The Flip-Flopping Continues

Hello All,

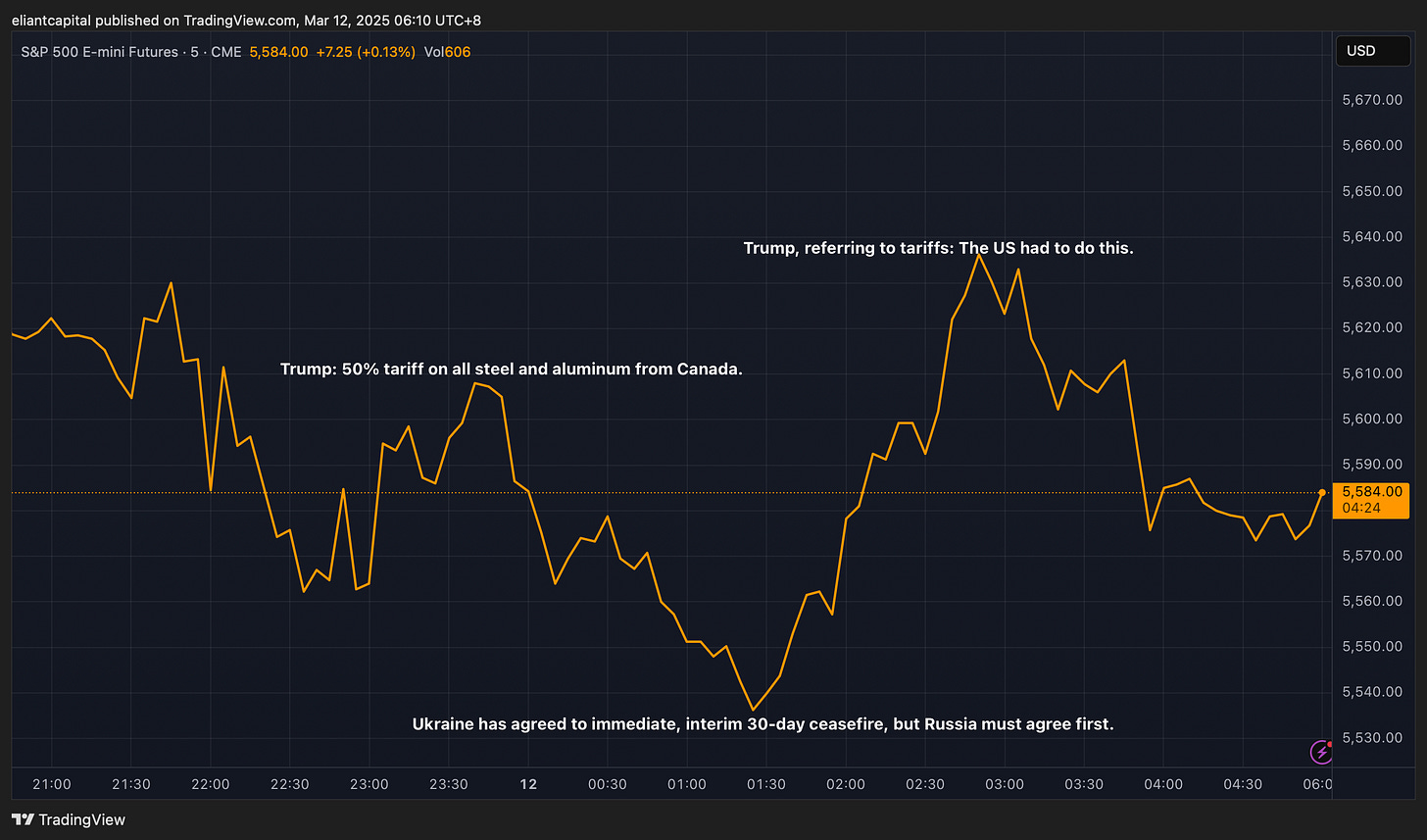

The headline driven madness continues as the initial decline in the indices kicked off yesterday which was mostly driven by a Fox Business interview from Trump over the weekend as uncertainties in regard to policy remain & then today, Trump came out shortly following market open stating that an additional 25% tariff on all steel & aluminum from Canada will be enacted tomorrow on the 12th (total of a 50% tariff) which created further uncertainties leading to an intraday decline before we finally saw indices make a low following a temporary ceasefire headline out of Ukraine.

The Q’s remain as the worst performing index on the week given the large degrossing yesterday we saw all across tech & beta whereas small-caps have been the “best” performing index… currently sitting down just over 260bps on the week.

This past week, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

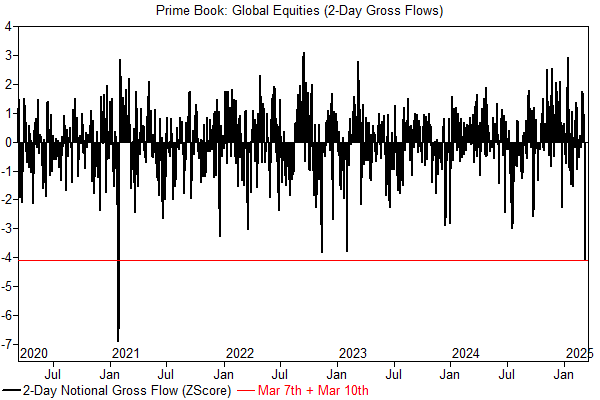

Quite the kickoff to the week in the market as the headline driven volatility remains… over the weekend, Trump spoke in a Fox Business interview & more so reiterated the same points; Tariffs may go up further / The economy is in a transition phase / I am not looking at the stock market / We want interest rates down etc… as a result, we had quite the down day in the indices across the board & it was the largest 2-day degrossing we have seen in the markets over the last 4-years.

Carrying over through today, we had JOLTs data which showed job openings increased to 7.740 million, surpassing both the anticipated 7.650 million and December's revised figure of 7.508 million. The uptick in job openings suggests that the labor market remained relatively robust at the start of the year, however, the number of quits rose to 3.3 million in January from 3.0 million in December… still below the record 4.3 million quits observed in 2022. Additionally, layoffs decreased slightly to 1.6 million, down by 34,000 from the previous month. All in all, a fairly solid report in which the market reacted positively until…

Shortly after the positive JOLTs report, we once again received another tariff headline out of Trump:

- Trump: I have instructed secretary of commerce to add additional 25% tariff, to 50%, on all steel and aluminum coming into the United States from Canada.

As a result, we saw the entire JOLTs pop unwind & Spooz ended up progressively selling past the overnight low from Monday night to go on and make news lows before we received another headline:

- Ukraine has agreed to immediate, interim 30-day ceasefire, but Russia must agree first.

Spooz quickly bottomed shortly after the headline & preceded to rally to a new HOD until… another headline:

- Trump, referring to tariffs: The US had to do this.

Uncanny how each time Spooz goes on to make a new HOD, we happen to get a headline out of Trump… sure enough, the markets preceded to sell into the close & of course, we got more headlines after-hours…

- Trump: Looking at backing down on the 50% duties on Canada.

- Trump Trade Adviser Navarro: No 50% steel and aluminum tariffs on Canada tomorrow.

So, the 50% additional tariffs stated by Trump in the morning lasted an entire 6 hours before Trump again once again backed down… the flip-flopping these last few weeks has more so created the general uncertainty within markets along whilst escalating recent growth fears & as of now, each time the current administration looks to be letting up / backing off, we get a new headline contradicting the exact opposite.

An illustration of the headlines today:

In respect to markets, I don’t think there is much of a doubt that things are oversold… the % of stocks above the 50d is currently sitting at 24%… just slightly above the late ‘23 lows & ‘22 lows… again, its fairly clear things are quite extended to the downside & prior instances of such extremes have led to bottoms.

In terms of % of stocks above the 200d, the current % is sitting at 34%… again, sitting just above the late ‘23 lows although still is a bit off from the ‘22 lows… point being again, things are still quite extended to the downside & the markets are more so looking for a positive headline to have a relief rally, but they just haven’t gotten it.

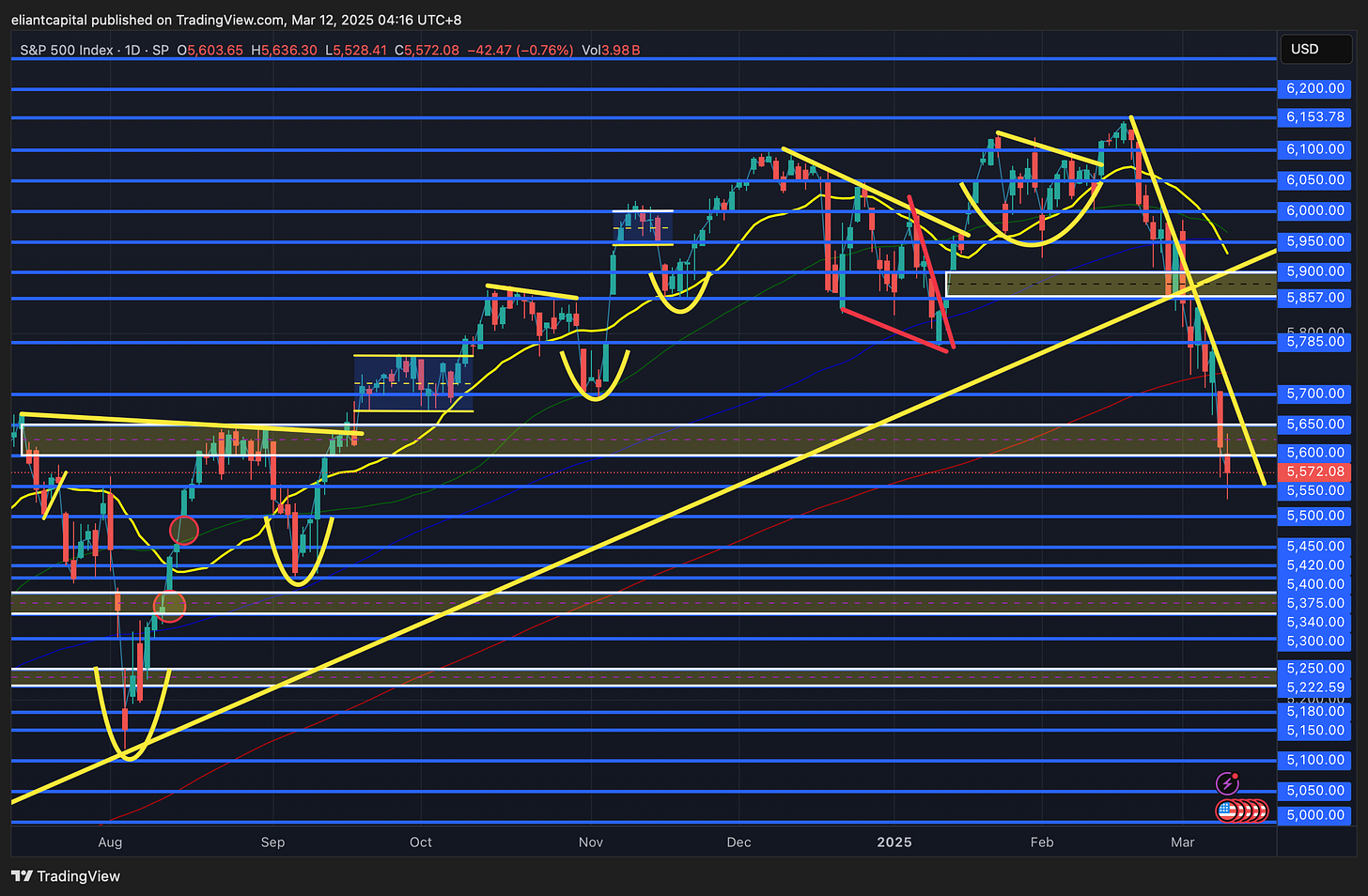

- SPY

In respect to Spooz, again, yesterday’s action led to the largest degrossing we have seen in indices in the last 4 years… it was quite ugly which led Spooz to fall below the 50wk as the decline after breaking the 200d has continued as Spooz now resides just below the Summer ‘24 highs… where to from here? We do have CPI #’s tomorrow & as of now, headline is expected to come in at 2.9% vs. 3% prior & Core YoY is expected to downtick as well to 3.2% from 3.3% prior. The best outcome for tomorrow is likely an inline report & or slightly softer… too soft of a report will stir up growth worries whereas a hotter than expected report will stir up stagflationary worries, so the report really does likely have to be “just right” to produce the best reaction. Not necessarily expecting any surprises, but do think the wildcard is if any front-running of tariffs may be attributed to this report & or rents showing a potential increase due to the California fires, but otherwise, do think inflation is set to a resume lower… partly attributed to base effects / shelter / commodities in general remaining tame which should be tailwinds for disinflationary forces resuming.

In regard to Spooz, we officially hit the 10% drawdown from highs entering a corrective phase which oddly enough marked the exact bottom on Spooz today… as we mentioned just above, but there isn’t really a doubt that Spooz is oversold & is due for a countertrend rally… do think a countertrend rally has potential to get Spooz to backtest 5850 / 5900ish above & the question from there more so boils down to if thats the spot to look to degross longs / start getting short & or if the path to new ATHs will emerge… all in all, it likely will boil down to uncertainties regarding policy & or if things have cleared up or more so stayed the same.

On the contrary, again, if the uncertainties surrounding policy continues & the headline driven volatility remains, maybe we see Spooz flush lower to retest the September lows near 5400ish & thats assuming things escalate fairly aggressively, but in general, am anticipating a countertrend rally & IF this is indeed a bear market (I’m not sure I would call it a bear market as it has been self-induced by policy & or recent uncertainties & that can change on the flip of a dime), but bear markets have some of the most violent countertrend rallies out there.

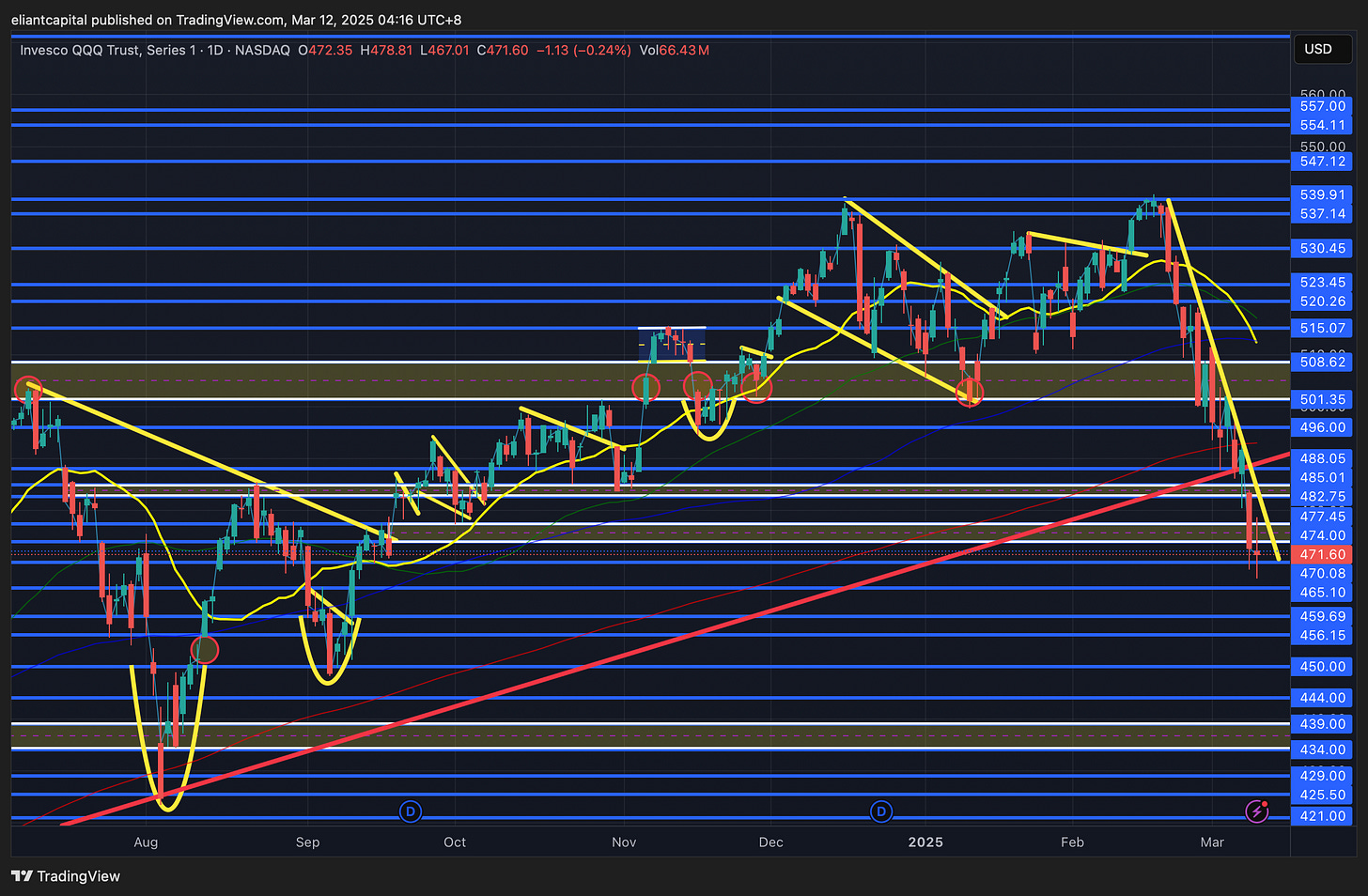

- QQQ

Similar story as to Spooz, but the steep downtrend has remained with the Q’s & tech in general along with beta was hit the hardest yesterday as crowded longs saw quite the unwind… do think the momentum unwind is in the homestretch, but we do need some sort of positive headline to firmly reverse this steep downtrend / get a countertrend rally going… the one big factor about today is we did see the Q’s along with small-caps show big relative strength compared to the other indices which more so is maybe a sign that yesterday may have been capitulation & today more so confirmed that action given the seller exhaustion / positive action across the board in several stocks.

MTUM (Momentum ETF) is at a bigger point of confluence as it resides just above this longer-term support TL dating back to late ‘23 whilst also backtesting the Summer ‘24 highs… a likely interim bounce spot at a minimum.

The same could be said for Mag-7 (MAGS) as well…

For a shorter-term reversion trade, I do think XLK/XLP will do very well on a countertrend rally bounce in tech… essentially long tech / short staples. Fairly simple thesis but tech is quite oversold here whilst staples are quite overbought… any sort of relief in equites will likely lead to an aggressive sell in staples / defensives & vice-versa in regard to a rush back into tech / momentum on any sort of positive headline.

Prior instances where XLK was this oversold these last few years:

Prior instances where XLP was overbought (started to roll over today due to the slight relief in tech):

In respect to the Q’s specifically, as of now, the Q’s filled the gap from this past September & more so have been oscillating just slightly below this gap-fill. Do think 465 / 470ish on the Q’s is a fairly important pivot & given how oversold the Q’s are, a snapback rally would likely precede a move towards 496 / 501ish above whereas the Q’s continuing to fail to find support may lead the Q’s to slip towards the earlier on September gap just below near 456ish which just nearly coincides with the September ‘24 higher low bottom as well after forming the bigger bottom in August ‘24 (Carry trade unwind bottom)… not the base case, as again, things are quite extreme at these levels… plenty of oversold readings / % of stocks below key MAs etc… but if the uncertainty surrounding policy remains / no positive headlines are given to the market, the volatility will likely remain for now in the interim.

Do think META, AMZN & TSLA again all look interesting as longs here… Tesla more so because sentiment is completely washed out & both META & AMZN look fairly compelling for a re-entry given current valuation / the way technicals are aligning from a risk-reward perspective.

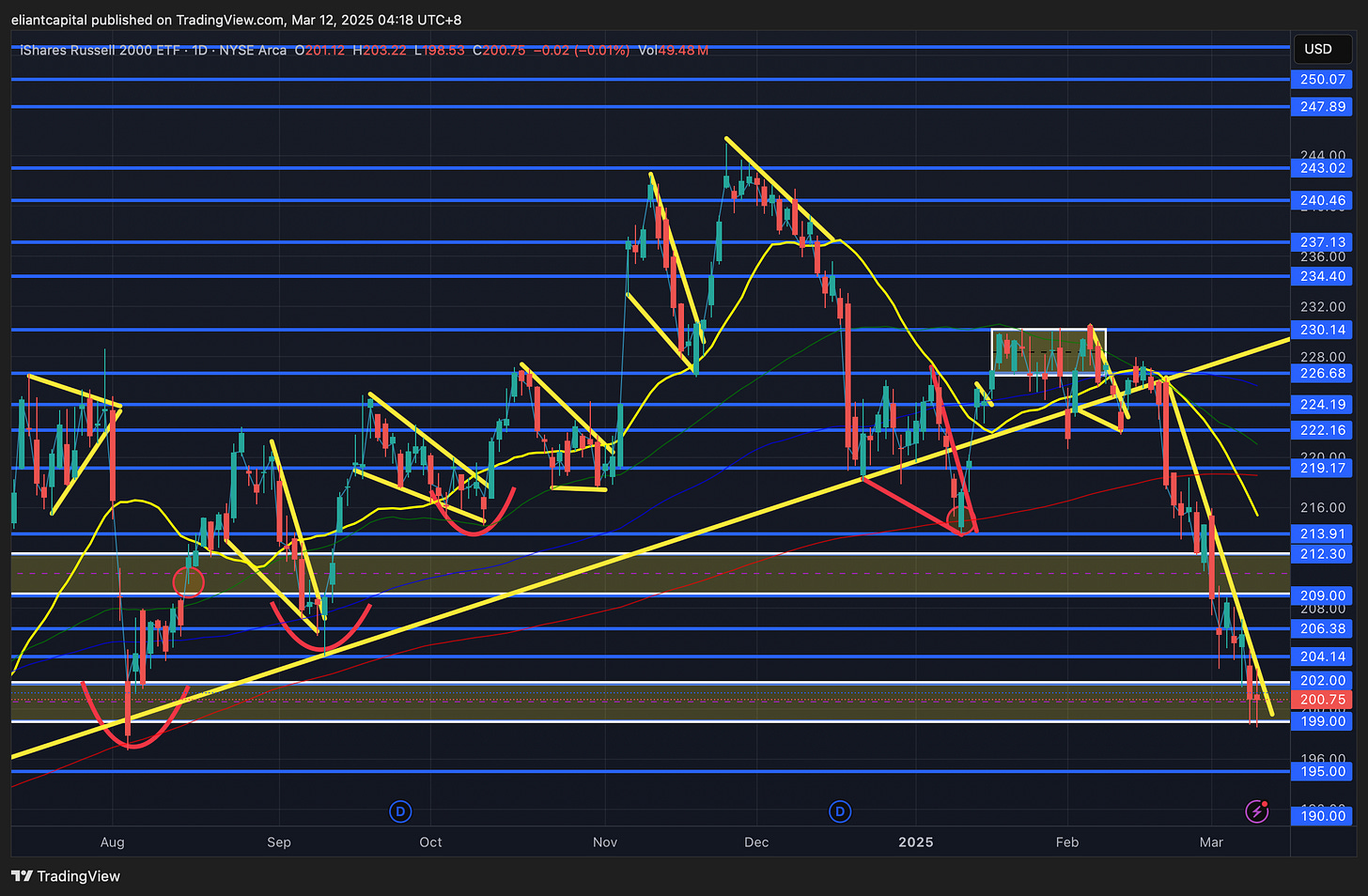

- IWM

The beating surrounding small-caps has continued this week as higher beta names suffered due to further momentum unwind yesterday, but today, we finally saw small-caps along with tech show a bit of relative strength comparatively to the other indices.

Fairly straight forward, but on the weekly, small-caps are clearly oversold & prior instances have led to interim bottoms / longer-term bottoms, but more importantly, small-caps have made their way back to the 200wk which tends to be a significant support & I’d be surprised given the recent & swift drawdown if it were to give in easy & at least not provide for a countertrend rally.

The story hasn’t really changed as the steep drawdown from recent highs has continued, but again, today was more so another signal that small-caps may have reached seller exhaustion given the relative strength against the other indices. As of now, IWM is trying to find support off the 200wk & the August ‘24 lows… this is a significant area of support & I’d be fairly surprised if these levels were to falter / give in quickly before at least leading to some sort of countertrend rally… if we were to see a countertrend rally, I do think we could see small-caps retreat upwards towards 212 / 214ish above to backtest the 20d before potentially pausing & resuming lower & or if data abides / grows scare & or fears simmer down along with disinflation resuming, we likely could see the small-cap rally have holding power.

On the contrary, if we were to see small-caps falter below the 200wk / August ‘24 lows, we likely could see selling persist in IWM towards mid-190s, but again, I would be fairly surprised if we didn’t see a countertrend rally unleash beforehand (of course, barring another headline out of Trump / more uncertainties rising / growth fears escalating etc…).

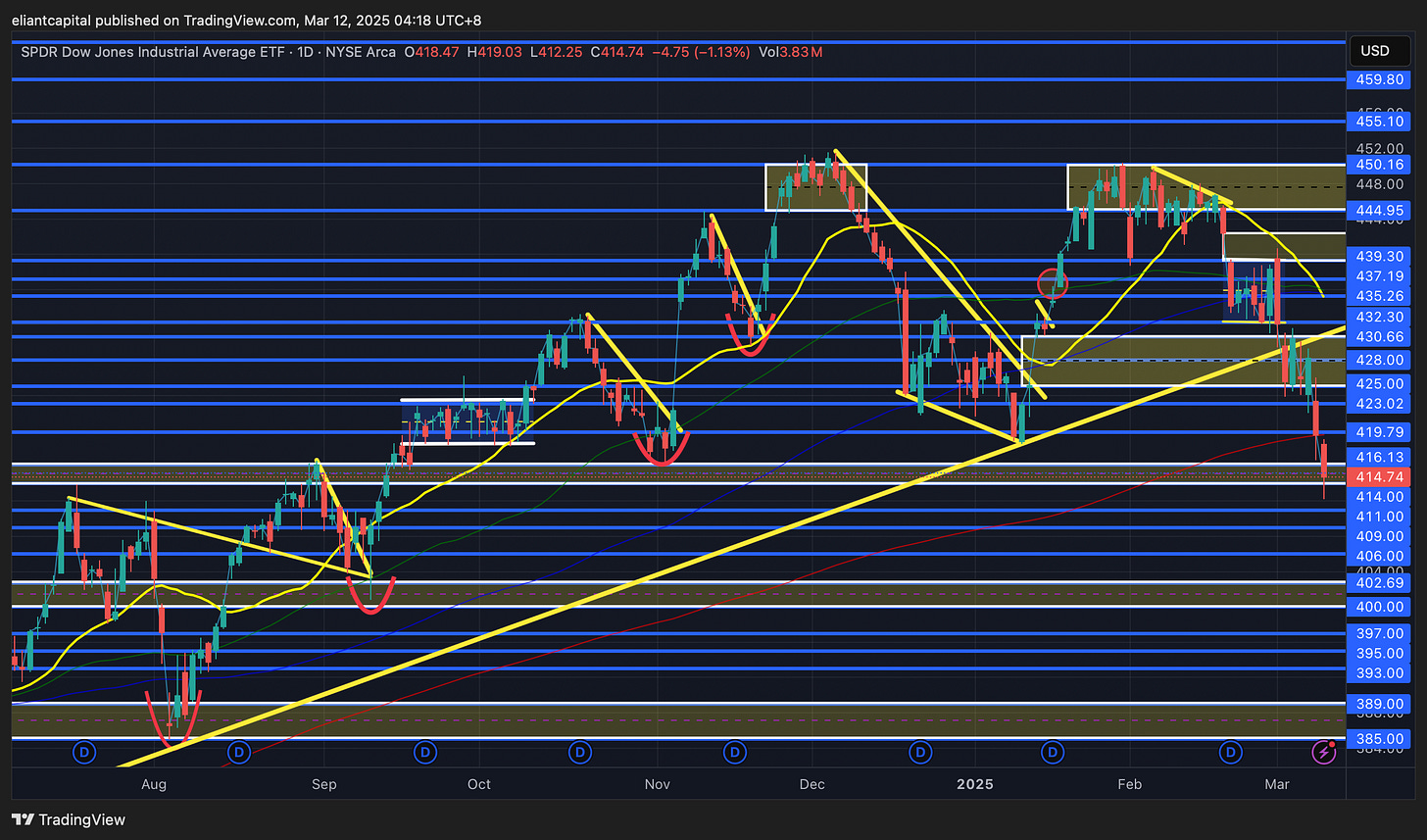

- DIA

Similar story as with all of the indices, but we saw quite the decline in DIA which was the last index to break the 200d & now finally, all of the indices reside below the 200d. As of now, DIA has fallen back towards the Summer ‘24 highs which remains as a general important pivot as it has potential to be a S/R flip (prior resistance flipping to support). Again, doesn’t need to be said but all of the indices remain very extended to the downside & if we were to see a countertrend rally in DIA, I do think we could see DIA backtest 430 / 432ish above before then pausing & or deciding where to go from there… a lower high & or resume towards ATHs?

On the contrary, if we were to see DIA continue to fall, the next bigger line of support is around 402 / 400ish which coincides with the September ‘24 lows but in general, barring a collapse due to a headline / outlier event, do think DIA is nearly at the point of reaching extension to the downside before a countertrend rally unleashes.