Risks Are Slowly Shifting

Hello All,

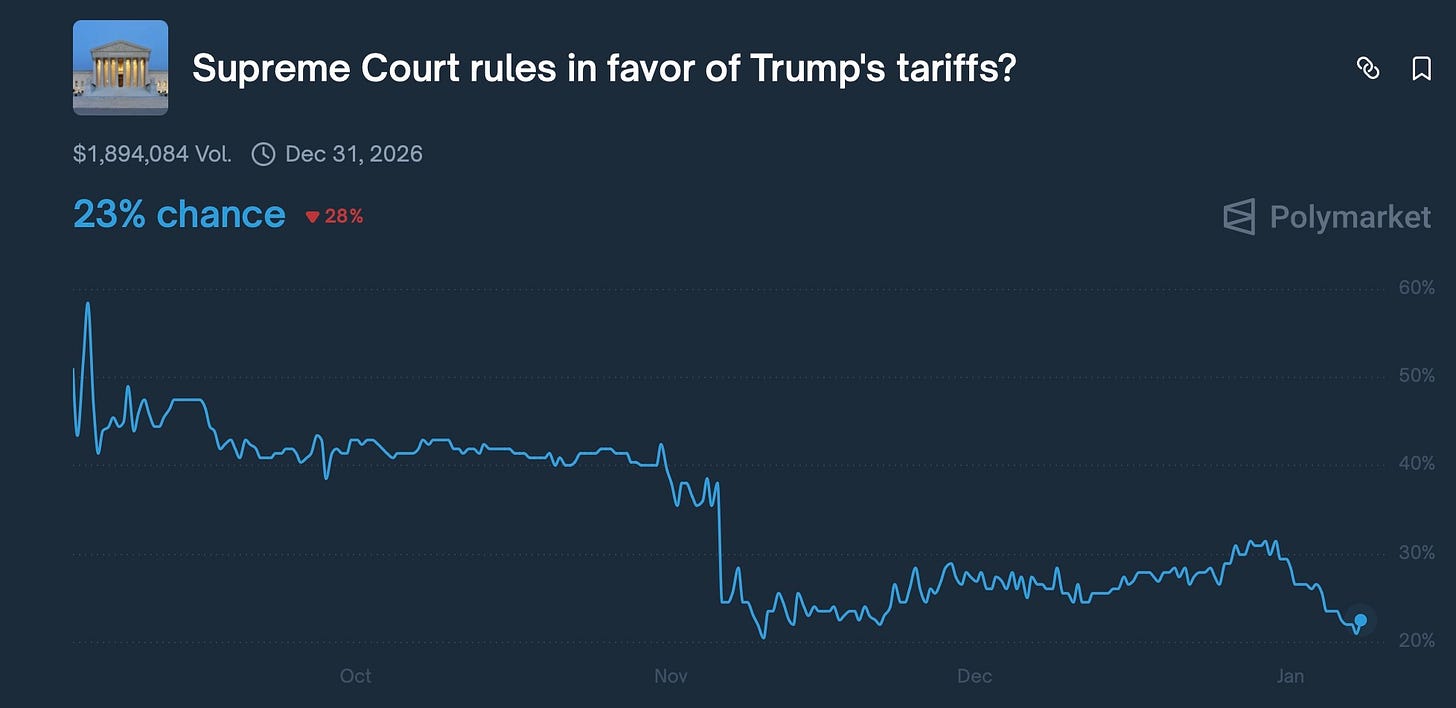

As the first ‘real’ trading week of ‘26 has kicked off, it’s generally been a quieter one on the economic data front, which for the most part, has continued to rehash the recent ‘Goldilocks’ regime in which both growth & inflation data aren’t too soft & or too hot, but instead, just right. Having said that, there’s also been speculation that the Supreme Courts may potentially rule on Trump’s tariffs on Friday on top of the scheduled NFP report, so somewhat of a pickup into the remainder of the week in terms of events.

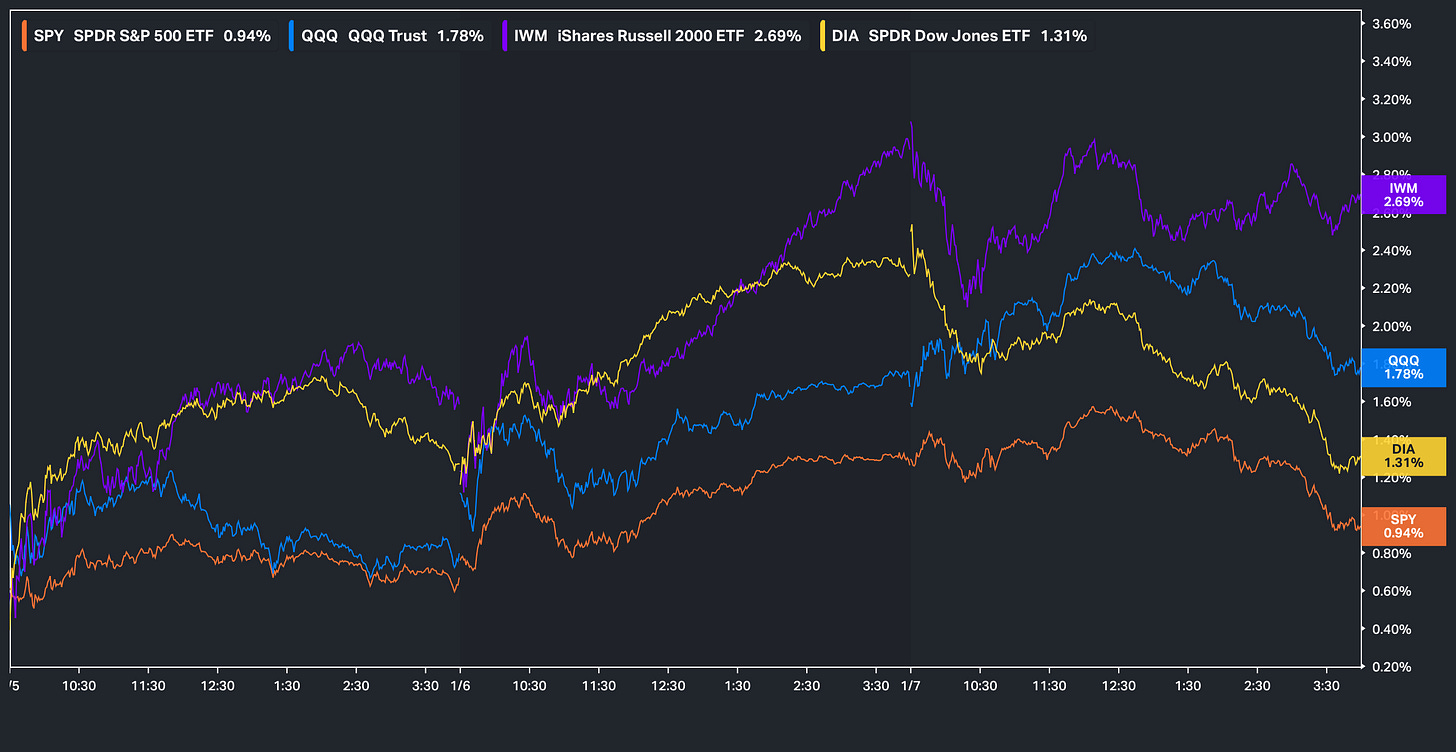

With that being said, given the generally ‘Goldilocks’ backdrop along with the added kicker of the Supreme Courts expected to rule against Trump’s tariffs, Small-caps have been the best performing of the indices on the week, currently higher by 269bps, whereas Spooz has been the ‘worst’ performing of the indices yet is still higher on the week by just under 100bps.

We recently published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as 2026 kicks off after coming off a strong ‘25 & for those whom would like to read the report, I included it just below:

Earlier in 2024, we launched a series titled Educational Pieces, covering a wide range of topics, many of which were suggested directly by you all (4-Part Series).

For those who may have missed the first installment, it covered topics including:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

A link to the original Educational Piece can be found here .

Given the positive feedback and how useful many of you found the first installment, we followed up with Educational Piece: Part Deux earlier in 2025 & for those who may have missed, a link to the piece can be found here & we then went on to release Educational Piece: Part Trois which can be found here.

And finally, the most recent installment, Educational Piece: Part Quatre, can be found here.

‘Risk management is the silent prerequisite for compounding & true wealth is built not by chasing the highest returns but by ensuring the survival necessary to realize them.’

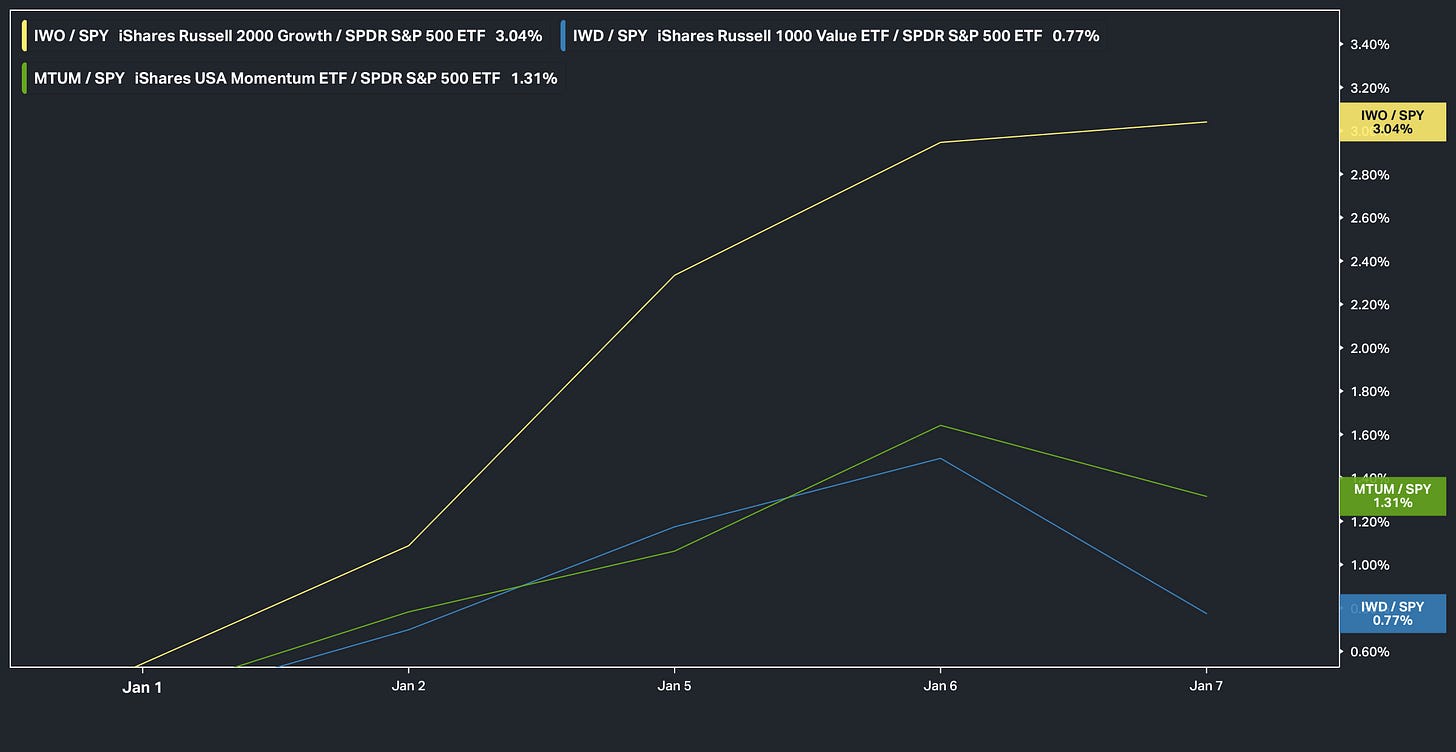

To jump straight into it, it’s been quite the start to the year for the indices with Small-caps currently leading the way & the Dow second behind & the general ‘theme’ of the year in terms of capital being drawn toward has been in relation to cyclicals & or ‘real economy’ along with growth / momentum-driven names as well whereas value has been the under-performer on the year.

The chart below highlights this dynamic well as Small-cap Growth along with Momentum is posting quite the outperformance over Value month-to-date:

And the action within cyclicals couldn't be any stronger either (Dow Theory Confirmation Triggered Yesterday):

- Transports:

New ATHs & working out of a 4.5+ year base:

- Regionals:

Breaking out of 3+ year downtrend / Above post-election highs:

- Commodities:

Working out of 3+ year base:

- RSP (Equal-Weight):

New ATHs / Breaking out of 1+ year base:

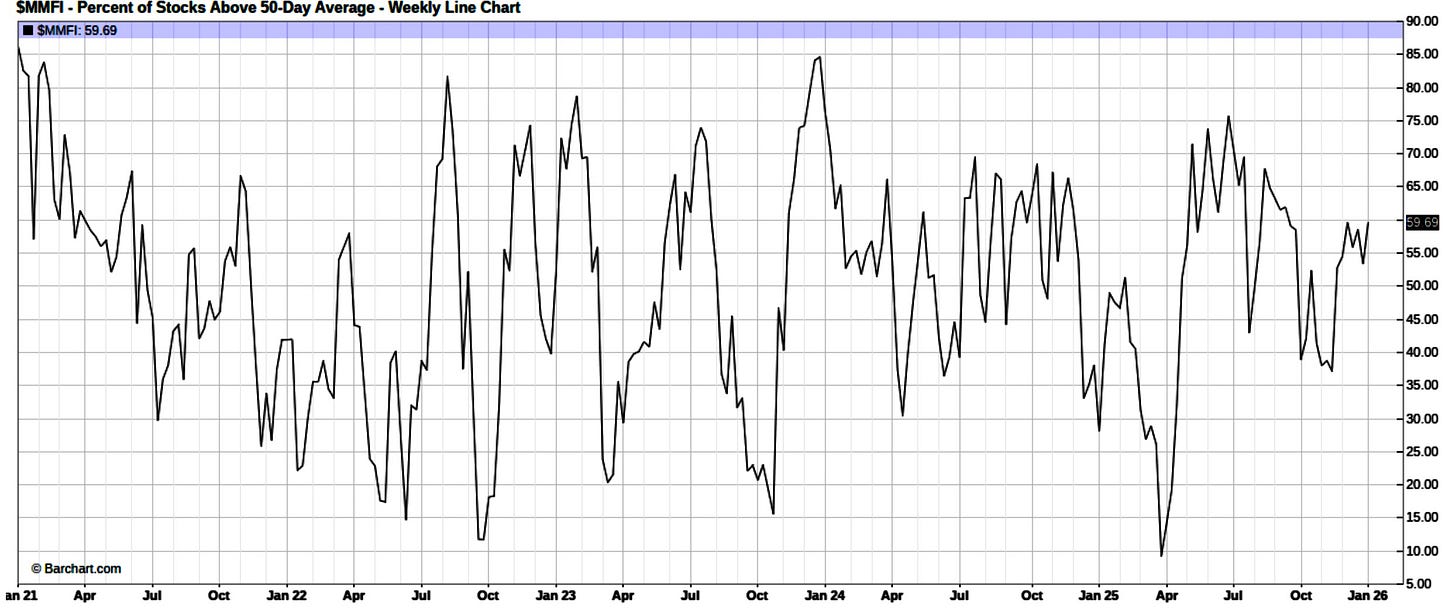

With that being said, despite the strong action & upside participation along with Spooz & even the Dow having made a new ATH this week, the % of Stocks Above the 20D is still stuck within neutral territory, currently 54%, which again, leans more neutral rather than oversold & or overbought in the shorter-term.

On a more broader timeframe however, the % of Stocks Above the 50D is slowly starting to work out of neutral territory & work into overbought territory with 59% of stocks as of now remaining above the 50D.

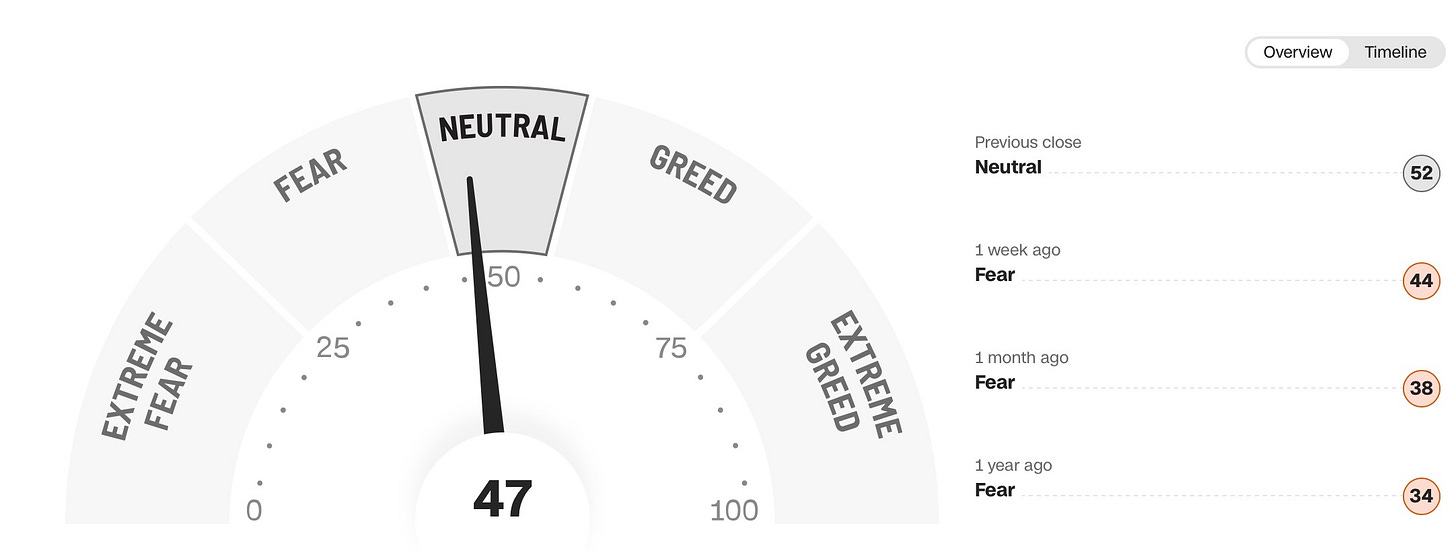

BUT, the phenomenon that continues to prevail despite the strong relative action across the indices & generally healthy upside participation is the fear-greed index STILL sits just barely within neutral territory after having worked out of the ‘extreme fear’ / ‘fear’ territory just recently following the December FOMC meeting:

Moving away from the indices and turning to economic data, the November JOLTS report reinforced the theme of a cooling but not cracking labor market. Job openings fell to 7.1M, the second lowest level post Covid, whilst hiring dropped to a cycle low, highlighting continued weakness in labor demand. That said, quits rose to a 5-month high & layoffs declined, suggesting worker confidence remains intact & that the slowdown is being driven more by reduced hiring than outright job losses.

And the counterpoint to the above was today’s strong ISM report for December. The headline rose to 54.4, a 14-month high, with new orders, employment, business activity, imports, and exports ALL accelerating, pointing to renewed momentum across the services economy whereas at the same time, prices paid eased slightly, reinforcing the view that growth is picking up without a re-acceleration in inflation.

In other words, a very ‘Goldilocks’ report given the stronger activity, improving demand, & contained pricing pressures.

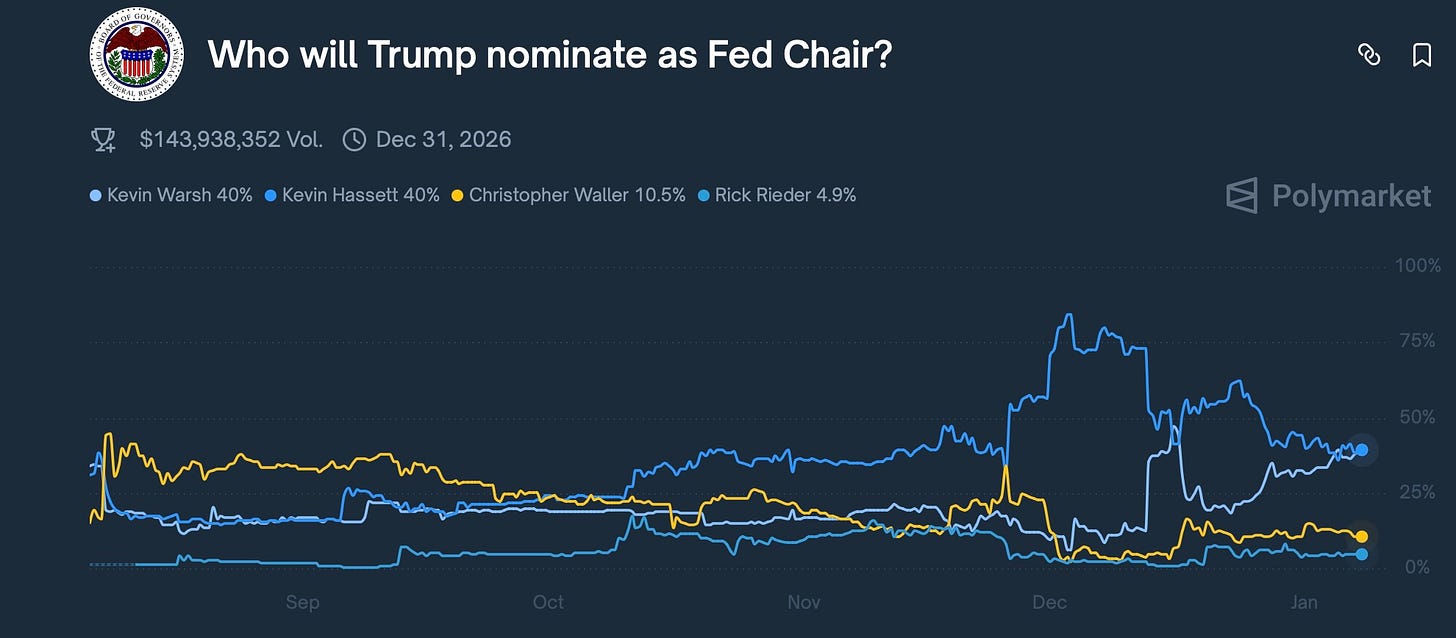

And with this re-acceleration in data, just as a reminder, let’s not forget that Trump has made it clear that he wants the U.S. to run the lowest interest rates in the world & the next Fed Chair is supposed to be chosen by the end of January & whomever is selected must be inclined to ease; it’s a requirement per Trump.

So, that macro backdrop makes the latest ISM report, a key leading indicator, even more notable as we likely will have a pro-easing bias Fed into an economy that’s potentially undergoing the process of a re-acceleration.

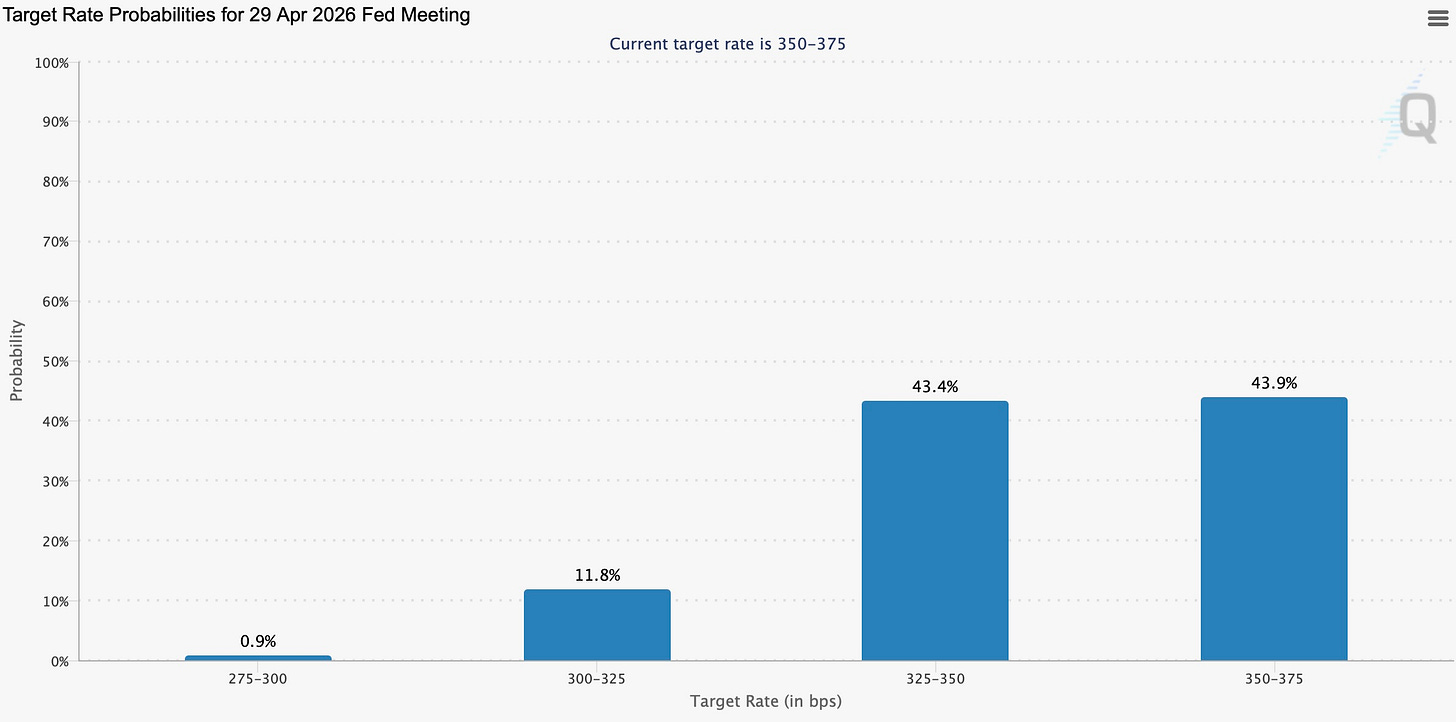

And even despite the generally stronger than expected data this week, not much has changed in terms of a January cut which is still essentially ruled off the table barring a collapsing jobs report on Friday but markets are still pricing in one more additional cut before Powell’s term ends hence expectations have generally remained unchanged although a surprise ‘hot’ report may push rate-cut expectations out even further, potentially to June… of course this is all assuming Trump doesn’t get his way which is certainly not priced into markets.

On that note, Trump is expected to select the new Fed Chair by the end of January & as of now, it’s 50/50 between Hassett & Warsh:

And finally, before we jump into the remainder of the recap, into the rest of the week, we do have NFP #’s on Friday which is essentially the ‘biggest’ economic datapoint remaining into week-end but we may also get a ruling on Friday by the Supreme Courts on Trump’s tariffs, which as of now, is only priced at a 23% chance in terms of the courts ruling in favor of keeping Trump’s tariffs intact: