90 Days of Relief

Hello All,

It has been quite the week within indices & a historic one to say the least, but initially, indices kicked off the week with a decline as uncertainties revolving around tariffs persisted as there was no resolve over the weekend… as the week progressed, not only did uncertainties persist / zero deals were officially made, we also had an escalation from China following the U.S. given the U.S. increased tariffs on China to 104%, so naturally, China retaliated by issuing 84% tariffs on the U.S.

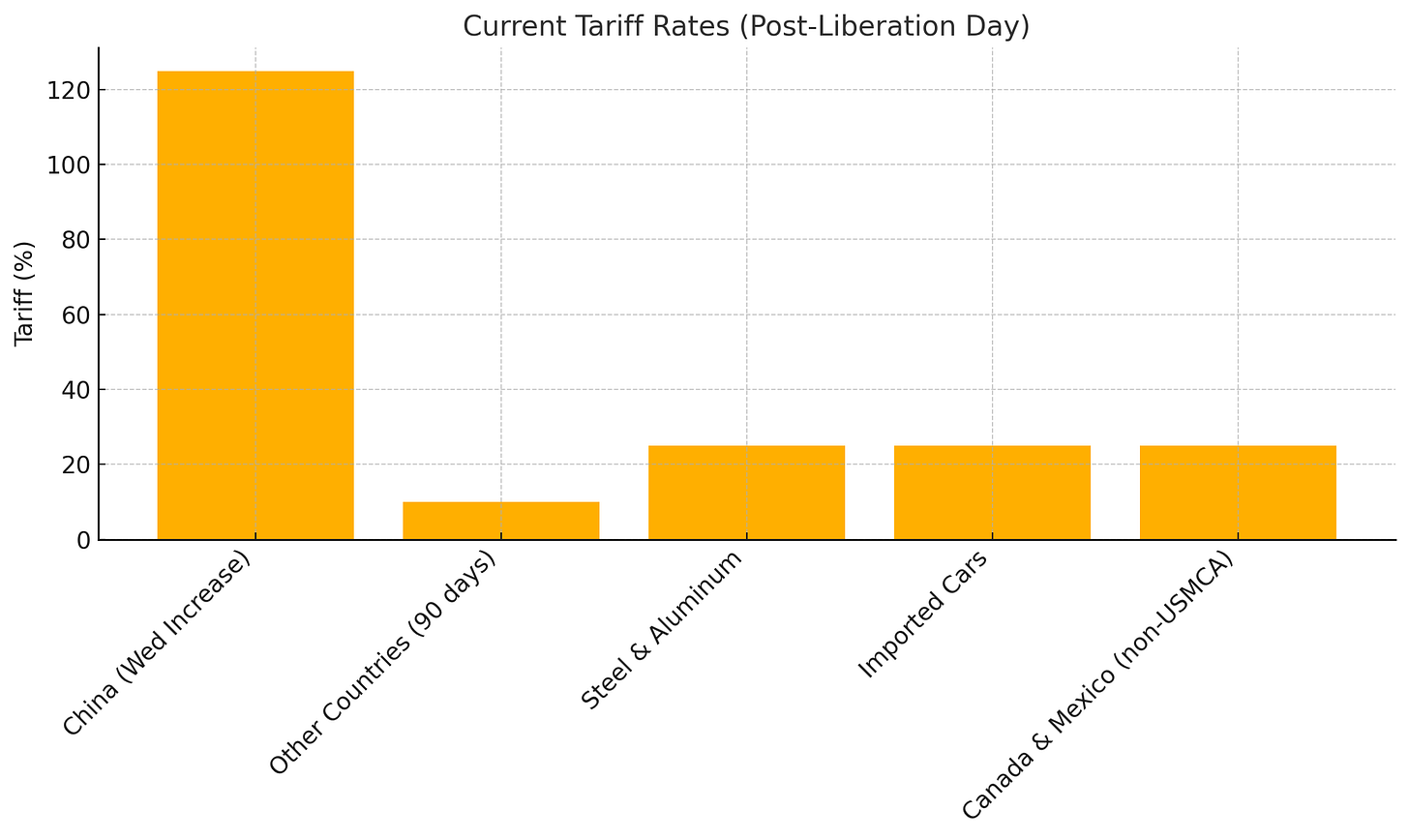

Today, the entire rhetoric changed… last night, we had a bit of a bond freakout in markets as bonds had declined 10% within 2 days which is a historic move in itself, but fears were encroaching into credit markets & that ultimately led the administration to panic… as a result, the administration issued a 90-day delay (China tariffs increased to 124%, but all other countries whom didn’t retaliate remained delayed at 10%). The point of the delay was to allow for more time to negotiate with other countries as the administration stated that 70+ countries are willing to negotiate but the administration ran out of time before tariff implementation day (today) which ended up leading to the announcement of todays delay.

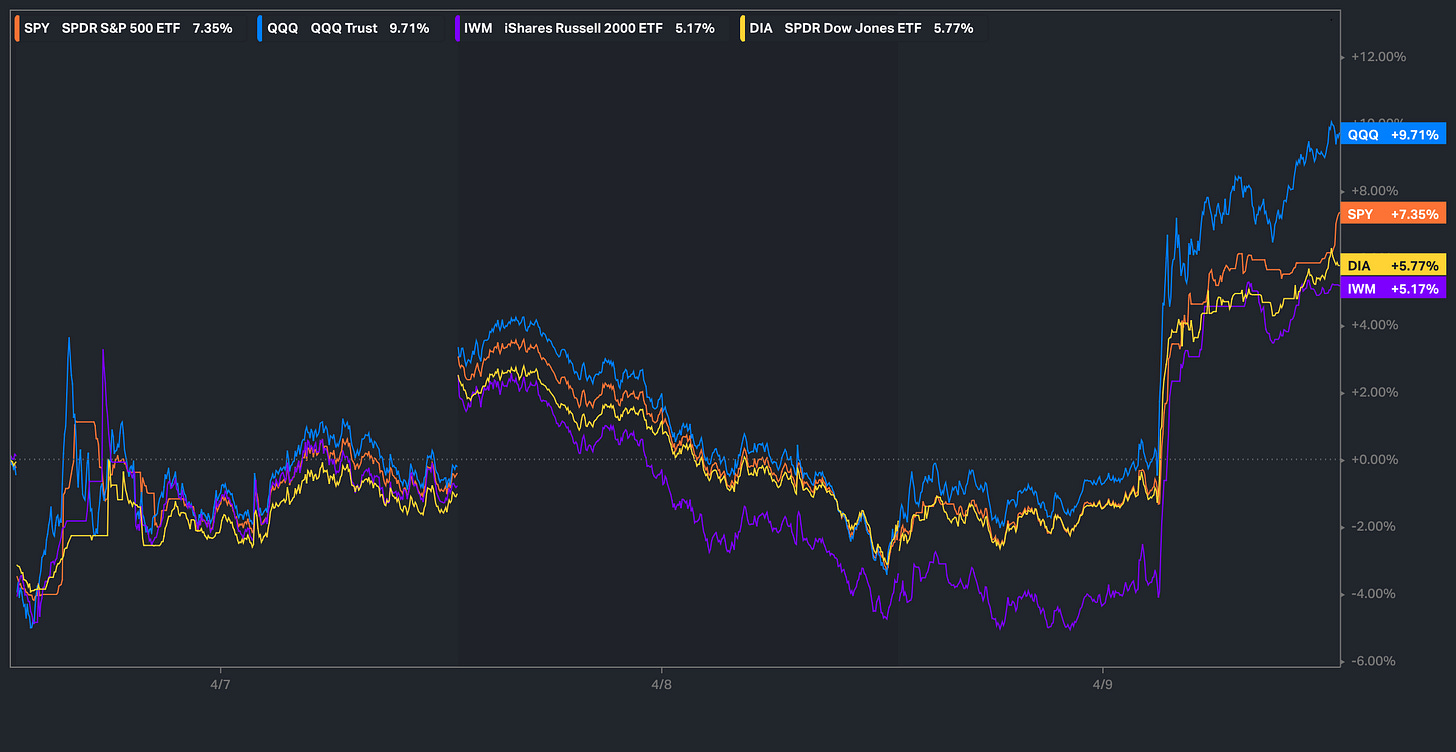

As a result, we saw a historic rally within the indices as the Q’s are up nearly 10% on the week as the best performing index whereas small-caps are the “worst” performing index on the week yet are still up 520bps on the week.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

A historic day within markets today as we finally reached the pain point for the administration as Trump issued a 90-day delay of reciprocal tariffs whilst bringing all tariff rate %’s lower to 10% for now in the interim & than lastly, China tariffs were increased to 125% from 104%.

To some, the delay was a bit of a shocker & that was shown given the magnitude of todays move as many individuals were offsides, but here’s a comment below from us Monday morning in a note pre-market:

Well, two days later and here we are…

In respect to the terms of the 90-day delay, again, the U.S. implemented a sharp increase in tariffs on China, raising them to 125% from 104%. For the next 90 days, a 10% tariff will apply to imports from all other countries, excluding Russia, North Korea, and Belarus. Tariffs on steel and aluminum remain at 25%, as do tariffs on imported cars. Additionally, Canada and Mexico will face a 25% tariff on goods that do not qualify under the USMCA trade agreement.

With the U.S. raising reciprocal tariffs on China & easing on everyone else, is this something to worry about? Well, given the softness on other countries today from Trump along with the U.S. not having to make a deal at this exact instance given the 90-day window, it’s clear the higher tariff %’s are just a negotiating ploy & Trump himself today had reassuring comments in regard to China which suggests that the tariff %’s on China are likely near the peak & the U.S. is ready to work to achieve a deal & get the negotiation process going.

A few standout quotes below:

Trump: I can't imagine a further increase of tariffs on China.

Trump: I'm not concerned about escalation with China.

Trump: I would talk or meet with China’s President Xi.

Trump: A deal could be struck with China.

Summary? Fairly self-explanatory, but tariff %’s likely won’t be increased further which means we’re near peak escalation along with the going back & forth of the U.S. & China… & secondly, Trump is ready to meet with Xi to strike a deal & get the negotiating process going… fairly constructive comments out of Trump altogether.

What about indices?

Well, despite today’s historic move, there is still only 12.5% of stocks currently sitting above the 50D… yes, thats how extended we were to the downside.

In terms of % of stocks above the 200d, we’re currently sitting around 24% after peaking around 14% earlier on this week… essentially reiterates & looking back historically that once again, we were VERY extended to the downside & any sort of positive headline was going to send the indices crashing upwards.

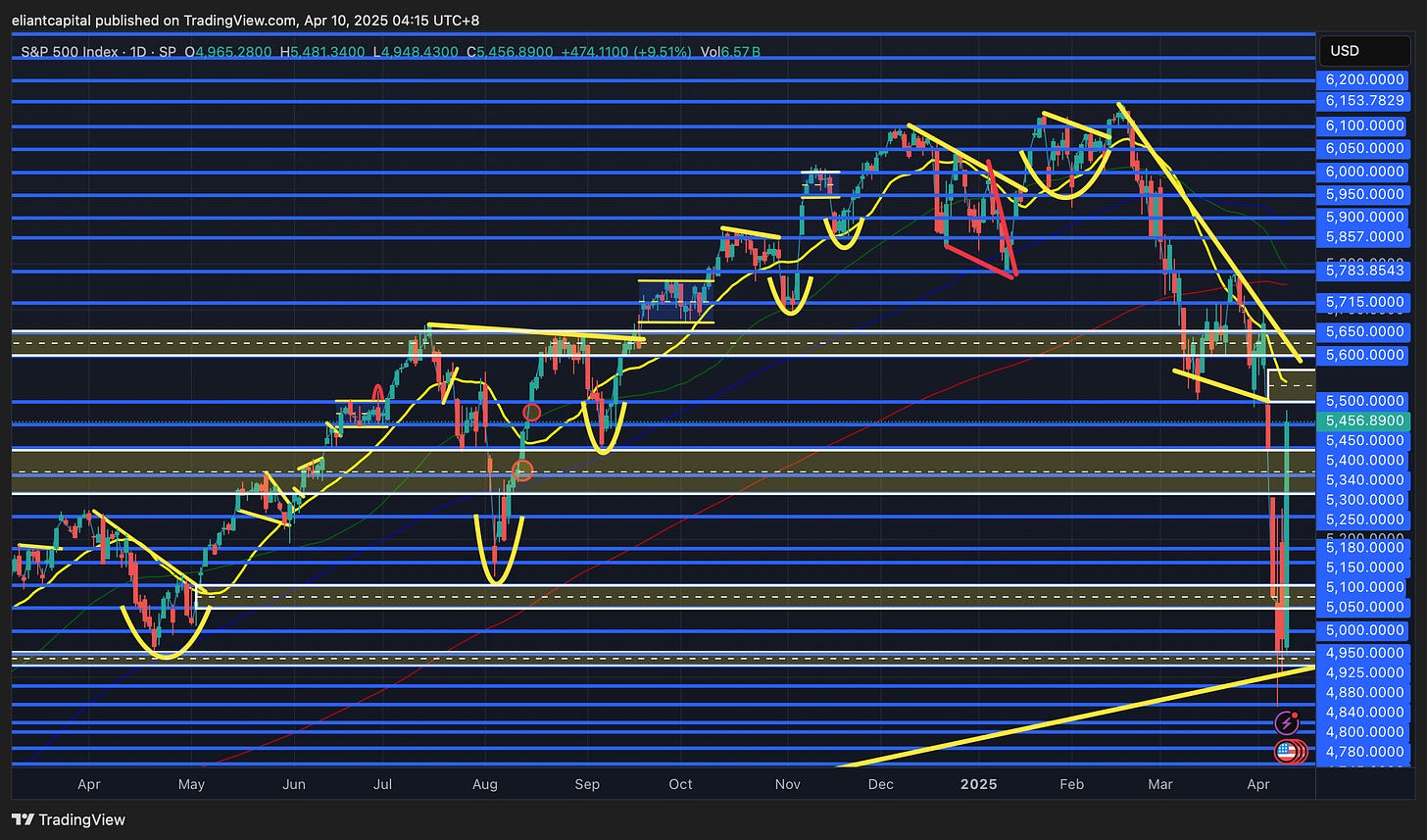

- SPY

The word to describe Spooz thus far on the week is textbook… as of now, Spooz pretty much bottomed to the tick off the 50% retrace from the ‘22 bear market bottom / recent high made along with the ‘22 highs for added confluence. Those that were waiting for the 200wk to get long has been a “no cigar” thus far as Spooz has rallied nearly 700-handles off the lows.

Today in itself was historic given the magnitude of the rally, BUT, Trump quite literally tweeted this morning that it was a great time to buy:

Maybe Trump does do TA after all (jokes), but fairly coincidental that Spooz did pretty much bottom to the tick off the Covid ‘20 support TL along with the other added confluence of the ‘22 highs backtest & again, the 50% retrace as we just mentioned above. A “hindsight” bottom at the end of the day, but certainly nothing we weren’t already expecting.

In looking at Spooz a bit closer, again, historic day to say the least, & as of now, Spooz closed right below the initial Liberation Day bear-gap, but did close the second / following bear-gap today. From here given the magnitude of the move, it seems like there is two (technically three) outcomes.

Spooz continues to trek / trend higher in a lockout rally to fill the Liberation day bear-gap above into 5600… from there, do ultimately think we need to see Spooz firm up and build a base above 5550 / 5600 to conitnue to try & push higher above towards mid-5700s to backtest the 200d again & from there, it either pauses & resumes back lower & barring another drastic policy shift, we likekly could make a higher low before resuming back higher & or this turns out to be one gigantic bear market rally before indices resolve back lower (likely would need escalation of tariffs / softer than expected economic data, but in this instance, the adminstration has stated tax-cuts & deregualtion is on the way which should be beneficial towards the economy / growth once we work out these recent kinks due to the ramifications from recent policy uncertainties).

Instead of a lockout rally, Spooz looks to digest / consoldiate this recent move before building out a bit of a base & or wedge / flag before then resuming higher. In this instance, it’s way down there as of now, but I think 5250ish is the general LIS, although would like to see Spooz maintain above 5340 / 5300ish if it were to retest lower first before resuming back higher.

Lastly, if we were to see Spooz fail to build out a flag / wedge & or we see a breakdown of 5340 / 5300ish with the last LIS of 5250ish faltering below, that likely would lead to a total unwind of todays move… likely would need to see escalations of tariffs / softer economic data & just general uncertainties with markets to amplify growth / recession fears for that full unwind given the magnitude of todays move.

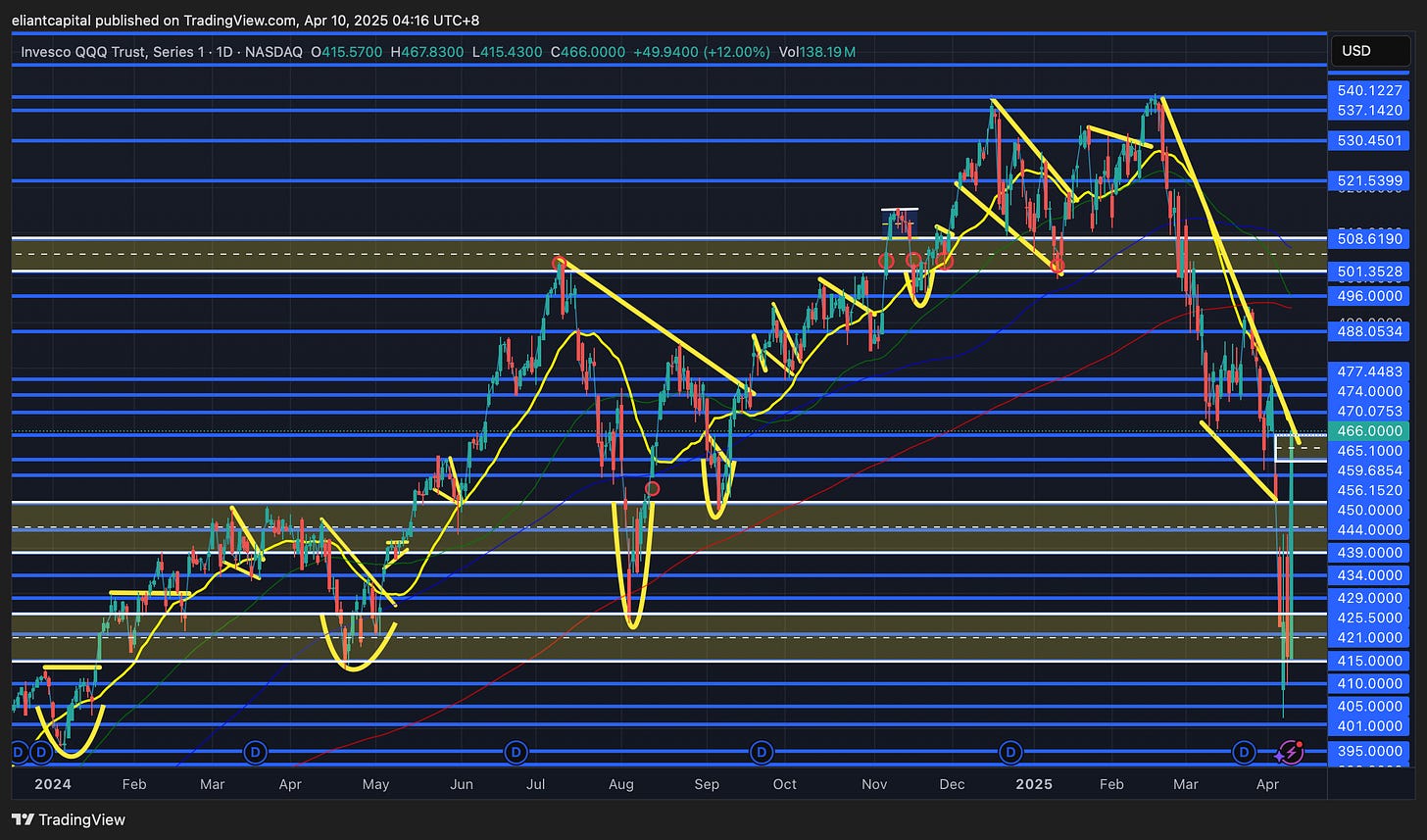

- QQQ

One of the more insane days that I can ever recall & historic, but nevertheless, indices have traded pretty technical this week as we noted above with Spooz finding support at the 50% retrace along with the ‘22 highs as we had expected & the same goes for the Q’s… perfectly backtested the ‘22 highs / Base breakout & the Nasdaq is up over 3000-handles since. Sometimes its best to keep things simple.

Something we discussed in this most recent week ahead was that for a “real” rally, we would need to see some sort of structural shift / change of tone by the administration & as we had called out on Monday, but it was fairly clear the administration was going to need to issue a delay to negotiate & the bond freakout last night more so sealed the deal, although I STILL am surprised how down to the wire they let markets & specifically credit get.

In respect to the Q’s… again, historic move & the Q’s have essentially made their way back to the Liberation Day gap to the tick. The main focus from here on out revolves around China & as we noted above, but Trump was fairly cordial in speaking about Xi & he even stated he doesn’t see tariff rate #%’s going higher from here, which one can then assume that Trump is ready to make a deal & get on a phone call with China… natural reaction is I do think we could see both the U.S. & China lower tariff %’s on each other to more so de-escalate the situation & continue negotiating on from there which would likely be the best scenario. Hard to see both China & the U.S. being persistent in terms of going back & forth with each other & continuing to raise tariff %’s, but again, both Trump & Xi can be wildcards as we know.

With the Q’s having filled the Liberation Day gap, the biggest question from here is if we get a gap & go which more so leads to a bit of a lockout rally (likely would need some further positive news out of China) & or if we see some digestion given the magnitude of todays move. One thing I know for certain & think what people are specifically missing is that this market doesn't need a China deal at this very moment… Trump made it clear that the high tariff rate %’s are being used just as a negotiating ploy & the response to delay 90-days whilst also reducing all reciprocal tariffs to 10% from where they respectively were more so shows that China will likely get a softer response over time. Trump knows there is a pain threshold that will change policy & the 90-day delay more so leaves plenty of time for the discussions to have been worked out.

Nevertheless, if we were to see the Q’s work lower & or digest this recent move, I would like to see 456 / 450 below supported, as otherwise, we likely will see the Q’s retrace lower towards the lower-440s (444/439 below). In terms of upside, there is still plenty of technical damage that needs to be repaired on the upside, but for more sustainable upside, would like to see the Q’s firm up and base above the mid-450s to start to work higher towards 474 / 477ish above & from there, we likely would see another impulse higher to backtest the 200d above. We do still have earnings season underway within the next week as it kicks off & there is still is plenty of uncertainties in terms of guidance likely to be issued as caution remains warranted given current policy ramifications & damage that has already been done even with todays delay on reciprocal tariffs… today was great, but still worth being aware of your risks.