Microsoft Soars, Funds Still Floor’d

Hello All,

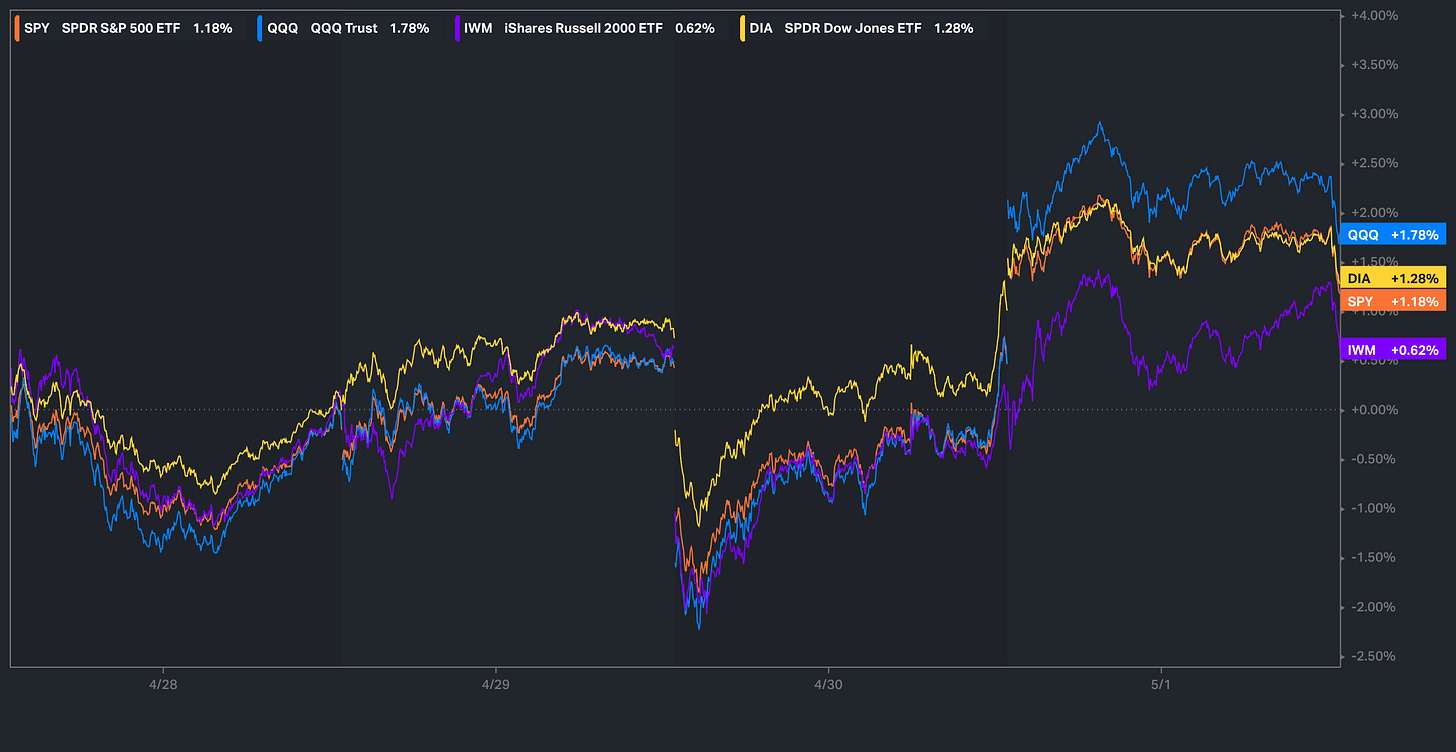

It’s been a relatively noisy past few days in respect to headlines / economic data, as initially, indices declined yesterday following the negative headline GDP report but actually ended up closing out the day green… following into today, Microsoft reported a great quarter last night which led to the indices to extend their gains further as Spooz specifically closed the day for its 8th green-day in a row… hasn’t done 9 in a row in over a decade. Heading into the remainder of the week, NFP #’s remain in focus, but thus far, the Q’s have been the best performing index on the week whereas Small-caps have been the laggard but still remain +62bps on the week.

A couple weeks back, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

Lastly, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

It’s been a relatively quieter / slow-churn upwards week within the indices, but yesterday, we did post a bit of volatility following the GDP report before market open which came in at -0.3%. The headline was certainly ugly which more so drove a selloff in the indices & at one point, Spooz was down over 140-handles on the day, but the biggest contributing factor to the sharp drop-off in GDP was due to the surge in imports due to the front-running of tariffs & decline in inventories as well. Funny enough, but the indices ended up reversing all of yesterdays gains & closed out the day green despite the negative headline GDP report.

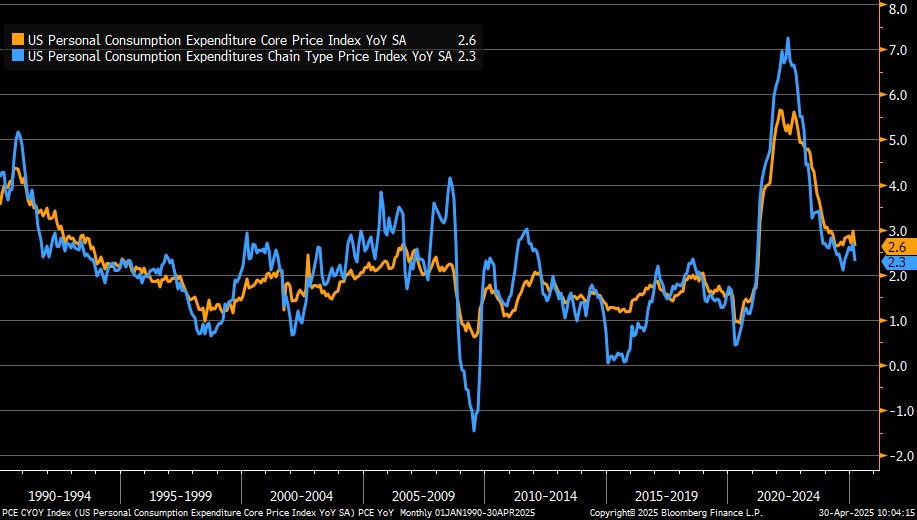

In respect to PCE #’s, headline came in at 2.3% vs. 2.2% estimated & Core came inline at 2.6% vs. 3.0% prior… all-in-all, a positive report all around, but the market is more worried about the bigger picture given the upcoming lingering effects of tariffs being implemented which has yet to show up in data & the question remains in terms of whether or not if it’ll be a one-time price shock & or a persistent inflation rebound ahead.

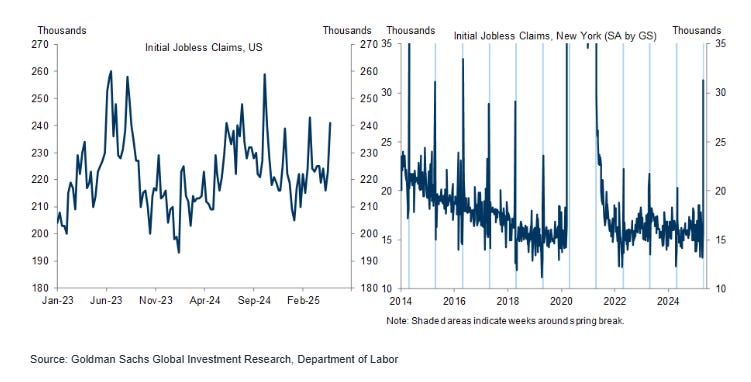

Lastly, today we had jobless claims which missed estimates & came in over 240k which raised a few eyebrows, BUT, the weakness was entirely driven by New York layoffs which coincides with Spring Break as shown below… non-seasonally adjusted claims on the other hand were muted showing the initial jobless claims print was noise despite the headline. Relatively speaking, hard data is still hanging in there.

- SPY

In respect to Spooz, it’s been a bit of a wilder week & an impressive one from bulls too say the least, but yesterday specifically, as we mentioned above but the bigger headline dagger was the negative GDP print… granted, in looking under the surface, it wasn’t as bad as it was made out to be, but nevertheless, the headline scare was enough to drive markets lower which resulted in Spooz backtesting this recent TL breakout after declining over 140-handles intraday but then to round off the day, Spooz closed green… in part driven by month-end flows, but nevertheless, we were already up 100-handles off the lows, so the end of day month-end flows ended up just being an added contributor to the gains.

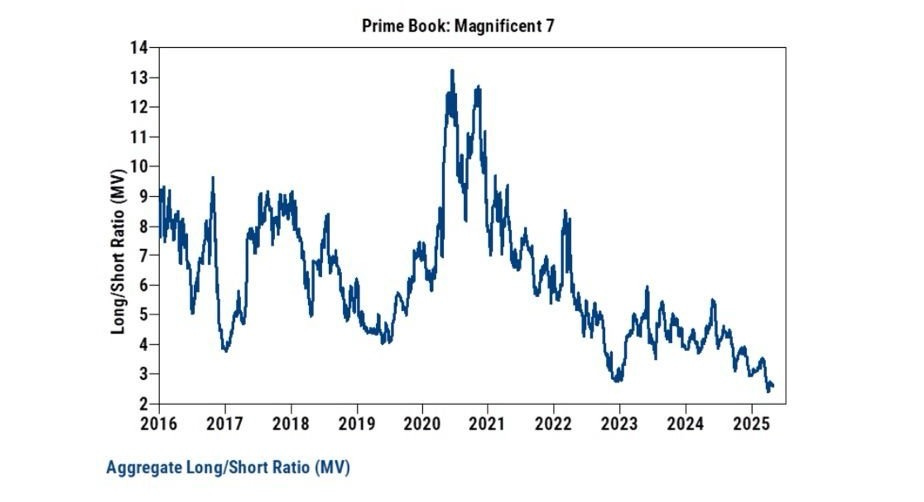

In respect to today, the hated rally continued for it’s 8th day & one thing we reiterated several times a couple weeks back is Nets are very low / The administration is cornered and will be forced to soften rhetoric / Right-tail & performance chase remains very real & well sure enough, we’re up 850-handles off the lows & yesterday, Microsoft added fuel to the fire by putting up a monstrous quarter thus igniting the pain trade in Mag-7 / Indices further as NO ONE really owns the Mag-7 as positioning is at multi-year lows…

As I am writing, a headline out of China came out as follows:

China’s Ministry of Commerce stated that it has noted repeated remarks by senior U.S. officials expressing a willingness to engage in tariff negotiations with China. Recently, relevant U.S. parties have also proactively conveyed messages to China, hoping to initiate talks. In response, China is conducting an assessment.

The Ministry emphasized that if the U.S. truly wants to negotiate, it must demonstrate sincerity by preparing to correct its wrongful practices and take concrete actions, including removing unilateral tariff hikes.

As a result, the indices have made their way back positive overnight & /ES is nearly back to todays highs despite both AAPL & AMZN being lower after earnings. IF we were to get substance out of the administration in regard to lowering tariff rate %’s on China, that’s just going to be further fuel for upside in a market where individuals are already performance chasing… we’ll see how things develop overnight & tomorrow.

As we head into tomorrow to round off the week, we have NFP #’s before market open & as of now, jobs are expected to come in at 130k & the UER is expected to remain unchanged at 4.2%. If the report is muted / inline, individuals will likely look through the report & anticipation likely boils down to the next report in terms of anticipating economic weakness, but in general in terms of hard data this week, its been relatively noisy but in looking under the surface, data is still holding in pretty well.

In respect to Spooz, again, we do have jobs data & China as a bit of a wildcard, but today, we did see Spooz gap above the 50d & IF the interim bull-gap below remains supportive (5670/5650ish), I do think indices in general will continue to remain bifurcated & positive developments / hard data continuing to hold in could even push Spooz higher towards the 200d in the mid-5700s. Spooz has gone 8-days in a row within the green & there hasn’t been a 9th day in over a decade, so a bigger historical test in general for markets along with being generally short-term overbought as well (although those conditions did get slightly reset yesterday on the decline). Bigger picture, I still would like to continue to see the bull-gap from this past Wednesday protected and it likely remains as a bigger LIS for the remainder of the quarter (5350 / 5340ish) although hard data deteriorating will likely push Spooz to fill that bull-gap below if it were to materialize, but for now, markets still remain within a wall of worry as we’ve called for. However, if that bull-gap were to falter as support, do think we can see Spooz continue to rollover towards 5300 / 5250ish to fill the entirety of the bull-gap & that very well could mark another higher-low, & the more broader picture view continues to circle around this past Monday’s low near 5100ish as the ultimate LIS for bulls as faltering below would likely lead to a full unwind of the 90-Day Delay move which would more so be driven by weaker hard data & or failed / escalation amongst trade talks.

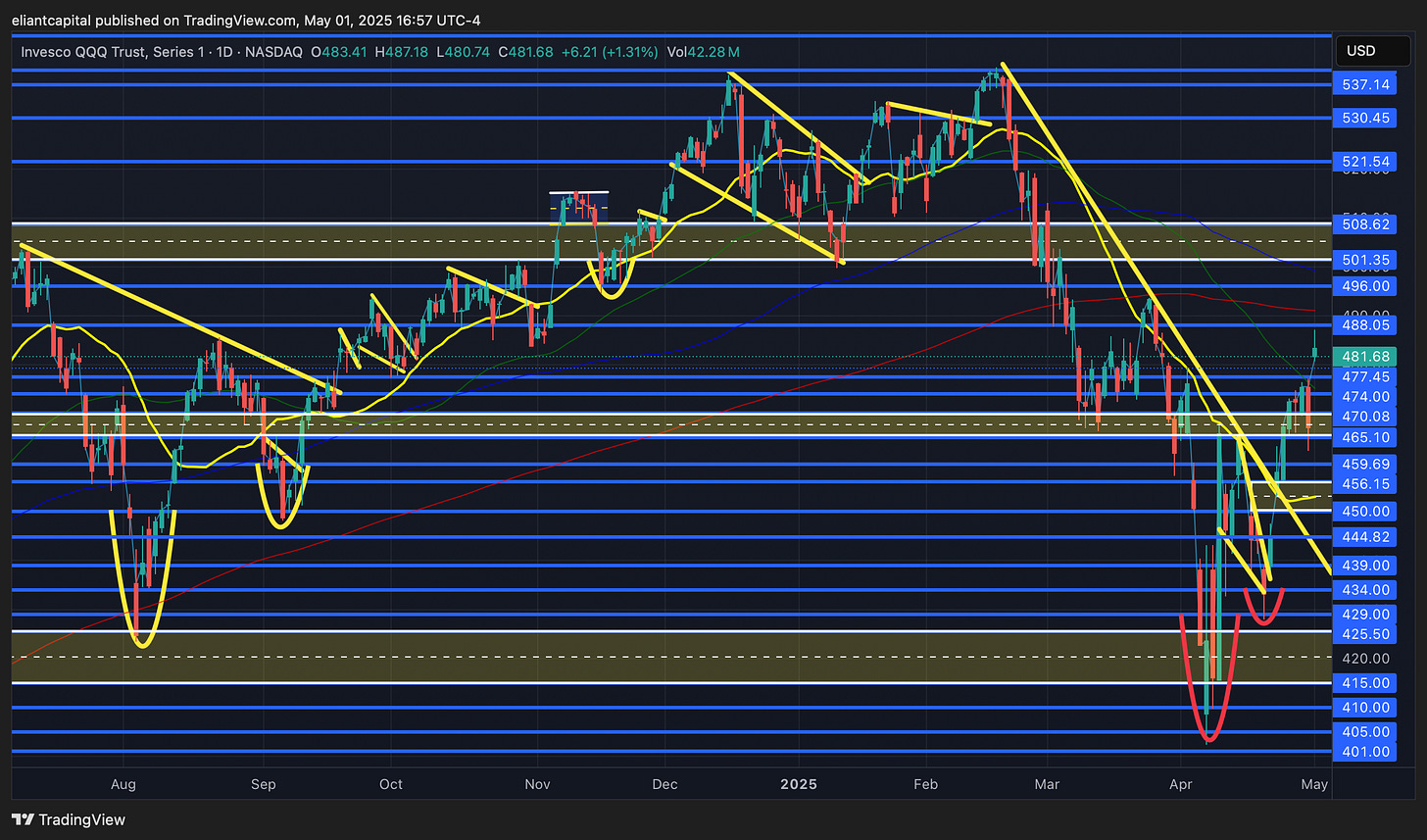

- QQQ

As we noted above, but Microsoft had a great report which left many by surprise given how UW Hedge-funds & PMs remain towards Mag-7… a clear pain trade there & likely can expect Microsoft to be a relative out-performer given they’re safe from tariffs as is NFLX which has been a big relative out-performer comparatively speaking as well.

Given the gap-up today following MSFT’s earnings report, the Q’s established another bull-gap just below as the Q’s ended up gapping over the 50d & nearly ended up tapping the 200d… the big question from here is if the Q’s can manage to go on and firmly reclaim the 200d & or if it flips into resistance thus capping this interim rally for now likely leading to the Q’s / general indices to at least backtest lower before deciding where to go from there. We’re in an interesting spot as Mag-7 net exposure remains extremely underweight which can fuel a right-tail performance chase & then on the other hand, we still have economic uncertainties to deal with even-though uncertainties do continue to clear up by the day which has more so fueled this large rally off the lows.

Nevertheless, in the interim, IF bulls can manage to sustain above this bull-gap created today (479 / 477ish), I do think bulls will continue to remain with edge & that would likely allow the Q’s to firmly test the 200d above which will be a bigger deciding factor in terms of where we go from there… if the chase continues & the Q’s go on to firmly reclaim the 200d, I could see the Q’s ultimately working higher towards 496 / 501ish above which coincides with a backtest of the early January Deepseek lows & would likely be a general pivot that creates some pause for the Q’s.

On the contrary, if we were to see the bull-gap below falter as support, I do think 465 / 463ish below (Yesterdays low) is a bigger LIS for bulls as you could argue another higher low was established, but if those lows were to falter, we likely will see the Q’s continue to roll-over towards this past Wednesday bull-gap below near 456ish which also coincides with a backtest of the 20d & would likely be a more firm support if backtested below.

/DXY

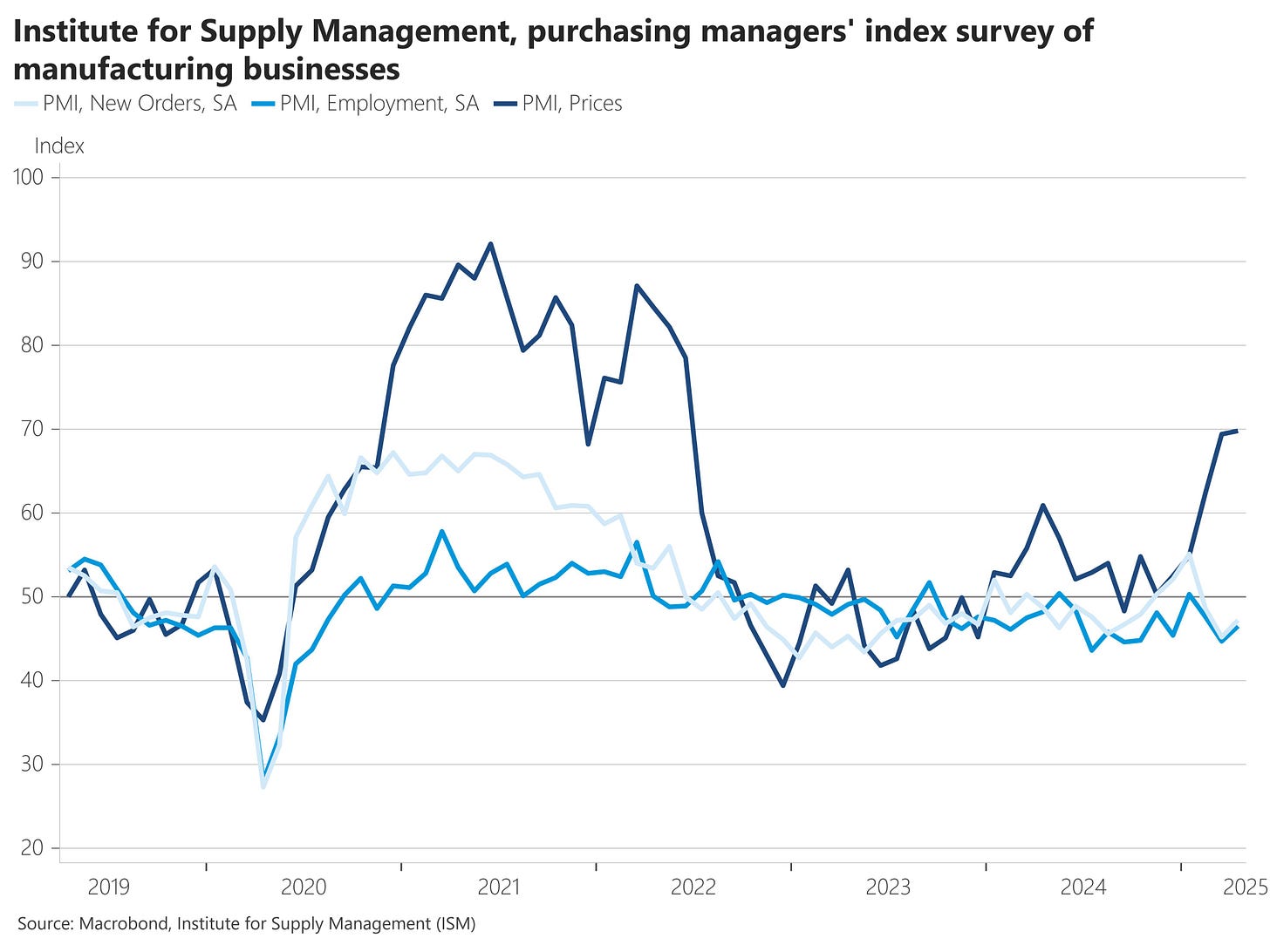

It’s been a relatively quieter week within FX altogether & there isn’t too much to recap respectively, but the biggest news ex-U.S. data was the dovish outlook from BOJ which caused a retreat from the Yen safe-haven bid & both EUR & GBP saw mean reversion as well thus fueling a bit of a dollar reversal. As we’ll discuss later on but a bigger driver of todays dollar upside reversal came after the early morning Mfg. print as PMIs came in slightly better than expected along with both New Orders & Employment coming in higher as well thus fueling a bit of confidence in U.S. along with Mag-7 (MSFT specifically) posting great #’s too. This week has been driven by mixed headline data whereas a brief look under the surface & the data is more so noise for now… nevertheless, Slowdown / Recession fears for the U.S. continue to dominate & into tomorrow, we have NFP #’s, which as of now, Jobs are expected to come in at 130k & the UER is expected to remain unchanged at 4.2%. As we’ve stated but there are two camps here… if hard data doesn’t start to soften around these incoming reports, it’ll be the next month & the other camp is if hard data doesn’t soften these incoming reports, it may not soften at all. Despite the damage that has been done to the economy already along with U.S. credibility, I do still think & it more so continues to look like the administration is banking on the situation being comparable to ‘22 in terms of a well anticipated slowdown / wealth effect taking a hit due to decline in stocks yet by the time a technical recession is completely confirmed, we’re already on the way out driven by tax cuts / deregulation / deficits blowing out further / supportive fed etc… it seems clear thats the direction we’re headed as of now, especially considering the administration has shown there is no fiscal austerity & deficits will continue to increase & DOGE actually meaningfully cutting deficits was one of the bigger risks into the year & thus far, its a moot point.

In respect to the dollar specifically, it does look like the dollar made a higher low this week as it now retreated higher to trade back over a 100-handle after initially trading lower earlier on in the week, but nevertheless, I do still think the structural damage has been done to the U.S. in terms of credibility & after this interim mean-reversion, the dollar will start to head back lower. If we can start to see the dollar reclaim 100.5s on the upside, I think we could see the dollar mean-revert further to the upside to start pushing back towards 102 / 102.8s above & I think that would be a good general fade spot for the dollar whether it be long the Euro & or Yen. If the counter-trend rally does end up stalling out & the dollar does start making its next leg lower, do think we’ll likely see the dollar push lower into the mid-90s.

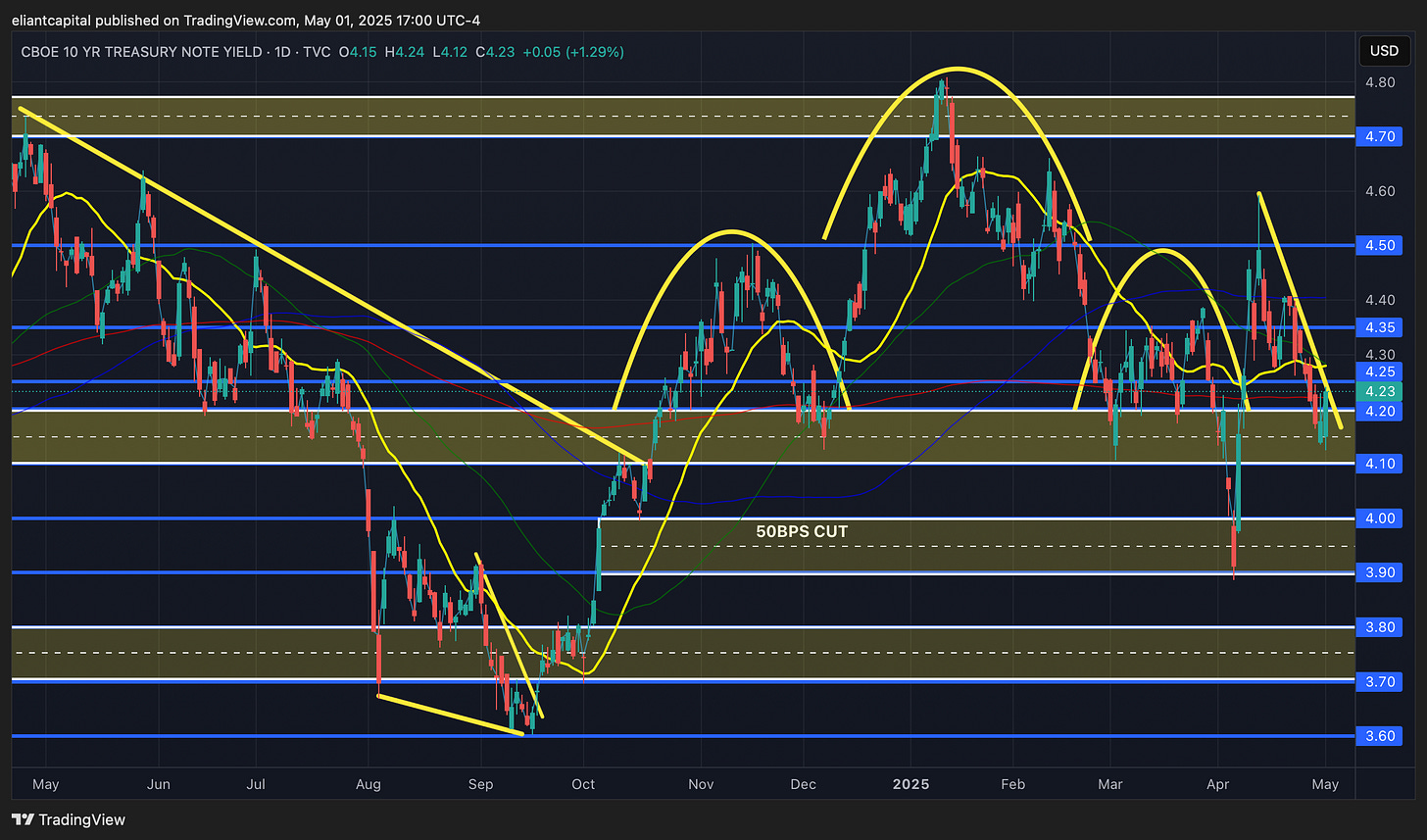

/TNX

As we noted above, but bonds started off the day strong with a relative bid but post ISM #’s shortly after market open, the bid quickly disappeared as 10s rose from 4.12s to finish off the day in the 4.23s. Mfg. PMIs came in slightly better than expected: 48.7 beating expectations of 47.9 whereas both New Orders & Employment also showed an increase thus suggesting a bit of stabilization… likely why we saw the slowdown / recessionary bid in bonds fade.

The one bigger headline overnight was out of Japan:

Japan’s Finance Minister Kato says the country’s massive U.S. Treasury holdings are on the table as leverage in trade negotiations, but adds that whether they’ll actually play that card is a separate decision.

Well, this is quite a dangerous statement out of Japan as they more so are asserting themselves over the U.S. in terms of “We hold the cards not you.” An idea we brought up in early April was that the U.S. has a bond issue & the rest of the world has a tariff issue… so, why wouldn’t the Trump administration get the rest of the world to buy U.S. bonds & in exchange, tariffs will be reduced & or dropped. Well, the one mistake that the U.S. made was publicly stating that the U.S. administration had to pivot as they felt “uneasy” with the bond volatility so it more so gave the rest of world the upper-hand as the achilles heel of the U.S. has been exposed & in this case, Japan is indirectly stating they will exploit it if they don’t get what they want (they asked for tariffs to be dropped completely).

We’ve continued to highlight both sides of bonds but have continued to reiterate that upside will likely be relatively capped, for the long-end specifically. Despite the recent recession / slowdown fears, 10s still remain above 4.2s & during the entirety of the selloff within U.S. equities, we briefly saw bonds act as a flight to safety but the gain in bonds was entirely reversed as bonds couldn’t catch a bid & declined over 10% within two days causing the admin to pivot. The main issue I continue to see with the long-end, is again, despite the efforts for fiscal austerity (DOGE cut 50b after promising 2T), the deficit is going to keep exploding higher / the administration is adamant on tax cuts, & now, we have Japan stating they will use their U.S. treasury holdings as leverage to negotiate (of course U.S. credibility has been damaged as well as an additional weight)… the setup for meaningful upside in bonds continues to diminish & if we were to get an upside flush (maybe on some soft hard data if presented itself), I do think bonds are a short & another panic in the long-end may even get the Fed to intervene this time… third times the charm?

In the interim, again, the 10Y posted quite the reversal off todays low but we do still have NFP #’s to round off the week but as we mentioned earlier, if the print is good / stronger than expected, individuals will likely assume the following prints will be the weak one that many have been anticipating whereas if its softer than expected, maybe we see another flush lower in 10s towards 4.1ish, but do think 10s green / bonds red on a weak print is a news failure to watch out for tomorrow.

If we do see 10s break out to the upside, we’re likely headed back towards the 4.35 / 4.5ish range above whereas again, a flush lower may lead to 10s falling back towards 4.1 / 4.0ish below (Keeping in mind the bigger range of 3.65 / 3.8 low-end & 4.75 / 5.0 high-end remains as well).