Detente in Motion

Hello All,

It’s been a relatively slower week as there hasn’t been much in terms of economic data of significance / news flow, but nevertheless, the general theme of the week has been rotation away from higher-beta / momentum driven names towards Value / Cyclicals & generally under-owned sectors with a mix of meme-mania in-between, but due to the general rotation, both Dow & Small-caps have been the best performing of the indices, granted, not by a huge margin whereas the Q’s are the ‘worst’ performing of the indices although are essentially flat on the week.

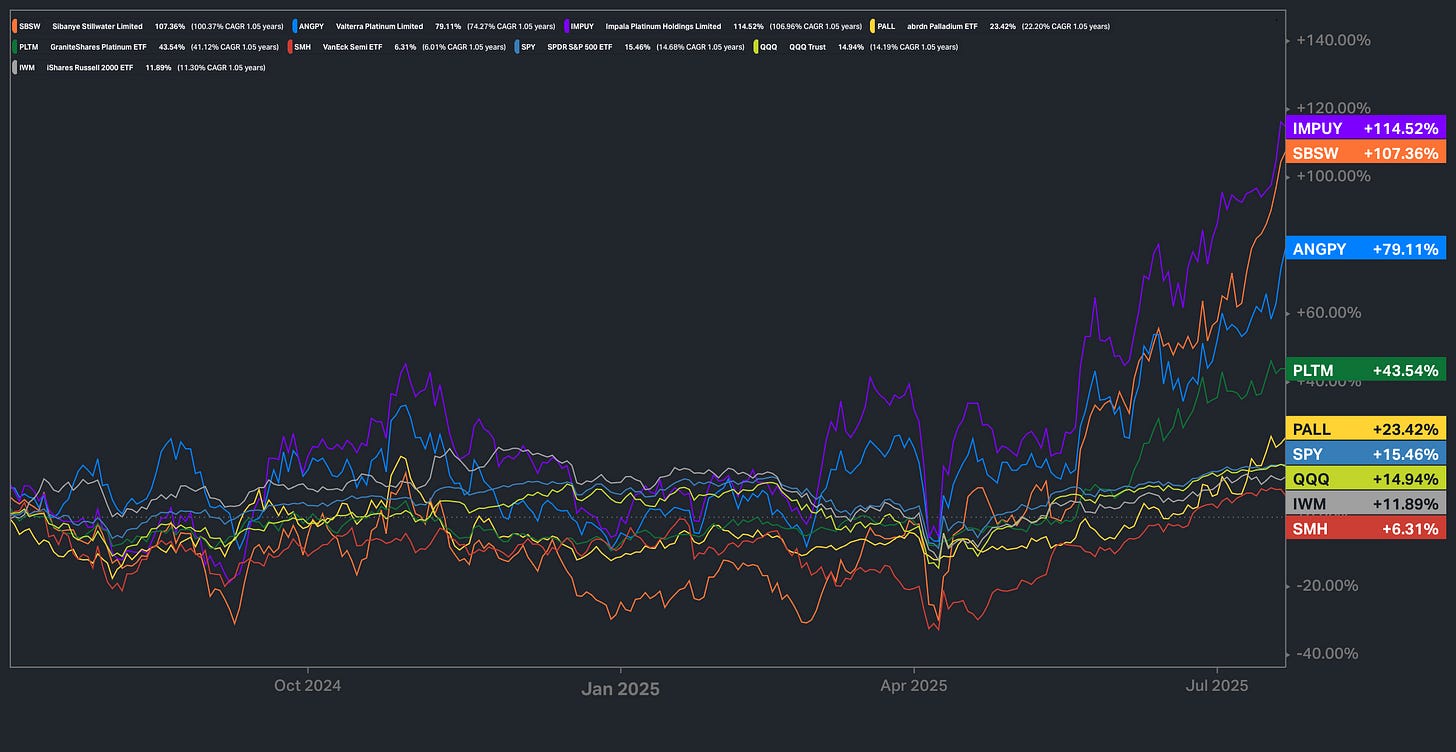

And whilst on the topic of ‘unloved’ sectors, a theme we wrote up as a ‘fat-pitch’ alongside with both Le Shrub & The Last Bear Standing was PGMs which was viewed as one of the most hated sectors within the market & at the time, no-one wanted anything to do with the sector & now, just over a year later, PGMs as a whole along with respective miners have drastically outperformed U.S. indices… yes, even Semiconductors in which SMH in itself has only returned 630bps whereas an EW basket of PGMs along with the miners is up just over 73%… not too shabby.

For those whom did want to go back & read the original write-up, a link can be found here.

In April, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed… it’s been pretty spot on.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

We also published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

As we mentioned earlier but it has been a relatively quieter week, but nevertheless, there has been a few standout headlines to recap:

- BESSENT: BY Q1 2026 GOING TO SEE GDP GROWTH AT 3% OR MORE

Oh how short-lived the attempt at an economic detox was as the administration now continues to emphasize they plan to ‘run growth hot’ to outpace spending to ultimately lower the Deficit-to-GDP… TBD if it ends up working out as they have pictured it.

- TRUMP ON CHINA: XI HAS INVITED ME TO CHINA

- BESSENT SAYS AUGUST 12 TARIFF DEADLINE LIKELY TO BE EXTENDED

Self-explanatory but it’s clear relations between the U.S. & China continue to improve given the Xi invite & in addition, Bessent reiterated that the China tariff exp. likely will be extended in order to preserve negotations & continue talks on further.

And lastly… a deal was finally reached with Japan. Following the 25% threat from a couple weeks back, the U.S. has settled at 15% reciprocal tariffs with Japan… in terms of major trading partners, that leaves the U.S. with both the EU & China left unresolved & as we just mentioned above but China tariff exp. plans to be extended, so that really just leaves the U.S. with the EU… general point being, interim tariff tail-risks continue to deflate.