The Week Ahead 1/11/26

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & wishing you all a successful year ahead.

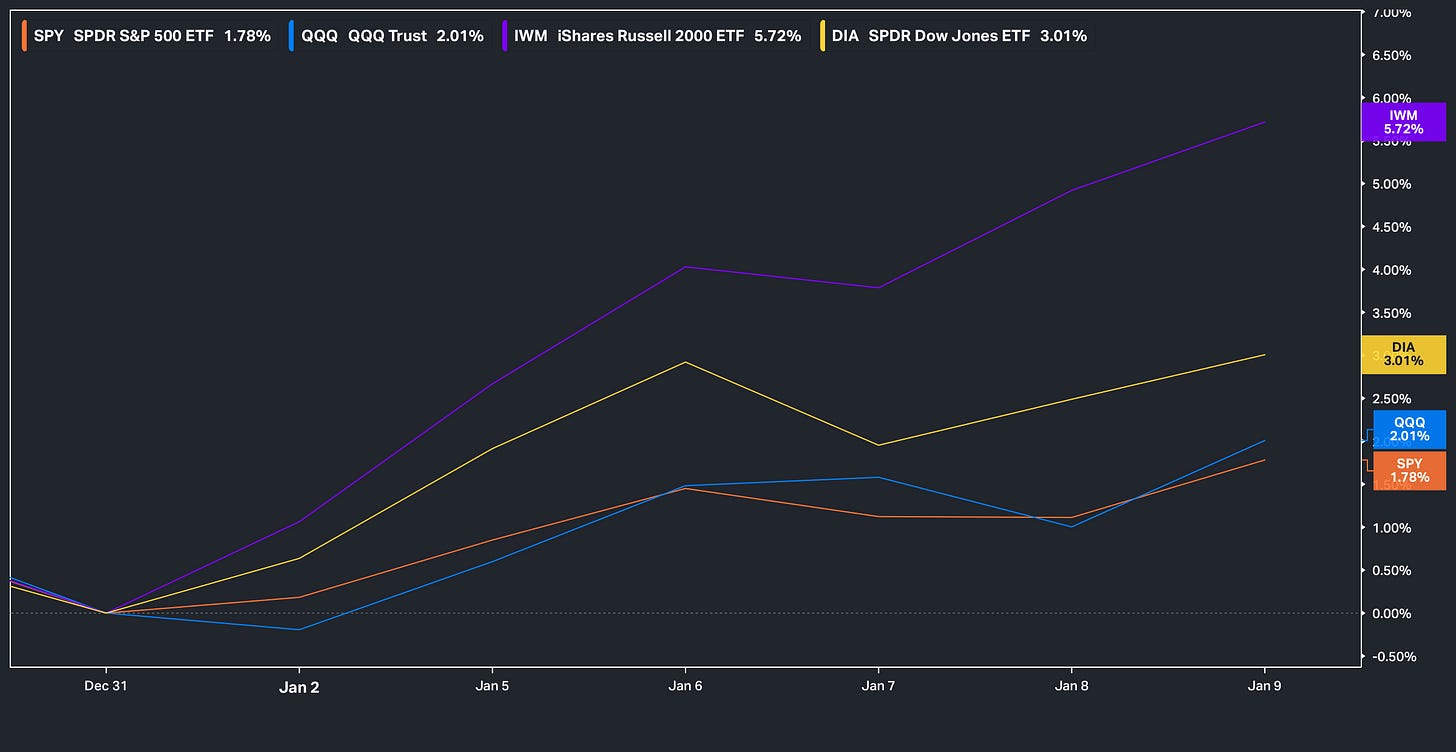

Looking back at this past week, we finally made it through the first ‘real’ trading week of the year & it didn’t disappoint but in regard to economic data, for the most part, the recent ‘Goldilocks’ regime got rehashed even further although signals are starting to accumulate & are slowly pointing toward an economic re-acceleration. Having said that, in the interim however, given the generally ‘Goldilocks’ backdrop, Small-caps were the best performing of the indices on the week, having closed higher by 460bps, whereas Spooz was the ‘worst’ performing of the indices yet still closed higher on the week by 160bps.

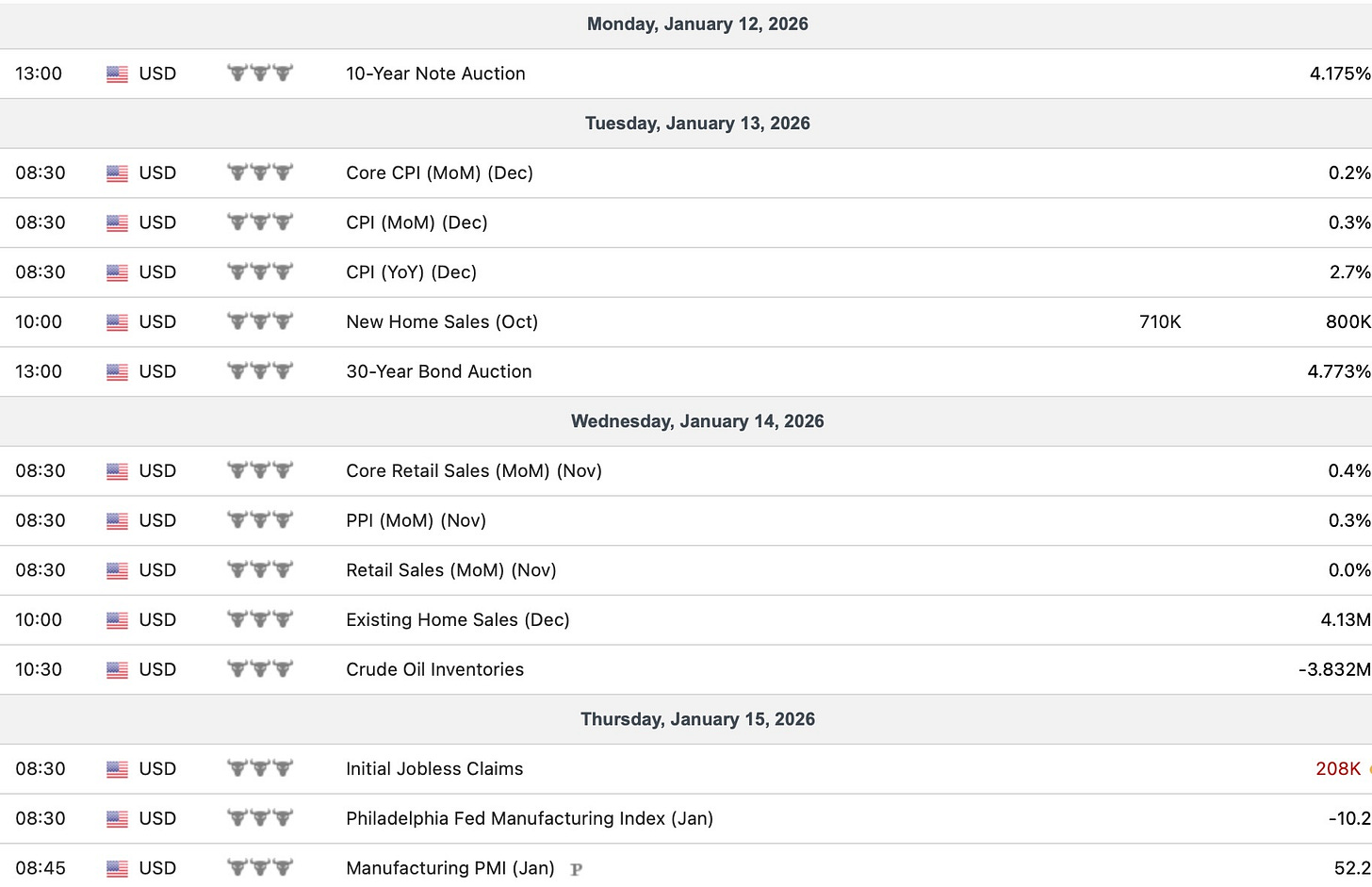

- Economic Data for the Coming Week:

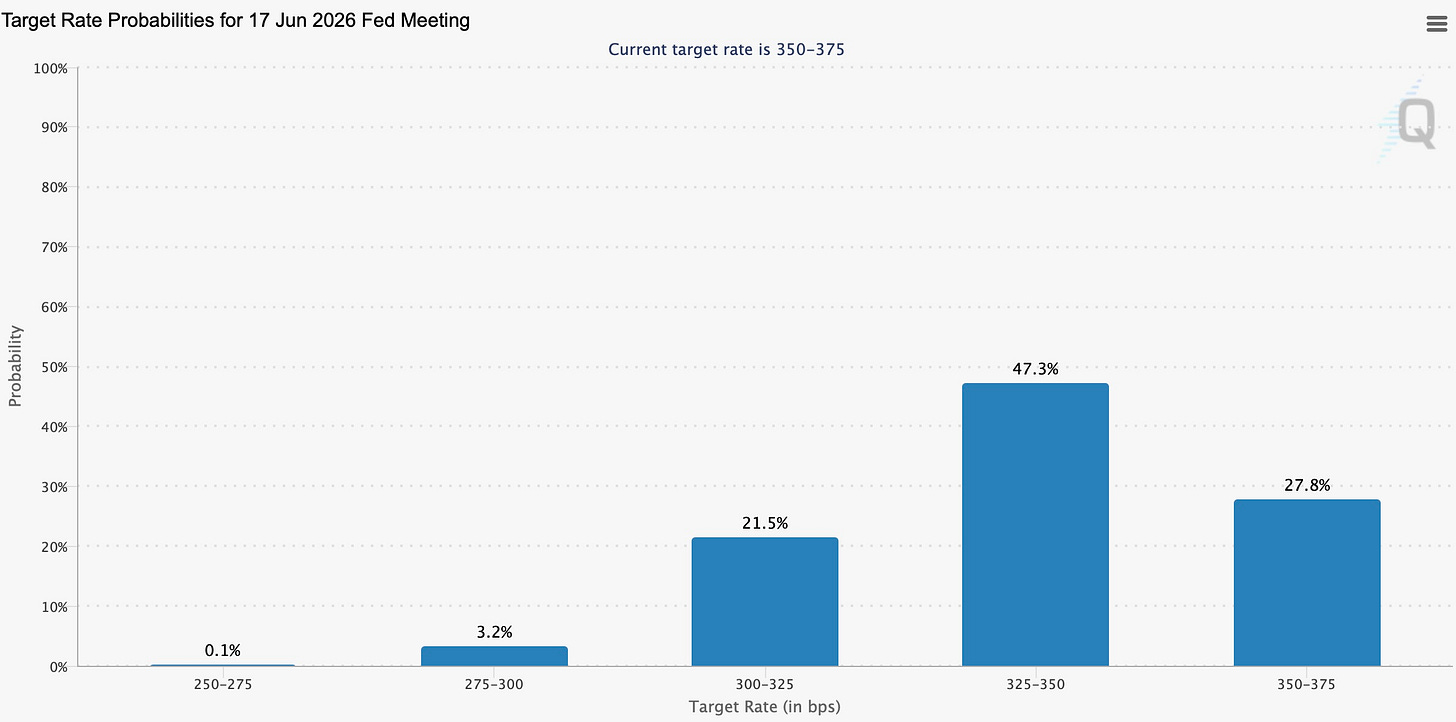

In regard to economic data into the upcoming week, with 2026 full-steam ahead, we have a few set of more ‘important’ datapoints including CPI / Retail Sales / PPI #’s, but generally speaking, odds for a January cut sit at 4% & April rate-cut hopes got pushed back to June, so this weeks upcoming data arguably doesn’t hold too much weight & if anything, if the data happens to be softer than expected, we could see markets back to pricing in an April cut, but otherwise, the ‘potential’ surprises seem relatively limited & what’ll be more important into month-end is whom does Trump select as the next incoming Fed-chair.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 184.10% return whilst in the same period, the Q’s have returned 77.84% / Spooz has returned 66.10% / Dow has returned 53.14% & Small-caps have returned 48.54%, so nice outperformance against all the indices whilst having a 81.5% win rate, averaging a 26.42% return on realized gains / winners & a 15.12% loss on realized losses / losers.

Looking forward to the future & continued success as we kick off ‘26.

We recently published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as 2026 kicks off after coming off a strong ‘25 & for those whom would like to read the report, I included it just below:

Earlier in 2024, we launched a series titled Educational Pieces, covering a wide range of topics, many of which were suggested directly by you all (4-Part Series).

For those who may have missed the first installment, it covered topics including:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

A link to the original Educational Piece can be found here .

Given the positive feedback and how useful many of you found the first installment, we followed up with Educational Piece: Part Deux earlier in 2025 & for those who may have missed, a link to the piece can be found here & we then went on to release Educational Piece: Part Trois which can be found here.

And finally, the most recent installment, Educational Piece: Part Quatre, can be found here.

‘Risk management is the silent prerequisite for compounding & true wealth is built not by chasing the highest returns but by ensuring the survival necessary to realize them.’

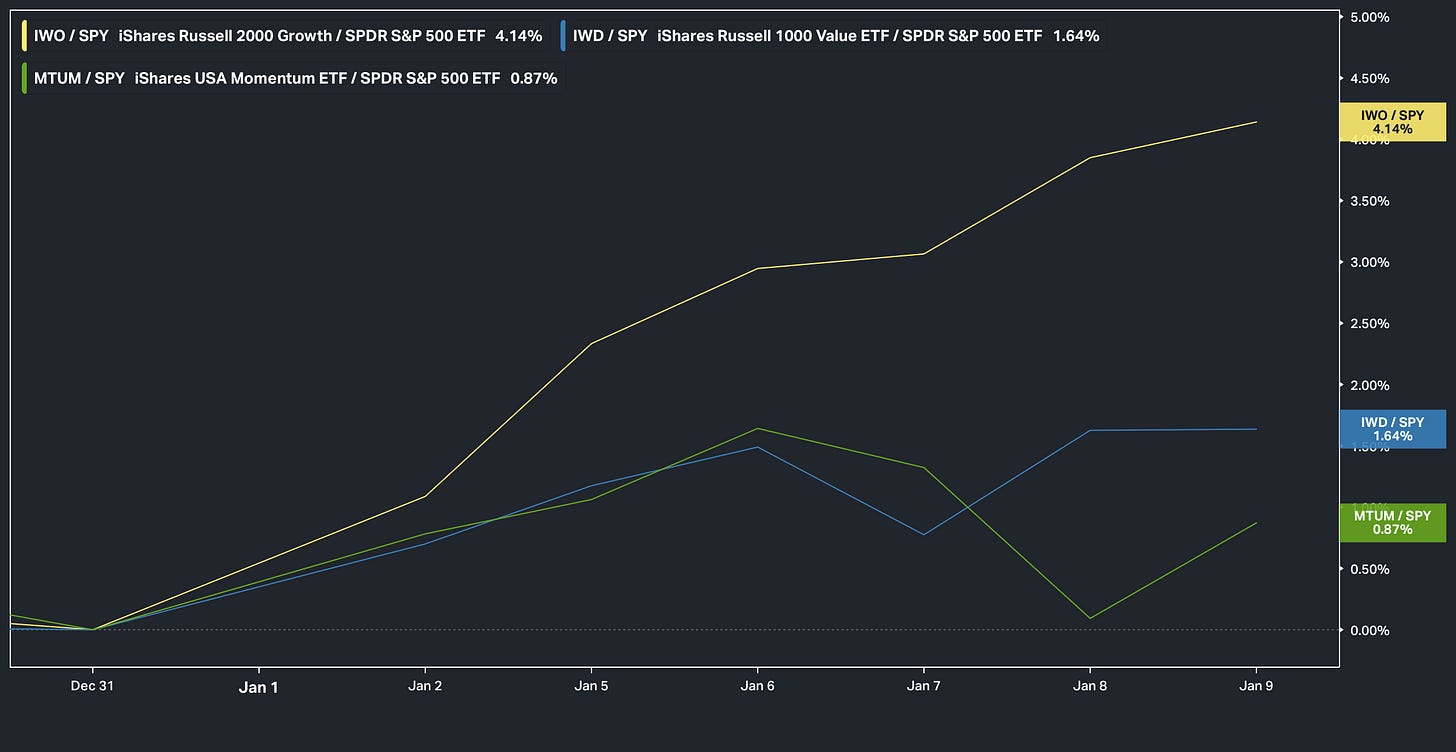

To jump straight into it, it’s been quite the start to the year for the indices with Small-caps currently leading the way & the Dow second behind & the general ‘theme’ of the year in terms of capital being drawn toward has been in relation to cyclicals & or ‘real economy’ along with growth / momentum-driven names as well whereas value has been the under-performer on the year.

The chart below highlights this dynamic well as Small-cap Growth along with Momentum is posting quite the outperformance over Value month-to-date:

And the action within cyclicals couldn’t be any stronger either (Dow Theory Confirmation Triggered This Past Week):

- Transports:

New ATHs & working out of a 4.5+ year base:

- Regionals:

Breaking out of 3+ year downtrend / Above ‘24 post-election highs:

- Commodities:

Working out of 3+ year base:

- RSP (Equal-Weight):

New ATHs / Breaking out of 1+ year base:

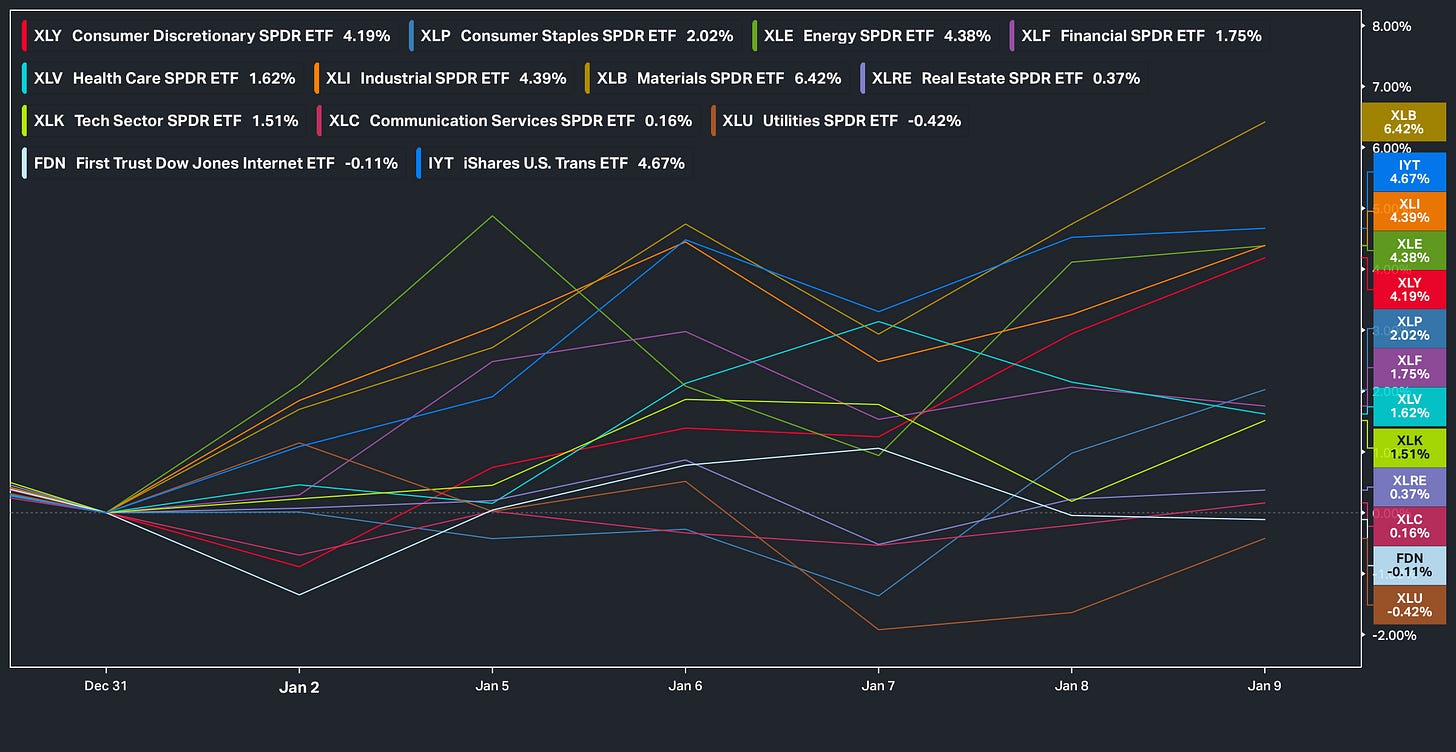

And in regard to sector performance, what are the top-performing ones year-to-date? You guessed it, cyclicals:

- Materials

- Transports

- Industrials

- Energy

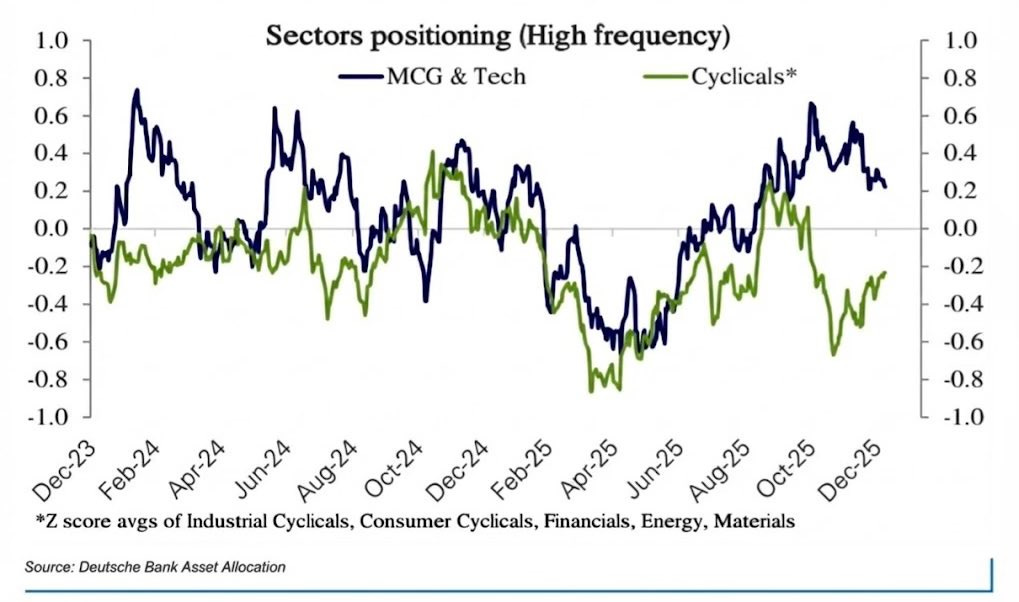

This outperformance / dynamic within cyclicals really started to amplify post Powell’s December FOMC speech & the move in such a shortened period of time has been quite aggressive YET positioning within cyclicals STILL remains quite underweight. Again, it’s more so just a testament to how under-owned the group is & this recent move has really just been mean-reversion.

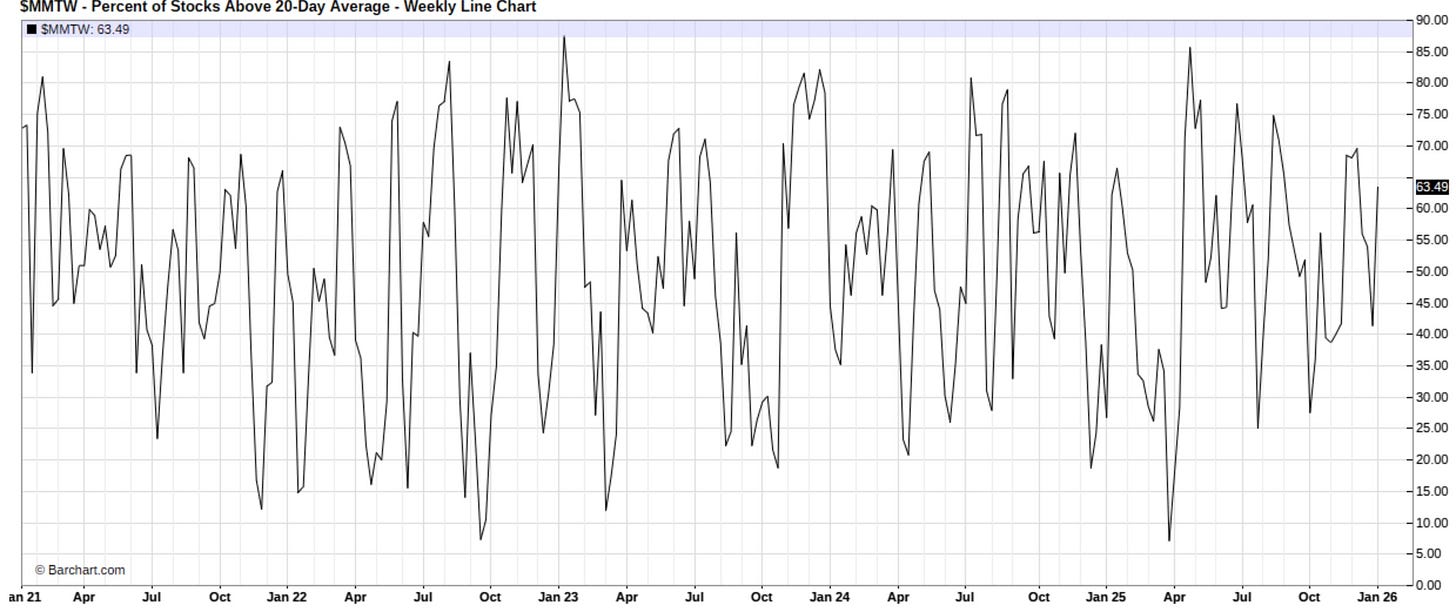

With that being said, given the strong performance from a diverse group of sectors on the year, we’ve seen quite the improvement in upside participation / breadth which has led to quite the snapback within the % of stocks above the 20d which currently sits at 63% & is starting to work into overbought territory in the shorter-term.

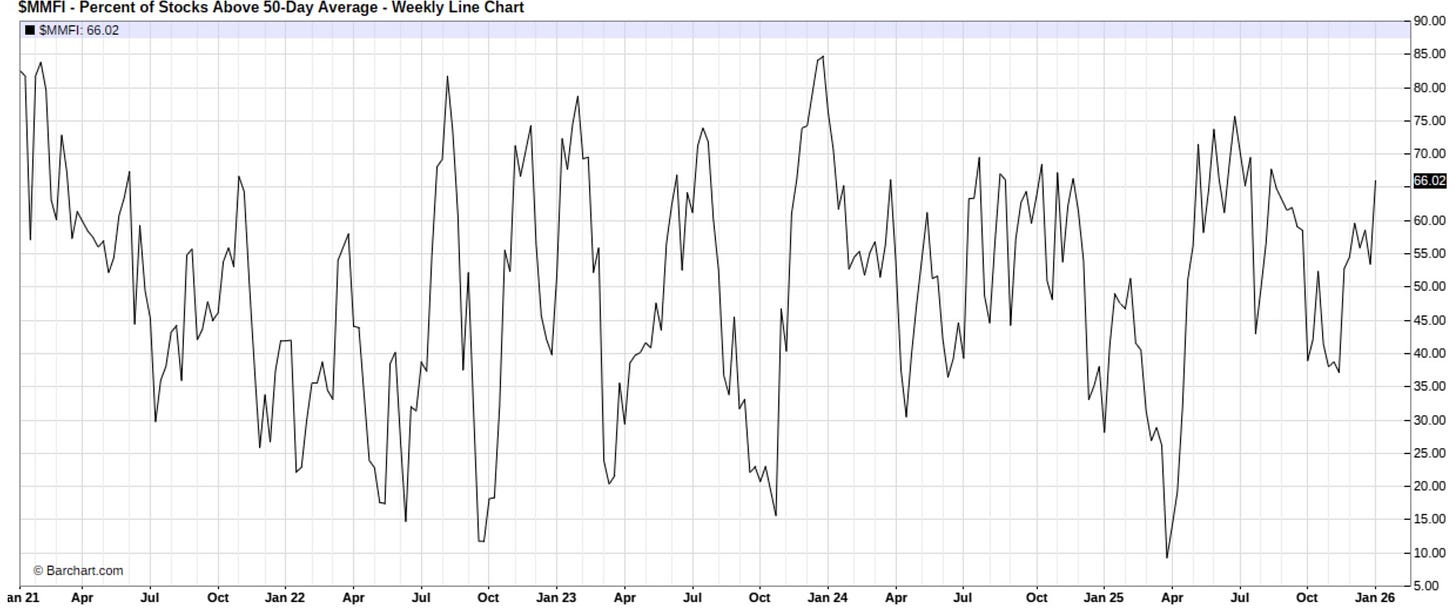

The same can be said on a more broader timeframe as the % of stocks above the 50d has snapped back higher ever since the late November lows near 35% as it now sits at 66% (Peak in last 5-years was December ‘23 near 85% following Powell’s initial signal that the Fed was ready to move toward a rate-cut cycle).

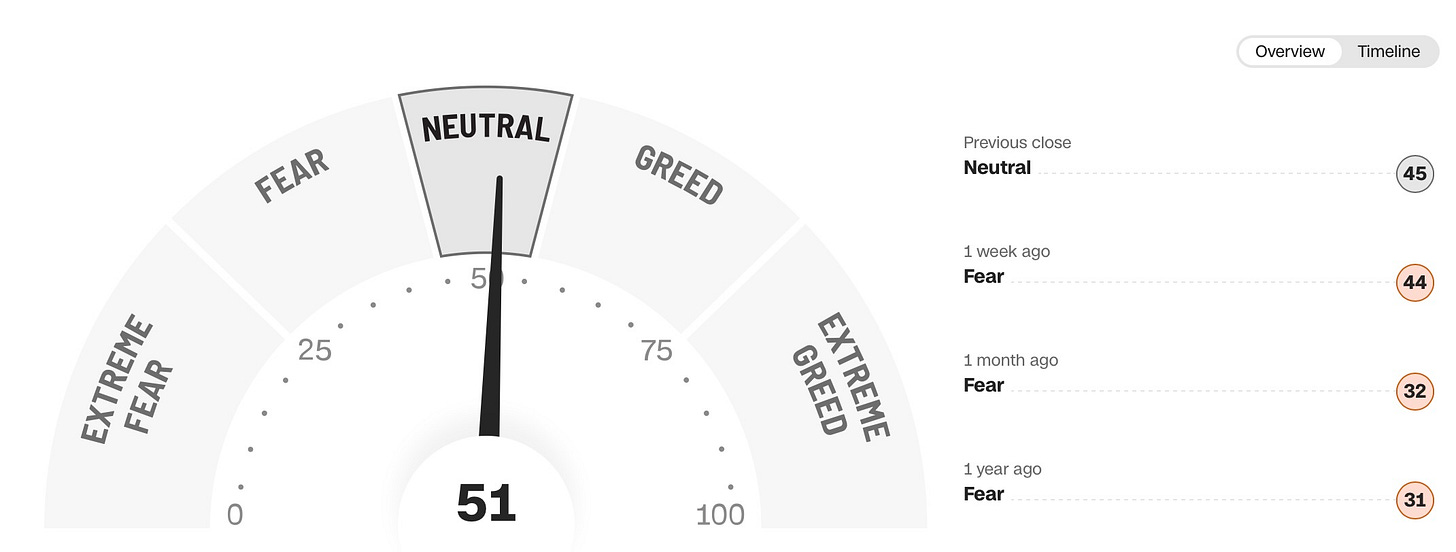

Having said that, despite shorter-term signals encroaching ‘overbought’ territory, the one interesting phenomenon that continues to take hold is the fear-greed index STILL remains within ‘neutral’ territory despite Spooz / Small-caps / The Dow having all made a fresh ATH this past week which leaves the Q’s as the only index in which hasn’t quite made a new ATH yet.

Moving away from the indices and turning to economic data, to recap this past week, arguably the most interesting datapoint on the week was the December ISM report. The headline rose to 54.4, a 14-month high, with new orders, employment, business activity, imports, and exports ALL accelerating, pointing to renewed momentum across the services economy whereas at the same time, prices paid eased slightly, reinforcing the view that growth is picking up without a re-acceleration in inflation.

In other words, a very ‘Goldilocks’ report given the stronger activity, improving demand, & contained pricing pressures.

The other datapoint worth mentioning from this past week was the December NFP report which reinforced the picture of a cooling but still-resilient labor market. Headline job growth came in at +50K, slightly below expectations of 67k, with private-sector hiring particularly muted (+35–40K), indicating businesses are slowing incremental hiring rather than cutting aggressively. However, despite weaker payroll growth, the unemployment rate fell to 4.4% from 4.6% (Unrounded 4.35%), a key offset that helped frame the report as deceleration rather than deterioration. Importantly, immigration continues to play a meaningful role in these dynamics as we’ve been discussing for months on end: the expansion of the labor force via immigration has increased labor supply, which helps contain wage pressures & absorb slower hiring without a spike in unemployment. In other words, even as job creation cools, a larger & more flexible workforce allows employment to remain stable. Net-net, the report rehashes the recent ‘Goldilocks’ regime as growth is not too soft & or too hot but is instead ‘just right’ & the slack within the labor market continues to remain non-disruptive which gives the Fed room in the interim to stay patient rather than react defensively (Early signs continue to point toward economic re-acceleration; Case in point ISM #’s above).

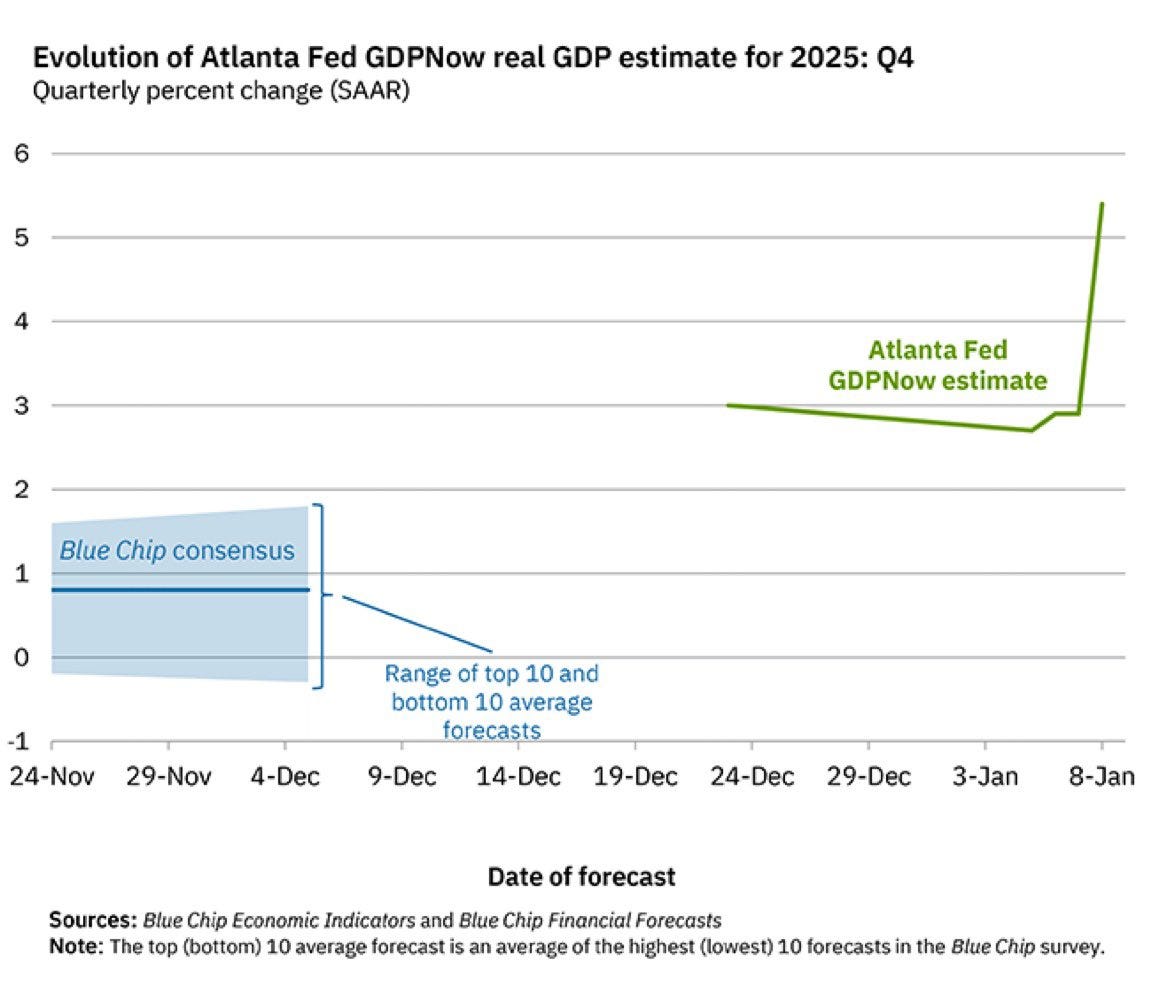

And speaking of re-acceleration, Atlanta Fed released their Q4 GDP estimates & as of now, their estimate is… 5.4%.

We’ve been an advocate of ‘run it hot’ since early May of ‘25 (Consensus for a recession in ‘25 at the time was within the 60-70% range) when it became clear in our view that the administration had fully abandoned all attempts at austerity & they instead were going to target improving growth to reduce the the deficit-to-GDP. 9-months later & it’s grown to quite the consensus (Nearly every bank called ‘26 a ‘run it hot’ year) but what’s not consensus is risks slowly shifting to ‘overheating.’

With that being said, following last weeks better than expected economic data, rate-cut hopes for April have now been pushed back until June although two cuts are still expected by year-end.

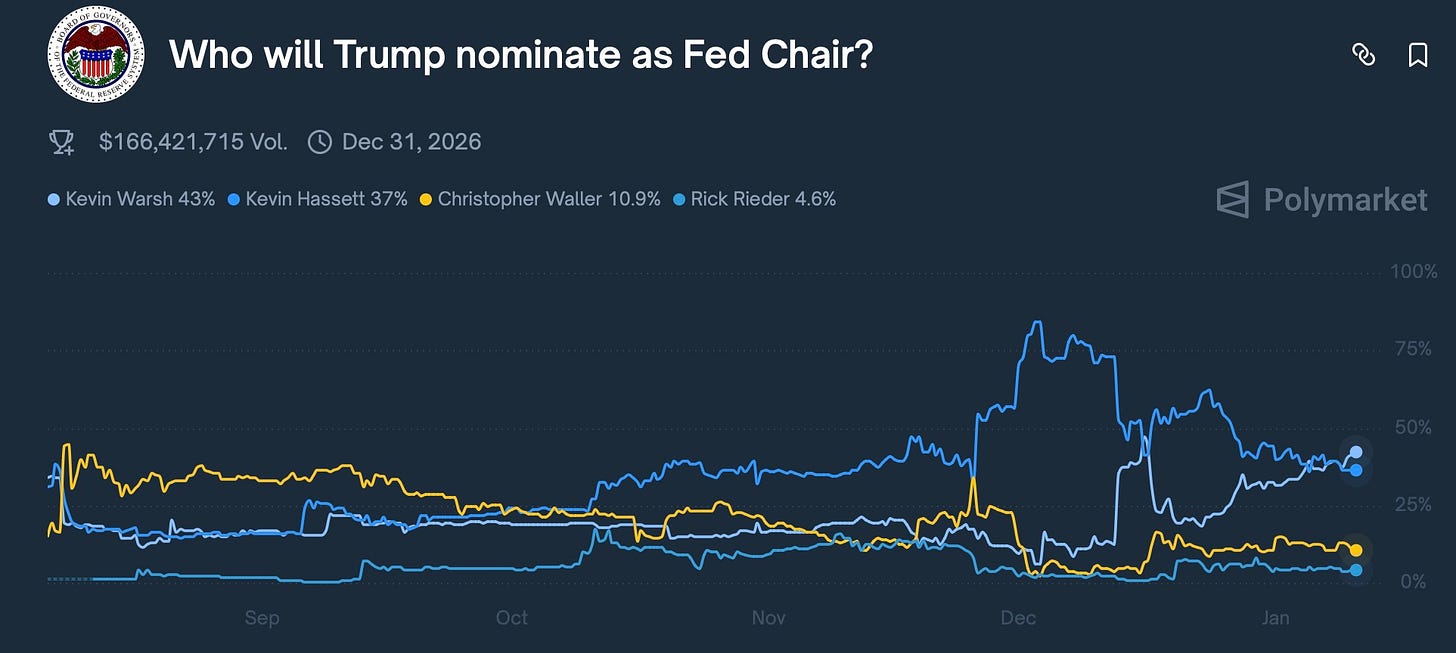

And finally, before we jump into the week ahead, & in regards to the note just above with respects to rate-cut expectations, Trump is expected to select the new Fed Chair by the end of January & as of now, Warsh has taken a slight lead over Hassett although it still is arguably a coin flip between the two with Waller remaining as the 3rd favorite & although not listed, would argue Miran remains as a ‘dark horse.’