What If?

This Fed does like to Pivot. After all, Pivoting is a feature of the System, not a bug!

Since Powell was appointed Fed Chair in 2017, there were a few notable pivots worth mentioning:

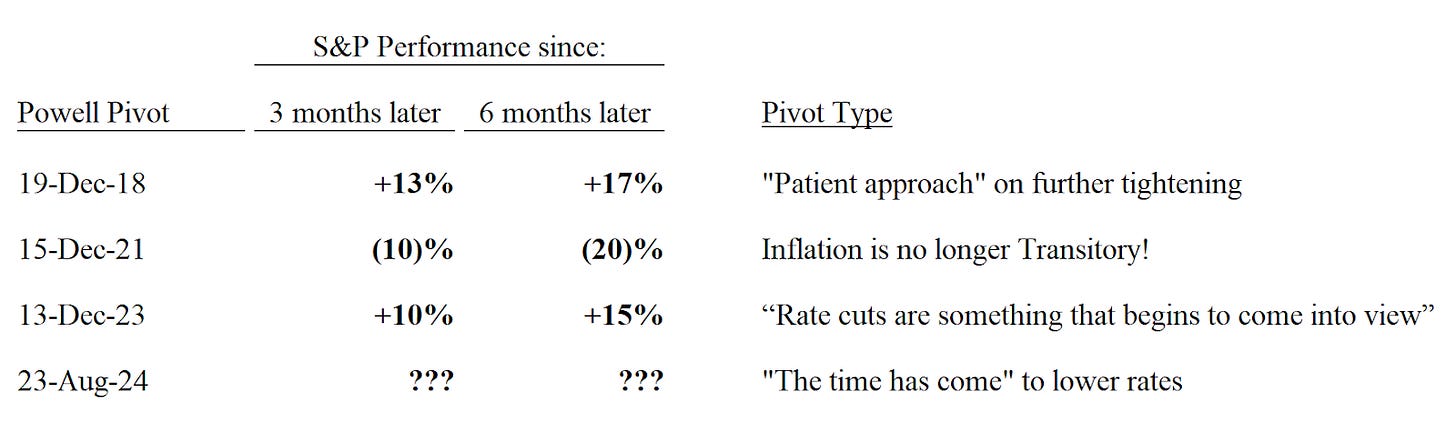

Dec 2018: Even though the Fed raised rates in the meeting, it signalled a more patient approach with further rate hikes, amid signs that the economy was starting to weaken. At the time, Trump urged the Fed to move cautiously “before they make another mistake.”

Dec 2021: After going on all year that Inflation was Transitory (spoiler alert: it wasn’t), the Fed announced that it would speed up the end of QE and would raise rates sooner than expected.

Dec 2023: Two weeks before the Fed meeting, Powell said that “it would be premature to…speculate on when policy might ease”. Then at the Fed meeting, Powell said that “rate cuts are something that begins to come into view”.

Aug 2024: “The time has come” to lower rates…

Each Pivot had its own consequences. The table below shows the S&P performance from the day of the Pivot to 3 months and 6 months later:

50bps vs 25bps

A key debate about the current Pivot is whether the Fed will cut by 25bps or by 50bps. The chart below (h/t CharlieBilello) shows the quantum of the first rate after a hiking cycle and it indicates that one should be careful what they wish for:

- A 50bps cut is usually associated with weakness in the economy and the forward returns of the Market are abysmal…

2007 vs 2024:

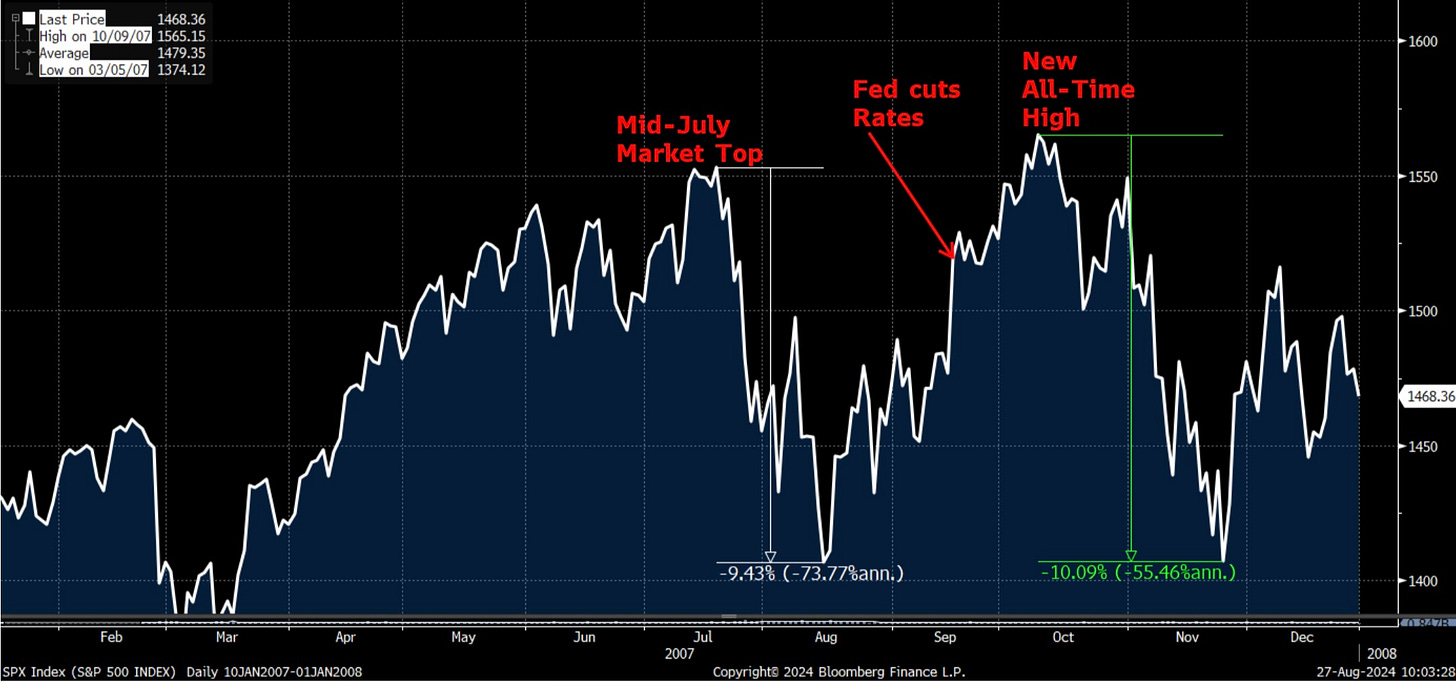

Speaking of which, the one period that comes to mind when we compare to today is 2007. Our friend PauloMacro just wrote a great piece on this, sharing the same thought.

There are some earie similarities. As @Brett_eth notes here that we present in table format:

There is a certain degree of Recency Bias in comparing with 2007 so it’s worth highlighting some major differences:

2024 is an election year and the Re-election Brigade is out in full force to keep the Economy and the Market going

2007 Subprime Crisis was a credit crisis with an over-leveraged banking system, which is not the case today

2024 vs 1976

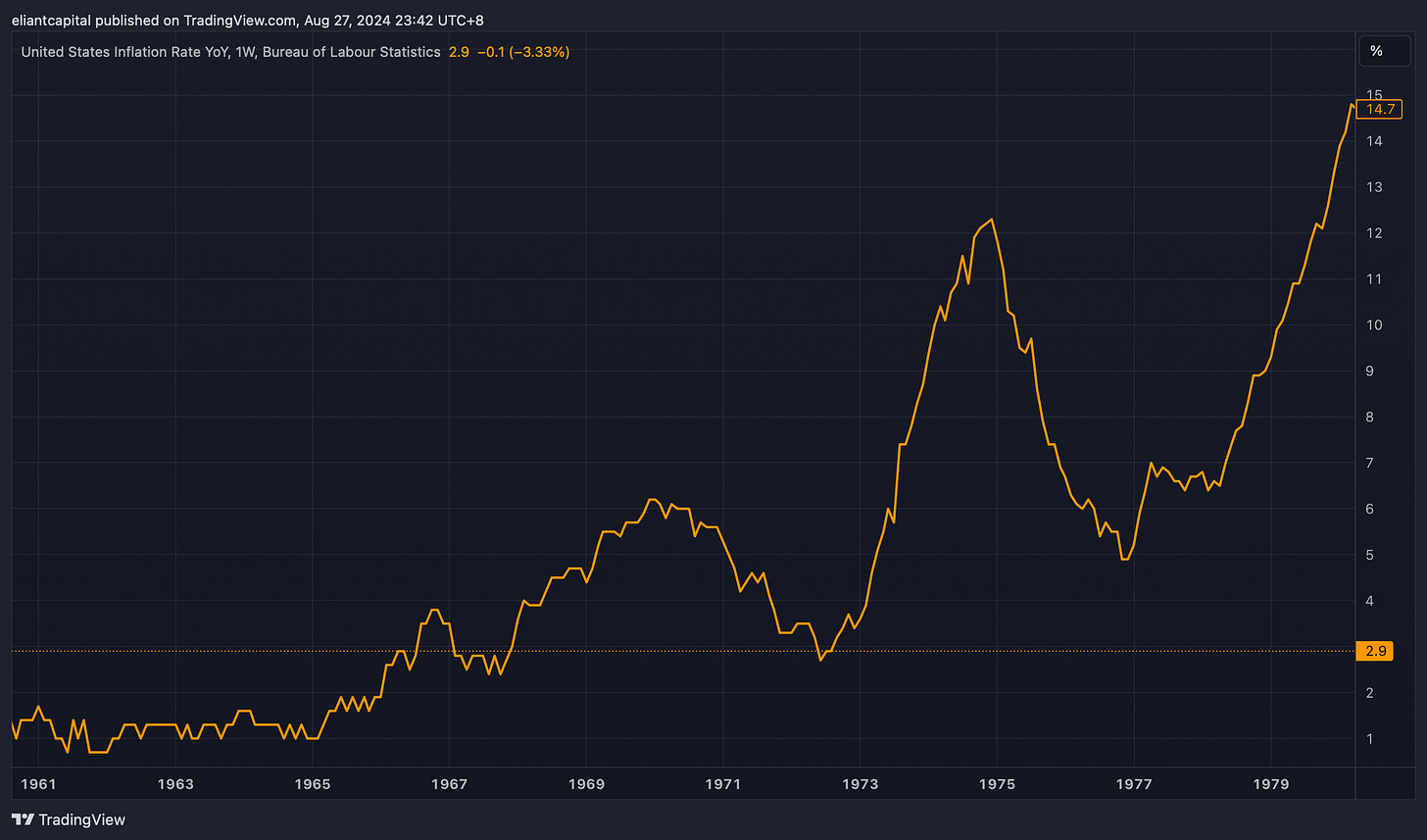

Back in December 2023 (and just after the last Fed Pivot!) we argued that 2024 could end up looking more like 1976. After all, both 1976 and 2024 were Election Years!

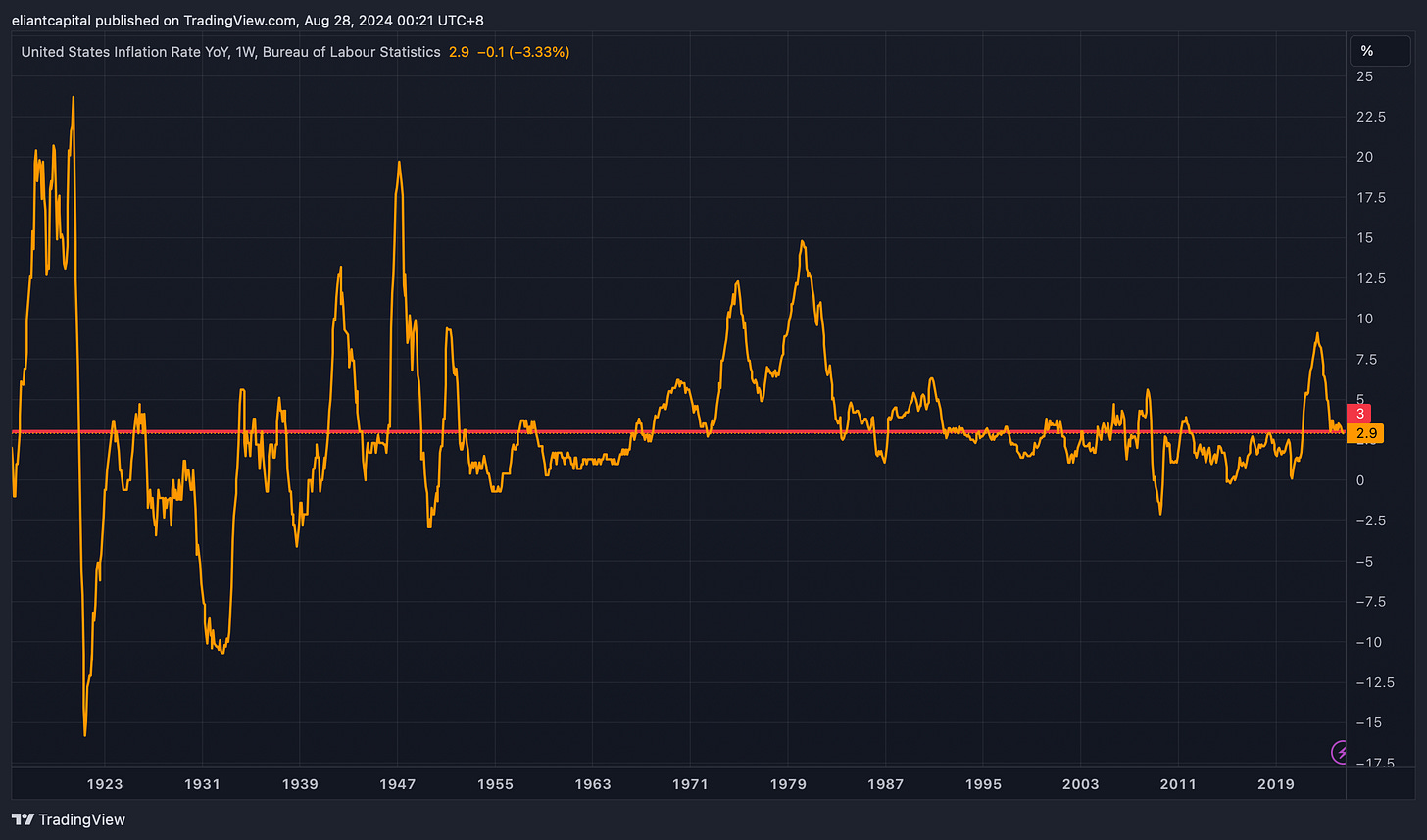

The Chart below by Apollo’s Torsten Slock plots the current inflation path and compares it to the 1974-1982 period (we drew a squiggly line up to today). Inflation was going down for TWO years after it peaked in 1974, but then it came roaring back. This was Burns’ legacy.

Back in December 2023, we imagined a conversation between Yellen and JPow where JPow expressed his concerns about repeating Arthur Burns’ mistakes but Yellen re-assured him that after the Election, they will tighten.

Tamagotchi Yellen: “Once we win, we will make sure we WON’T repeat Arthur’s mistake! In 2025 we will tighten up financial conditions again so we don’t have a repeat of the 1970s!”

Jerome: “Pinkie Promise?”

Tamagotchi Yellen: “Pinkie Promise” <crosses her fingers behind her back>

Well, here we are. Are we about to repeat the same mistake from the 1970s?

* A little side note: In the 1976 election, the incumbent President Gerald Ford LOST to Jimmy Carter.

Let’s take a closer look at the accommodative policy the Fed implemented in the ‘60s to support growth / general backdrop that led to the inflationary issues in the ‘70s:

The 1960s marked a significant period in U.S. economic history, where the Federal Reserve adopted monetary policies that, while aimed at fostering growth and employment, ultimately contributed to one of the most challenging economic periods of the 20th century—the stagflation of the 1970s. The decisions made during this decade, particularly the Fed's interest rate cuts and generally accommodative stance, played a pivotal role in setting the stage for the inflationary pressures and economic difficulties that followed.

The U.S. economy entered the 1960s facing a mild recession. In response, the Fed, under the leadership of Chairman William McChesney Martin, cut interest rates to stimulate economic activity. By mid-1961, the federal funds rate had been reduced from around 4% in 1960 to approximately 2.25%. This move was aimed at encouraging borrowing, investment, and consumer spending to reignite economic growth.

As the decade progressed, the U.S. economy grew robustly. The expansion was fueled by a combination of factors, including rising consumer demand, technological advancements, and significant government spending (Sounds just like ‘24) on President Lyndon B. Johnson's "Great Society" programs and the Vietnam War. Despite the strong economic growth, the Fed maintained a relatively accommodative monetary policy throughout much of the 1960s. Interest rates remained lower than might have been expected given the economic conditions, as the Fed sought to support full employment and avoid derailing the expansion.

By the late 1960s, the consequences of the Fed's accommodative policies began to manifest. The combination of strong economic growth, expansive fiscal policy, and low interest rates led to rising inflation. Price pressures began to build as demand outstripped supply in various sectors of the economy, and inflation climbed from around 1% in the early 1960s to over 5% by 1969.

Moreover, the sustained period of low interest rates and government spending contributed to a shift in inflationary expectations. Businesses and consumers began to anticipate higher future inflation, which influenced wage demands and price setting. This change in behavior further entrenched inflation, making it more difficult to control.

So, to recap, the Fed's decision to cut interest rates and maintain an accommodative policy stance in the 1960s was driven by the desire to promote economic growth and full employment. However, these policies also contributed to rising inflationary pressures that, coupled with external shocks and fiscal imbalances, led to the economic challenges of the 1970s.

Now, lets take a look at the response of the December pivot of ‘23 (Powell: Rate Cuts are now on the table):

Looking back at the December pivot, that essentially kicked off the rally in commodities into this year / growth fears in ‘23 were put to rest as the Fed was choosing to support growth over inflation hence driving the re-acceleration in the economy (stimulative), which in return sparked the rally in commodities as well.

In regard to the Dollar & Bonds, initially, bonds spiked higher for about a week before rolling over & then declining for 5 months before bottoming in late April / Early May… the Dollar is essentially in reverse and declined for about a week before bottoming at the end of ‘23 and then staged a rally for about 5 months before peaking (Commodities rallied with the dollar whilst bonds declined).

What’s our conclusion here? The Fed pivoting in December of ‘23 (“Rate cuts are now on the table”) ignited a rally in commodities / supported growth / Bonds rallied initially for a week before declining & the Dollar fell lower for about a week before bottoming.

Now, looking back at last week (FOMC) / this week, let’s review some statements made from Powell & other Fed members:

FED'S POWELL: WE WILL DO EVERYTHING WE CAN TO SUPPORT A STRONG LABOR MARKET AS WE MAKE FURTHER PROGRESS TOWARD PRICE STABILITY.

FED'S POWELL: WE DO NOT SEEK OR WELCOME FURTHER COOLING IN LABOR MARKET CONDITIONS.

FED'S POWELL: THE POLICY RATE LEVEL GIVES AMPLE ROOM TO RESPOND TO RISKS, INCLUDING UNWELCOME FURTHER WEAKENING IN THE LABOR MARKET.

FED'S POWELL: MY CONFIDENCE HAS GROWN THAT INFLATION IS ON A SUSTAINABLE PATH BACK TO 2%. (Victory Lap)

FED'S DALY: WE WANT THE LABOR MARKET TO STAY ABOUT WHERE IT IS.

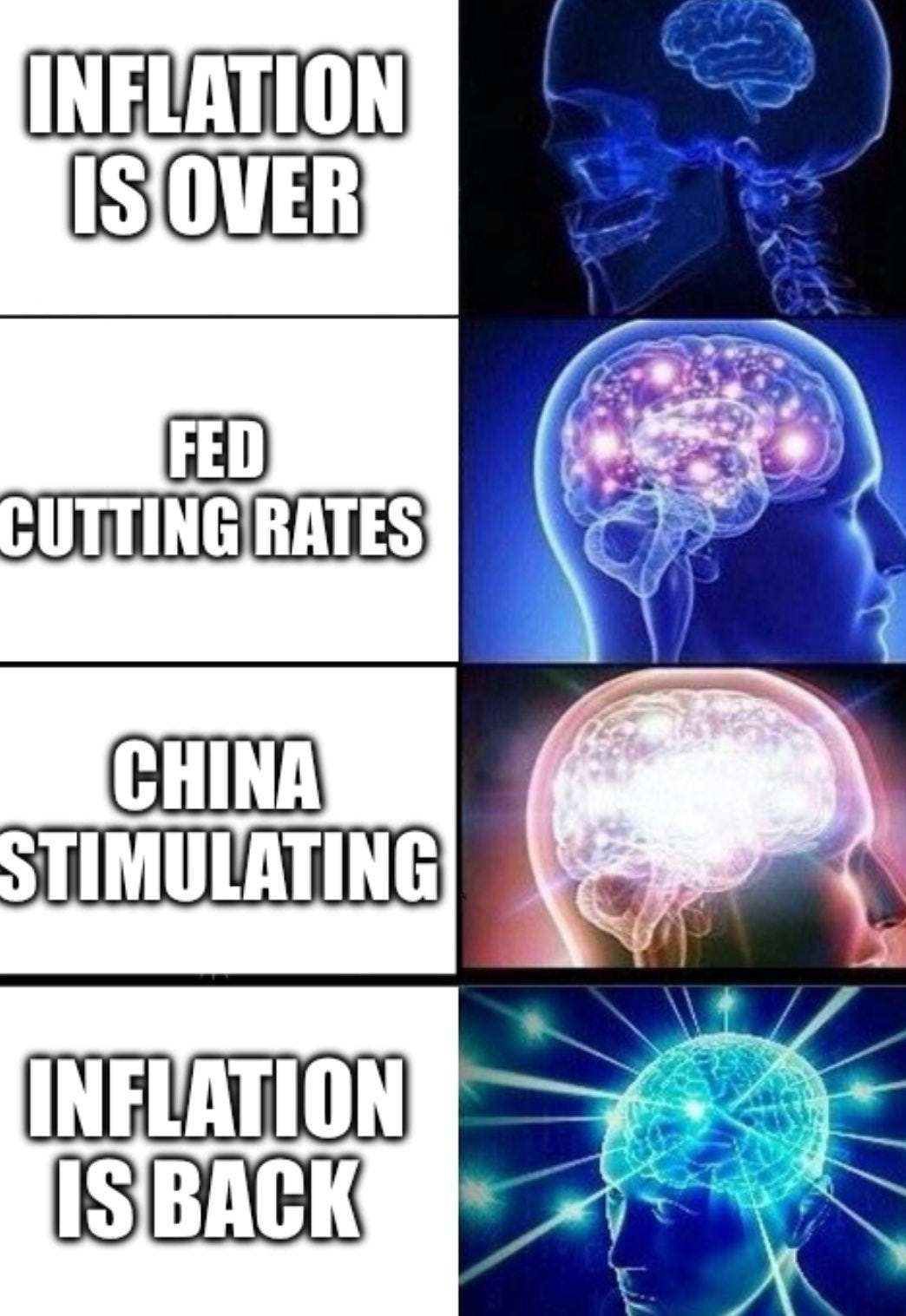

Conclusion: The Fed is worried about the labor market & initiated the “Fed Put” and is ready to be accommodative & issue rate cuts & support growth (Where have we seen this before?)… while inflation is still above their target (Abandoning Inflation Target / Choosing Growth Over Inflation?).

So, in the ‘60s, the Fed chose to accommodate growth which in return led to a rise of inflationary pressures which were also due to external shocks along with strong fiscal impulses.

In terms of where we are now, Powell said several times at this past FOMC that the Fed is worried about growth & is ready to accommodate and support growth… parallel to the ‘60s.

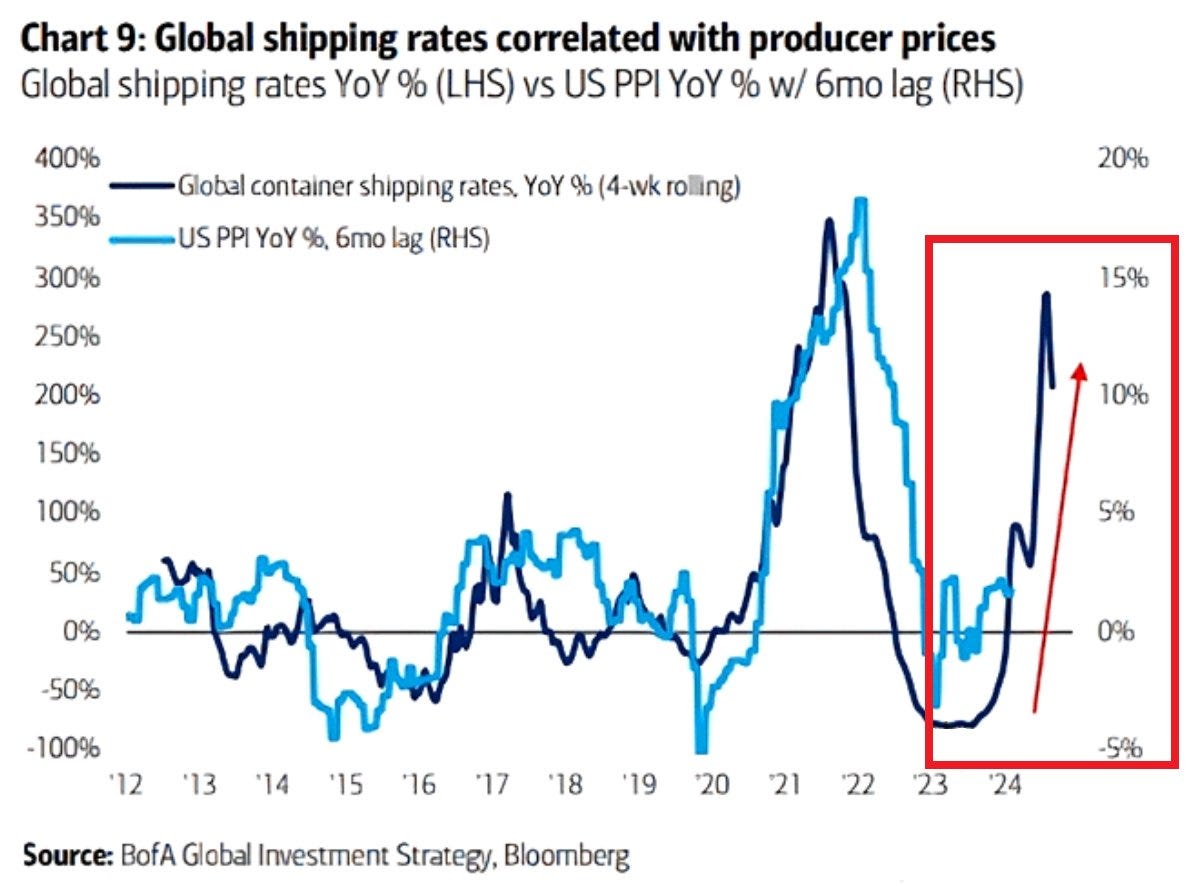

In regard to external shocks, maybe Iran does something or maybe they never will, but shipping rates have gone parabolic this year which has correlated with producer prices in the past… *Taps sign, maybe we have yet to see the impact & that’s coming here soon enough.

And lastly, strong fiscal impulses… Fiscal Deficits are already blowing out as it is as the Govt. can’t stop spending, but now given it’s an election year and both presidential candidates have plans which will cost… MOAR $$$ continuing to drive strong fiscal impulses / blowing deficits out further…

Heck, Kamala wants to give First-Time Homeowners $25K for a Down-Payment!

Ok, so where are we going with this & what’s to come from it?

So, the parallels are clearly there in comparison to the ‘60s in regard to accommodative policy (Fed choosing to support growth by cutting rates) along with potential geopolitical pressures / further escalation in ME (External Shocks) & the strong fiscal impulse (Govt. is not going to stop spending & both presidential candidates have plans to spend MOAR $$$).

With all that being said, the “R” word has been the big buzzword, and rightfully so given recent mixed economic data (UER ticked up to 4.3 which surpassed the Fed’s expectations & likely caused this recent worrisome / language by the Fed). With Powell coming out last week essentially saying the Fed is ready to do whatever it takes to support growth… this makes you wonder if the “R” word is about to shift violently back towards inflation… sure seems like it given the parallels to the ‘60s / ‘70s.

Moving forward with the given backdrop & recent data, it seems like inflation has reached a bottom & with the Fed choosing to support growth over inflation, that likely confirms that thesis… especially given the Fed wants to re-accelerate the economy by issuing rate cuts thus improving demand which will be a driver of a commodity rally as well.

After all, Inflation hasn’t spent much time around 2% & always tends to oscillate around 3%

And the big wildcard is China if they ever decide to implement massive stimulus…

But in summary, if the U.S. does avoid a recession & the Fed cuts into a growth rebound… get ready for the new movie coming to a theater near you.

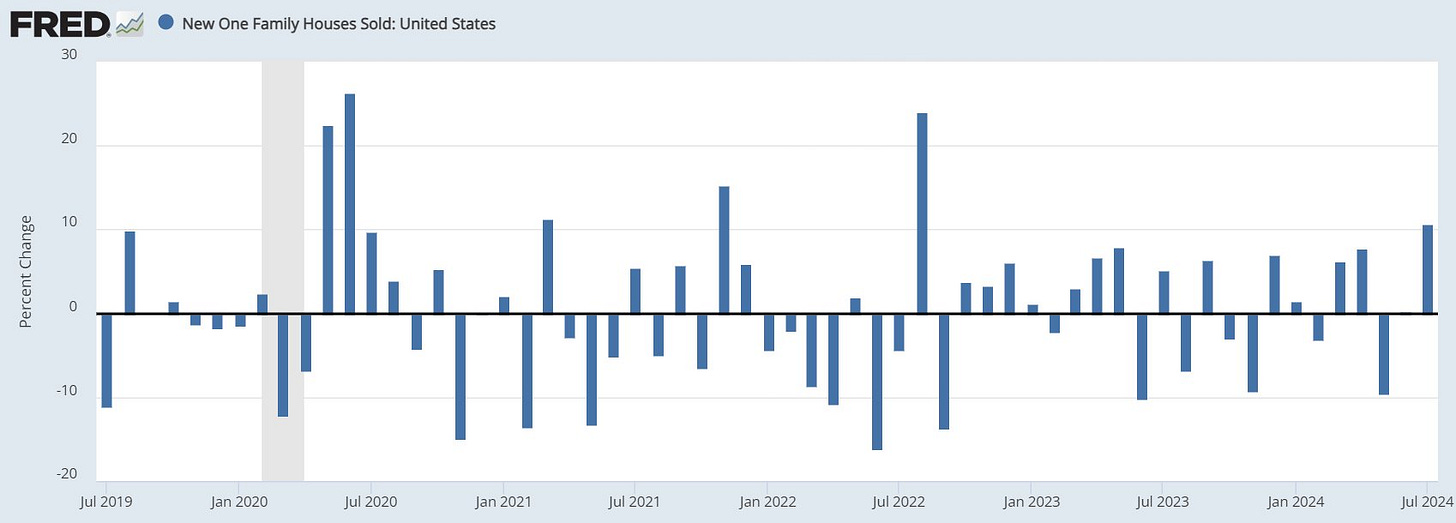

And speaking of growth rebound, New Home Sales were up 10% last month… lower rates & all of the individuals whom have been waiting to buy & have been sitting on the sidelines are now ready to pounce… certainly doesn’t sound disinflationary & or the economy is suffering if individuals are rushing to buy houses.

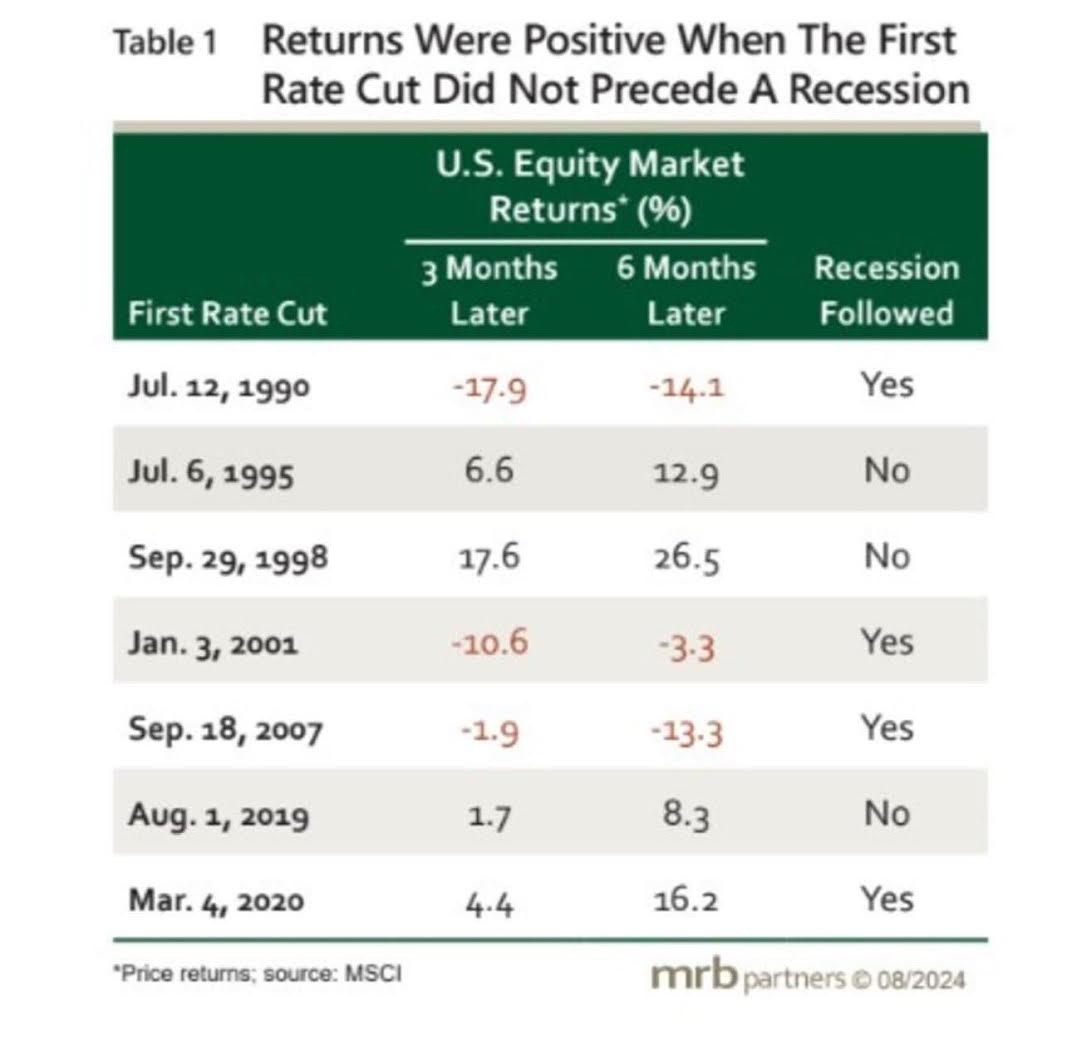

And while on the topic of the U.S. avoiding a recession, but in regard to the markets, returns were positive when the first rate cut did not precede a recession:

What to do?

I think the Memes speak for themselves. Sometimes it’s that easy, depending on the path that the Dollar and the Bonds will take:

And of course, if the Fed is choosing to support growth thus rebounding inflation, bonds likely won’t do too well either… they certainly didn’t do well in ‘22 when inflation was going up.

The 10Y continues to protect 3.8…

And lastly, more Govt. Spending / Fiscal Impulse to continue to support growth with entrenched inflation should continue to benefit Precious Metals / Commodities in general… especially if the “What If” recession part gets put to rest and we see growth rebound along with inflation.

Both Gold & Silver have been in strong trends on the upside all year as they continue to work out of multi-decade breakouts:

~ Eliant & Shrub

Y’all absolutely CRUSHED this! Great freaking job! 🎯

I'm a mess around and get gold teeth lol. Going to get heavy in PAAS/NEM. Probably buy a gold Cuban if it moons all jokes aside.