Position of Weakness

Hello All,

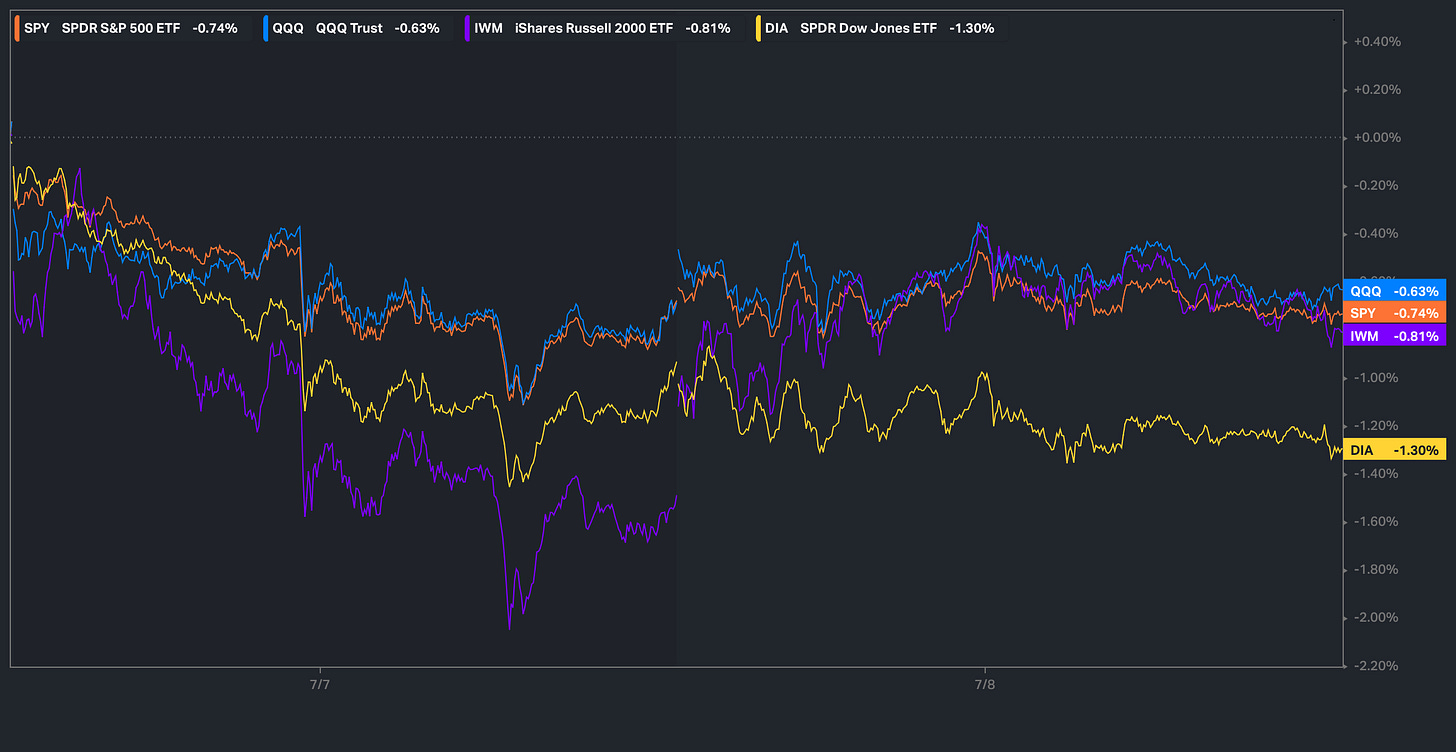

It’s been a rather quiet kick off to the week in respect to economic data, and focus has more so solely shifted back to tariff driven headlines, and due to the general headline volatility, indices have worked lower, although nothing out of the ordinary or material considering majority of the indices are back to levels not seen since this prior week. Nevertheless, the Dow has been the ‘worst’ performing of the indices as it sits lower by 130bps, whereas the Q’s have been the ‘best’ performing of the indices, although also still sit lower by just over 60bps.

In April, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

We also published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

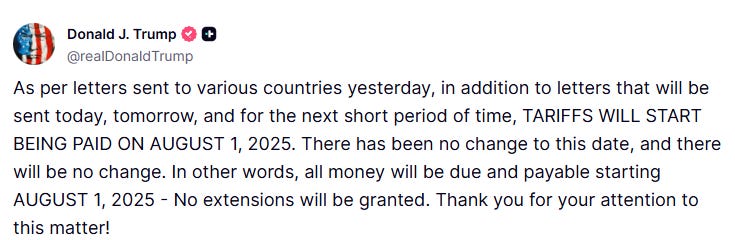

This week has kicked off to be a relatively quieter one in regard economic data as focus has mostly entirely shifted back to trade-talks given the 90-day delay expiration was supposed to be on the 9th / Tomorrow, but instead, the administration pushed the date back to the 1st of August… likely to give countries a last minute 3-week window as the U.S. tries to issue higher tariff rates from a negotiating standpoint to get other countries to jump at the U.S. & ultimately try and strike a deal.

So essentially, recent interim tail risks have been removed, at least until the 1st of August, & as the week has progressed, we’ve continued to get brief updates surrounding trade-deals & I included a few standout headlines below:

- ‘The US has offered an agreement to the EU that it would keep a 10% baseline tariff on all EU goods, except for some sensitive sectors such as aircraft and spirits’ ~ Politico

Well, considering Trump had threatened the EU with 50%+ tariffs prior by July 9th, IF this deal is true / confirmed, the 10% baseline across majority of EU goods is quite the softening of tone… & as we’ve discussed prior but the market really only cares about China / EU / Japan & partially Canada & Mexico as well… so again, 10% baseline would be quite the positive development & more so would emphasize towards other countries that if ‘Country X’ does act in good-faith with the U.S, the U.S. is happy to soften tone & give a fair deal instead of an extreme tariff %.

- US Commerce Secretary Lutnick: Trump left flexibility on tariff rates in letters.

- US Commerce Secretary Lutnick: If countries are good to us, they may get another rate.

Similar points as mentioned just above but Lutnick is essentially reiterating that the letters sent out with tariff rates are flexible and not set-in-stone & are more so being implemented to kick off negotiation & IF ‘Country X’ does act in good-faith when negotiating with the U.S., similar to the rumor surrounding the EU deal but the U.S. will soften rhetoric / tone & give a more realistic tariff % rate instead of the initial tariff rate sent out within the trade-letters.

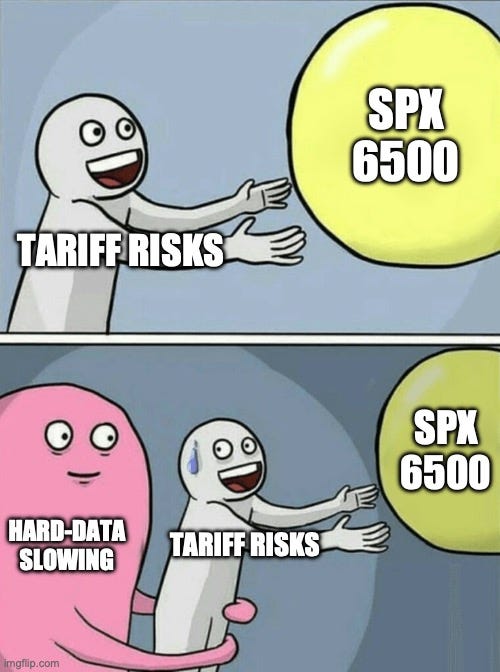

Now having said all that, as we’ll discuss later but I would still argue that at this stage, markets have been more acclimated by the tariff headlines & recessionary data / surprise weak hard-data is a bigger risk than tariff headlines & is more so the obstacle that could stop the indices / derail this market.

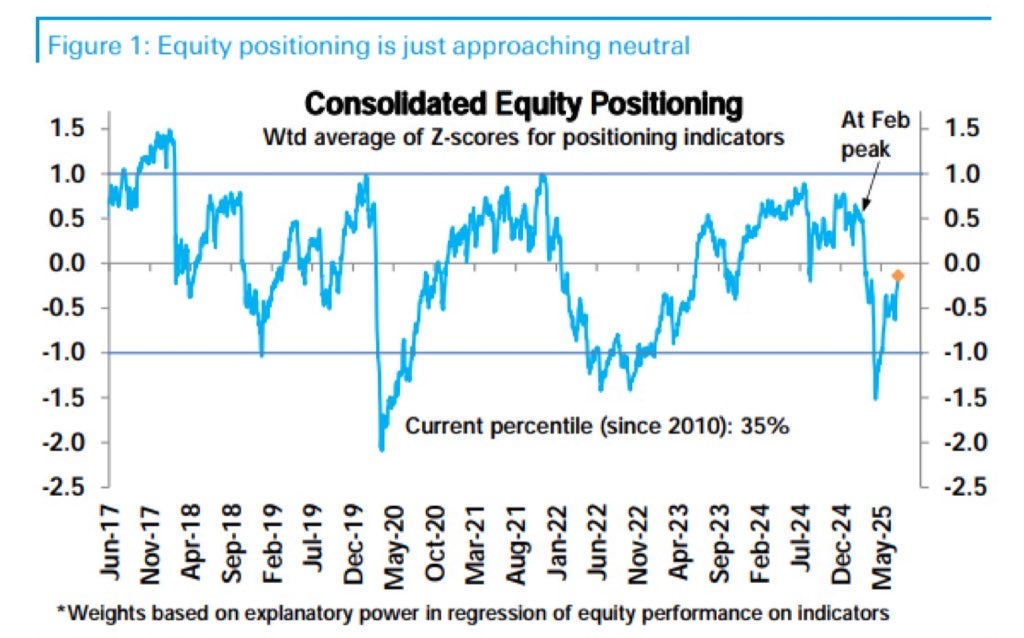

And lastly, before jumping into the recap, a topic we have talked many times throughout the entirety of the rally is how much of a general tailwind UW positioning has remained for equities & I believe since we started talking about right-tail as serious risk for HFs / PMs UW stocks that Spooz in itself has risen 1100-handles in a straight line… hasn’t been the worst call. Nevertheless, positioning is just getting back to neutral levels and is still well off the February highs… a big testament that upside complacency STILL remains & with positioning still well off the February highs, I would argue that if there isn’t a correction between now and August / September… talking 7-10% which would give HFs an opportunity to bring nets up further, that a performance chase into Q4 is the bigger risk to play catch-up as many would likely be underperforming at that stage & be forced to chase.