Walked Back Again?

Hello All,

Quite the kickoff to the week in markets thus far as the headline driven volatility remains… yesterday, the markets initially kicked off the week in positive territory as we saw some slight upside followthrough from this prior Friday, but later on in the day, markets were once again met with a tariff headline which led to a late-day selloff & further continuation into today.

Thus far, the Q’s ended up tapping the 200d & producing a look below and fail before quickly reclaiming & rallying higher today whereas Spooz just missed the touch of the 200d, but did produce a nice bounce off the lows. As of now, small-caps are the worst-performing index of the week as there still fails to be a meaningful bid for beta / small-caps due to all the recent uncertainties whereas the remaining indices are all pretty much performing inline with each other.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes & I included a link to the report / write-up here for those who would like to go back & read.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

Another fairly volatile kickstart to markets this week… initially, Spooz / General indices were led with a slight gap up yesterday, but shortly following market open & a tad bit softer economic data (mostly driven by uncertainties surrounding tariffs), the indices resolved lower & couldn't manage a close above Fridays highs & the icing on the cake was Trump stating tariffs are “a go” which led Spooz to close yesterday out below last weeks lows which then ended up leading to a followthrough day to the downside in markets today.

In looking at the bigger picture on the weekly timeframe, Spooz is threatening to lose this upward parallel channel which has remained intact since the late ‘23 bottom… so in general, a fairly important upcoming weekly close for the markets.

In regard to intraday action… markets in general were all over the place, but shortly after bottoming about an hour after market open, it was a fairly steady grind up all day which initially led to a nice hammer off the 200d / green daily close, but later on in the day, a rehashed headline from a few days ago stating Trump is implementing tariffs on Taiwan semiconductors led to a near 100-handle reversal off the highs in the last 20 minutes of the trading day… granted, the headline wasn’t new information & it was just rehashed old information, but in a market as volatile & chaotic as this, every headline is taken at face value.

Nevertheless, we did exit the remainder of our March Spooz puts today about an hour after the market open…

Pretty much turned out to be the the low of day, so not a bad cover there & overall, these hedges worked out fairly well for us. We initially put the hedges on a week before the Deepseek scare in which we then covered half on Deepseek week given the big decline in such a short amount of time & then last week, we once again cut the put spreads in half for a 3X & then today, we sold the remaining 1/4th of the spreads to completely take the hedges off.

In regard to headlines… again, it was all over the place today. The most important headline of the day came after-hours from Lutnick:

LUTNICK SAYS HE THINKS TRUMP WILL MEET MEXICO, CANADA IN THE MIDDLE ON TARIFFS

Which although not yet confirmed by Trump, it seems pretty clear that Lutnick is trying to do a bit of damage control, whereas if Trump does confirm, that likely does provide a bit of upside in the indices… after all, Spooz was trading 5950s prior to this tariff tantrum, so if a deal of some sort is worked out which removes interim uncertainties, we could see quite the unwind in vol… at the end of the day, vol needs a reason to stay bid.

The big question as of now is did we reach the Trump put? Again, what we saw from Lutnick after-hours is without of doubt trying to place some sort of damage control… if Trump DOES confirm that a deal is likely to be made with Mexico & Canada, and tariffs will be backed off a bit, this will be the second time Trump has caved within a day of implementing tariffs.

In respect to economic data through the remainder of the week, tomorrow we have ISM #’s which may be a bit more volatile given recent uncertainties with tariffs (prices paid), but the bigger datapoint comes down to Friday with NFP #’s & as of now, estimates have shifted to Jobs expecting to come in at 170k vs. 143k prior & the unemployment rate is expected to remain unchanged at 4%. Not necessarily expecting any surprises in regard to this jobs report & if anything in regard to govt. / federal job cuts showing up in data, it likely wouldn’t show up in data until the end of Spring. A good jobs report Friday *should help ease recent growth worries & help curb those uncertainties.

In respect to Spooz, again, as of now, Spooz lost the support TL dating back to the late ‘23 lows which makes this weekly close an important one. As of today, Spooz nearly ended up clipping the 200d, but fell a tick short, but nevertheless, we did see a strong response from buyers & excluding the end of day selloff from the rehashed headline, Spooz had a fairly good close off the lows today.

As we head into the remainder of the week, Trump is expected to speak tonight, but the question I have is what more can he say? He certainly can deny the headline from Lutnick which would put pressure on markets, but otherwise, it doesn't seem like there is much “new” for him to say. Nevertheless, as of now, Spooz is up 80bps after-hours following the Lutnick headline & if this upside action sticks, Spooz may open up with an island bottom gap up which I do think would solidify today being THE interim bottom for now at least. For any sort of meaningful upside action, I do think we need to see Spooz reclaim the 5850 / 5900ish range above, as otherwise, we may still continue to see pops get sold until Spooz forms a bit of a base down here as it builds support above the 200d.

On the contrary, if we were to see todays lows get taken out / Spooz firmly breaks the 200d, I think we likely see Spooz flush lower towards the summer ‘24 highs near 5650 / 5600ish, which in general, I do expect that to be bigger support if tested (although not base case as of now given the somewhat positive developments from todays action along with the constructive headline after-hours as well).

- QQQ

In regard to the Q’s, today was the first day in quite some time where we saw the Q’s outperform & Mag-7 sustain a bid… we more so saw a complete rotation out of defensives into “risk-on” names today, which to me, signals the markets likely reached an interim bottom.

In looking at the Nasdaq below, similar to Spooz, but the Nasdaq still remains within the upward parallel channel it has remained in since late ‘22, so all in all, no “big” technical damage has been done on the bigger picture & this more so was just a quick & violent pullback to the bottom of the channel as of now.

In respect to the Q’s, the Q’s as well ended up testing the 200d & producing a look below and fail whilst also finding support right at the TL that dates back to late ‘22. Fairly simple from here, but if the Q’s do open with a gap-up tomorrow & it sticks, the Q’s very well could establish an island bottom that starts to lead the markets to trek higher as tariff uncertainties & growth fears ease… ultimately, we need to see the Q’s reclaim 508ish on the upside to get some sort of meaningful upside action, as otherwise, rallies may still be faded until the Q’s build out a bit of a base above the 200d.

On the contrary, if todays lows were to falter as support, we likely will see the Q’s go on to work lower & potentially fill that gap from mid-September near mid-470s, but in general, I would argue today was the first day of constructive price-action in the Q’s that we have seen in a long time… now its just a matter of if the Q’s can get followthrough into tomorrow to start to make the case that we have likely made an interim low which leads the indices in general to be set up for a potential violent snapback rally.

- IWM

A pretty ugly start to the week in small-caps but a fairly big reversal off todays lows… there isn’t TOO much to discuss in regard to small-caps, but in zooming out to look at the bigger picture, small-caps remain at a critical juncture… currently backtesting this near 3+ year base breakout whilst the 200wk sits just below more so as the ultimate LIS.

As we discussed earlier, but we do have jobs data on Friday which is more so the bigger datapoint of the week & as of now, jobs are expected to come in at 170k vs. 143k prior & the unemployment rate is expected to remain unchanged at 4.0%. This would be a GREAT report for small-caps & markets in general as it would help ease recent growth fears… I do think as long as jobs remains above 100k & or the unemployment rate remains below 4.1%, growth fears in general should remain contained.

In respect to IWM… another week of further technical damage has been done thus far, but as mentioned just above, IWM is still backtesting this near 3+ year base breakout & the ultimate LIS (200wk) is sitting just below near 200ish. As of now, small-caps are up 100bps after-hours following the Lutnick headline & similar story as with all of the indices, but if the headline were to be confirmed by Trump, I do expect markets to solidify an island gap up tomorrow which could potentially solidify the interim bottom being in for now as recent uncertainties ease a bit, but for any sort of meaningful upside, we do still need to see IWM reclaim 213/ 214ish to start to work higher towards 219ish, as otherwise, interim rallies may continue to be faded until IWM forms a bit of a base to work off of & or establishes some support / a higher low gets made.

On the contrary, again, if todays lows in IWM get taken out (todays action off the lows was fairly constructive so not base case), we likely will see small-caps get the test of the 200wk just below near 200ish which should be a fairly big & reactive support & do not necessarily expect that support to give easy & at the very least, it should produce some sort of violent snapback rally.

- DIA

Similar to Spooz, but the Dow is currently teetering on the edge as it sits on the bottom of the upward parallel channel it has remained in since late ‘23… an important weekly close ahead this week for the Dow & all of the indices on that note.

In respect to DIA, we finally saw DIA fill the CPI bull-gap from early January which marked the interim bottom as of now… as long as todays lows do hold, do expect DIA to retrace towards 432ish, but ultimately, still do need to see 439ish taken out on the upside to get some further upside momentum going, as otherwise, the market will still likely remain in “all rallies being sold” mode (of course barring a headline).

On the contrary, if we were to see todays lows falter as support, the 200d is sitting just below on DIA & more so will likely act as a magnet that leads DIA to test the 200d below which also happens to coincide with the January lows, so in general, it should be a more firm support if it were to be tested & potentially lead to a more sustainable interim bottom (assuming todays lows fail to hold as support).

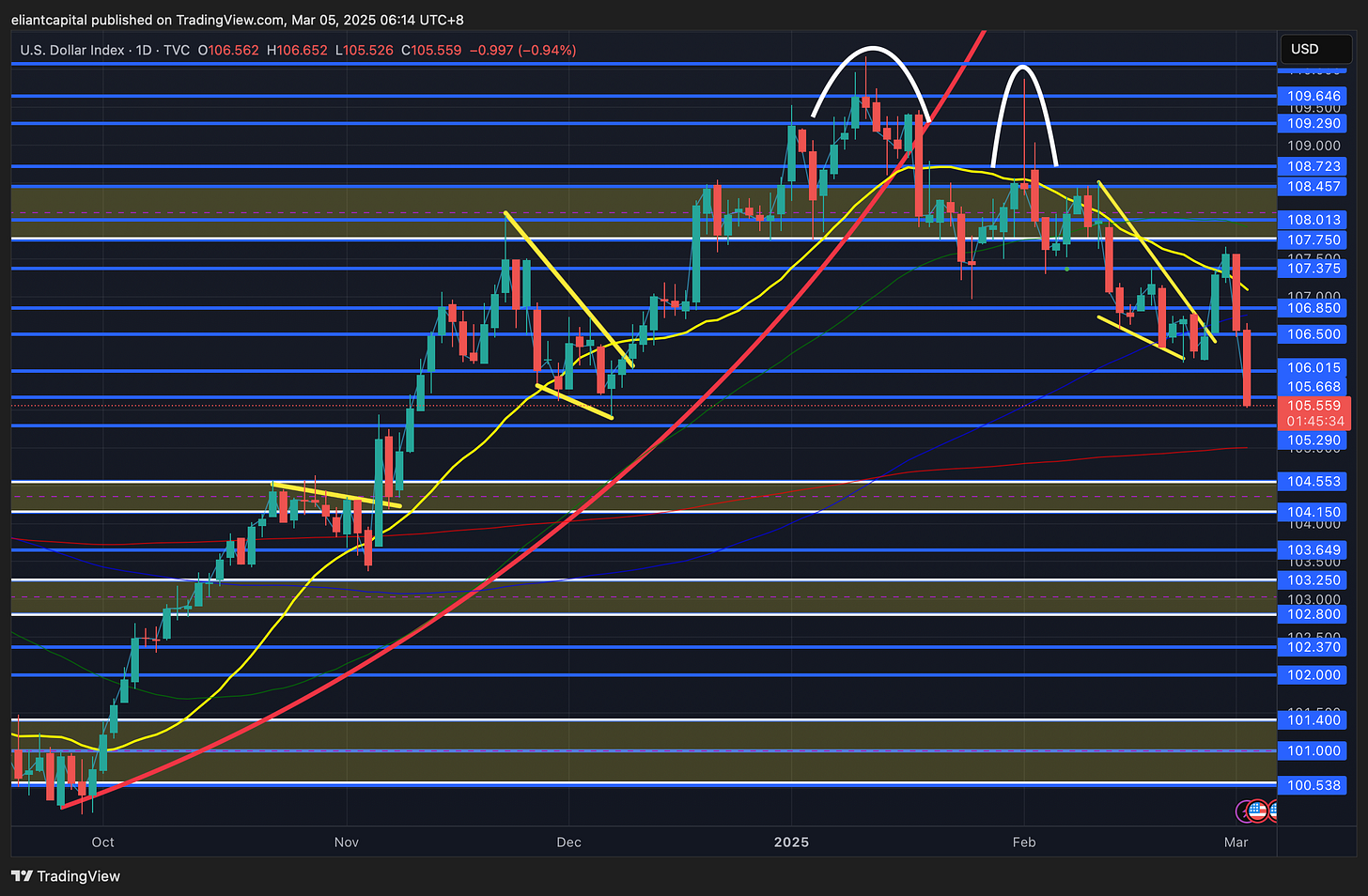

/DXY

Quite the week for the dollar thus far… as we expected, the recent reversion in the dollar from the prior week was once again faded as the dollar has now nearly made its way back to the 200d just below as it now resides in the mid-105s after being over 110 just a couple of months ago back in the beginning of January.

We’ve continued to maintain a bearish stance on the dollar & still do… following after-hours today, again, we received a headline out of Lutnick essentially suggesting that the U.S. will likely look to back off on tariffs if a deal can be reached with Mexico & Canada… granted, this has yet to be 100% confirmed by Trump. Nevertheless, following the headline, both CAD & MXN made highs against the dollar / dollar made lows, so as of now, market does clearly believe the headline. In regard to the other contributing factor towards the weakness in the dollar, again, it circles back to Europe… we’ve been a bull on the Euro despite the continued crowded calls for parity earlier on the year & it was such a “sure trade” but here we are with Europe stepping up & now significantly shifting focus towards fiscal spending which has led to this bigger breakout in the Euro against the dollar hence contributing to the general downside pressures in the dollar. Don’t necessarily see a clear catalyst to shift this momentum anytime soon besides technicals given the 200d sits just below.

We do have NFP #’s on Friday, & if the report were to be better than expected, that may bring about a bid in the dollar & we could potentially see a retrace towards 106.5 / 106.85s, but otherwise, do expect the dollar to ultimately tag the 200d below & the next layer of support is near 104.5s / 104.1s. Given all this recent downward action in the dollar & if the market starts to stabilize / shape up, this should be generally beneficial for U.S. indices, but especially stimulative towards EMs. In respect to U.S., SEVERAL companies & a very common theme this earnings season was blaming ERs guides / misses due to FX headwinds, but given the recent relief in the dollar, this should be a direct tailwind for many companies into this next quarter… just something to keep in mind as long as the downside in the dollar sustains / we don’t get any meaningful rallies.

/TNX

A bit of an interesting day in the bond market, but today, we ended up exiting the bonds we got exercised on in January with the sold puts & booked the gains a couple hours after market open.

What was the main reasoning? Spooz was down nearly 100-handles & at the same time, bonds were red… what was the conclusion? If the indices started to rally off the lows, one would assume that bonds would start to selloff & unwind a bit of the recent panic bid…

Sure enough, we ended up exiting bonds pretty much near the high of the day as bonds then preceded to selloff quite aggressively as indices rallied off the lows & we more so saw the recent panic bid in bonds deflate a bit / unwind.

I thought this was interesting as well & felt like it was worth sharing, but quite a large short was put on bonds today… going against the grain of Bessent & the current Admin’s goals, which given the large reversal from 4.1s to nearly mid-4.2s in the matter of hours, they haven’t been too successful given majority of the bid in bonds has been due to panic / flight to safety & a big portion of the recent rally got faded today.

I do think theres a good case to be made that the 10Y bottomed today… of course barring job #’s on Friday, but if we were to see markets rally from here / growth fears ease, I think we could see the 10Y retreat towards the 4.35 / 4.4 range, whereas if recent uncertainties persist / flight to safety continues in bonds, we ultimately need to see 4.1s on the 10Y taken out to start to work lower towards 4% & in that case, we likely would need some continued weaker economic data to escalate recent growth fears further, as otherwise, the 10Y does look ripe for a snapback higher as long as the lows near 4.1 stick.