Retaliatory or Nearing the End?

Hello All,

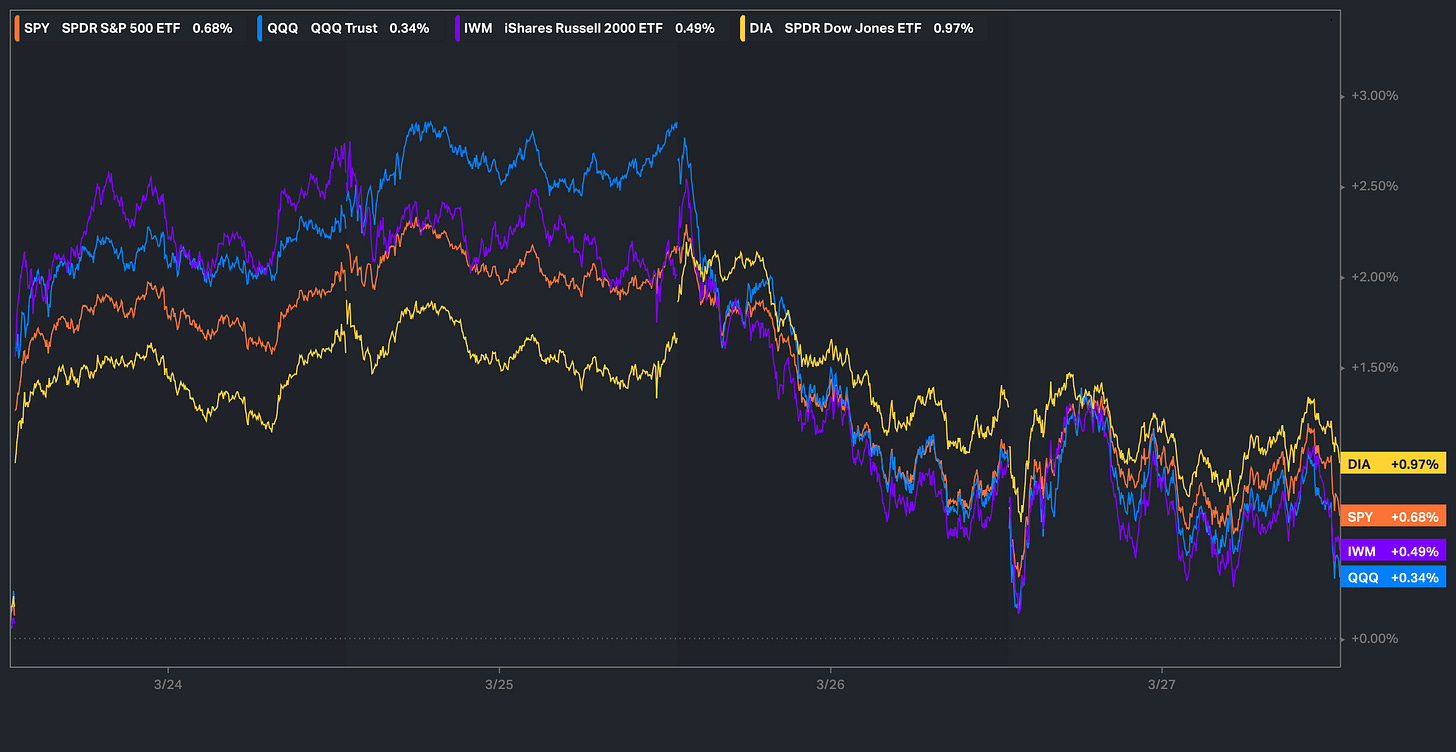

Despite the volatility these last couple of days, the indices still remain positive on the week… quite the perspective when you zoom out on the week. Majority of the recent losses these past couple of days have been due to the Semi / Ai trade unwinding & or remaining pressured due to Downgrades / Bearish notes out of TD Cowen along with generally poor technicals & we also still have uncertainties surrounding tariffs as the market still remains on edge as we near Liberation day into next week.

Heading into Friday, we do have PCE #’s & as of now, headline is expected to remain unchanged 2.5% whereas Core YoY is expected to tick up to 2.7% vs. 2.6% prior… for those who don’t recall but PCE components that feedthrough both CPI & PPI came in hotter than expected a couple weeks back hence this has led to the general expectations of a stubborn PCE print leading to estimates being revised up for tomorrow.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.