), and more. This diversification can offset slowdowns in any one particular segment.

Cloud Computing Growth: Alibaba Cloud is the leading cloud service provider in China and is growing rapidly. The global shift towards digital transformation and the increasing adoption of cloud services provide significant growth opportunities.

New Retail Initiatives: Alibaba's "New Retail" concept, which blends online and offline shopping experiences (e.g., Hema supermarkets), showcases its innovation in retail and can drive growth in both urban and rural areas.

International Expansion: While China remains its core market, Alibaba is expanding internationally through platforms like AliExpress and investments in regional e-commerce players in Southeast Asia, South Asia, and other regions.

Logistics Network: Cainiao, Alibaba's logistics affiliate, provides a competitive edge by ensuring efficient and timely delivery of goods.

Financial Services: Through its affiliate Ant Group, Alibaba has exposure to a wide range of financial services, including digital payments, lending, insurance, and wealth management.

China risk—love has just came out of the panic zone, but sentiment and positioning towards China in general continues to be skewed negatively

Bear Thesis:

Regulatory Scrutiny: Alibaba and its affiliate companies, especially Ant Group, have come under increased regulatory scrutiny in China. The Chinese government's tightening regulations on tech giants and fintech companies can pose challenges to Alibaba's operations and growth prospects.

Competitive Landscape: While Alibaba dominates many sectors, it faces stiff competition from companies like Tencent, JD.com, Pinduoduo, and others, especially in e-commerce and cloud computing.

Economic Slowdown: Any slowdown in China's economy could impact consumer spending, affecting Alibaba's core e-commerce business.

Geopolitical Tensions: Rising geopolitical tensions, especially between China and the U.S., could pose challenges. Concerns over delistings of Chinese companies from U.S. stock exchanges or restrictions on U.S. investments in Chinese firms could impact Alibaba's stock price and investor sentiment.

Dependency on the Chinese Market: Despite its international ventures, a significant portion of Alibaba's revenue still comes from China. This heavy reliance makes the company vulnerable to domestic economic and regulatory shifts.

Future EPS / Revenue Expectations:

Valuation ratios:

Technicals:

Continues to base and consolidate. Essentially continues to range between 80 on the lower bound and 100 on the upper bound and has been a great trading vehicle in terms of fading edges. As it continues to coil within this wedge, a bigger breakout may potentially be in the works on the next break of 95 / 100 on the upside.

- NIKE (NKE)

1. Strong Brand Recognition:

Global Presence: Nike is one of the most recognizable brands globally, with a massive following and significant brand loyalty.

Marketing Mastery: Nike's marketing campaigns, celebrity endorsements, and collaborations have historically resonated well with consumers, helping maintain its brand value.

2. Innovative Product Line:

Diverse Portfolio: Nike's wide range of products caters to various sports, demographics, and consumer preferences.

3. Direct-to-Consumer (DTC) Focus:

Digital Growth: Nike has been focusing on growing its digital presence, which not only increases sales but also improves margins.

Retail Stores: Nike's own stores (both online and offline) allow better control over brand presentation and customer experience.

4. International Expansion Opportunities:

Emerging markets, especially in Asia, provide significant growth potential, with a rising middle class and increasing interest in health and fitness.

Bear Thesis:

1. Intense Competition:

The sportswear and footwear industry is highly competitive, with strong players like Adidas, Under Armour, and Puma, among others.

2. Supply Chain Disruptions:

Dependence on Overseas Manufacturing: A majority of Nike's products are manufactured outside the U.S., making them susceptible to trade tensions, tariffs, and geopolitical issues.

3. Market Saturation:

In mature markets like North America, there might be limited growth opportunities due to market saturation.

4. Changing Consumer Preferences:

The fashion and sportswear industry is subject to rapidly changing consumer trends. If Nike doesn't adapt quickly, it could lose market share.

5. Sociopolitical and Cultural Concerns:

Nike has faced backlash on various fronts, from its stand on political and social issues to concerns about manufacturing practices. These could potentially affect its brand image and sales.

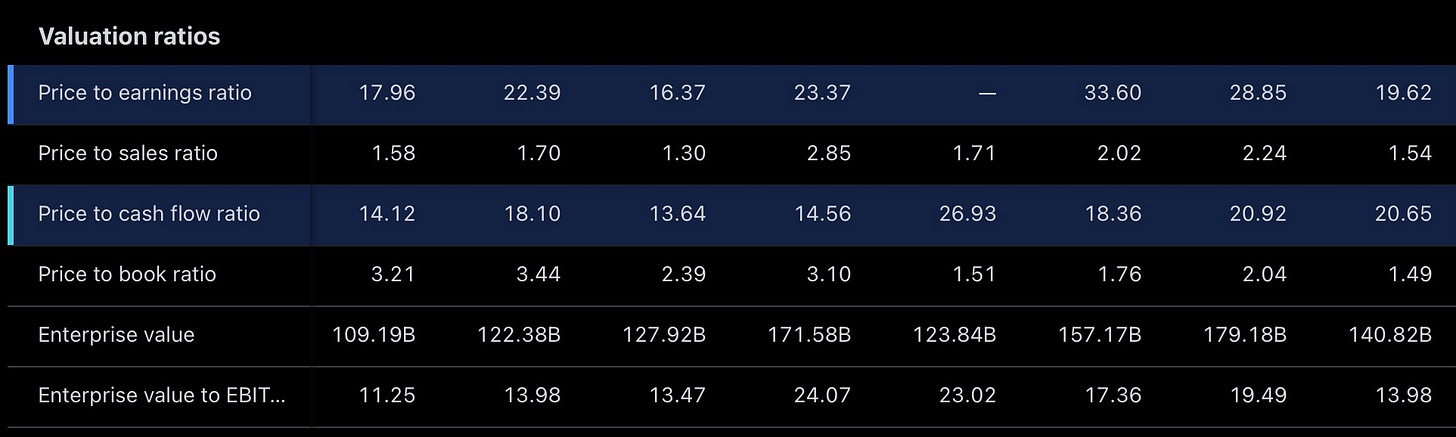

Valuation ratios:

Projected Future EPS / Revenue:

Technicals:

Within this broader wedge continuing to form higher lows dating back to the Covid lows off this TL along side working up against this DT dating back to ATHs and is on the verge of a breaking. Also worth noting this most recent low so far has been a higher low.

- Estee Lauder (EL)

Bull Thesis:

1. Strong Brand Portfolio:

Diverse Range: Estée Lauder owns a broad array of prestige beauty brands, including Clinique, MAC, Aveda, and Jo Malone, catering to different demographics and geographies.

Brand Equity: The company's namesake brand, Estée Lauder, holds strong brand recognition and loyalty worldwide, indicating a continued potential for growth.

2. International Growth Opportunities:

Emerging Markets: Estée Lauder continues to see opportunities in emerging markets, especially in Asia-Pacific regions, including China, where luxury and prestige beauty products are in high demand.

3. Digital and E-commerce Strength:

Adapting to Change: Estée Lauder has invested significantly in its digital and e-commerce capabilities, which became even more crucial during the COVID-19 pandemic when online sales surged.

Personalized Marketing: Utilizing data analytics and AI, Estée Lauder offers personalized experiences to online shoppers, driving sales and customer loyalty.

4. Innovation and R&D:

Product Development: Continuous investment in research and development has allowed Estée Lauder to launch innovative products that resonate with consumers' evolving needs.

Sustainability: Recognizing the global trend towards sustainability, Estée Lauder is making strides in creating eco-friendly products and packaging, appealing to a more eco-conscious consumer base.

5. Skincare Segment Growth:

The skincare segment, a major revenue driver for Estée Lauder, continues to grow globally. As consumers become more educated about skincare, there's a shift from makeup to skincare, positioning Estée Lauder favorably.

6. Strategic Acquisitions:

The company's strategic acquisitions, like the purchase of brands that cater to younger demographics or have a unique value proposition, further diversify its portfolio and ensure it remains contemporary and relevant.

Bear Thesis:

1. Intense Industry Competition:

Rising Challengers: The beauty and skincare industry is highly competitive. New indie brands and direct-to-consumer startups can quickly gain market share with the right marketing, especially among younger consumers.

Established Players: Estée Lauder also faces stiff competition from established beauty conglomerates like L'Oréal and Coty.

2. Changing Consumer Preferences:

Shift in Trends: Beauty and fashion trends change rapidly. A shift away from the kind of prestige products Estée Lauder offers, or a preference for more minimalistic beauty routines, could impact sales.

Natural and Organic Demand: An increasing number of consumers are seeking natural, organic, and "clean" beauty products. If Estée Lauder doesn't adapt or if its offerings are not perceived as clean, it could lose a segment of its market share.

3. Economic Vulnerability:

Luxury Market Sensitivity: Being in the prestige segment, Estée Lauder's products could face reduced demand during economic downturns, as consumers might prioritize essential spending or opt for cheaper alternatives.

4. Supply Chain Disruptions:

Dependency on Few Suppliers: If Estée Lauder relies heavily on specific suppliers for certain ingredients or products, any disruption in their operations could affect the company's production.

5. Retail Challenges:

Department Store Decline: Historically, Estée Lauder has relied significantly on department stores for sales. With many department stores facing challenges or even closures, this could impact Estée Lauder's distribution channels.

Valuation ratios:

Technicals:

Finding some demand into the covid lows, fairly coiled up within this wedge right as it meets this demand zone.

- General Motors (GM)

Bull Thesis:

General Motors (GM) is one of the largest automobile manufacturers globally and has shown significant interest and investment in electric vehicles (EVs). Here's a hypothetical bull thesis focused on GM's electric vehicle endeavors based on data available up to January 2022:

General Motors Bull Thesis: Electric Vehicles

1. Commitment to Electrification:

Strategic Shift: GM has announced its vision for a future with zero crashes, zero emissions, and zero congestion. This vision underscores its commitment to electric vehicles.

Investment: The company has pledged billions of dollars towards the development and production of EVs and related infrastructure, signifying its serious commitment to the sector.

2. Extensive EV Lineup:

Variety: GM plans to launch several electric models across different segments and brands in the coming years, targeting various customer demographics and price points.

Innovative Products: With vehicles like the Hummer EV, GM is pushing technological and performance boundaries, demonstrating its capabilities in the EV sector.

3. Ultium Battery Technology:

Competitive Edge: GM's proprietary Ultium battery technology promises longer range, faster charging, and lower costs, giving it an edge in the competitive EV market.

Scalability: The modular nature of the Ultium platform means it can be used across a variety of vehicle sizes and types.

4. Manufacturing and Supply Chain Expertise:

Existing Infrastructure: GM's extensive experience and infrastructure in vehicle manufacturing give it an advantage in scaling up EV production efficiently.

Supply Chain Control: GM's joint ventures, like the one with LG Chem for battery cell production, help ensure supply chain reliability and cost efficiency.

5. EV Infrastructure Investment:

GM has partnerships and investments in EV charging infrastructure, like its collaboration with EVgo, ensuring that the necessary charging infrastructure will support its growing EV lineup.

6. Government Support and Regulations:

As governments worldwide push for stricter emissions standards and offer incentives for EV purchases, companies like GM that are investing heavily in EVs stand to benefit.

Bear Thesis:

1. Intense Competition:

Established EV Players: Brands like Tesla have a head start in the EV market, with significant brand loyalty and technological advancements.

Traditional Automakers: Other legacy automakers, such as Ford and Volkswagen, are also investing heavily in EVs, leading to a crowded market.

New Entrants: Startups like Rivian, Lucid, and NIO are introducing innovative products, adding further competition.

2. Technological Hurdles:

While GM's Ultium battery technology shows promise, there's no guarantee it will outperform or even match the advancements made by competitors, especially dedicated EV manufacturers.

3. Production & Supply Chain Disruptions:

Dependency on External Suppliers: Reliance on external suppliers, especially for essential components like battery cells, can pose risks in terms of cost, quality, and availability.

4. Transition Challenges:

Internal Struggles: Managing the transition from internal combustion engine (ICE) vehicles to EVs could present internal organizational and operational challenges.

Investment Returns: The large investments required for EV development and production might strain finances, with no guarantee of immediate returns given the competitive landscape.

5. Regulatory Risks:

Changes in government policies or subsidies related to EVs, especially in key markets, could impact sales and profitability.

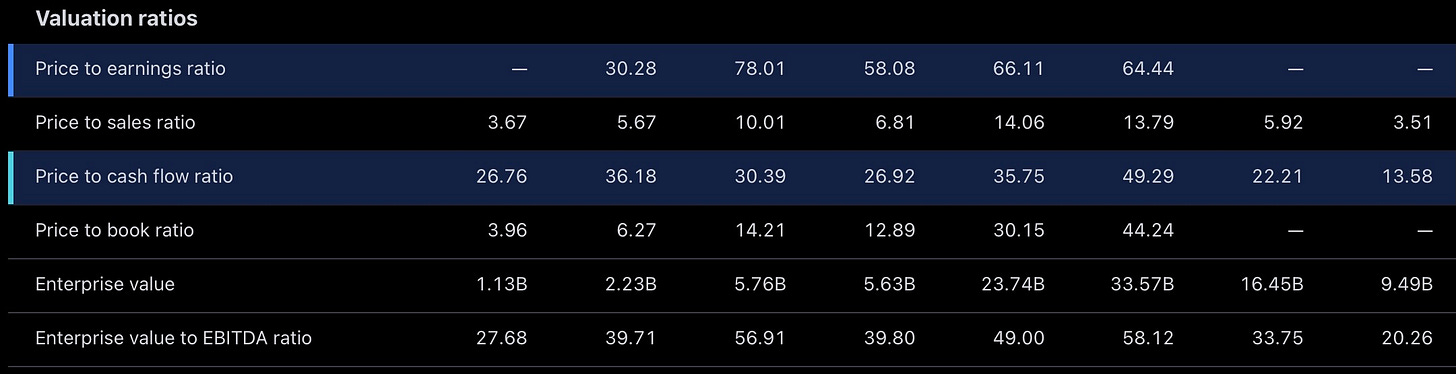

Valuation Ratios:

Technicals:

Big demand zone dating back to 2013 that has continued to provide support excluding the covid crash.

- Paypal (PYPL)

Bull Thesis:

1. Dominant Position in Digital Payments:

Market Leader: PayPal is one of the most widely recognized and used digital payment platforms globally, processing billions of payment transactions annually.

2. Strong User Growth and Engagement:

Expanding User Base: PayPal has consistently expanded its active account base, leading to an increase in the number of transactions and payment volumes.

High Engagement: Features like One Touch have significantly enhanced user convenience and increased transaction frequency.

3. Diverse Product Portfolio:

Venmo: PayPal's mobile payment service, Venmo, has gained significant traction, especially among younger users.

Pay Later: PayPal introduced "Pay in 4" and other buy now, pay later (BNPL) solutions, tapping into the growing demand for flexible payment options.

Business Solutions: PayPal offers a suite of services tailored for businesses, from payment processing to working capital loans.

4. International Expansion Opportunities:

While PayPal has a substantial presence in many countries, there's still considerable growth potential in emerging markets where digital payments are becoming more mainstream.

5. Strategic Acquisitions and Partnerships:

PayPal's acquisitions, such as Braintree (which brought Venmo under its umbrella) and Honey, have expanded its service offerings and user base.

Partnerships with major card networks and banks ease integration and expand PayPal's reach.

6. E-commerce Growth Tailwind:

The global shift towards online shopping, accelerated by events like the COVID-19 pandemic, bodes well for PayPal, which is well-positioned to benefit from increased e-commerce transactions.

Bear Thesis:

1. Intense Competition:

Diverse Competitors: PayPal faces competition from a range of companies, from tech giants like Apple (with Apple Pay) and Google (with Google Pay) to fintech startups and traditional financial institutions venturing into digital payments.

2. Regulatory and Compliance Risks:

Global Presence: Operating in multiple countries means PayPal must navigate a complex web of regulations and compliance requirements, which can be costly and subject to change.

Data Privacy: As a financial service provider, PayPal must adhere to stringent data protection regulations, with breaches potentially leading to significant fines and reputational damage.

3. Reliance on Few Key Partners:

A significant portion of PayPal's transactions are facilitated through major card networks like Visa and Mastercard. Any disruption or change in these partnerships could impact PayPal's operations.

4. User Growth Saturation:

While PayPal has seen strong user growth, there's a risk that growth rates could decelerate as the company reaches saturation in its core markets.

5. Integration and Acquisition Risks:

While acquisitions like Braintree and Honey have expanded PayPal's capabilities, integrating these businesses can pose challenges. There's also the risk that the expected synergies or growth from these acquisitions don't materialize.

6. Rapid Technological Changes:

The fintech space is evolving rapidly. If PayPal fails to innovate or adapt to changing consumer preferences and technological advancements quickly enough, it could lose market share.

7. Macroeconomic Factors:

Economic downturns or global events can reduce consumer spending and transaction volumes, impacting PayPal's revenues.

Valuation ratios:

Technicals:

Not too much demand of demand below but a bit of support… slow grind within this wedge. Think you need a catalyst to breakout of this wedge, but as of now, the market continues to price in PayPal being a value trap, although the risk reward from these levels to potentially take a shot into 2024 given how much the valuation has come down and how “cheap” it has gotten.

- Match Group (MTCH)

Bull Thesis:

1. Leadership in Online Dating:

Dominant Player: Match Group holds a commanding position in the online dating industry, owning multiple top brands that cater to various demographics and preferences.

Diverse Portfolio: The range of apps and websites under Match Group caters to different audiences, from casual daters to those looking for serious relationships.

2. Strong Growth Metrics:

User Growth: Platforms like Tinder have seen robust user growth, leading to increased revenues from premium subscriptions and features.

Monetization Opportunities: Enhanced features, advertising, and premium subscription models offer multiple channels for revenue growth.

3. Global Expansion Potential:

Online dating is still in the growth phase in many countries and regions. Match Group's international expansion strategy could tap into these large and untapped markets.

4. Technology and Innovation:

Match Group consistently invests in AI and other technologies to enhance user matching algorithms, safety features, and overall user experience.

Video Integration: Incorporating video chat features in response to the COVID-19 pandemic showcases the company's agility in adapting to changing user behavior.

5. Network Effect:

Dating platforms inherently benefit from the network effect: the more users that join, the more valuable the platform becomes to its existing and potential users.

6. Recurring Revenue Model:

Premium subscription models, especially on platforms like Tinder, create predictable and recurring revenue streams.

7. Cultural Shift Towards Online Dating:

Societal attitudes towards online dating have become more positive over the years. Especially among younger demographics, online dating has become a primary method of meeting new people.

8. Acquisition and Partnership Strategy:

Match Group has a history of successfully acquiring and integrating online dating platforms, ensuring it stays ahead of potential competitors and enters new market niches.

Bear Thesis:

1. Intense Competition:

Emerging Players: New entrants continue to emerge in the online dating space, offering innovative features and catering to niche audiences.

Tech Giants: Platforms like Facebook have ventured into the dating space, leveraging their massive user base and resources.

2. Changing Consumer Behavior:

Subscription Fatigue: With an increasing number of apps moving to subscription models, consumers might resist adding yet another paid service.

Shifts in Dating Trends: The way people approach dating and relationships can evolve, potentially making some platforms less relevant over time.

3. Monetization Challenges:

There's a delicate balance between monetizing users and ensuring user satisfaction. Overly aggressive monetization could alienate users.

4. Dependence on Key Platforms:

A significant portion of Match Group's users access its services through mobile apps, making the company dependent on app stores like Apple's App Store and Google Play. Changes in policies or fee structures of these platforms could impact Match Group's profitability.

5. Growth Sustainability:

While Match Group has experienced impressive growth, maintaining this growth rate can be challenging, especially in mature markets.

6. Economic Downturns:

Economic challenges might lead users to prioritize essential spending and cut back on discretionary expenses, including premium dating app features.

Valuation ratios:

Technicals:

Similar chart to BABA in all honesty although the consolidation hasn’t been quite as long. Had a failed breakout a couple months back and has since been on a downtrend and has formed the tighter wedge. 35 has been a pretty hard support since 2018 / 2019 / 2020.

- Target (TGT)

Bull Thesis:

1. Strong Brand and Retail Presence:

Nationwide Coverage: With over 1,900 stores in the U.S., Target's vast retail footprint ensures it remains accessible to a large portion of the American population.

Consumer Trust: Target has built a strong brand over the years, and many consumers trust the retailer for its product quality, pricing, and customer service.

2. In-House Brands:

Target offers a variety of popular private-label brands across clothing, home goods, and other categories. These brands often come with higher margins than third-party products and help differentiate Target from competitors.

3. Adaptive Store Formats:

The company has been experimenting with different store formats, including smaller urban stores, to cater to various demographics and locations.

4. Supply Chain Enhancements:

Target has invested in its supply chain, ensuring quicker restocks, better inventory management, and faster delivery to consumers.

5. Loyalty Programs and Digital Engagement:

Target RedCard: This loyalty program offers users 5% off every purchase and has a significant user base.

Target Circle: A newer loyalty initiative, offering personalized deals and rewards for frequent shoppers.

6. Diversified Product Portfolio:

Target offers a mix of essentials, home goods, apparel, electronics, and more, insulating it somewhat from downturns in any particular sector.

Bear Thesis:

1. Intense Competition:

Retail Landscape: The U.S. retail market is highly competitive with giants like Walmart, Amazon, and a slew of other brick-and-mortar and online retailers vying for the same customers.

2. Economic Sensitivity:

Economic downturns or reduced consumer spending can significantly impact Target's sales, especially in non-essential categories.

3. Consumer Backlash:

Divisive Issues: While many consumers appreciate and support companies taking stands on social issues, others might find these positions divisive or politically charged. Taking a stance can lead to boycotts or reduced sales from segments of the population that disagree.

4. Operational Challenges:

Implementing broad-scale diversity, equity, and inclusion initiatives can be complex, and missteps or inconsistencies can lead to both internal and external criticisms.

5. Reputational Risks:

Any failures, controversies, or perceived insincerities related to wokeness initiatives can result in negative media coverage and public relations challenges.

6. Overextension:

While addressing social issues, companies might spread themselves thin and lose focus on their core business operations, potentially impacting performance.

7. Competitive Response:

Competitors might counter Target's initiatives with their campaigns or messaging, leading to an escalating "wokeness" battle that could further polarize consumers.

8. Changing Social Climate:

What's considered "woke" today might evolve, and companies have to constantly adapt. There's a risk of being caught off guard or being seen as out of touch with newer social dynamics.

Valuation Ratios:

Technicals:

Demand zone below dating back to 2018 / 2020, firmly in this downtrend but has a strong demand zone below in the range of 110 / 90.

- Dollar General (DG)

Bull Thesis:

1. Ubiquitous Retail Presence:

Broad Reach: With over 17,000 stores in the U.S., Dollar General's extensive retail footprint ensures it remains easily accessible to a vast portion of the American population.

Rural Focus: Unlike many retailers that prioritize urban areas, Dollar General has traditionally found strength in serving rural communities, often becoming the go-to store in underserved markets.

2. Value Proposition:

The company’s commitment to keeping prices low and providing value resonates with budget-conscious consumers, especially in uncertain economic times.

3. Recession-Resilient Model:

Discount retailers like Dollar General tend to perform relatively well during economic downturns, as consumers become more price-sensitive.

4. Private Label Growth:

Dollar General has been expanding its private label offerings, which typically come with higher margins than branded products.

5. Diversification of Offerings:

Dollar General has been expanding its product categories, including fresh produce in some stores, offering customers more reasons to shop and increasing basket size.

6. Digital Initiatives:

Dollar General's investments in digital capabilities, such as its DG GO! mobile checkout, enhance the shopping experience and appeal to a broader customer base.

Bear Thesis:

1. Margin Pressures:

Rising costs, whether from supply chain disruptions, wage increases, or inflation, can put pressure on Dollar General's margins, especially given its value-oriented pricing strategy.

2. Economic Improvements:

While discount stores often fare well in economic downturns, a robust economy might lead consumers to shift their spending to premium or specialty stores.

3. Overexpansion Risks:

With already more than 17,000 stores, there's a risk that further expansion could lead to cannibalization of sales or diminish returns on new store investments.

4. E-commerce Threat:

As online shopping continues to grow, Dollar General's predominantly brick-and-mortar model could face challenges. Adapting to or competing with e-commerce giants can entail significant investments.

5. Supply Chain Vulnerabilities:

Global supply chain disruptions can lead to stockouts or increased costs, impacting sales and profitability.

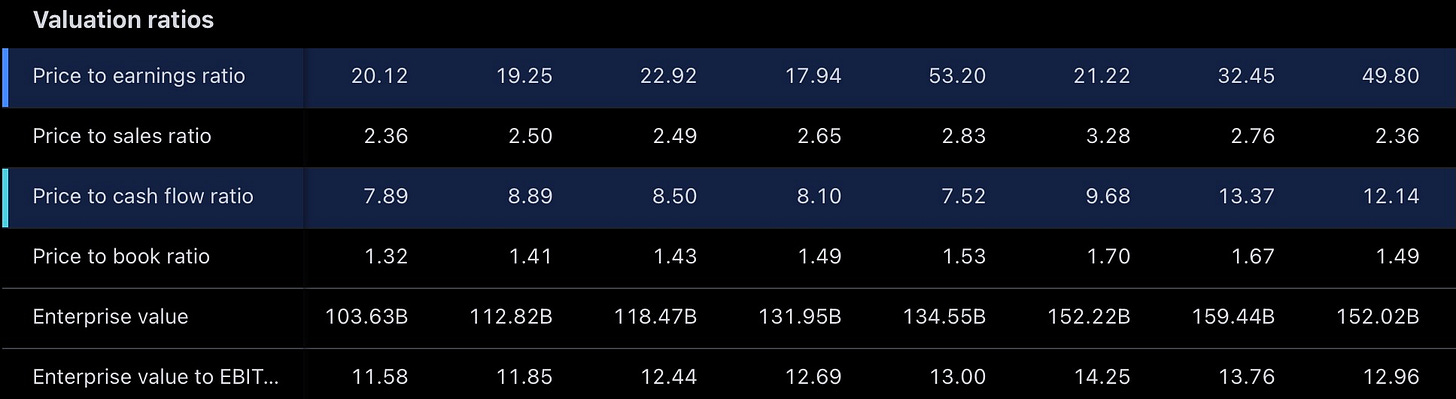

Valuation Ratios:

Technicals:

Found a longer term support TL dating back to 2014 and has since bounced. Also coincides with a demand zone as well around 100.

- ETSY (ETSY)

Bull Thesis:

1. Unique Value Proposition:

Niche Market: Etsy provides a platform for unique, handmade, and artisanal goods, setting it apart from other generic e-commerce platforms.

2. Global Reach:

With sellers from around the world, Etsy offers a diverse range of products and taps into global demand.

3. Scalable Business Model:

As a platform, Etsy doesn't hold inventory, which reduces overhead and allows for scalable growth.

4. Growth Opportunities:

Category Expansion: There's potential for Etsy to expand into new product categories and services.

Market Penetration: While Etsy is well-known in certain regions, there's growth potential in underpenetrated markets.

5. Sticky Seller and Buyer Ecosystem:

Etsy offers tools, resources, and a supportive community for sellers, creating stickiness on the platform. Many buyers also come to Etsy for the specific kind of products it offers, leading to repeated purchases.

6. Beneficiary of E-commerce Tailwinds:

The shift towards online shopping, accelerated by events like the COVID-19 pandemic, bodes well for e-commerce platforms like Etsy.

Bear Thesis:

1. Intense Competition:

General E-Commerce: Etsy competes with large e-commerce platforms like Amazon, eBay, and Alibaba, which have substantial resources.

Niche Competitors: New platforms catering to handmade or unique goods might emerge or gain traction.

2. Growth Sustainability:

Some of the growth Etsy experienced, particularly during the COVID-19 pandemic, might be temporary. As physical stores reopen, there might be a shift back to in-person shopping for some segments of consumers.

3. Dependence on Seller Community:

Discontent or issues within the seller community, like concerns over fees or platform changes, can harm Etsy's business model.

4. Counterfeit or IP Issues:

As with any e-commerce platform, there's a risk of sellers offering counterfeit goods or violating intellectual property rights, which can result in legal issues and damage to Etsy's reputation.

5. Economic Downturns:

In economic recessions, discretionary spending on non-essential items (like many of the unique and handmade items on Etsy) might decrease.

6. Reliance on Search Engines:

A significant portion of Etsy's traffic comes from search engines. Changes in search algorithms or decreased search visibility can adversely affect traffic and sales.

Valuation Ratios:

Technicals:

Nothing too standout in terms of technicals. Has found support off a demand zone dating back to 2019. Entire range essentially was a zone Etsy was consolidating within before finally breaking out during the Covid boom and has since retraced the entirety of the move and is right back to where it started. Up against a longer term DT similar to the other names I have mentioned as well.

- Duke Energy (DUK)

Bull Thesis:

Stable and Predictable Revenue Streams: Utilities like Duke Energy often have stable revenue streams because electricity and power are essential services. Regardless of economic conditions, consumers and businesses will need power.

Infrastructure Investments: Duke Energy has been consistently investing in infrastructure upgrades, expanding its reach and improving its services. Such investments can increase the company's asset base, which is useful for rate case proceedings with regulators and can lead to increased rates and returns.

Transition to Renewable Energy: As there is a global shift towards renewable energy sources to combat climate change, Duke Energy has been progressively investing in renewable projects. This positions the company well for the future energy landscape and can result in long-term growth and positive environmental impact.

Electric Vehicles (EVs) Growth: As the adoption of electric vehicles increases, there will be a greater demand for electricity. This could benefit utility companies like Duke Energy in the long term.

Resilience during Economic Downturns: Utilities are generally considered defensive stocks because they tend to be less volatile than the broader market during economic downturns. This resilience can be attractive for investors looking for stability.

Focus on Innovation and Modernization: Duke has been proactive in modernizing its grid and investing in new technologies. This not only enhances reliability and service quality but also ensures that the company stays competitive in the evolving energy landscape

Bear Thesis:

Transitioning to Renewables: While Duke is investing in renewable energy, the transition might be challenging. Rapidly changing technology, capital-intensive nature of renewables, and potential competition from more agile or technologically advanced players might pose threats.

Environmental and Legal Liabilities: Duke Energy has had to deal with environmental challenges in the past, like coal ash disposal. Such events can result in substantial cleanup costs, legal liabilities, and reputational damage.

Debt Levels: Like many utilities, Duke Energy has a significant amount of debt on its balance sheet. High debt levels can lead to increased interest expenses and reduce financial flexibility.

Economic Conditions: While utilities are generally considered to be recession-resistant, prolonged economic downturns can still reduce energy consumption, impacting revenues.

Decentralization of Energy: With the rise of home solar panels, battery storage, and other decentralized energy solutions, consumers might become less reliant on traditional utilities. This can erode the customer base and revenues for companies like Duke Energy.

Valuation ratios:

Technicals:

Has held up well respective to other utility names. Essentially consolidating with this demand zone right below between 78.50 / 86. Rates start to come down and DUK should start to outperform for that reason alone.

- Expedia (EXPE)

Bull Thesis:

Dominant Market Position: Expedia, alongside its various subsidiaries like Hotels.com, Orbitz, Travelocity, and Trivago, has a significant share of the online travel market. This scale allows for greater negotiating power with suppliers and a broader customer base.

Diversified Offerings: Expedia's portfolio is not limited to just hotel bookings. The company offers a wide range of services, from vacation rentals to car rentals and cruises, allowing for multiple revenue streams and resilience against sector-specific downturns.

Growth in Vacation Rentals: With its Vrbo platform, Expedia has a significant presence in the vacation rental market, which has seen robust growth and offers an alternative to traditional hotel accommodations.

International Expansion: While Expedia has a strong presence in North America, there's potential for growth in emerging markets and regions where online travel booking is still gaining traction.

Efficient Marketing Spend: Expedia's scale allows it to have efficient customer acquisition costs. By leveraging its data, the company can optimize its marketing spend to target higher-value customers effectively.

Bear Thesis:

Competition from Direct Bookings: Many hotel chains and airlines are pushing for direct bookings through their platforms, offering loyalty points, exclusive deals, and other incentives to bypass OTAs like Expedia.

Fierce OTA Competition: The OTA market is highly competitive, with players like Booking.com, Airbnb, and others vying for market share. This competition can lead to increased marketing spend and reduced margins.

Economic Downturns: Economic recessions can have a substantial impact on discretionary spending, including travel. A prolonged economic downturn could lead to reduced bookings and revenues.

Regulatory and Tax Issues: In various markets, there's a push to regulate and tax OTAs or the services they list, such as short-term rentals. These changes can affect profitability and operational freedom.

Margin Pressure: To stay competitive, Expedia might need to offer discounts or invest heavily in promotions, which could squeeze profit margins.

Valuation Ratios:

Technicals:

Tight consolidation within this wedge where it has found support from the covid lows. Really has just been within a range between 123 / 90 consolidating.

- Walgreens (WBA)

Bull Thesis:

Diversified Revenue Streams: Beyond just pharmacy sales, Walgreens has a diverse range of revenue streams including front-store retail sales, specialty pharmacy services, and healthcare clinics.

Digital Transformation: Walgreens has been investing in its digital capabilities, including its mobile app and online platforms. This can enhance customer experience, drive online sales, and improve operational efficiency.

Growth in Health Services: Walgreens is expanding its on-site health clinic model, offering primary care and other health services directly to consumers, positioning itself as a broader healthcare provider.

Partnerships and Collaborations: Walgreens has been actively pursuing partnerships with a range of healthcare companies. Collaborations with the likes of VillageMD, LabCorp, and others can diversify service offerings and drive additional foot traffic to stores.

Loyalty Program: The Walgreens Balance Rewards program has millions of members. This loyalty program can drive repeat business, provide valuable customer data, and enhance targeted marketing efforts.

Strategic Cost Management: Walgreens has been focused on cost-saving initiatives which, if executed effectively, can improve its operating margins over time.

Pharmaceutical Wholesale: Through its Alliance Healthcare segment, Walgreens has a significant presence in the pharmaceutical wholesale market, diversifying its business model and revenue streams.

Bear Thesis:

Competitive Landscape: Walgreens faces intense competition from both traditional retail pharmacies like CVS and big-box retailers like Walmart that have expanded their pharmacy and healthcare services.

Retail Decline: The broader retail sector, especially brick-and-mortar stores, has faced challenges from e-commerce growth. As online shopping continues to grow, foot traffic to physical stores might decline.

Amazon's Entry: Amazon's acquisition of PillPack and its push into the healthcare space poses a significant threat to traditional pharmacy chains like Walgreens.

Economic Conditions: Economic downturns can lead to reduced consumer spending, which might impact the non-pharmacy retail side of Walgreens' business.

Technological Disruption: The healthcare industry is rapidly evolving with telehealth, online pharmacies, and health tech startups offering new ways of accessing healthcare. If Walgreens fails to innovate or adapt quickly, it might lose its competitive edge.

Debt Levels: Mergers, acquisitions, and other strategic moves have led to Walgreens accumulating debt. High debt levels can pose financial risks and limit flexibility in future strategic decisions.

Valuation ratios:

Technicals:

At a demand zone dating back to 2008 and the early 2000s. Not much support below in terms of demand and may be prone to a dividend cut which may provide a flush opportunity down to 18s. High levels of debt, which wouldn’t make a dividend cut out of the ordinary.

- Enphase (ENPH)

Bull Thesis:

Leadership in Microinverters: Enphase is recognized as a global leader in microinverter technology, which is an essential component for residential and commercial solar installations. Microinverters convert the direct current (DC) power from individual solar panels into alternating current (AC) power.

Integrated Solar Solution: Enphase offers an end-to-end home energy solution, including solar generation, energy storage, and cloud-based monitoring. This integration provides consumers with a seamless and efficient solar experience.

Growth in Solar Market: As countries and corporations target more ambitious renewable energy goals, the solar industry is expected to grow significantly in the coming years. Enphase, as a key player in the industry, stands to benefit.

Energy Storage Opportunity: Enphase's expansion into energy storage solutions, like the Encharge battery system, positions the company to capitalize on the growing demand for home energy storage solutions.

Recurring Revenue Streams: Enphase's software and monitoring platforms, such as the Enlighten platform, offer potential for recurring revenue streams.

Grid Services Potential: With a vast network of connected solar and storage systems, Enphase is well-positioned to offer grid services, helping stabilize and balance the grid, which could open up new revenue streams.

Positive ESG (Environmental, Social, Governance) Profile: As an integral player in the renewable energy sector, Enphase stands to benefit from the growing interest in ESG investing.

Bear Thesis:

Competition: Enphase faces stiff competition from other solar technology providers, including both microinverter competitors and companies offering alternative technologies like power optimizers and string inverters.

Supply Chain Vulnerabilities: Enphase relies on global supply chains for manufacturing its products. Disruptions, whether due to geopolitical tensions, trade disputes, or other factors, can impact their ability to deliver products.

Economic Downturns: In periods of economic uncertainty or recession, consumers and businesses might delay or reduce spending on solar installations, impacting Enphase's sales.

Execution Risk: As Enphase seeks to expand internationally and diversify its product lineup, there's always a risk of missteps in entering new markets or launching new products.

Price Pressure: As the solar industry grows and matures, there's increasing pressure to reduce costs, which could lead to shrinking margins for products like microinverters.

Customer Concentration: If a significant portion of Enphase's revenue comes from a limited number of customers, the loss of any one of those customers could have a disproportionate impact on revenues.

Valuation Ratios:

Technicals:

Found support from a TL dating back to early 2020 as well as into a demand zone that has provided robust support previously - 110 / 120 range. Working on trying to breakout of this DT dating back to the peak last year.

- Raytheon (RTX)

Bull Thesis:

Diversified Portfolio: Raytheon has a diversified product and service portfolio, ranging from advanced defense systems and missile technologies to commercial aerospace products. This diversification helps mitigate risks associated with individual sectors.

Strong Defense Backlog: Defense contracts often span several years, giving Raytheon a substantial backlog and providing revenue visibility.

Global Footprint: Raytheon operates globally, serving both U.S. and international customers, which diversifies its revenue streams and reduces dependence on any single market.

R&D Capabilities: The company's commitment to research and development positions it to stay at the forefront of technological advancements in defense and aerospace.

Increasing Defense Budgets: Many nations, especially the U.S., have either maintained or increased their defense budgets, reflecting the need for advanced defense capabilities in an evolving geopolitical landscape.

Aftermarket Revenue: The company earns significant revenue from aftermarket services, parts, and maintenance – a steady income stream, especially for its commercial aerospace segment.

Bear Thesis:

Defense Spending Volatility: While defense spending can be robust, it is also subject to government budgets and political dynamics. Reductions in defense spending by major customers, especially the U.S., could impact Raytheon's revenues.

Competitive Landscape: The defense and aerospace sectors are intensely competitive. Raytheon competes with other large defense contractors, and any technological advancements by competitors can pose challenges.

Long Sales Cycles: Defense contracts often involve long sales cycles with no guarantee of a win at the end. Significant investment in bidding for these contracts without success can impact profitability.

Debt Levels: After significant mergers or acquisitions, companies often take on increased debt, which might limit financial flexibility or increase vulnerability during economic downturns.

Valuation Ratios:

Technicals:

Still within this downwards channel and has recently found a bid due to the Middle East conflicts. Quite a bit of demand below between 68 and 64 which I’d imagine should be decent valuation support.

- JD.COM (JD)

Bull Thesis:

Robust E-commerce Platform: JD.com is one of the largest B2C online retailers in China by transaction volume, offering a vast range of products and enjoying a large user base.

Integrated Supply Chain: Unlike many of its competitors, JD.com has an in-house logistics network, which provides faster and more reliable delivery, bolstering customer trust and satisfaction.

Technology Investments: JD.com has invested heavily in technology, including automation, artificial intelligence, and drone delivery, ensuring that it remains at the forefront of e-commerce innovation.

JD Health & Diversification: JD.com has diversified its services, including the growing health tech segment with JD Health, tapping into the rapidly expanding online healthcare market.

JD Cloud & AI: The company's foray into cloud services and artificial intelligence provides additional revenue streams and further integrates its suite of services.

Offline Retail Strategy: JD.com has ventured into brick-and-mortar retailing, providing a seamless integration between online and offline shopping experiences for consumers.

Growing Middle Class: The expanding middle class in China is driving consumption and increasing online shopping, benefiting e-commerce giants like JD.com.

Partnerships and Investments: Strategic partnerships, like that with Tencent, provide JD.com with user traffic and potential collaboration opportunities. Moreover, JD.com's investments in various startups can lead to symbiotic growth and strategic integrations.

Bear Thesis:

While JD.com has a strong presence in the Chinese e-commerce landscape, there are various challenges and concerns to consider. Here's a bear thesis outlining potential risks for the company:

Intense Competition: JD.com faces fierce competition in the e-commerce sector, particularly from giants like Alibaba, Pinduoduo, and other emerging platforms. These competitors have vast resources and can potentially undercut JD.com on prices or services.

Regulatory Scrutiny: The Chinese government has shown increased interest in regulating and supervising large tech companies. This regulatory environment could lead to restrictions or penalties that impact JD.com's operations and growth.

Economic Slowdown: A slowdown in China's economic growth or consumer spending could directly impact e-commerce sales and JD.com's revenues.

Overreliance on the Chinese Market: While JD.com has begun international expansion, a significant portion of its revenue still comes from China. This heavy reliance makes the company vulnerable to domestic market fluctuations.

Geopolitical Tensions: As JD.com expands internationally, it may face challenges in markets where there are geopolitical tensions with China, potentially affecting its global growth ambitions.

Valuation ratios:

Technicals:

Coming into a demand zone dating back to 2019. Continues to be in a downtrend within this wedge as sentiment for China is arguably nearing a trough as well as China in general.

- Overstock (OSTK)

Bull Thesis:

Ecommerce Growth: With the rise of online shopping, especially accelerated by the COVID-19 pandemic, e-commerce platforms like Overstock have a significant opportunity to capture a growing market.

Niche Market Position: Overstock has positioned itself as a go-to online destination for home goods, furniture, and decor, which can differentiate it from more generalist e-commerce platforms.

Loyalty Program & Customer Retention: Overstock's loyalty program, Club O, provides benefits such as free shipping, rewards, and exclusive access to sales. This program can increase customer retention and encourage repeat purchases.

Blockchain Ventures: Through its subsidiary, Medici Ventures, Overstock has been an early investor in blockchain technology. While it's a speculative venture, any significant breakthrough or adoption in this space could provide substantial upside.

Private Label Offerings: Overstock's private label brands, such as Porch & Den and The Gray Barn, allow it to cater to specific customer segments and potentially achieve higher margins.

Resilient Supply Chain: Overstock has worked on diversifying its supplier base and optimizing its logistics, which can ensure a smoother flow of goods even during global disruptions.

Potential Acquisition Target: As the e-commerce space continues to consolidate, Overstock, with its niche focus and established infrastructure, could be an attractive acquisition target for larger players.

Bear Thesis:

Intense Competition: Overstock faces stiff competition from larger e-commerce platforms like Amazon, Wayfair, and Walmart. These competitors have more significant resources, brand recognition, and customer bases.

Margin Pressures: Continuous promotions, discounts, and the need to offer free shipping to compete can put pressure on profit margins.

Fluctuating Traffic and Sales: Overstock's sales and website traffic can be seasonal and may fluctuate based on promotional activities, which can result in inconsistent revenue.

Evolving Consumer Preferences: Changes in home decor trends and consumer buying habits can influence sales, requiring Overstock to continuously adjust its product mix.

Blockchain Uncertainties: Overstock's investments in blockchain through Medici Ventures are speculative. The adoption and profitability of blockchain projects remain uncertain, and significant capital has been allocated to these ventures.

Economic Downturn: Economic recessions or slowdowns can impact consumer spending, especially on discretionary items like home decor and furniture.

Valuation Ratios:

Technicals:

Broke this interim downtrend, but has found some demand around 14ish. Does have some short interest along with recent insider purchases as well.

To cap it off, I thought RH may potentially be an interesting name, especially if rates come down.

- Restoration Hardware (RH)

Bull Thesis:

Luxury Positioning: RH's focus on luxury and high-end products sets it apart from many competitors, allowing it to cater to a more affluent demographic and achieve higher margins.

Strong Branding: RH's emphasis on sophisticated branding, high-quality catalogs, and a consistent aesthetic has helped it create a strong brand identity that appeals to its target demographic.

Diverse Product Offerings: Beyond furniture, RH has diversified into various categories, including lighting, textiles, bathware, decor, outdoor, and more, providing a comprehensive home luxury offering.

International Expansion: RH has growth potential in international markets. Expanding its brand beyond North America could significantly increase its addressable market.

Direct-to-Consumer Model: A significant portion of RH's sales comes from its direct-to-consumer model, which can offer better control over customer experience and potentially higher profitability than relying on third-party retailers.

Membership Model: RH's membership program, which offers members discounts and other benefits for an annual fee, encourages customer loyalty, repeat purchases, and provides the company with a predictable revenue stream.

Supply Chain Control: RH has invested in controlling more aspects of its supply chain, from manufacturing to home delivery, ensuring product quality and customer satisfaction.

Resilient Even in Economic Downturns: The luxury market often proves more resilient during economic downturns, as affluent consumers typically maintain their purchasing power.

Bear Thesis:

While Restoration Hardware (RH) has a unique position in the luxury furniture and home goods market, there are potential risks and challenges to consider. Here's a bear thesis on Restoration Hardware:

Economic Sensitivity: Luxury goods are often more sensitive to economic downturns. If the economy enters a recession or consumers pull back on discretionary spending, RH could see a decline in sales.

High Pricing: RH's luxury positioning means its products come with a premium price tag. This limits its addressable market to a narrower demographic, which could hinder growth if that segment becomes saturated.

Competition: The luxury home furnishing space has other notable brands, both online and brick-and-mortar, competing for the same affluent customer base.

Real Estate Costs: RH's strategy of opening large, opulent galleries, especially in prime locations, can be capital-intensive and come with high ongoing operating costs.

Debt Levels: RH has had significant debt in the past. If not managed properly, high debt levels can limit financial flexibility and increase vulnerability during economic downturns.

Valuation ratios:

Technicals:

Found support on a TL in which was prior resistance but has since flipped too support in which now has formed this wedge pattern which continues to expand. Recent ERs caused the recent decline paired with the repurchasing of shares also being from much higher levels. Has started to find some support in the 250 / 230 range in which it has done previously. Rates coming down may act as a potential tailwind keeping in mind a potential economic slowdown underway as well may counteract.

Provided a mix and a variety of names that were recent under-performers in 2023 and may potentially go on to out-perform in 2024 as the likelihood of tax-loss selling on many of these names may potentially provide great entries into the new year as well. Similar to what we saw in terms of the tech selling into EOY last year leaving HFs underexposed to tech paired with the narrative of AI has spewed the huge rally in tech this year along with the selling of both value names as well as growth / beta names as well which in the end result may be presenting an opportunity towards the EOY similar to how tech did last year. All of these names may work and or none of them may work at all! It is important to do your own due diligence on whether or not some of the companies I mentioned may potentially work out from these levels as we reach the EOY with the likelihood of potential increased selling due to tax-loss harvesting in many of the names I mentioned. I tried to get a great variety of names whilst trying too keep in mind the potential background heading into next year as well.

Included a general excel of entire basket below. Feel free to comment other names that may fit the criteria or you think have the potential to outperform next year.

As always, if you did enjoy this write-up, likes are ALWAYS appreciated and feel free to give feed back and or share this article with individuals whom may find it interesting! Wanted to get this out ahead before the end of the year as some names may present opportunities with the upcoming tax-loss harvesting likely to take place in some names. I hope you all have a fantastic rest of the year.

~ Eliant

Dude, this is incredible information and I appreciate the time you took to create it! I understand and respect the effort. Great work.

amazing Eliant, can’t wait to ride or die a few of these with you $TGT $DG $NKE .. gonna wait til mid Dec, when I recall $META being bid-less last year