Where breadth goes to die

Hello All,

It’s been quite a jam-packed week in respect to economic data / earnings / general event risks, but all things being said, it’s been a relatively quieter week in respect to the indices although both the Dow along with Small-caps have been a clear laggard on the upside given the lack of general upside participation within the indices as Small-caps sit lower by just over 200bps as the worst performing of the indices whereas the Q’s have been the ‘best’ performing of the indices yet still sit lower by just over 21bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

- SPY

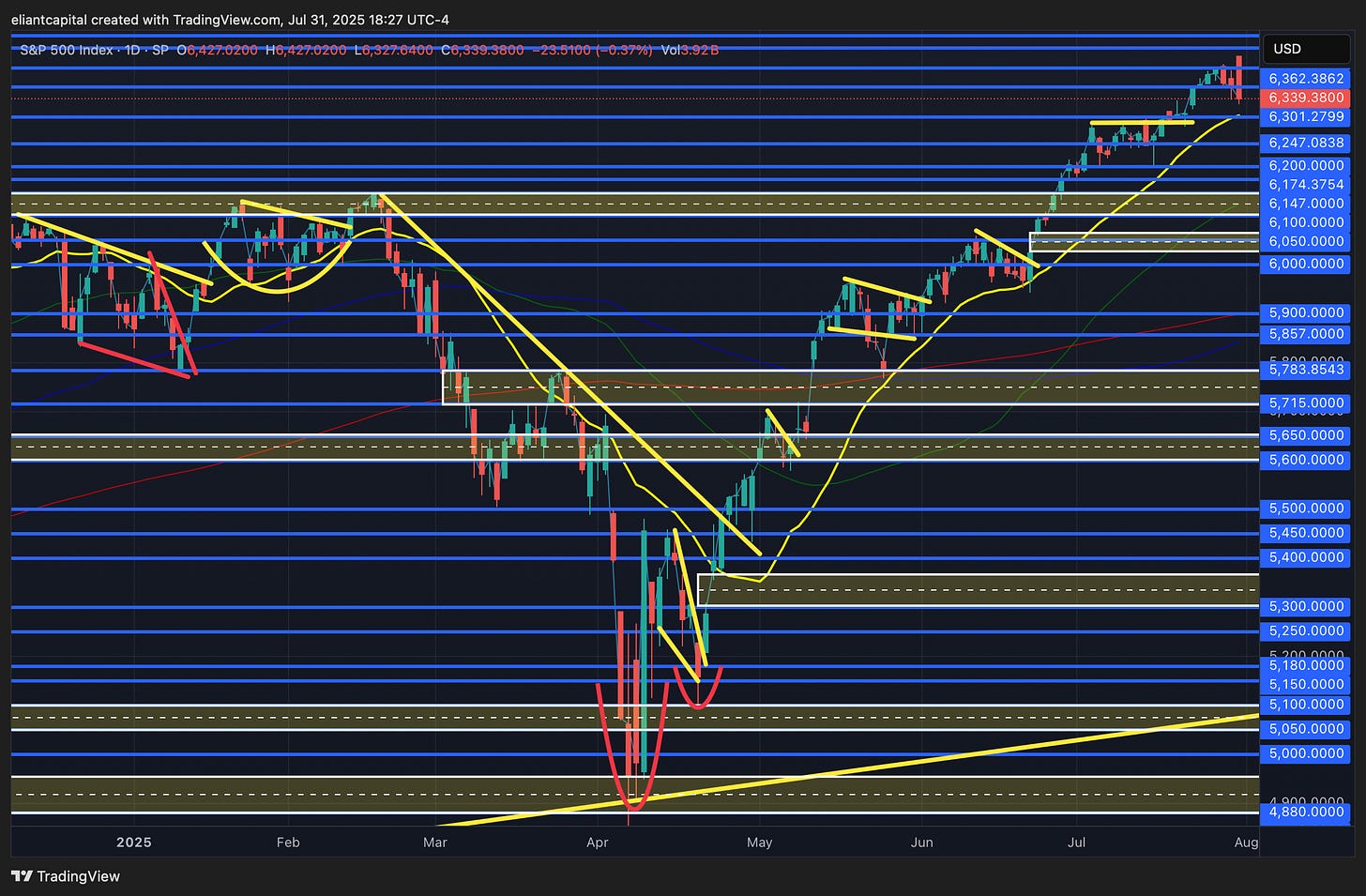

To jump right into it, the word to describe the week thus far has been “narrow” in terms of the lackluster participation on the upside, but nevertheless, we did see Spooz briefly making another new ATH today following the blowout MSFT & META ERs reports but Spooz ended up quickly engulfing the entirety of the candle & closed out near the lows today… again, mostly driven by the lack of participation on the upside / overall weaker breadth along with month-end likely playing a role as well.

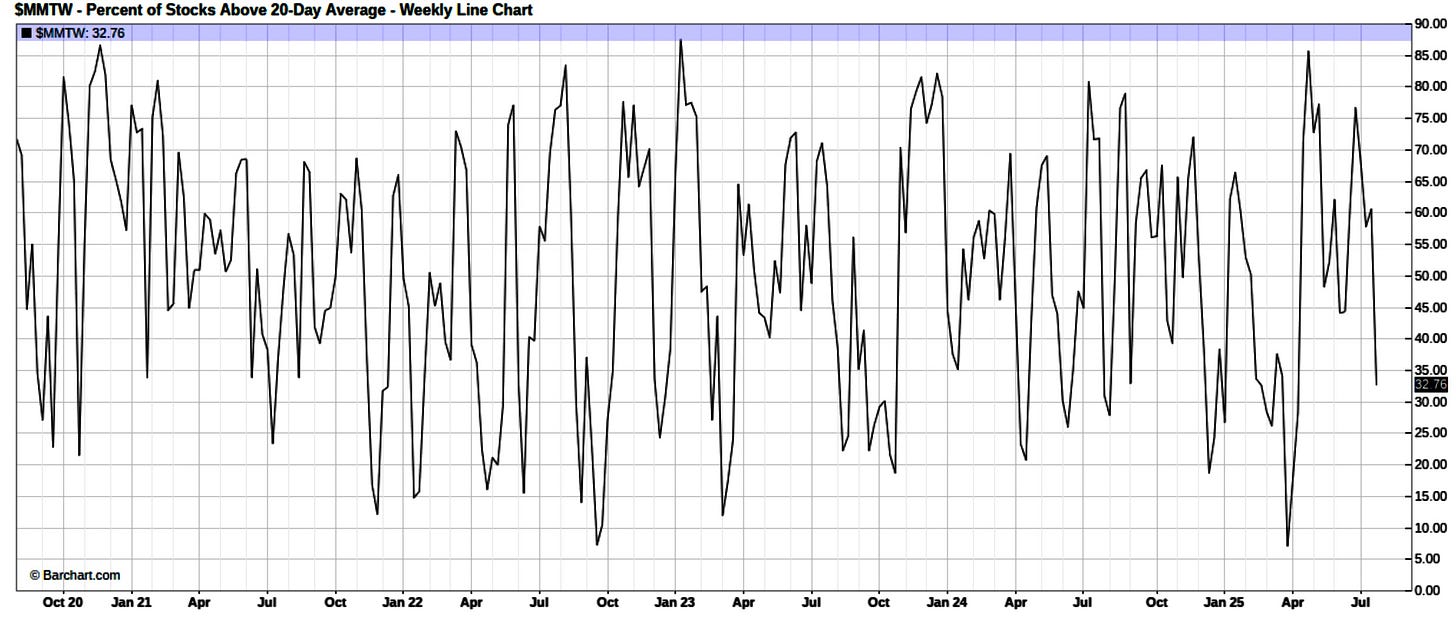

And with the word of the week being “narrow,” well, it’s been made pretty clear in looking at the % of Stocks Above the 20D as it has since fallen to just 32%… quickly approaching oversold territory which is a bit crazy to think about as Spooz & the Q’s are barely off their local highs, but again, it more so emphasizes that the indices have been gradually correcting under the hood for the last few weeks as upside participation has been quite lackluster overall.

Moving on to Spooz more specifically, but as of now, Spooz is lower by just over 70bps on the week despite both MSFT & META crushing earnings along with the major Semiconductors rallying on the backs of better than expected Capex #’s & finally, the announcements of trade deals & more importantly, the resolve between the EU & U.S. which was the bigger worry coming into the week as a deal was essentially 50 / 50.

So, is this a bit of a news failure?

Yes and no.

Yes, because despite the good news, markets have struggled to hold gains — pops have been sold, and while new all-time highs are being made, they’ve come with fading momentum.

&

No, because the weakness isn’t necessarily due to bad news, but rather poor breadth. A major issue has been the extreme crowding within the Mag-7 and a handful of mega-cap names. That crowding has made the market *look strong on the surface, but in reality, it’s siphoned liquidity from the broader S&P 493. The result has led to weak participation under the hood, and the Mag-7 can only carry so much weight before exhaustion sets in hence contributing towards the underlying weakness.

Nevertheless, not much has changed overall & Spooz hasn’t even tapped the 20d yet… Our expectation into July was that if Spooz were to extend out of the prior 3-week consolidation (6200-6300ish) to the upside that we’d likely see Spooz melt higher towards the 6400 / 6500ish range above & well, we did pretty much get that move & barring a collapse in jobs data tomorrow which we’ll talk more about later, I don’t necessarily see a bigger reason for markets to selloff (3-5% would be normal but in terms of a bigger correction, think would need to see softening in hard data) unless it’s just due to underlying technicals & or allowing for a period consolidation which would also likely then be led by rotation under the hood which wouldn’t be a bad thing either.

However, if we were to see Spooz continue to retrace in the interim, again, the 20D is sitting just below which essentially coincides with 6300ish which was a prior firm resistance for nearly 3-weeks before it finally led to this recent breakout to the upside to new highs so bulls would like to see 6300ish flip from prior resistance to support but if Spooz were to falter below 6300ish / 20d, I could see Spooz pulling back further towards 6175 / 6145ish (Coincides with prior ATHs) & as long as that general area does remain supportive (highlighted demand zone), do think that bulls will continue to maintain edge / dips will continue to remain shallow & bought & for a deeper correction, again, do think we would start to need to see softening in hard-data which would likely lead Spooz to rollover further, assuming the prior ATHs fail to come in as support, towards 6050ish which essentially coincides with the Ceasefire bull-gap established just over a month back & in general, I do think the prior range before this bigger rally to new highs (6050 / 5950ish) will likely serve as a broader support, whilst important MAs (200d / 100d) sit just below as well for added confluence, and will continue to keep indices more bifurcated on the medium-term picture, and of course the other added factor to keep in mind is that many Individuals / HFs / PMs have been itching for any sort of dip to ‘let them in’ to this market so barring a surprise shock (still maintain that hard-data rolling over > tariff headlines), do think that dips will still likely continue to get bought until proven otherwise.