Fiscal Runs the Show

Hello All,

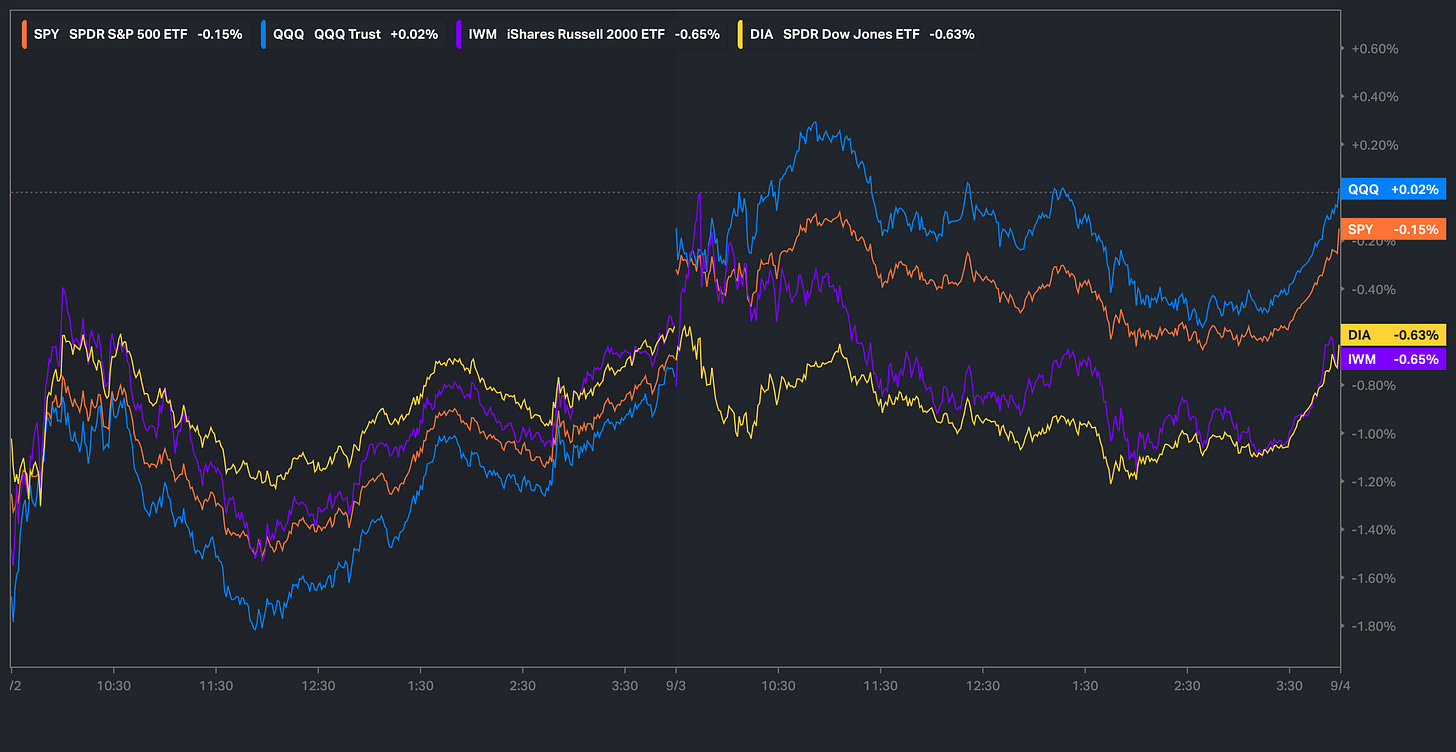

It’s been a relatively quieter start to the shortened week in regard to economic data / general event risks & initially coming into the week, the indices kicked off with a gap down given the growing fiscal worries / rise within global yields but since, the dip for the most part has been paired off with the Q’s essentially working back towards flat on the week & Spooz not too far behind either, only down 15bps, whereas Small-caps & the Dow are slightly lower on the week but only by about 60bps so nothing too out of the ordinary.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

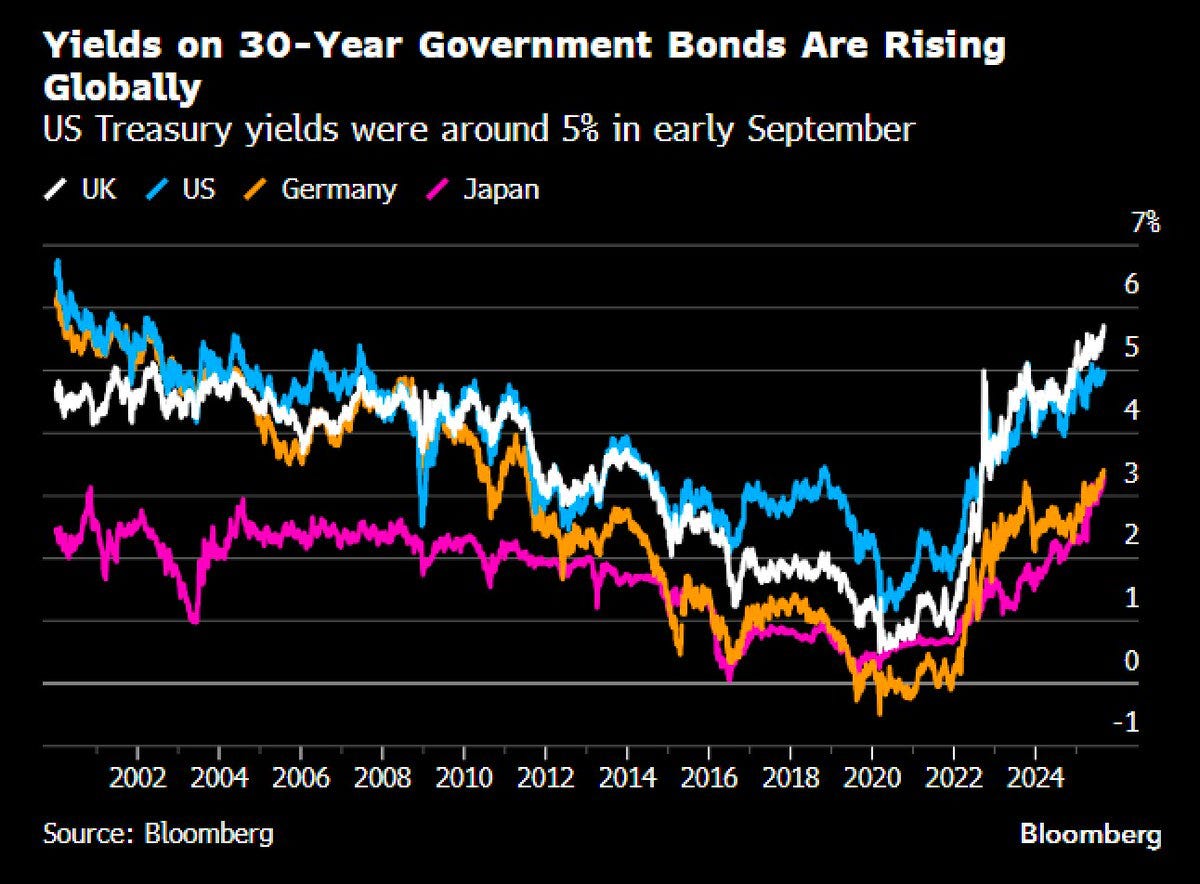

It’s been a relatively quiet week amongst the indices after the initial ‘narrative chase’ yesterday following the general rise within global yields over concerns of fiscal (no signs of ANY austerity in sight) but we called it out yesterday morning to likely be a ‘nothing-burger’ for a couple of reasons: For starters, the France / IMF bailout headline was last week yet there was hardly any reactions within FX / Bonds, if any at all… hence again, yesterday felt like a narrative chase on supposed fiscal worries as rate differentials alone weren’t supportive of the moves within FX. And secondly, at the end of the day, a big factor we’ve learned these past few years is the pain tolerance for central banks is VERY minimal… for those that recall in late ‘22 during the gilt crisis, the moment central banks panicked, markets as well stopped panicking… & who’s to say it won’t happen again (If erratic action continues, it likely will). And lastly, yesterday very well could’ve just been part of Month-end hangover / September seasonality scares… general point being, a lot more ‘noise’ in terms of looking for a confirmation of price-action as we kicked off into September hence why it’s generally being referred to as a ‘narrative chase’ as overall, nothing really changed.

Following the initial concerns / worries of the rapid rise within global yields, we saw the dollar initially catch a bit of a ‘flight-to-safety’ bid (pretty much unwound the entirety of the pop today) as the dollar continues to remain just barely supported above this critical juncture / upward parallel channel since ‘11:

And well, again, following the general fiscal concerns, what was bid? Hard assets & Commodities… With the entire world easing & going fiscal, hard assets will remain a cornerstone where capital will likely continue to flock towards.

Who could’ve seen this coming?

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

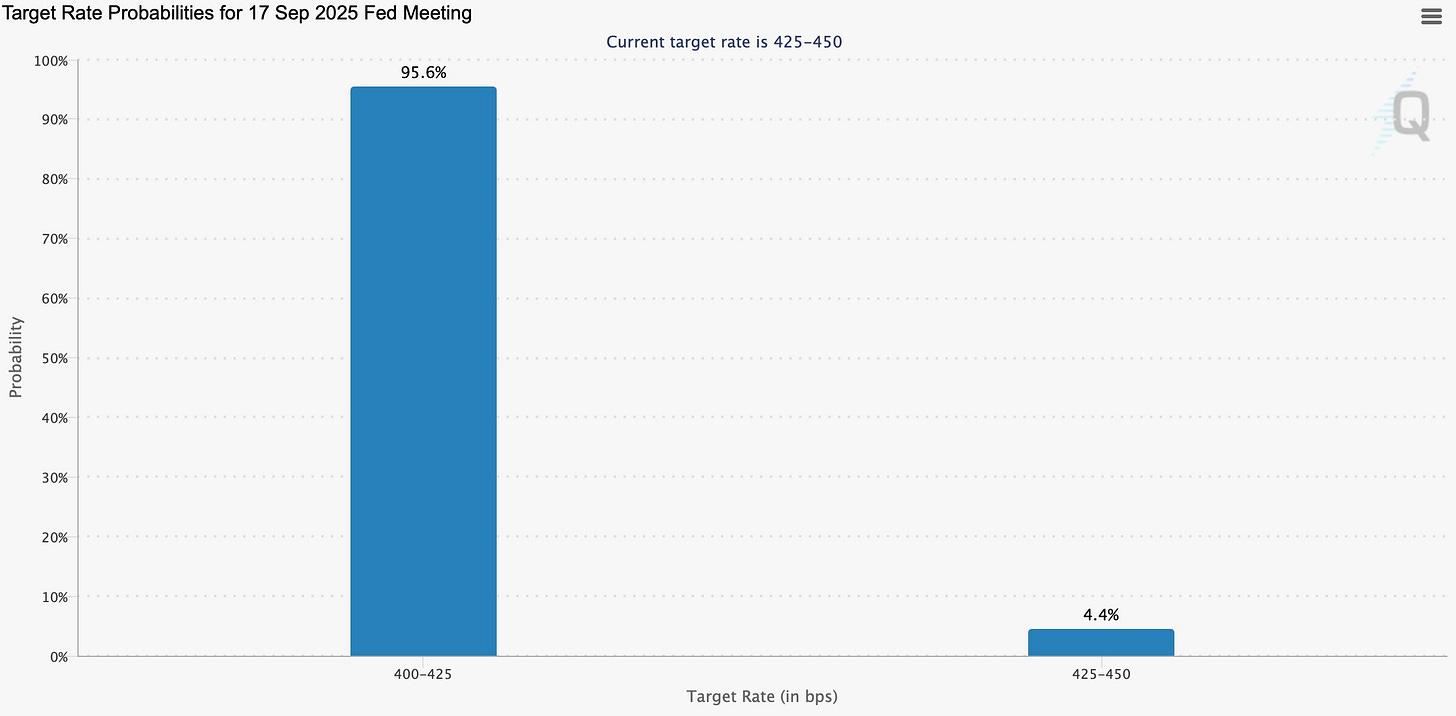

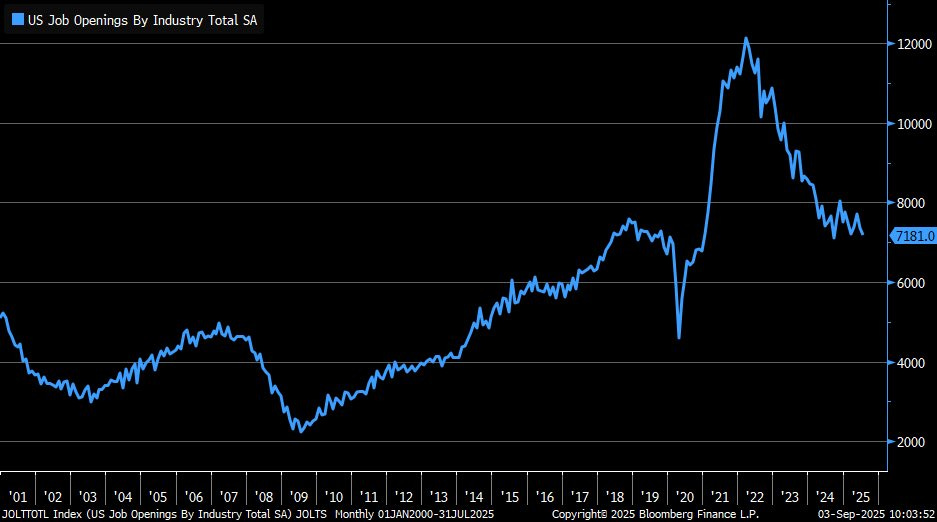

Moving along into today, again, thus far its generally been a quieter week in regard to headline driven news / economic data, but today, the JOLTs release came in softer than expected with Job openings falling to 7.181M, below the 7.38M consensus estimate and down from the prior 7.357M, which was also revised lower from 7.437M... slight hints of softness continue to show up within labor market.

And following the softer than expected JOLTs report, September rate-cut odds jumped to 95.6% thus essentially solidifying a cut at the next meeting & into Friday with NFP #’s, IF the report happens to be softer than expected / a jump in the unemployment rate to new cycle highs (4.4+), the conversation will likely not only shift to a September rate-cut being solidified but as well as should the Fed cut 25bps or 50bps (3-cuts for the year would likely be priced in compared to the 2-cuts currently being priced in).