Continued Walkbacks

Hello All,

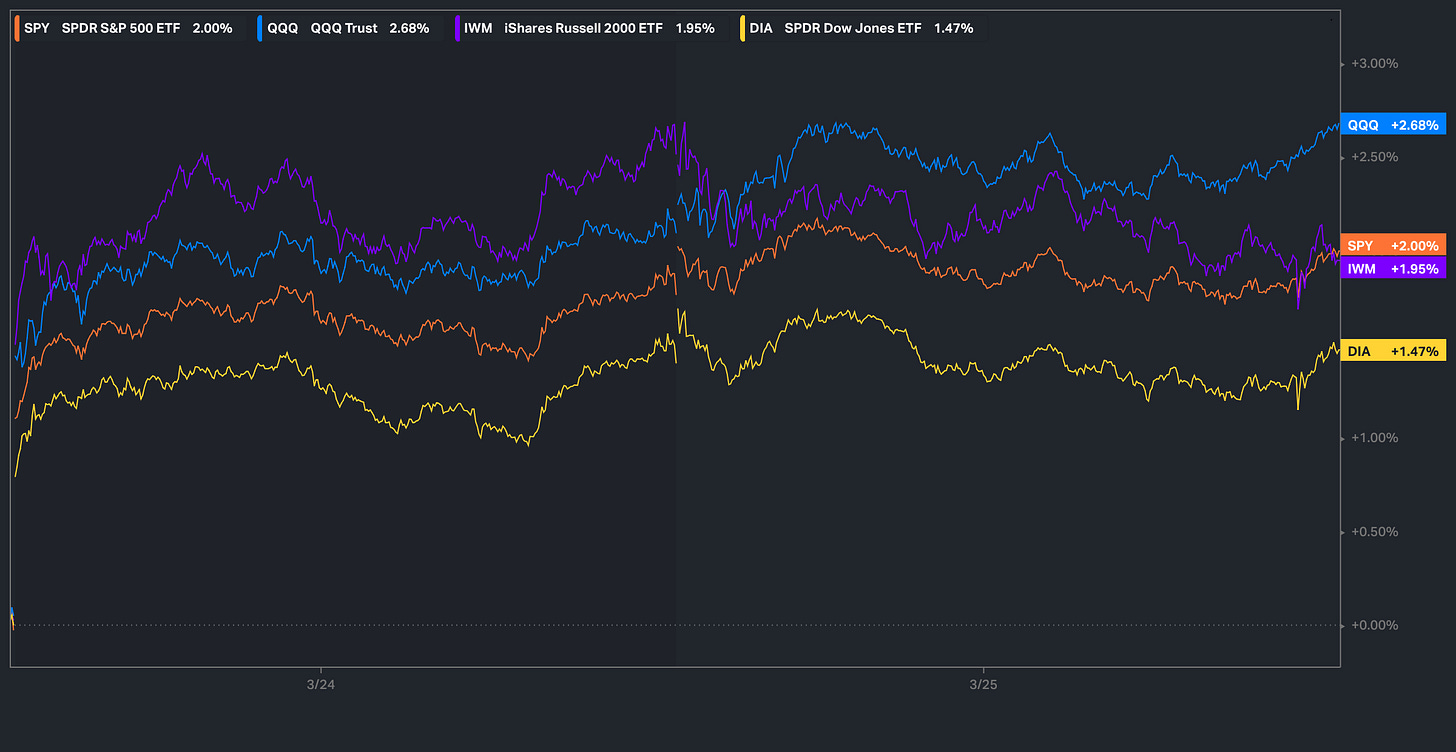

Quite the kick off to the week in the indices as we have seen further followthrough from the current administration in regard to “walkbacks” of recent tariff hysteria which initially started on Friday when Trump had stated that the U.S. has flexibility & tariffs were essentially reciprocal. The Q’s have been the best performing index on the week which has mostly been driven by the rebound within Mag-7 as the Q’s sit up just under 270bps on the week whereas the Dow has been the laggard on the week, although does still sit up just under 150bps on the week.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

It’s been a relatively quieter week in respect to economic data as the week has kicked off, but we have seen some followthrough from the administration in regard to tariffs / walkbacks from this past Friday…

For those who don’t recall, but on this past Friday, Trump had an entire change of tune & stated “There will be flexibility on tariffs. Basically it's reciprocal.” There were two important key factors here… 1. Trump is willing to negotiate / won’t remain stern (Flexibility) & 2. Tariffs are reciprocal… essentially if Country X wants to cooperate & lower % against the U.S., the U.S. will match that & vice-versa. The initial headline on Friday did trigger a bit of upside action, but not as much as one would think given the clarity Trump provided to markets with such a simple statement… & then came Sunday evening.

Sunday evening, this headline shown below was posted by the WSJ… another confirmation of a walkback by the administration & sure enough, markets loved it as Spooz in itself was up over 100-handles on Monday whilst also having reclaimed the 200d & managing a close above.

And lastly, we had one more headline out of Trump yesterday to add on to the recent “walkback” speculation by the current administration:

BREAKING: Trump: I may give a lot of countries breaks on tariffs.

Fairly self-explanatory here, but Trump clearly plans to be very flexible / a lot more lenient compared to how he initially came off about reciprocal tariffs a couple weeks ago.

The one other positive headline out of Trump today:

Trump: Mexico and Canada have stepped it up a lot.

As we’ve known, but Mexico has stepped up significantly & the president has been VERY cooperative with Trump & the U.S. & there really hasn’t been much of an issue there, but Canada did initially give Trump / U.S. some trouble with the back & forth conversing where not much progress was really being made & sure enough, Trump stated that both Mexico & Canada have stepped up a lot… likely signals that he’ll continue to be more lenient on both / he’s willing to negotiate & work with the two countries… again, another subtle walkback.

In regard to economic data as the week has kicked off, granted, it’s been a fairly quiet week to start but we did have PMIs yesterday which did show a sharp rise in Services which rose to 54.3, beating expectations of 51.0 signaling stronger growth whereas in contrast, the Manufacturing PMI slipped to 49.8, below the expected 51.8 and down from 52.7, indicating a contraction in factory activity. The majority of the improvement, again, was driven by the services economy as output growth picked up momentum for the first time this year… we also saw companies reporting improved new business flows with some subtle signs of strengthening customer demand along with better weather compared to earlier in the year as an added contributor, but in respect to manufacturing, again, did see a notable decline & Mfg. is back below 50 & that was mostly due to recent Mfg. output being buoyed by the front-running of tariffs earlier on in the year (hence the drop is likely a bit of an unwind of the front-running from earlier on in the year).

Today, we had Consumer Confidence: The Conference Board's Consumer Confidence Index fell to 92.9, below the expected 94 and down from a revised 100.1 in February (previously 98.3). The Present Situation Index declined slightly to 134.5 from 136.5, while the Expectations Index dropped more sharply to 65.2 from 72.9, indicating growing consumer concerns about the future.

I don’t think this report is too much of a surprise given recent volatility within markets along with the rise in 1-Yr. inflation expectations (total nonsense but is clearly playing a role) & the consumer still remains concerned about high prices on household staple items like eggs (Egg prices have recently cratered back to pre bird-flu levels so its a moot point), & along with the potential impact of tariffs weighing in on consumer confidence as well.. again, not much of a surprise given the lack of clarity by the administration really only up until this past Friday / this week where we’ve finally started to see some uncertainties dissolve within markets.

- SPX

As we talked about earlier but given the walkback & followthrough out of the current administration, it’s led to quite a bit of positivity within the indices this week & Spooz alone is up 200bps on the week. There is one big theme for the indices here & it’s the big island bull-gap highlighted below… why is this significant? For those unaware, but when gaps on indices are established & they aren’t filled rather quickly / have holding power, it typically leads the indices to continue to trend in that respective direction thus potentially solidifying island bottoms (coming out of downtrend) & or island tops (coming out of uptrend). As of yesterday, Spooz has formed an island bottom & it was nice to see some followthrough to the upside today… especially considering the negative headlines from Consumer Confidence earlier on in the morning, but Spooz completely shook it off & maintained the big island bull-gap below whilst still remaining firm above the 200d & also having reclaimed the 20d as well.

From here, its fairly simple… I do think bulls will remain with edge as long as the bull-gap below remains firm / Spooz remains above 5715ish… if we were to see Spooz continue to float higher into the end of quarter, I do still think 5850 / 5900ish is a logical target & ultimately, the bigger test with bulls will come on the backtest of the 50d from below near 5900ish as that *could put an upside cap in this recent rally before markets potentially resolve back lower, but above that, don’t necessarily see why Spooz can’t rally back to ATHs.

On the contrary, if the bull-gap below were to invalidate fairly quickly (gap-fill), I do still think we need to see bears reclaim 5600ish on the downside, as otherwise, Spooz / Indices in general may still remain a bit buoyant on the upside, but below 5600, there isn’t too much support until the prior local lows near 5500ish, so I very much so could see Spooz going on to make lower lows on a falter of 5600ish… maybe that comes on Trump walking back the walkback (a bit tougher to see & is also a boy who cried wolf situation if so) & or maybe it comes on recessionary / weaker economic data (hard data has been fairly good since the beginning of the year, so also seems like a bit of a stretch at this given moment).

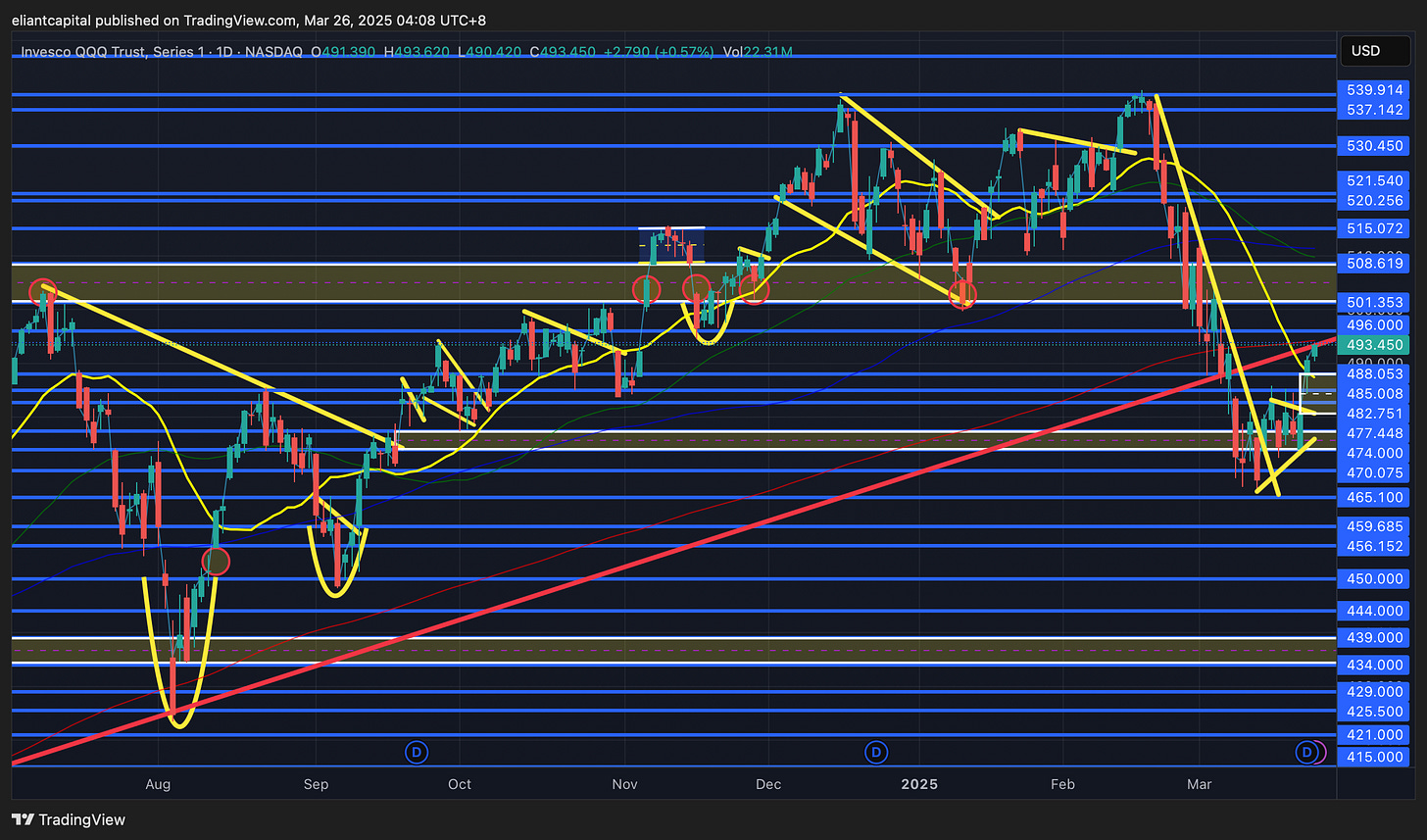

- QQQ

Similar story with the Q’s as to the rest of the indices, but again, as of now, the Q’s have established an island bottom below & as long as the gap below remains supportive, bulls will continue to remain with edge in the interim. We have finally seen a slight return to Mag-7 names which has been a big driver of the recent strength out of the Q’s as the week has kick off & as of todays close, the Q’s closed a tick below the 200d, but has firmly reclaimed the 20d. If we were to see the Q’s continue to sustain above the bull-gap (488ish) whilst also reclaiming the 200d, do still think we can see the Q’s work higher into the 501 / 508ish highlighted zone (prior breakdown) above which likely also would coincide with a backtest of the 100d & 50d… from there, again, it more so circles back to if this countertrend rally is just another lower high before resuming lower once it has run its course & or if the Q’s do go on to firmly reclaim the 100d & 50d, there likely isn’t much stopping the Q’s from attempting to work higher to fill some further upside gaps above.

On the contrary, if we were to see the Q’s fail to firm up / overcome the 200d, again, it comes down to the island bull-gap just below, but if that were to falter as support (gap-fill), we likely will see the Q’s go on to retest mid-470s where ultimately, if those lows do cave in, we could see a flush to lower lows leading the Q’s near 459 / 456ish below (just about coincides with the September ‘24 lows). For this scenario, would likely need to see weaker earnings out of tech / more tariff & slowdown hysteria etc…

- IWM

Small-caps have faired fairly well as the week has kicked off & the look below and fail of the 200wk / retest of the 2+ year base breakout continues to look like it may have marked a medium / longer-term low in small-caps (at least for the time-being barring a collapse in economic data etc…).

As we head into the remainder of the week, the biggest event still remains PCE #’s on Friday which as of now, headline is expected to remain unchanged from the prior month at 2.5% whereas Core is expected to tick up to 2.7% YoY vs. 2.6% the prior month… again, the stubborn PCE print isn’t necessarily unexpected as the majority of the revisions were to the upside given the read-throughs from both CPI & PPI #’s a couple weeks back as components that feedthrough PCE came in hotter than expected. So in general, the bar is a bit higher for an upside beat & lower for a surprise to the downside. Besides PCE #’s, we of course have Liberation day on the 2nd of April, which as we’ve discussed earlier, but there continues to be positive developments / walkbacks from the current administration which has more so relieved some of the recent uncertainties & more so has provided that upside action within the indices as the week has kicked off.

In respect to small-caps, similar story as to all of the indices, but again, IWM as of now has established an island bottom & as long as the bull-gap below remains supportive (206ish), bulls will remain with edge in the interim. We did end up seeing a nice reclaim of the 20d & Small-caps today more so produced a bit of an inside day look / flag pattern over the bull-gap & a breakout to the upside should lead IWM to retreat upwards towards 209 / 212ish above to fill the gap from earlier on in March… from there, it’s more so a question of if IWM goes on to form a lower high before resuming lower & or if hard data continues to remain supportive whilst inflation data remains tame thus fueling further upside for small-caps potentially leading to that test of the 200d / 50d above near 219ish which will likely initially be a bigger resistance to overcome.

On the contrary, if we were to see IWM falter below the bull-gap (gap-fills quickly), we likely will see IWM go on and retest the prior week lows near 202ish which pretty much coincides with both the 200wk / 100wk & does have potential for a higher low to form, but if those lows were to falter, we likely will see IWM work back towards the mid-190s / early ‘24 lows, but for that sort of scenario at this given moment, we likely would need to see some sort of surprise in markets whether it be weak economic data to stir up recession fears & or recent uncertainties regarding policy continuing to persist with no resolve in sight… (we’ve had fairly constructive responses out of the current administration in respect to policy / some recent uncertainties have cleared up so it is a bit tougher to see a walkback of the walkback, but as always, still worth remaining open-minded).

- DIA

The Dow has been the “worst” performing index on the week, granted, it’s still up just under 150bps on the week. Again, same story as with all of the indices, but yesterday, we saw bull-gaps established across the board & as of now, DIA has seen followthrough to the upside & the bigger positive is that the gap was created above both the 200d & 20d… why’s this such a positive? It means there is then 3 orders of confluence… the bull-gap below / the 200d / the 20d. As long as the bull-gap does sustain / remains firm, do expect bulls to remain with edge in the interim (423ish LIS). If we were to see bulls sustain the gap, don’t see why we can’t see DIA float up towards the prior breakdown from February near 430 / 432ish above… from there, the question more so circles back to if DIA is forming a lower high before resuming lower & or if DIA goes on to reclaim the prior breakdown level & starts to trek higher to fill the Mid-February gaps above.

On the contrary, if we were to see DIA fail to sustain upside / fill the bull-gap below rather quickly (assuming both the 20d & 200d falter as support as well), we likely will see DIA retreat right back lower towards 416 / 414ish, where ultimately, as long as those lows do remain protected, it should keep DIA from going on to retest the prior local lows from earlier on in March, whereas if those lows do cave in as well, I do think we could see DIA potentially flush lower towards 402 / 400ish which essentially coincides with the September ‘24 lows… not necessarily my lean at this given moment & certainly would be news-driven if it were to happen (Trump walks back the walkback & or some sort of recessionary data leading to an escalation of recent growth fears).

/DXY

Over the weekend, we more so gave an entire outline on recent developments / potential scenarios in regard to tariffs & more so reiterated how constructive the statement was out of Trump on Friday & since, we’ve continued to get further positive developments as we discussed earlier. It’s fairly clear that someone got in Trump’s ear as compared to two weeks ago, Trump has had a total change of tune (not like we’re surprised). And again, the positive developments have continued this week as Trump stated he plans to give many countries a break on tariffs & in regard to specifics, there has been lots of progress with both Mexico & Canada. At this point, it seems like Mexico & Canada are both going to skate by with no serious issues & that really leaves Europe & China… I’d argue there could be more issues with Europe then China as both the U.S. & China know its a bit counterintuitive to go back & forth with each other over tariffs, although if Trump does remain stern, again, could see China getting the worst out of all of this (still would probably be more short-lived). There still is a bit of a lack of clarity of Liberation day & what exactly is going to happen, but I think the biggest takeaway is Trump has backed off compared to his tune two weeks ago & he seems willing to work / negotiate with countries to strike deals etc… I do expect more clarity on Liberation day as the week progresses & I would imagine there will be some leaks later on in the week.

In respect to the dollar, it’s been a fairly muted week thus far… we do have PCE #’s later on in the week on Friday & in general, majority consensus is expecting a more stubborn print with potential upside bias given the read-throughs from both CPI & PPI, but again, Liberation Day is still likely more important the following week & holds more weight & I do think that can be a proponent for upside strength in the dollar… of course depends how exactly the situation turns out, but a negative outcome leads to upside pressure on dollar and vice-versa.

In regard to technicals, not too much has changed with the dollar, but for any sort of material upside / to at least backtest the 200d above, we need to see the dollar go on to reclaim 104.55s, as otherwise, one can assume pops will continue to get sold as the dollar is more so just potentially taking a breather before resuming lower.

/TNX

Not too much to comment on bonds, but as we all know, the indices have seen quite the lift as the week has kicked off & sure enough, its led to a bit of an unwind out of the panic / flight-to-safety bid in bonds. One thing to note is we did see quite a sharp reversal in the 10Y today after it initially briefly jumped over 4.35 before rejecting & closing lower following the weaker consumer confidence #’s this morning. Do still expect bonds to remain bid as long as 4.35ish does continue to cap upside on the 10Y, but if the rebound in the indices does persist / growth fears continue to fade whilst uncertainties continue to unwind, I don’t see why the 10Y can’t retrace & head back towards 4.5… definitely not what Bessent / current administration wants but as we discussed earlier on in March, they clearly need a new plan as the destructive headlines in which caused damage to the indices along with uncertainties in recent survey data hardly provided a bond rally considering the magnitude of uncertainties & even the decline that we saw within the indices… again, zero progress made & all it did was cause unnecessary destruction.