A Breaking Point

Hello All,

Once again, the headline driven volatility has continued as the uncertainties revolving around tariffs & policy in general remains… today, the headlines were in regard to Wine & Whiskey between the U.S. & EU… & as the day progressed, continued talks between the U.S. & Canada persisted, but after market close, it did seem like some positive progression was made between the U.S. & Canada.

Despite the positive economic data (disinflation resuming / good jobs data), the market has continued to remain under pressure all week as the recent uncertainties have overpowered the “goldilocks” data. The Q’s as of now remain as the worst performing index on the week & are sitting down just over 460bps on the week whereas small-caps have been the “best” performing index on the week as they sit down just under 400bps on the week.

This past week, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

The headline driven market continues, but as the week has progressed, we finally have gotten a bit of economic data to discuss, although granted, market as of now is solely focused on recent uncertainties regarding policy & that likely doesn’t change until we get a bit more clarity on that subject.

Looking back at yesterday, CPI #’s ended up coming in a tad softer than expected as headline fell to 2.8% vs. 2.9% est. & 3.0% prior & Core fell to 3.1% YoY vs. 3.2 est. & 3.3% prior… all around, a fairly positive report as the recent inflation blip that sparked questions in January looks to be resuming back towards the downside.

PPI #’s this morning also ended up coming in softer than expected… PPI #’s came in at 3.2% vs. 3.3% est. & 3.7% prior & Core came in at 3.4% vs. 3.5% est. & 3.7% prior… all in all, another positive report & a bigger driver of the recent decline was due to egg-flation finally subsiding a bit.

The one look-through is that the components that feed through PCE from PPI did generally come in hotter than expected which led PCE estimates to be revised upwards which we receive within the next two weeks… also was a contributor to recent bond action as the 10Y in general has remained quite stubborn despite recent positive inflation data.

In regard to headlines, there’s too many to discuss, but after market close, there was two positive headlines out of Canada that showed some progression was being made…

- Ontario premier: Meeting with Lutnick productive

- Temperature has dropped, Ontario Premier

Our base case has continued to be that Trump will be more lenient on Mexico, but harder on Canada & it couldn’t be more true… if we were to see some progress revolving around Canada & or a potential resolution is reached & or at least some sort of clarity, it likely would be very positive for markets.

The other headline that I found quite odd…

- Trump: Avoiding a trade war

Not sure what needs to be said here… maybe the headline was a typo or maybe we get some clarity revolving around recent tariff uncertainties / trade-wars tomorrow.

In looking at Spooz below, we have officially entered into corrective territory as Spooz has declined 10%+ from the recent highs… the bigger piece of the puzzle is Spooz has made its way back to the midpoint of the regression channel dating back to ‘18, so in general, a fairly big pivot ahead for Spooz & the general indices altogether.

Despite all of the positive data, Spooz has continued to fail to break higher (5625 / 5630ish has continued to keep a lid)… the one positive? as of the overnight session, theres a very good case to be made that Spooz could’ve did a look below and fail of the earlier on week lows, but it’ll depend on how things shape up tomorrow, but as of now, things do look promising overnight.

- SPY

In regard to Spooz, again, we officially hit the 10% drawdown from highs entering a corrective phase & it’ll be quite the coincidence if that headline ends up marking the local low… despite the lackluster price action, do still think a countertrend rally is very much so in the cards… the markets are looking for any sort of headline to rally on & if we were to see a positive headline / some sort of clarity, I do think we can see Spooz rally back towards 5850 / 5900ish above… the question from there more so boils down to if thats the spot to look to degross longs / start getting short & or if the path to new ATHs will emerge… again, it likely will boil down to uncertainties regarding policy & or if things have cleared up or more so stayed the same (does seem like we’ve nearly reached the breaking point & individuals surrounding the admin are getting antsy for a settlement).

On the contrary, again, if the uncertainties surrounding policy continues & the headline driven volatility remains, maybe we see Spooz flush lower to retest the September lows near 5400ish & thats assuming things escalate fairly aggressively, but in general, am anticipating a countertrend rally & IF this is indeed a bear market (I’m not sure I would call it a bear market as it has been self-induced by policy & or recent uncertainties & that can change on the flip of a dime), but bear markets have some of the most violent countertrend rallies out there.

Yesterday, given Spooz failed to break the earlier on in the week highs, we did timely put on some hedges for April expiration & the ones mentioned were: SPX 5500/5300P spreads for 4/17 around 40.00ish & or SPY 4/17 550/530P for around 4.8ish. Not necessarily a big directional bet, but more so the red flag of Spooz failing to take out the earlier on in the week highs despite the positive data was a bit of a cautionary sign & sure enough at todays lows, we were down over 100-handles from that point.

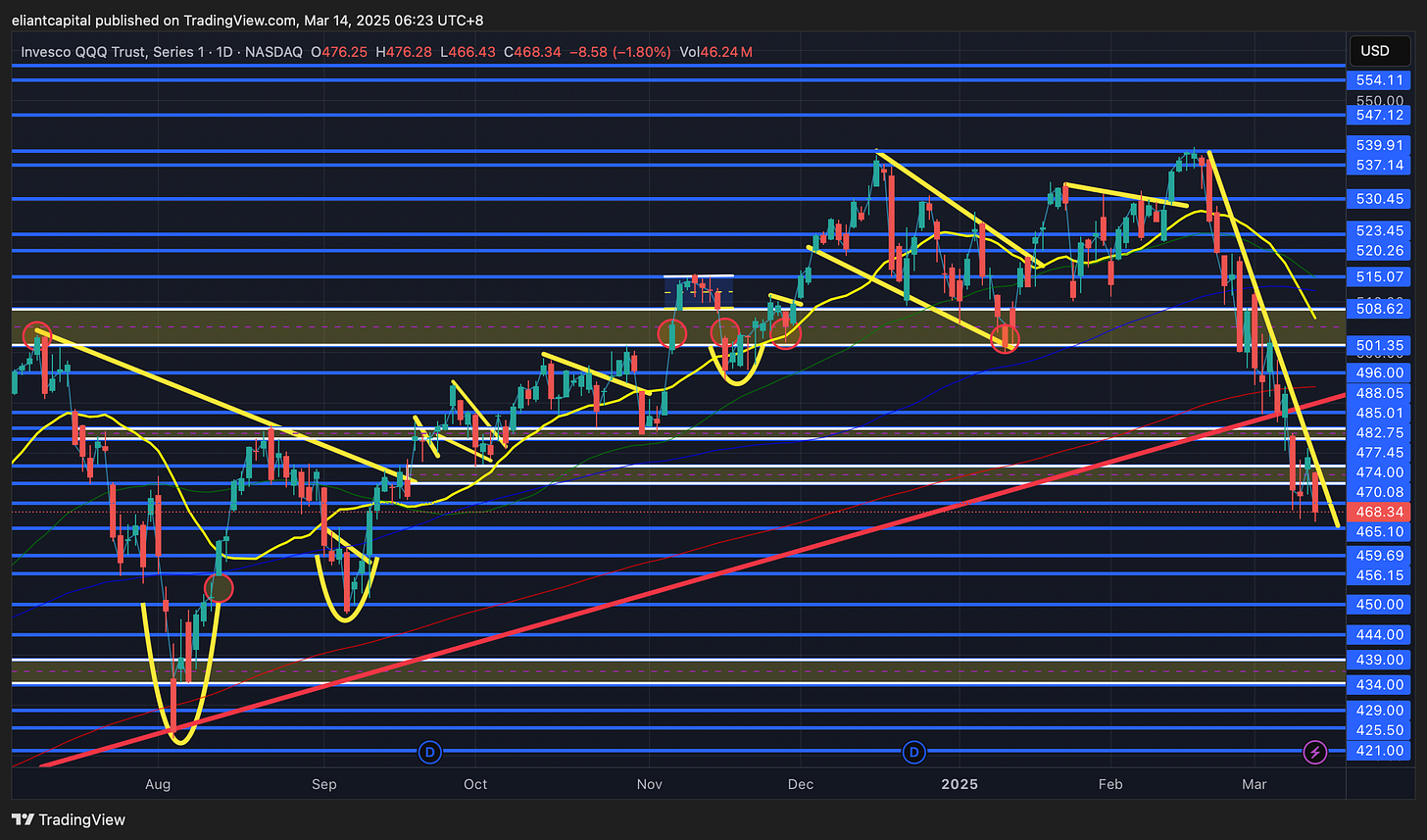

- QQQ

Not too much has changed in respect to the Q’s… yesterday, given the positive CPI data, the Q’s did try to break out of the respective downtrend, but once again came up short, & sure enough, we got more headlines in regard to tariffs which aided to the recent continued deleveraging within tech / indices in general leading the Q’s to close near the lows on the week thus far.

Very steep downtrend in the Q’s as with all of the indices, but a fairly big support TL that has supported continued higher lows since late ‘23 when this TL was initially established.

Earlier on in the week, we did see the Q’s fill the gap from this past September in ‘24 & as of now, the Q’s have more so been oscillating just slightly below this gap-fill. Do continue to think that 465 / 470ish on the Q’s is a fairly important pivot & given the Q’s still remain within oversold territory, although it doesn’t need to be said, the Q’s are due for a snapback rally & if it were to materialize, it likely would precede a move towards 496 / 501ish above whereas if the Q’s continue to fail to find support, it may lead the Q’s to slip towards the earlier on September gap just below near 456ish which just nearly coincides with the September ‘24 higher low bottom as well after forming the bigger bottom in August ‘24 (Carry trade unwind bottom)… not the base case, as again, things are quite extreme at these levels, but the bigger issue at the moment is the selling has remained very controlled, albeit within a steep downtrend, but there hasn’t been that “flush” & or “event” bottom… maybe we don’t get it since everyone is more so looking for a firm bottom to be established, but in the interim, it really all boils down to the continued uncertainties surrounding policy & whether or not a universal settlement on tariffs can be reached & or if we haven’t quite reached that point just yet… does feel like participants are getting antsy on that end & as we talked about above with respective headlines out of Canada & Lutnick, things do seem to be moving the right direction… its just a matter of if a deal can be solidified & last more than a day.

- IWM

The lackluster action in small-caps has continued as IWM sits lower by just under 400bps on the week & small-caps in general have made their way back to quite an important pivot… small-caps briefly broke below the 200wk today (reclaiming it as I type in the OVN session), but in looking below, small-caps are currently backtesting the 200wk which is a very big pivot in itself, but also backtesting the 2+ year breakout that led to the rally in small-caps in ‘24… the ultimate S/R flip (prior resistance flipping to support).

Similar as to all of the indices, but the story hasn’t really changed as the steep drawdown from recent highs has continued… we have seen small-caps show some relative strength compared to the other indices as of late, but the risk-off action within markets today wasn’t enough to maintain the recent outperformance which ultimately led IWM to fall below the 200wk as well… the big question as of now is whether or not this fall below the 200wk produces a look below and fail move which would be VERY constructive & or if we see sustained selling below the 200wk which would be quite a bad look (at this point, barring a crash, I would be pretty surprised if this didn’t produce a look below and fail move of the 200wk leading to a snapback rally).

If we were to see a countertrend rally, I do think we could see small-caps retreat upwards towards 212 / 214ish above to backtest the 20d before potentially pausing & resuming lower & or if data abides / growth scare & or fears simmer down along with disinflation resuming, we likely could see the small-cap rally have holding power (data has been great this week, but it more so boils down to some sort of resolution with recent uncertainties in regard to tariffs & or at least some clarity in that aspect… otherwise the volatile action will likely remain).

On the contrary, if we were to see small-caps sustain below the 200wk / August ‘24 lows, we likely could see selling persist in IWM towards mid-190s, but again, I would be fairly surprised if we didn’t see a countertrend rally unleash beforehand (of course, barring continued headlines out of Trump / more uncertainties rising / growth fears escalating etc…).

- DIA

Again, the steep downtrend within indices has continued & DIA was the last index to firmly break below the 200d earlier on this week as now all indices remain firmly below the 200d… As of now, DIA has fallen back towards the Summer ‘24 highs & resides just below, but in general, it still remains as an important pivot as it has potential to be a S/R flip (prior resistance flipping to support / important weekly close as could produce a look below and fail). If we were to see a countertrend rally in DIA, I do think we could see DIA backtest 425 / 430ish above before then pausing & or deciding where to go from there… a lower high & or resume towards ATHs being the bigger question…

On the contrary, if we were to see DIA continue to fall, the next bigger line of support is around 402 / 400ish which coincides with the September ‘24 lows but in general, barring a collapse due to a headline / outlier event, do think DIA is nearly at the point of reaching extension to the downside before a countertrend rally unleashes.

/DXY

Not too much to discuss in regard to the dollar, although we have seen a SLIGHT rebound off this weeks lows, but it hasn’t been anything material… The story hasn’t changed much, but the flip-flopping between headlines in regard to tariffs has continued… after market close, it did seem like there was a tad bit of progress made between Canada & the conversation that went on with Lutnick, but at the end of the day, either some sort of resolution / deal is reached or not… the biggest positive I found was the apparent tensions have “cooled off” which is good to hear as nothing productive tends to get done in heated discussions.

Our main assumption has continued to be that Trump would be more lenient on Mexico over Canada which has continued to be spot on as Mexico hasn’t even shown up in recent headlines as the spotlight has been all on Canada… again, based on the headlines after-hours which could change by the morning, it does seem like progress is being made between the U.S. & Canada. Despite all of the recent events & headlines, it does seem like we’re reaching the breaking point as members surrounding Trump are likely getting a bit antsy for some sort of settlement, but as long as the uncertainties persist around policy, do still expect the dollar to remain generally contained on the upside as flows continue to come out of the U.S. from foreign parties.

Not too much to recap in regard to data, but both CPI & PPI #’s came in softer than expected, which didn’t matter too much to bonds & or FX as the dollar in itself was already quite extended to the downside. It does seem like the dollar has found an interim bottom & if we were to see a retrace higher, we likely would see a rally back towards 104.15 / 104.5s above & if the rally were to extend, potentially a backtest of the 200d near 105ish, where ultimately, that may turn out to be another lower high thus leading to a continued resolve lower in the dollar then leading to new local lows.

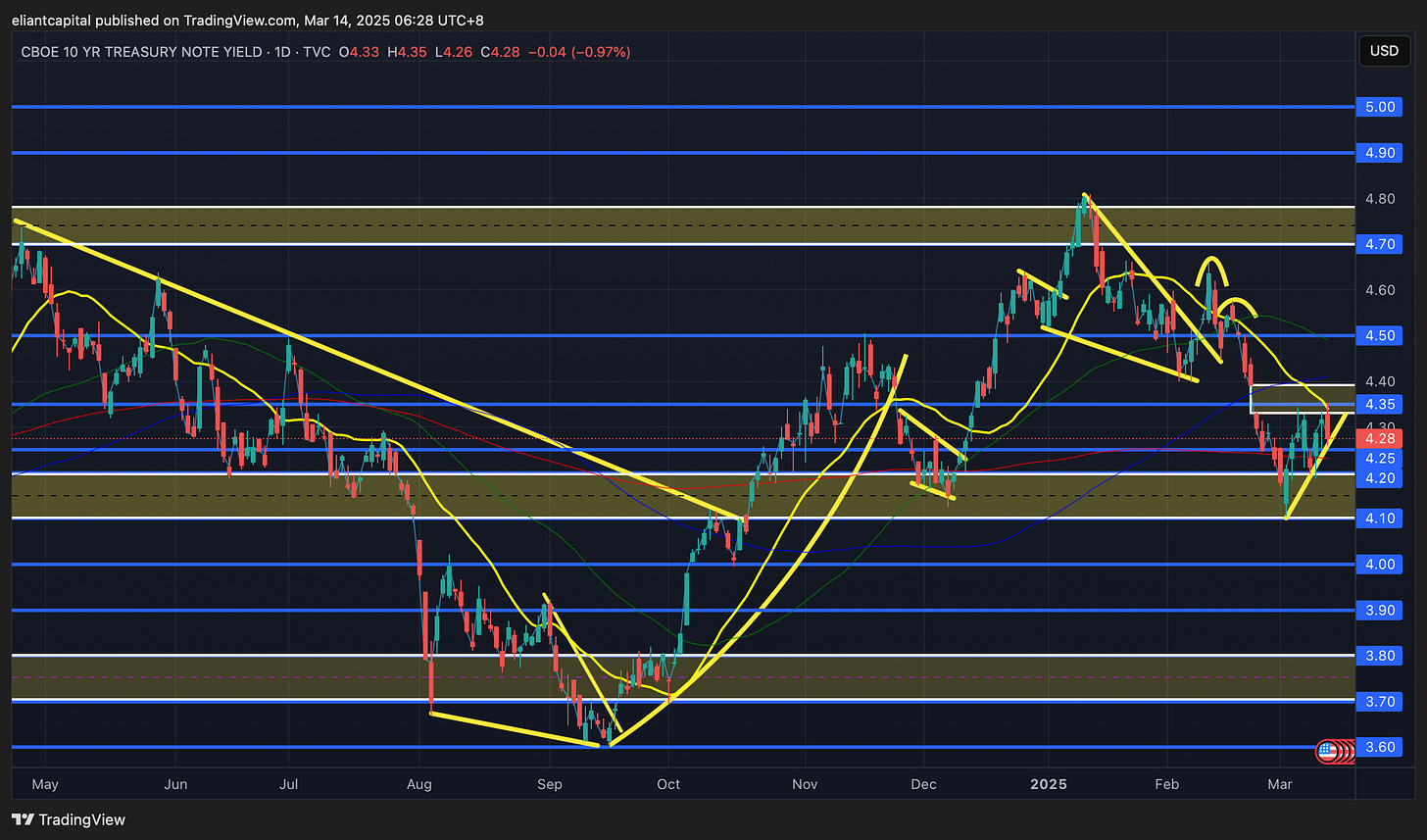

/TNX

It’s been quite the week in the indices as the vast majority have declined by over 400bps on the week & despite the general risk off action within equites, bonds have still barely caught a bid… & that’s also despite softer than expected CPI & PPI #’s this week… so what’s the issue? As we talked about earlier, but PCE #’s for this upcoming print continue to be revised up due to components that feed through PPI that reflect in PCE coming in a bit hotter than expected today & the other issue more so boils down to both Germany & Japans bonds as yields continue to rise over there hence putting pressure on U.S. yields. Considering the main goal for this administration that has been repeatedly stated over and over again is to get the 10Y down… well, 10%+ corrections within all of the indices & the 10Y having only fallen to 4.28 from 4.55s is hardly any progress.

Another factor we’ve called out is that the cuts to the deficit are likely smoke & mirrors & more so the current admin along with Bessent given his recent rhetoric around deficits & his bold statement of “We’re going to cut Fiscal / GDP to 3% down from 6.4%…” well, in regard to February’s deficit, absolutely zero progress was made & the spending has continued… no wonder why Gold has remained so resilient these last couple of weeks despite recent risk-off action within equities which was more so our main assumption as if the market took the admin seriously on the deficit, gold would be trading MUCH lower but it wasn't.

As discussed Tuesday, I do still think the economy in general continues to hold up along with the consumer better than most think, BUT the bigger worry as of now is the negative wealth effect on the consumer combined with uncertainties surrounding businesses given the lack of clarity on policy as that is going to take a toll on the economy if this does persist… we likely would get the rally in bonds that both Trump & Bessent seem to be looking for, but at what cost of the damage that would be done to the economy? In my opinion, people around the administration are getting antsy for some sort of settlement in regard to tariffs to help easy recent uncertainties surrounding policy… people close to Trump have called him “insane” for what he is doing… do think we will reach a resolve as the admin is playing a pretty dangerous game at this point if they don’t resolve recent uncertainties.

Moving along to the 10Y, at the end of the day, we have continued to view bonds as a range trade & I still think that narrative remains as such… just in January, the economy was overheating & inflation was ready to roar back with the 10Y back in the 4.8s & then just last week, we saw the 10Y make a low near 4.1s whilst the recession calls got louder & louder & here we are with the 10Y right back to sitting just under 4.3 as the economy in general still continues to hold up (jobless claims once again better than expected today along with a generally solid jobs report this past week). We don’t have much data into the remainder of the week as we just have consumer sentiment tomorrow, but next week, we do have FOMC which we’ll provide more thoughts on that subject this weekend in the week ahead. The 10Y does look fairly 50/50 here, but as long as 4.35s on the upside continues to give trouble / lack of followthrough on the upside, I do think this *could be a lower high before the 10Y starts to resolve back lower… maybe that comes with weaker than expected economic data / risk-off action persisting… we’ll see.