Next Up, Liberation Day

Hello All,

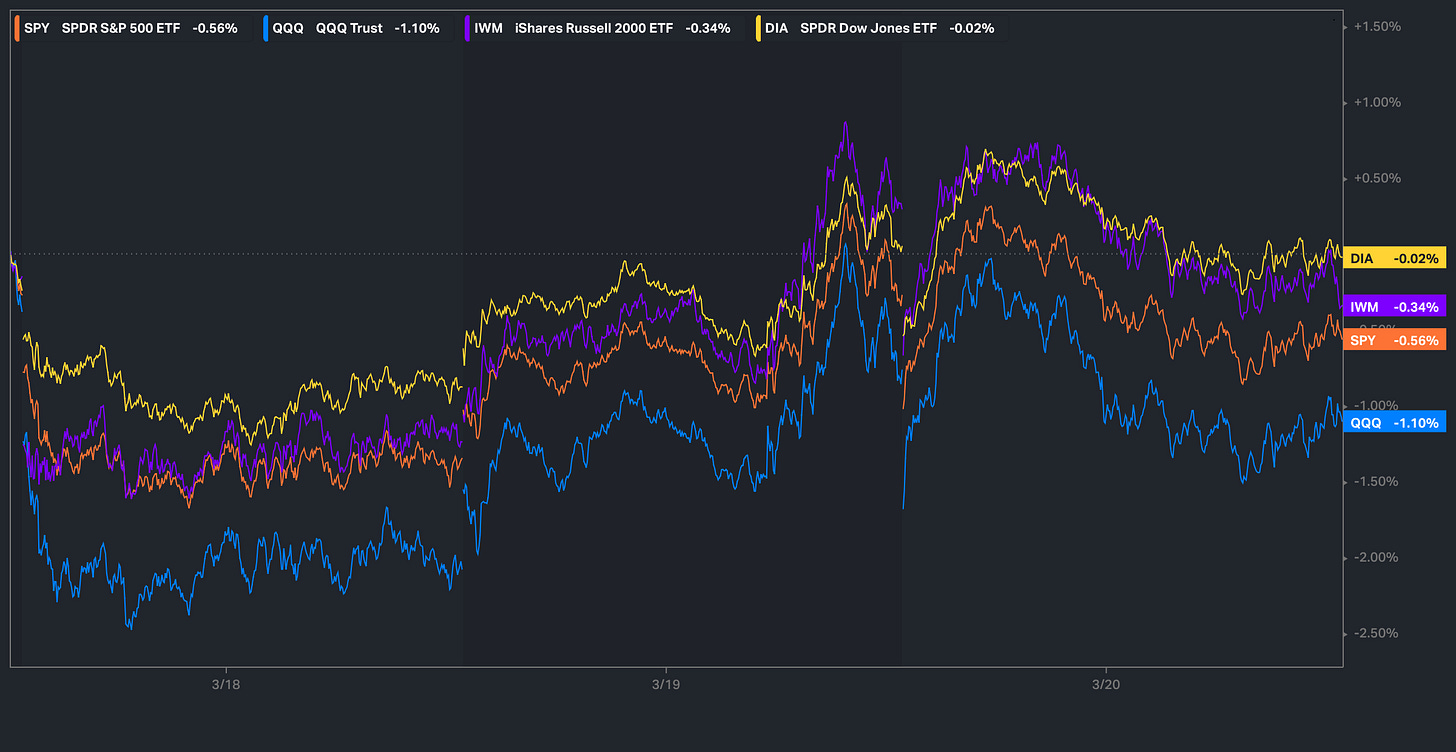

It’s been a fairly quieter week in respect to economic data & headlines, but yesterday, we finally had FOMC & to all surprise, the markets have done exactly NOTHING since Tuesday’s close… yes, they’re flat. The Dow & Small-caps are the “best” performing indices on the week, granted, they’re essentially flat / slightly lower on the week whereas the Q’s continue to be lackluster & the under-performer of the bunch as Mag-7 continues to struggle to post any sort of upside gain.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

Despite the events within markets the last couple of days, the indices in general are trading relatively flat from Tuesday’s close… but, lets do a bit of recapping on what has gone on since Tuesday.

For starters, yesterday was FOMC day & nothing necessarily groundbreaking happened… the Fed held dots at 2 cuts for ‘25 & the decision was mostly due to the uncertainty revolving around tariffs as there was initial speculation that the Fed may include 3 cuts for ‘25 but that wasn’t the case. Another big factor which was a bit unexpected this meeting was QT was tapered significantly from 25B to 5B… essentially a near end / pause to QT. Heading into the meeting, majority consensus was calling for a hawkish Powell & that just wasn’t the case… BUT, the Fed did revise growth expectations lower along with inflation expectations up, and again, it was more so attributed to recent uncertainties surrounding tariffs whereas long-term inflation expectations remain well anchored & hard economic data in general continues to come in better than expected. The Fed still remains in “wait & see” mode & would still like to see further confidence that inflation is on its last leg / disinflation is resuming before initiating further rate cuts.

A few standout quotes from Powell below:

Fed's Powell: My base case is that there is no policy signal from tariffs, but I can't know that.

Fed's Powell: Fed staff forecasts assume full tariff retaliation.

- Two key-points here… the Fed’s forecast for this FOMC assumed full tariff retaliation… so, if tariffs turn out to be less of a worry than feared, that gives the Fed plenty of room to adjust / be more accommodative & secondly, Powell more so reiterated that his base case for tariffs is short-term noise which shouldn’t lead any signal to future policy to cause for a reaction.

Fed's Powell: The base case is that inflation will be transitory.

Fed's Powell: I'm not dismissing the rise in short-term inflation expectations, but there's no story of an increase in long-term expectations.

- Powell reiterated the infamous “transitory” revolving around inflation & more so stated that short-term inflation expectations are noise over signal as long-term inflation expectations still remain well-anchored.

Fed's Powell: The relationship between survey data and actual economic data hasn't been very tight.

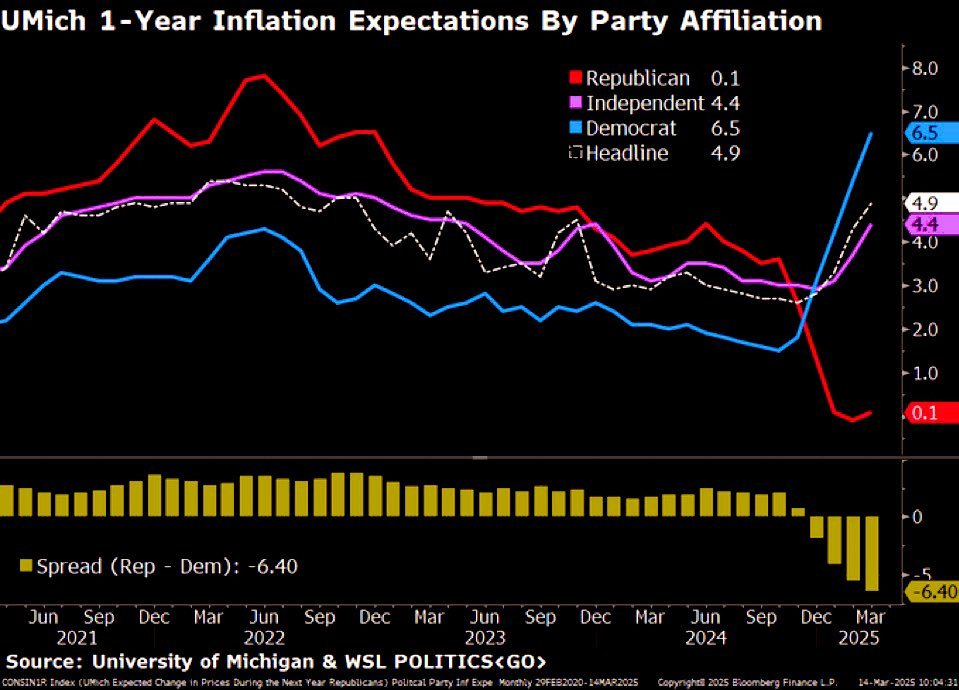

Fed's Powell: The University of Michigan inflation expectations reading is an outlier.

- A bigger piece of yesterday’s FOMC was Powell completely dismissing recent survey data… this past week, we had a UMICH survey which showed a large rise in 1-YR inflation expectations & it more so shows how partisan these surveys have become given the large skew between both Republicans & Democrats. Powell even went ahead to refer the survey as an outlier & once again reiterated that the relationship between surveys & actual hard data hasn’t been tight at all & or more so hasn’t had much of a correlation.

Fed's Powell: If the soft data affects the hard data we will know it very quickly, but we don't see that yet.

- Lastly, once again, Powell reiterated several times that hard data / economy in general continues to hum along & there hasn’t necessarily been any effects from soft data “yet” but once again, this has been a fairly reactive Fed & it continues to be reiterated that any sort of weakness within the labor market will allow the Fed to respond & be accommodative (Fed put on labor market).

Moving into today, futures were initially quite green in the overnight session, but things took a turn once SNB surprisingly cut rates when they were expected to hold. Why is SNB important? Well, they hold a lot of U.S. equities & they more so try to manage expectations around CHF hence there’s fear around selling U.S. equities to manage CHF as they are one of the bigger currency “manipulators” & are more so known for that.

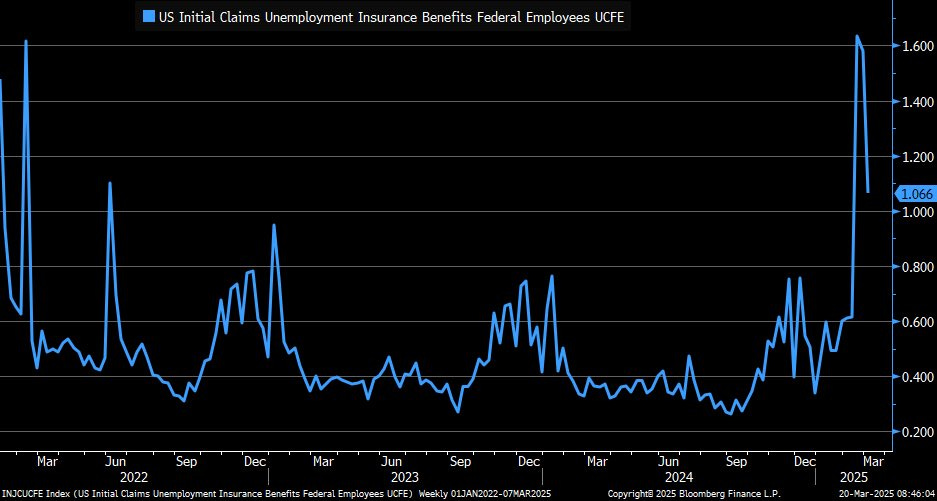

In respect to economic data, today, we had the standard jobless claims report which came in slightly better than expected: 223k vs. 224k est. & 221k in prior week

Besides the one initial spike in jobless claims a couple weeks back, claims continue to be relatively muted / no necessary signs of stress within jobless claims.

In looking at the chart below, it shows US Initial Claims for Unemployment Insurance Benefits for Federal Employees & we briefly saw a spike earlier on in the year & as we all know, DOGE has been trying to cut glut out of federal jobs which is more so what the spike was attributed towards, but otherwise, things still remain relatively tame.

April / May timeframe will be bigger datapoints to pay attention to as we *should start to really see how material the impacts of DOGE cutting federal / jobs really is & or if it turns out to be smoke and mirrors.

Lastly, we also had existing home sales today which ended up surging 4.2% month-over-month & significantly outperformed the expected -3.2% decline whilst rebounding from the prior month's -4.7% drop (revised from -4.9%). The median home price rose 3.8% year-over-year to $398,400, while housing supply saw a 17% year-over-year increase, marking the largest February jump since 2020. A generally good report, but quite a bit of increase in housing supply… housing activity in general has remained stale these last couple of years but IF we continue to see a rally in bonds, that likely will continue to be stimulative towards housing as just recently, we have started to see a pickup in mortgage applications / even some refinancing & then again today, the surge in existing home sales.

Well, since we’ve made it through FOMC, what’s next? April 2nd is “liberation” day when reciprocal tariffs are supposedly going to be enacted & as Powell himself said, there remains a ton of uncertainty revolving around trade policy which has gave the Fed some pause putting them in the “wait & see” camp whilst also continuing to be an overhang on markets as well.

The chart below is fairly self-explanatory & more so reiterates the general uncertainties revolving around tariffs & policy as there hasn’t necessarily been a concrete plan by the administration. Some rumors are suggesting reciprocal tariffs won’t even go on the 2nd of April & Trump may allow room to negotiate up until the 2nd of April & others are calling for a full-on deflationary shock come April 2nd… again, more so just proves the point that there isn’t much clarity in markets revolving around policy.

- SPY

In respect to Spooz, the one cautionary signal as of now is bull’s continuing to fail at this bear-gap as shown below… the bear-gap was initially established this past week on Monday when we had the big gap-down due to the uncertainties post Trump’s Fox business interview from the prior weekend & ever since, the gap has now been tested 3 times, but bulls have failed each time to work up into the gap & fill it above… I would argue the bear-gap along with the 200d sitting just above is the bear’s edge at this given moment.

As of now in terms of the bulls, we have seen Spooz form higher low after higher low since the rebound off the lows this prior week, but again, we do need to see bulls firm up above 5700ish to start to fill the bear gap above & ultimately look to reclaim the 200d as I do think we could see Spooz rally towards 5850 / 5900ish above in a continued countertrend rally… from there, the question more so boils down to if thats the spot to look to degross longs / start getting short & or if the path to new ATHs will emerge.

On the contrary, if we were to see recent uncertainties persist revolving around tariffs & this recent rebound more so plays out as a bear flag, I do think we could end up seeing Spooz flush lower to retest the September lows near 5400ish & thats assuming things escalate fairly aggressively from here… certainly not impossible given how markets have reacted to recent headlines, but in general, if uncertainty in markets persist, do expect volatility to persist right there with it as well.

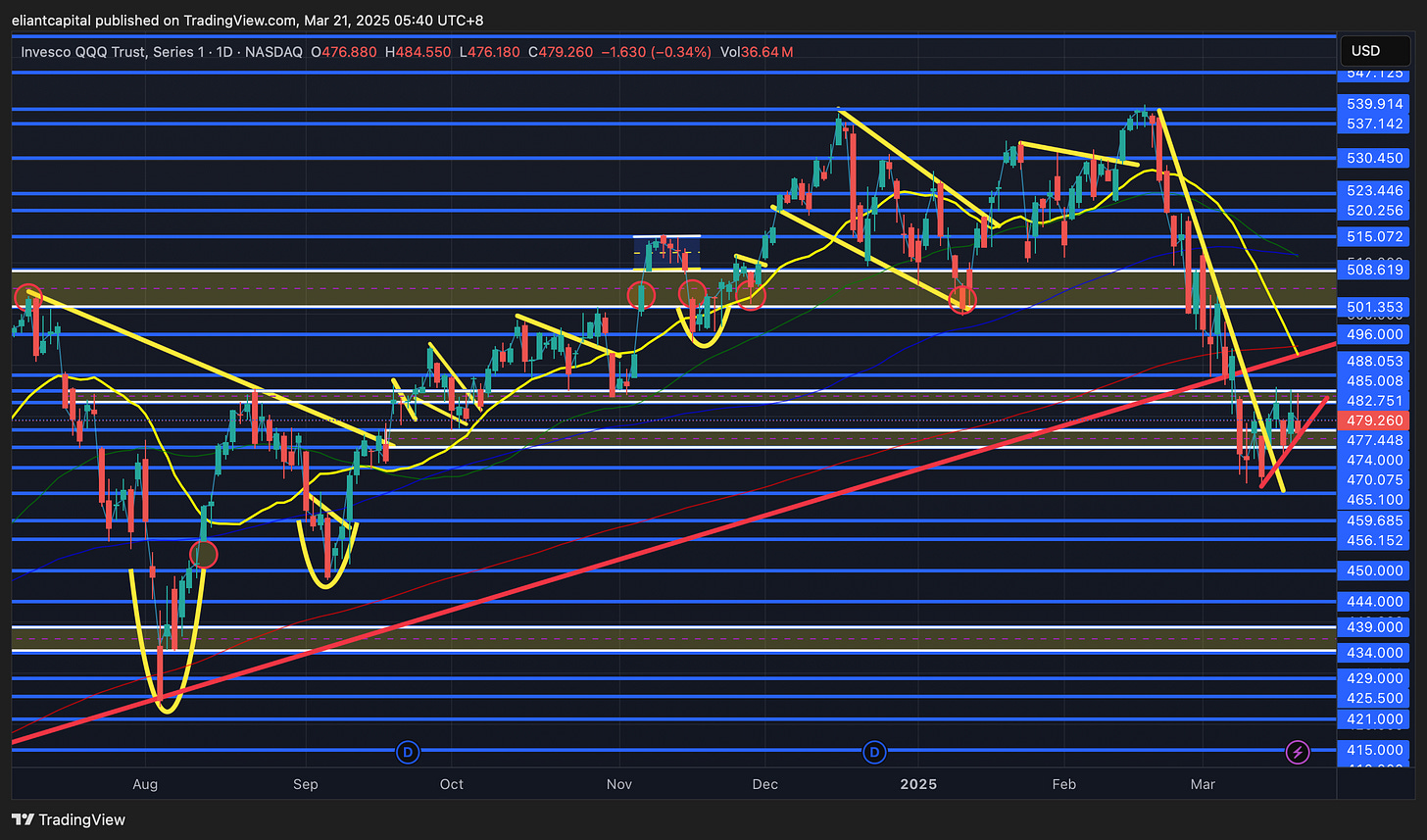

- QQQ

A similar story as with the Q’s to Spooz, but as of now, the Q’s have tested the bear-gap above from the prior Monday 3X now but each test of the bear-gap has been met with resistance as bears continue to remain firmly in control.

Action within tech still continues to be lackluster & even today, we saw Mag-7 try and post an intraday rally, but the pop once again got faded. Bulls again need to find a way to work up into the bear-gap above to start to work back up towards the 200d, where ultimately if firmly reclaimed, I do think we could see the Q’s try and stage a rally up towards 496 / 501ish above before potentially pausing / digesting the recent snapback & then more so the question remains whether or not this is a lower higher within a potential bigger respective downtrend & or if the trek to new ATHs persists.

On the contrary, if we were to see bulls continue to fail at the bear gap just above & remain under pressure with each and every pop continuing to get sold, it ultimately may lead the Q’s to flush towards the earlier on September ‘24 gap just below these prior local lows near 456ish which just nearly coincides with the September ‘24 higher low bottom as well after forming the bigger bottom in August ‘24 (Carry trade unwind bottom)… not necessarily a base case, but after the continued failed rallies on the upside, I do think it should be considered despite the Q’s still remaining well within oversold territory as overall index strength has still been pretty lackluster across the board.

- IWM

A bit of a different story with small-caps as unlike the Q’s & Spooz, small-caps don’t have a bear-gap above. Earlier on in the week, we did see IWM break out of the respective downtrend that has remained in place since this downtrend initially kicked off back in Mid-February & since, IWM has more so just slowly chopped its way up to the upside.

The one thing small-caps do having going for them here is the look below & fail produced below the 200wk this past week along with the backtest of the 2+ year base breakout which led to the ‘24 rally… essentially the big LIS for bulls here in the interim

If we were to see small-caps go on to firmly reclaim the 20d & or more so see a thrust upwards instead of the slow burn upside action like we’ve seen this week, I do think small-caps will go on to retreat towards 209 / 212ish above to fill the gap from earlier on in March before potentially pausing & resuming lower & or if data abides / growth scare & or fears continue to simmer down along with disinflation resuming, we likely could see the small-cap rally sustain & have holding power. The biggest weight on markets continues to revolve around the recent uncertainties regarding policy & with “liberation day” coming up on April 2nd, I’d imagine we see some sort of clarity within markets… for better or for worse given there isn’t much to gauge / project as of now.

On the contrary, if we were to see this most recent rebound in small-caps fail & IWM starts to revert back lower below the 200wk / August ‘24 lows, we likely could see selling persist in IWM towards mid-190s, but I would be a bit surprised if we were to see that outcome as we likely would need to see some sort of surprise in markets whether it be weak economic data to stir up recession fears & or recent uncertainties regarding policy continuing to persist with no resolve in sight… (again, not base case, but still is worth always remaining open-minded).

One of our small-caps, GEO, had investor day today so I thought I would include a bit of a summary / key highlights below:

Expansion plans:

- New Delaney Hall (NJ), Karnes County (TX), and North Lake (MI) ICE contracts, expected to generate over $200M annually.

- Reactivation of idle facilities for additional detention capacity.

Immigration & ICE Contract Focus:

- Expected increase in ICE Processing Center beds from 46,000 to 100K-160K.

- ISAP (Intensive Supervision Appearance Program) participant count expected to grow from 370K to 500K+, driving $600M+ in revenue.

BI & Electronic Monitoring Growth:

- BI Incorporated, GEO’s electronic monitoring subsidiary, provides:

- GPS tracking, alcohol monitoring, biometric ID, and home confinement technology.

- 24/7 case management and compliance support.

- New product development includes AI-powered monitoring solutions to reduce law enforcement workload.

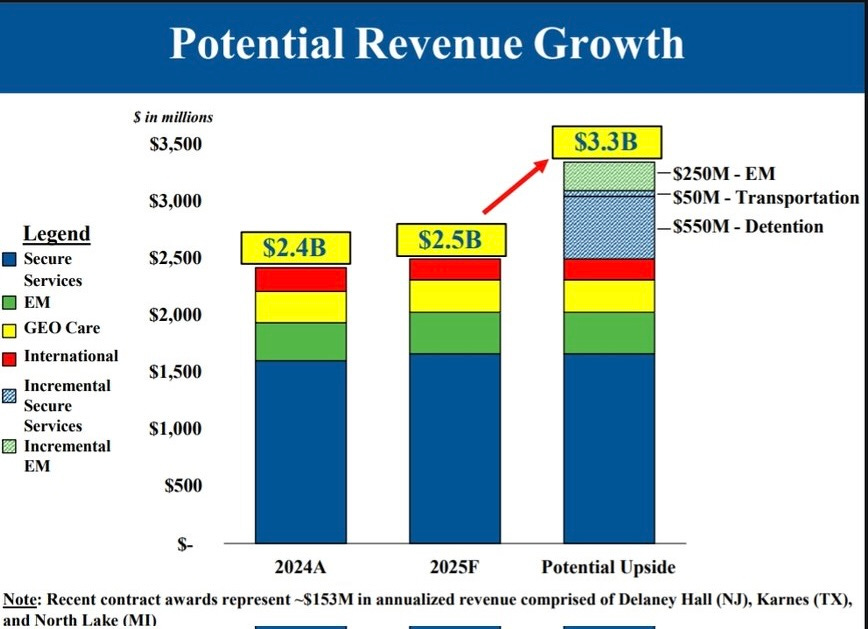

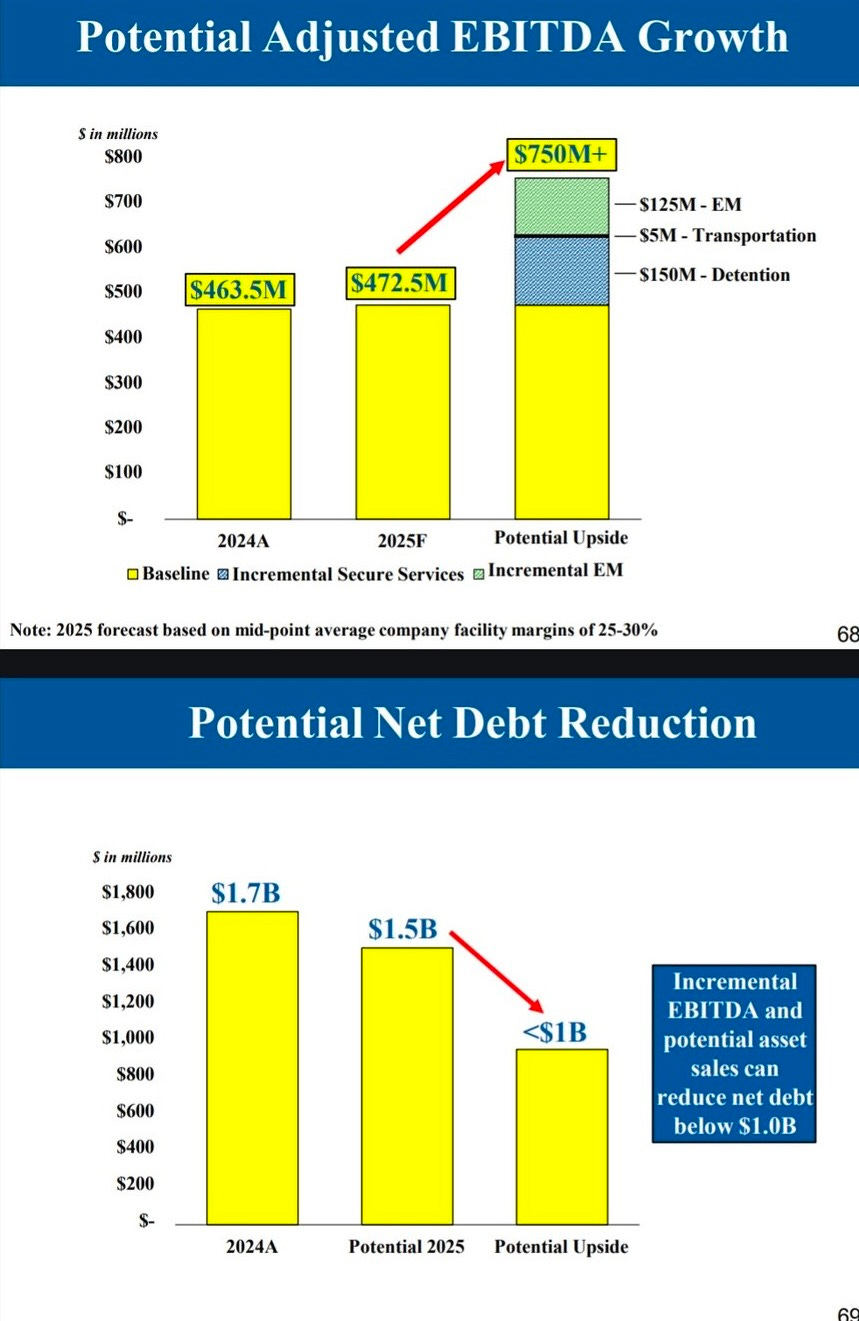

Financial Growth & Expansion Plans:

- GEO expects significant revenue growth from new contracts and facility reactivations:

- Potential revenue increase from $2.4B (2024) to $3.3B+.

- Potential EBITDA growth from $472M to $750M+.

- Debt reduction goal: From $1.7B to below $1.0B.

- 70M investment plan includes ICE services enhancements, GPS tracking production, and secure transportation expansion.

- Exploring asset sales worth up to $550M to further reduce debt and improve shareholder returns.

To summarize all of that again, the biggest takeaway for me is very simple… GEO guided 2.5B for ‘25 & they just stated today that potential upside is upwards of 3.3B in revenue… we give thanks to management for sandbagging as we originally thought. Secondly, GEO projected to due potentially 750M+ in EBITDA from $472M… we’re starting to print cash here. And thirdly, the last bigger standout is the reduction in leverage… GEO expects to pay down debt which will decrease from 1.7B to 1B… we’re getting close to the point where GEO will be deleveraged enough & they will start buying back the stock with all of the free cash flow.

We originally pitched GEO in the 7s back in late ‘23 & exited post-election in the 20s before just recently buying back as it was an attractive entry & the story remains very compelling. Nice weekly flag / wedge breakout & just technically speaking, a move should lead GEO to trade with a 4-handle based on a measured move.

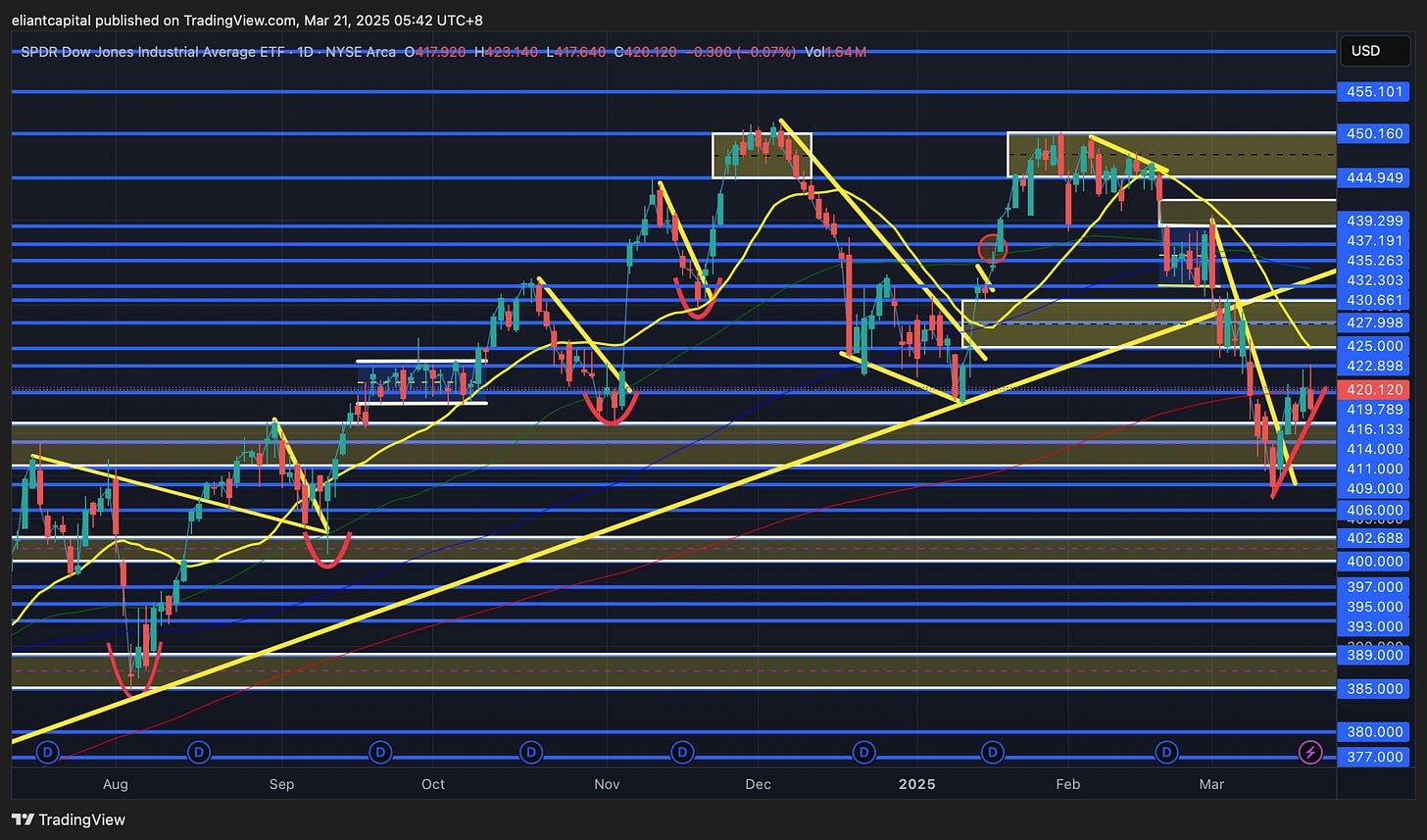

- DIA

As of now, the Dow has been the “best” performing of the indices on the week, but granted, it’s essentially flat on the week. Overall, not too much has changed for the overall picture, but as of now, DIA found some support this past week right off the Summer ‘24 highs (416 / 411 zone) & in general, I do expect this area to remain as an important pivot as it has potential to be a S/R flip (prior resistance flipping to support). Similar to the other respective indices, but DIA did initially post a nice rally, but as of now, the Dow has continued to fail to sustain above the 200d… bears still remaining in control thus far. If we were to see bulls firm up above the 200d, I do think we could see DIA push further to the upside towards 425 / 430ish (20d within range) before then pausing & or deciding where to go from there. If the countertrend rally were to extend, again, the biggest question as we’ve discussed is if it will be a rally to sell into / degross longs & start to look to add shorts & or if the trek to new ATHs continues… still continues to depend on recent uncertainties regarding policy getting resolved / economic & or labor market data continuing to hold up & of course, FOMC tomorrow as well.

On the contrary, if we were to see DIA continue to reject the 200d above & fail to firmly reclaim 420ish & this more so turns into a potential bear flag before resuming lower, the next bigger line of support is around 402 / 400ish which coincides with the September ‘24 lows… a bit make or break here for indices in general as you could argue all of them are within bear flags & or you could argue all of them are trying to base / find some support & potentially establish a higher lower before resuming higher.