Global Trade at a Crossroads

Hello All,

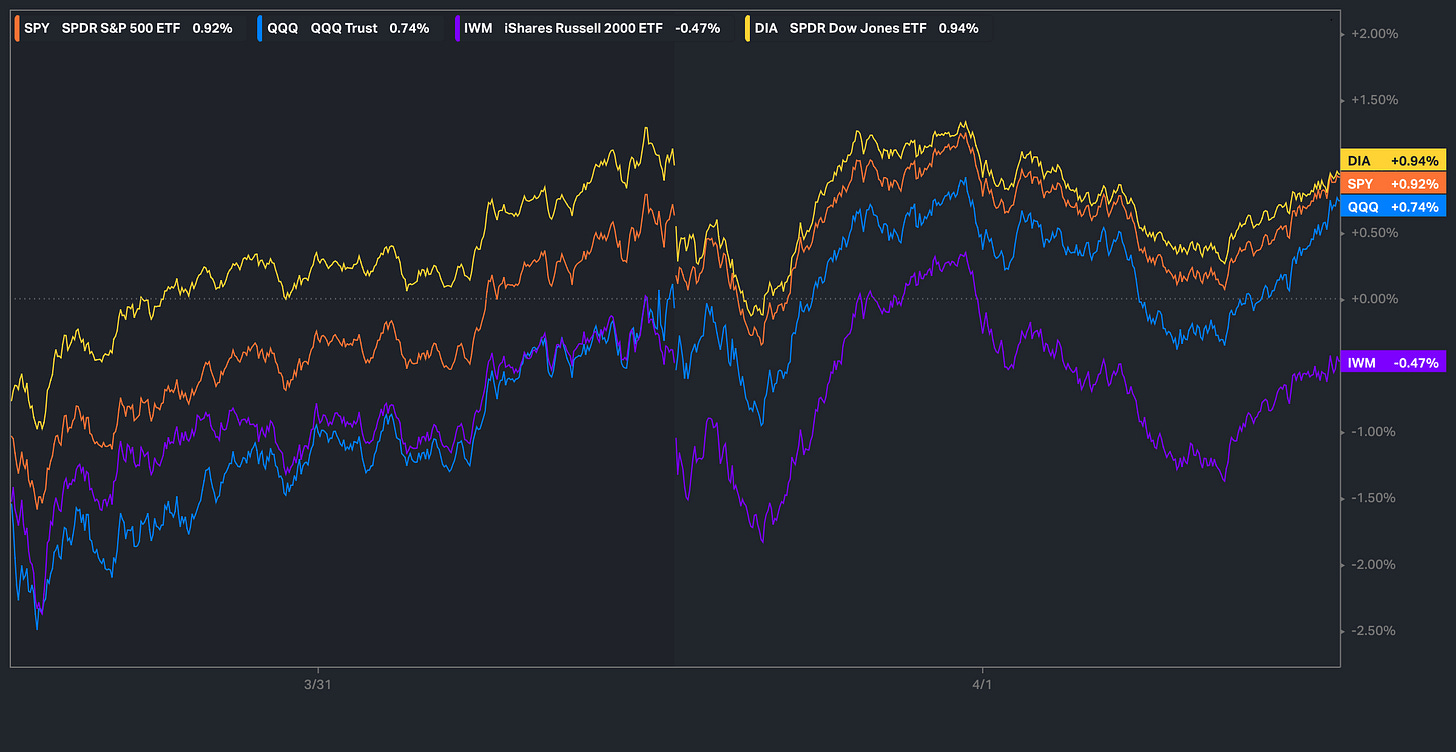

Liberation Day is nearly finally here as Trump is expected to speak tomorrow right at market close around 4pm & as the week has kicked off, the headline volatility has continued with markets initially posting quite the gap down on Monday which did end up leading to quite the snapback off the lows as all of the indices are now within the positive on the week besides small-caps which still remain lower by just under 50bps… not too bad considering majority of the indices at one point were all down 200bps+.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

Before we jump into it, one interesting point of confluence on Spooz, similar to the Q’s, that I thought was worth pointing out is as of now, Spooz found support off this TL that initially was established in the beginning of ‘24 & has now acted as support in four other instances prior (if we bottomed off it yesterday, that will mark the 5th instance).

In terms of another added point of confluence, we once again have seen Spooz make its way back to the midpoint of the regression channel dating back to ‘18… initially saw Spooz bottom off the midpoint earlier on in March & do expect it to continue to be a bigger pivot to pay attention to moving forward.

In taking a closer look at Spooz as the week has kicked off, thus far, Spooz has produced over a 140-handle rally off of yesterdays low… was that THE interim bottom? Well, in terms of orders of confluence, as we pointed out above but Spooz is sitting on a support TL that dates back to early ‘24 & has held in 4 instances (5 instances if bottomed off the TL yesterday) / Spooz is maintaining the midpoint of the upward channel that dates back to ‘18 which is exactly where Spooz bottomed back earlier on in March & lastly, given the lower low in Spooz that was established yesterday, Spooz is flashing a bull divergence on the daily… if we were to see Spooz followthrough to the upside & the bull divergence materializes, we still ultimately need to see Spooz work higher to go on and reclaim 5650ish above (20d) to then try & breakout of the wedge to the upside which should then precede a backtest of the 200d / retest of these prior local highs in the 5780s… from there, it more so boils down to if Spooz ends up failing once again at the 200d (if we see further clarity in regard to policy, doesn’t seem like Spooz will pause again there) before then resolving back lower whereas if we were to see a firm reclaim, we likely will see Spooz rally higher to backtest the 50d above in the 5850 / 5900ish range.

On the contrary, if Spooz were to invalidate this recent bull divergence / falters & goes on to make lower lows, maybe we finally get a flush towards the September ‘24 lows near 5400ish (gap just below near 5340ish as well for added confluence of support)… would likely need to see 20%+ universal tariffs / retaliatory tariffs / bad economic data etc…

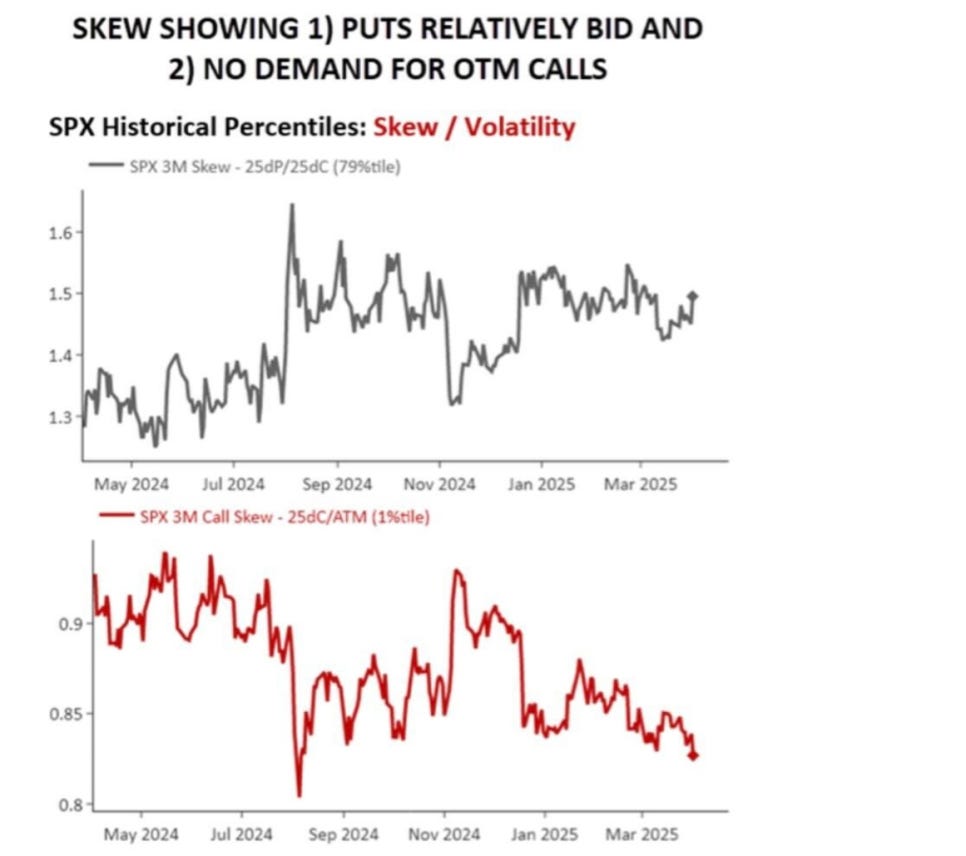

In respect to tomorrow for Liberation Day / Looking ahead, I found the chart below quite interesting… essentially, there is zero demand for calls / right-tail & the market is more so solely prepped & focused on downside as puts still remain relatively bid… what happens if tomorrow isn’t doomsday? Certainly would see a lot of right-tail chasing…

It does seem like the administration has removed some event risk given the following after-hour headlines as shown below:

- The U.S. Trade Representative’s office is preparing a 3rd option—an across-the-board tariff on a subset of nations that likely would not be as high as the 20% universal tariff option. The new, middle-ground tariff option comes after pushback from industry, labor groups.

It seems clear that “scenario 3” more so removed the risk of the universal tariff being implemented which is arguably the worst scenario in play.

- To then follow up with that, Bessent stated that tomorrow’s tariffs are a “cap” - that the amounts announced tomorrow are the highest the tariffs will go and counties could then take steps to bring the tariffs down. I thought this was relatively good news IF you believe the administration… there has been tons of fear that Trump could raise tariffs even further (if there is retaliations, Trump may still raise tariffs), but Bessent (as of now) basically confirmed that tomorrow is the highest % that the administration plans to go & as we have stated previously, but the ultimate goal is to get other countries to negotiate & strike a deal to then lower the tariff %’s…

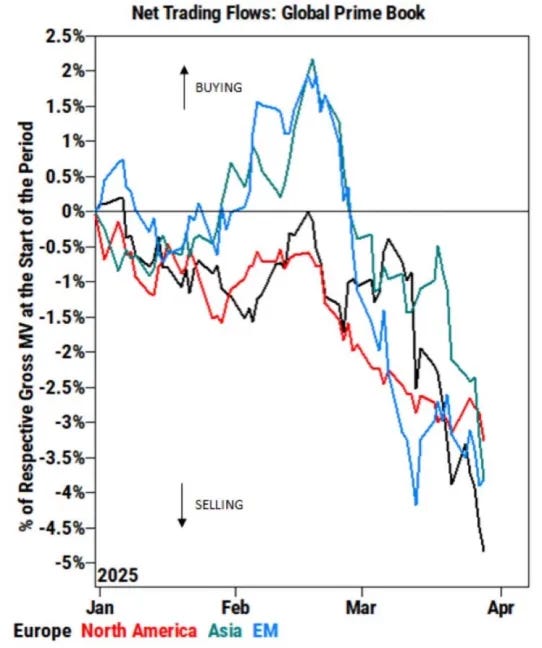

In respect to positioning, I thought the below were quite interesting (quite pessimistic):

We’ve obviously seen quite the degrossing / negative flows (selling) as the year has kicked off & the following chart below reflects that… what’s interesting is despite the rallies in Europe / Asia / EM, net outflows have reached the same of the U.S. at -3.5 / 5%…

Same can be said in terms of the slowdown / recession trade, but we’ve seen individuals pile into defensives whilst selling cyclicals simultaneously…

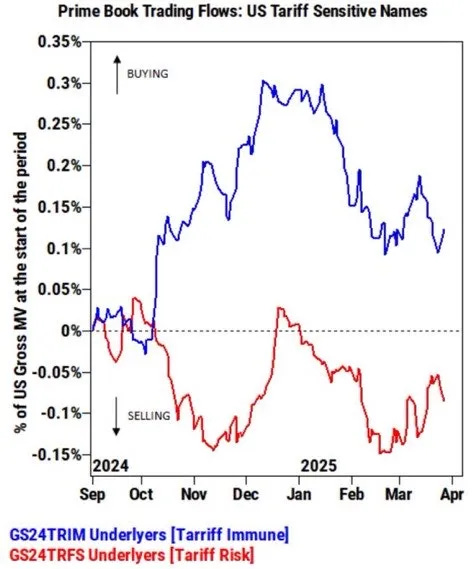

And of course, the same can be said for names with non-tariff / tariff risk…

General conclusion being that people are positioned quite defensively / there has been big degrossing into Q1 in general…