Grow Your Way Out

Hello All,

Despite the lack of economic data & general event risks this shortened trading week, it certainly hasn’t been a quieter one as the week initially kicked off with the U.S. (Trump Administration) issuing threats (Tariffs) against the EU in order to secure Greenland, although just 2-days later, tensions were relieved as Trump stated the U.S. wouldn’t try to ‘take Greenland with force’ & the initial deadline of the February 1st tariffs on the EU were cancelled as well.

With that being said, this week has been more or less of the same action that has being undergoing all year:

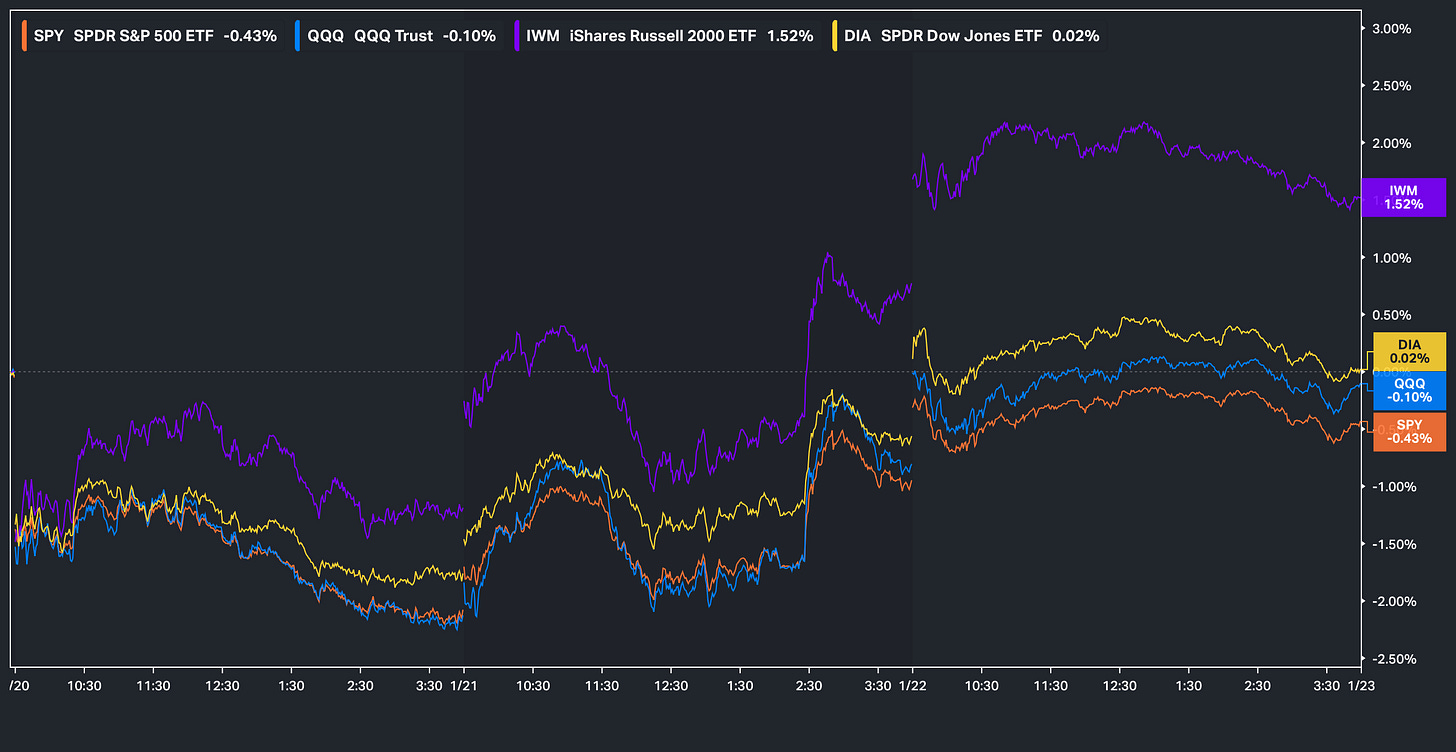

Small-caps yet again outperforming on the week, currently higher by just over 150bps, whereas the remaining indices are flat / slightly lower on the week with Spooz as the ‘worst’ performing of the indices although only sits lower by just over 40bps on the week.

For those who may have missed, we published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as ‘26 kicks off after coming off a strong ‘25 & for those whom would like to go back & read the report, I included it just below:

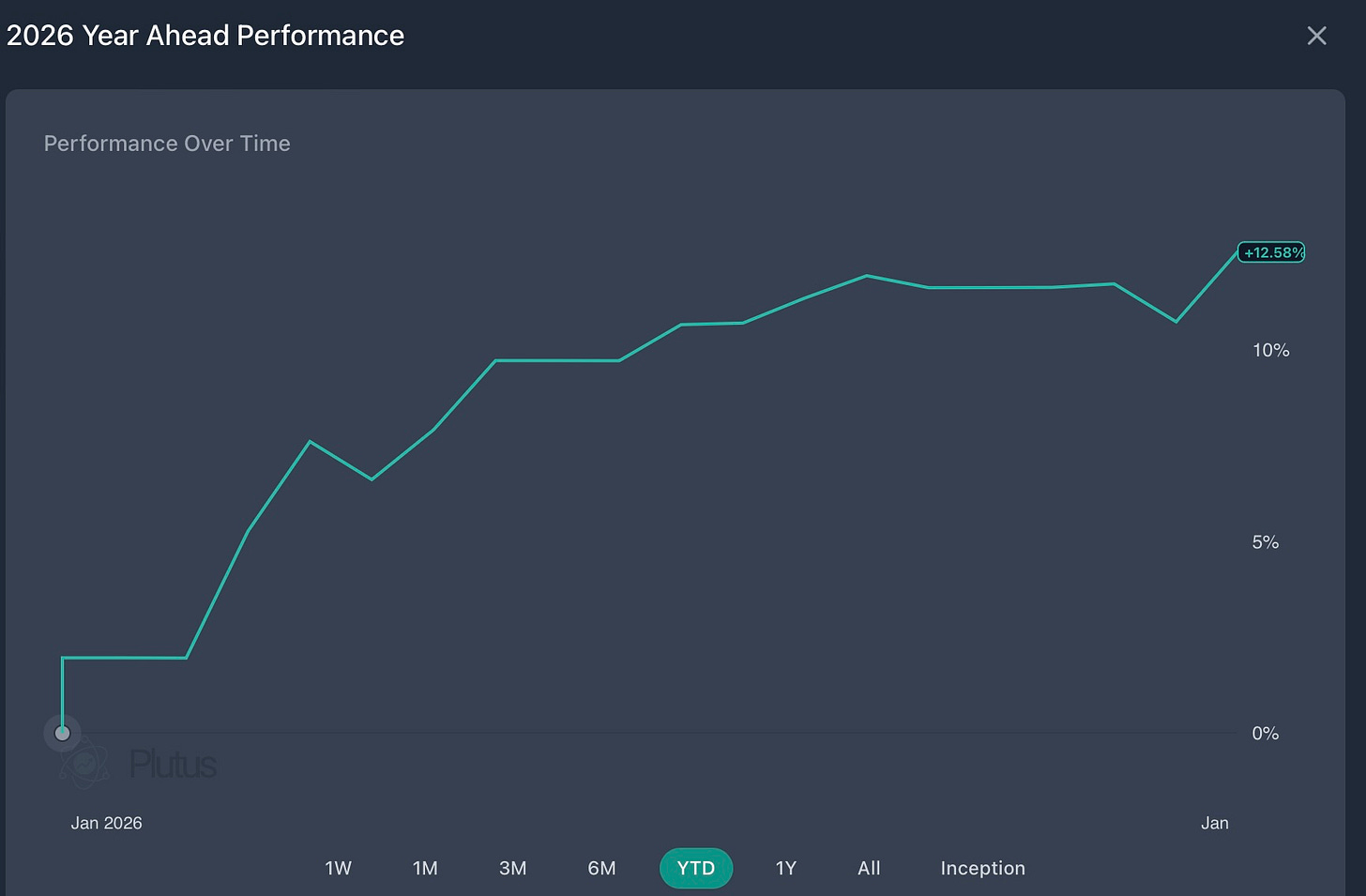

YTD Performance of names covered within ‘26 Year Ahead:

And for anyone who wants to follow an actively managed portfolio in real time:

I’ve joined Plutus as the cleanest, day-to-day way to track an actively managed portfolio in real time. It’s a live dashboard that’s broader, more diversified, actively managed by me, & updated continuously.

The Eliant Flagship is published on RunPlutus.

Once your Plutus account is approved, you’ll have the option to allocate right away. If you do, it’s straightforward: create an account, link your brokerage (Available only for IBKR at this time), & select the Eliant Flagship (or any of the baskets I’ve built). Your money stays in your account, and trades, position changes, and rebalances are replicated automatically so there’s nothing manual to manage. The idea is to make it easier to access an actively managed portfolio run by me without the overhead of traditional fund structures or high minimums, whilst you keep full custody of your assets & I stay focused on research, positioning, and portfolio construction.

And just to be clear, NOTHING is changing with Substack. It’ll stay exactly what it’s always been since we originally launched in the Summer of ‘23: where I share the thinking, research, & select trades behind my personal PA, along with ongoing commentary across all markets.

Earlier in 2024, we launched a series titled Educational Pieces, covering a wide range of topics, many of which were suggested directly by you all (4-Part Series).

For those who may have missed the first installment, it covered topics including:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

A link to the original Educational Piece can be found here .

Given the positive feedback and how useful many of you found the first installment, we followed up with Educational Piece: Part Deux earlier in 2025 & for those who may have missed, a link to the piece can be found here & we then went on to release Educational Piece: Part Trois which can be found here.

And finally, the most recent installment, Educational Piece: Part Quatre, can be found here.

‘Risk management is the silent prerequisite for compounding & true wealth is built not by chasing the highest returns but by ensuring the survival necessary to realize them.’

To jump straight into it, as we briefly mentioned earlier but the week initially kicked off with U.S. / EU tensions following the disagreement by the EU of not approving & or initially wanting to make a deal for Greenland with the U.S. but just 2-days following, Trump stated that the U.S. will not take Greenland by force, thus reducing overall aggression fears, whilst also deciding to remove the initial February 1st tariff deadline threat on the EU to ultimately try & work out a deal & or framework in which both the U.S. & the EU are satisfied.

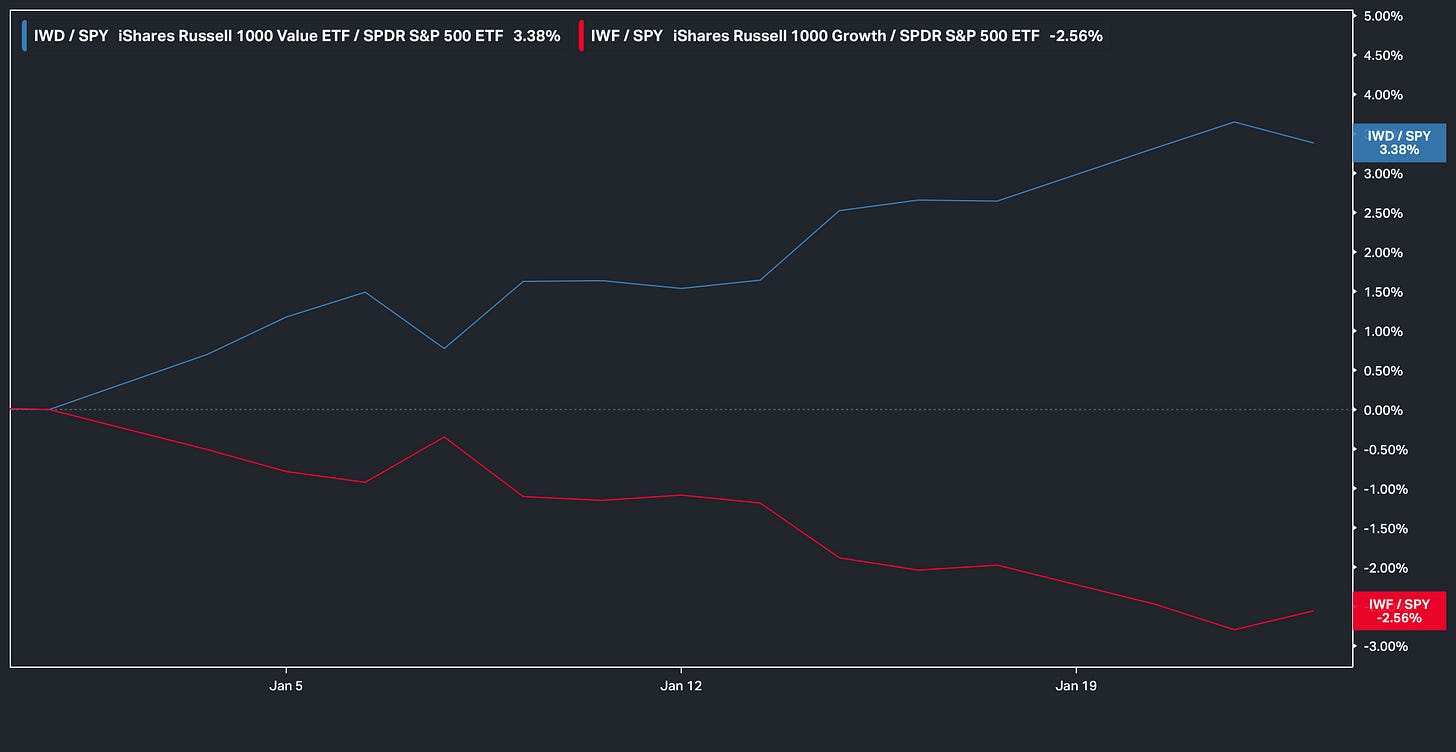

With that being said, despite the relative headline noise, the underlying dynamic continuing to make way year-to-date is the relative outperformance of Value over Growth (Cyclicals & or ‘Real Economy’ names outperforming) as we’ve now encroached a near 6% spread between the two:

And another chart highlighting this underlying dynamic is the Value/Growth chart below which has just recently posted a 3+ year breakout:

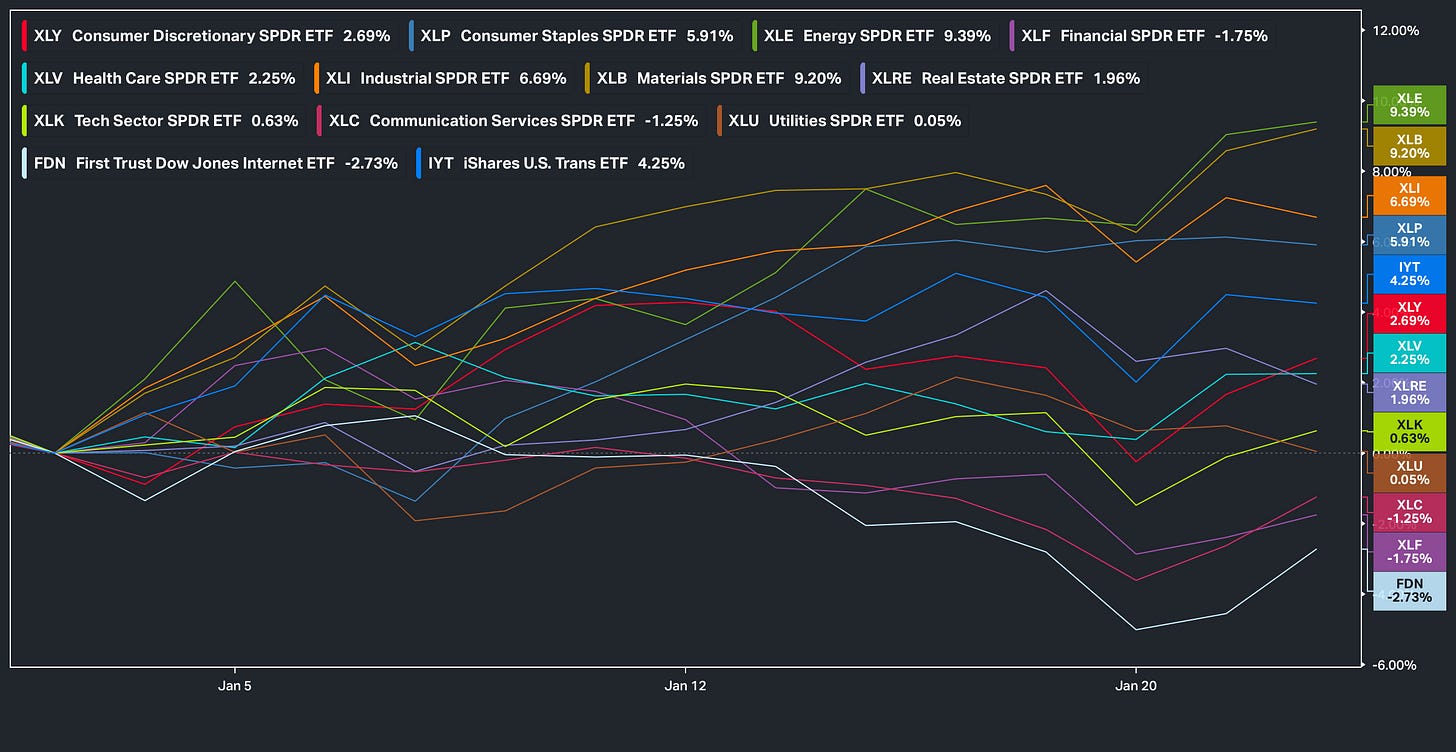

And this underlying rotation toward cyclicals & or ‘real economy’ names continues to be noticeable across a broad set of sectors:

RSP at ATHs:

Small-Caps at ATHs:

Transports at ATHs:

Regionals encroaching ATHs:

Commodities emerging out of 3+ year base:

And in regard to sub-sector performance, what’s the top performing group YTD? You guessed it, Cyclicals:

- Energy (Cyclical)

- Materials (Cyclical)

- Industrials (Cyclical)

- Staples (Non-cyclical / Defensive)

- Transports (Cyclical)

- Consumer Discretionary (Cyclical)

5/6 top performing sectors YTD are all cyclical:

General point being, despite the perceived ‘lackluster’ action amongst both Spooz & the Q’s YTD due to the underperformance within the Mag-7, capital has instead just flowed elsewhere (S&P 493) which has driven quite the uplift in breadth & overall upside participation which is made clear, as shown below, given the new high within the ADV-DECL Line despite Spooz for instance still being around 100bps off the recent ATHs made the other week:

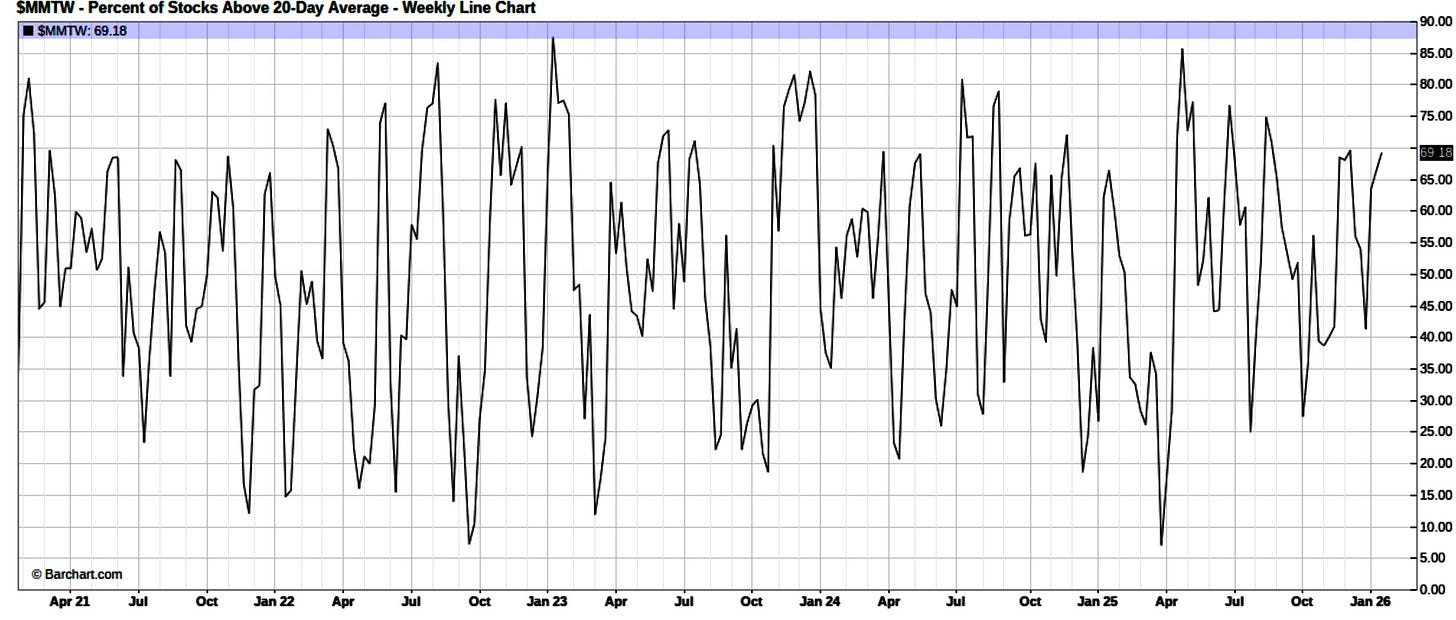

With that being said, despite the overall lackluster price action within the indices, especially given recent headline noise, overall breadth has STILL continued to remain strong as the % of Stocks above the 20D currently sits at 69% which is essentially encroaching shorter-term overbought territory.

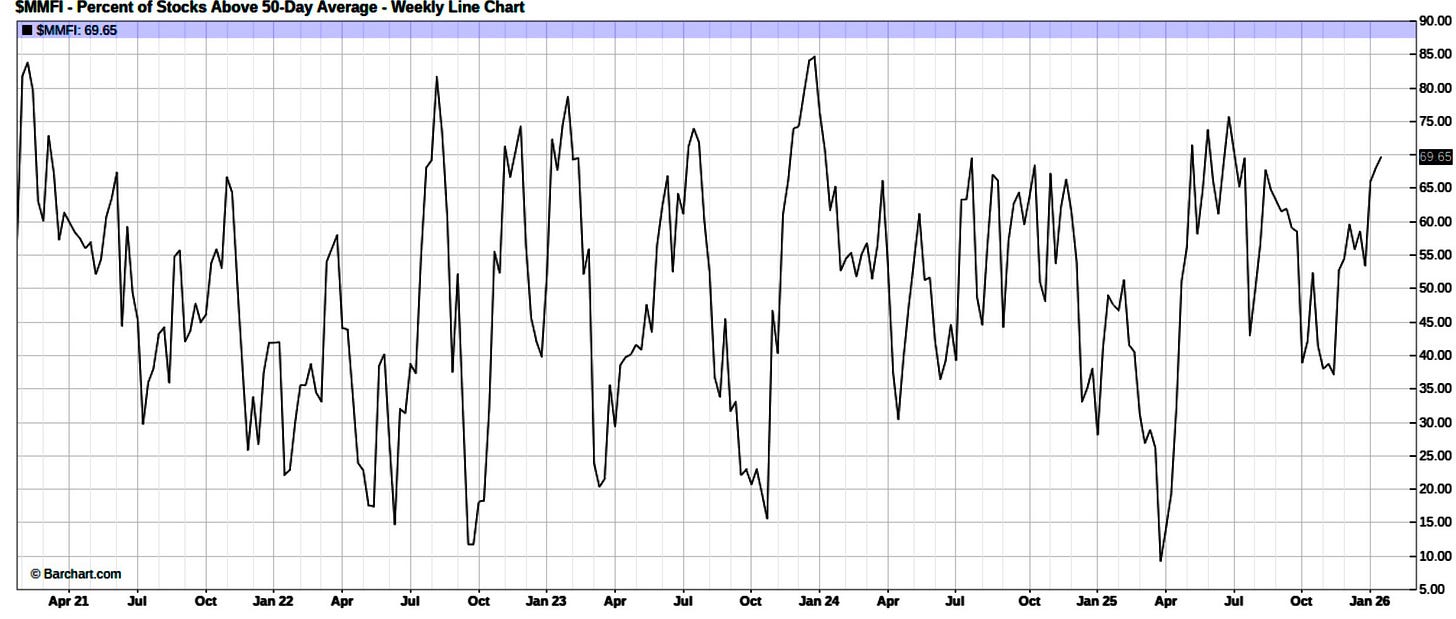

And the same can be said on a more broader timeframe as the % of stocks above the 50d currently sits at 69% too (Peak in last 5-years was December ‘23 near 85% following Powell’s initial signal that the Fed was ready to move toward a rate-cut cycle):

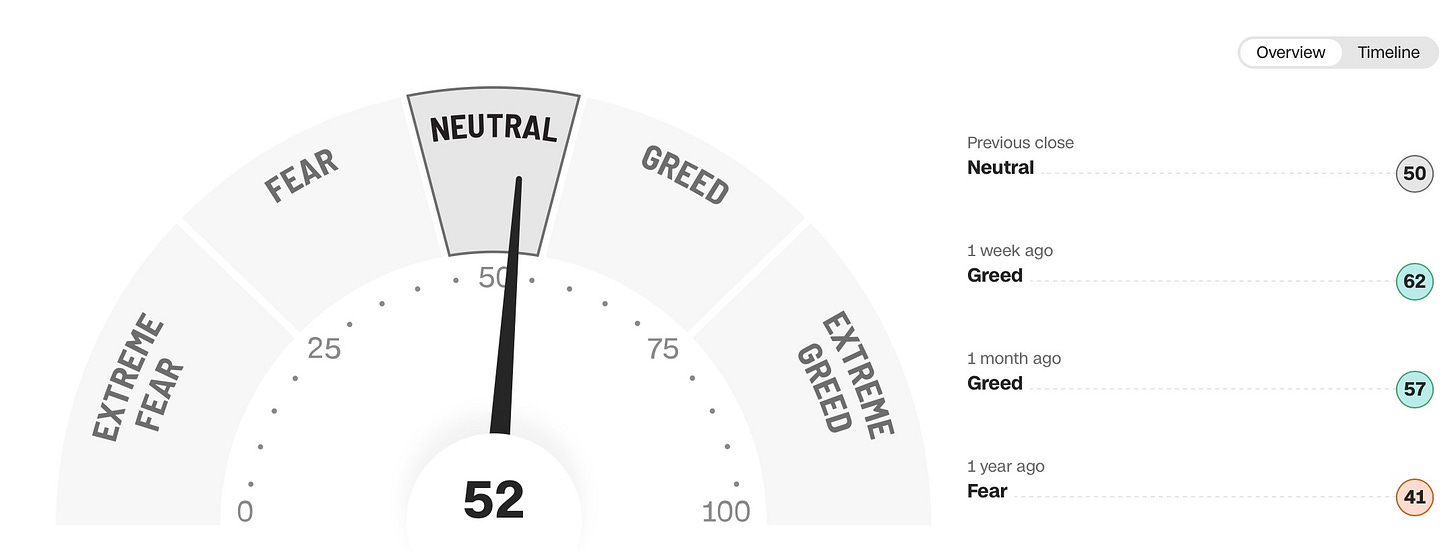

Having said that, despite the uplift in breadth & general broadening out of upside participation amongst the indices, the Fear-Greed index doesn’t remain as enthusiastic as it still sits within ‘neutral’ territory after having briefly worked into ‘Greed’ territory for the first time since September ‘25 this past week.

How can that possibly be considering how well so many sectors are performing YTD? Well again, the Nasdaq hasn’t made a new high since October ‘25 (Likely playing a big role) & earlier this week, the Mag-7 for instance were essentially as oversold as the Liberation Day lows in April of ‘25:

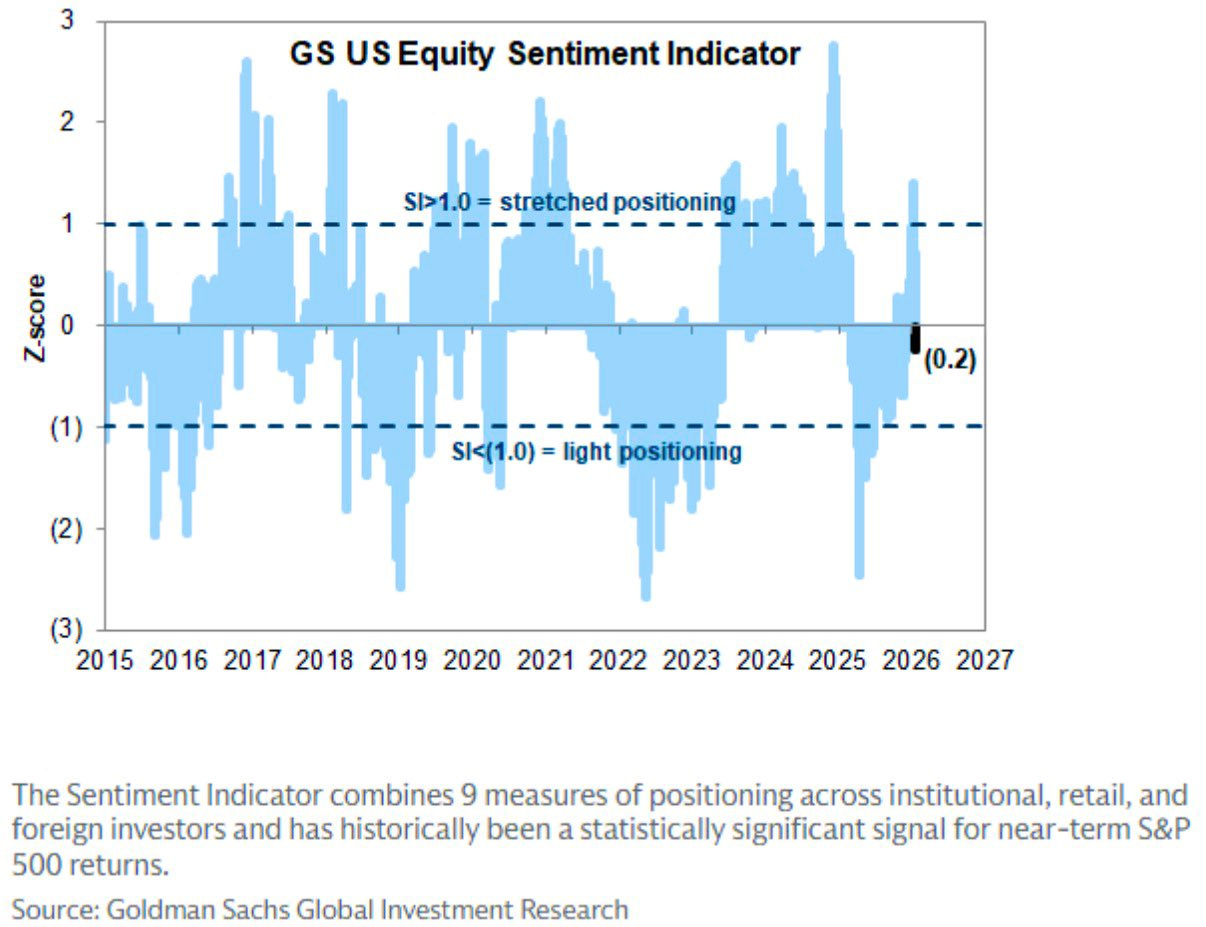

And to add on to this point, after having briefly worked into positive territory, the Goldman Sachs U.S. Equity Sentiment Indicator has fallen right back into negative territory thus emphasizing it continues to be a market filled with upside complacency: