The Week Ahead 12/14/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 & get ready to head into ‘26.

Looking back at this past week, we finally made it through FOMC & to surprise, despite the ‘Hawkish Cut’ consensus, Powell ended up surprising with a more dovish stance as he once again emphasized growth risks over inflation risks & with the faulty ‘Hawkish Cut’ consensus, sure enough, Small-caps ended up being the best performing of the indices on the week, having closed higher by 127bps whilst also having made a new ATH, whereas the Q’s ended up being the worst performing of the indices, closing lower by 172bps on the week which was more so amplified by the general unwind within the AI-complex on Friday.

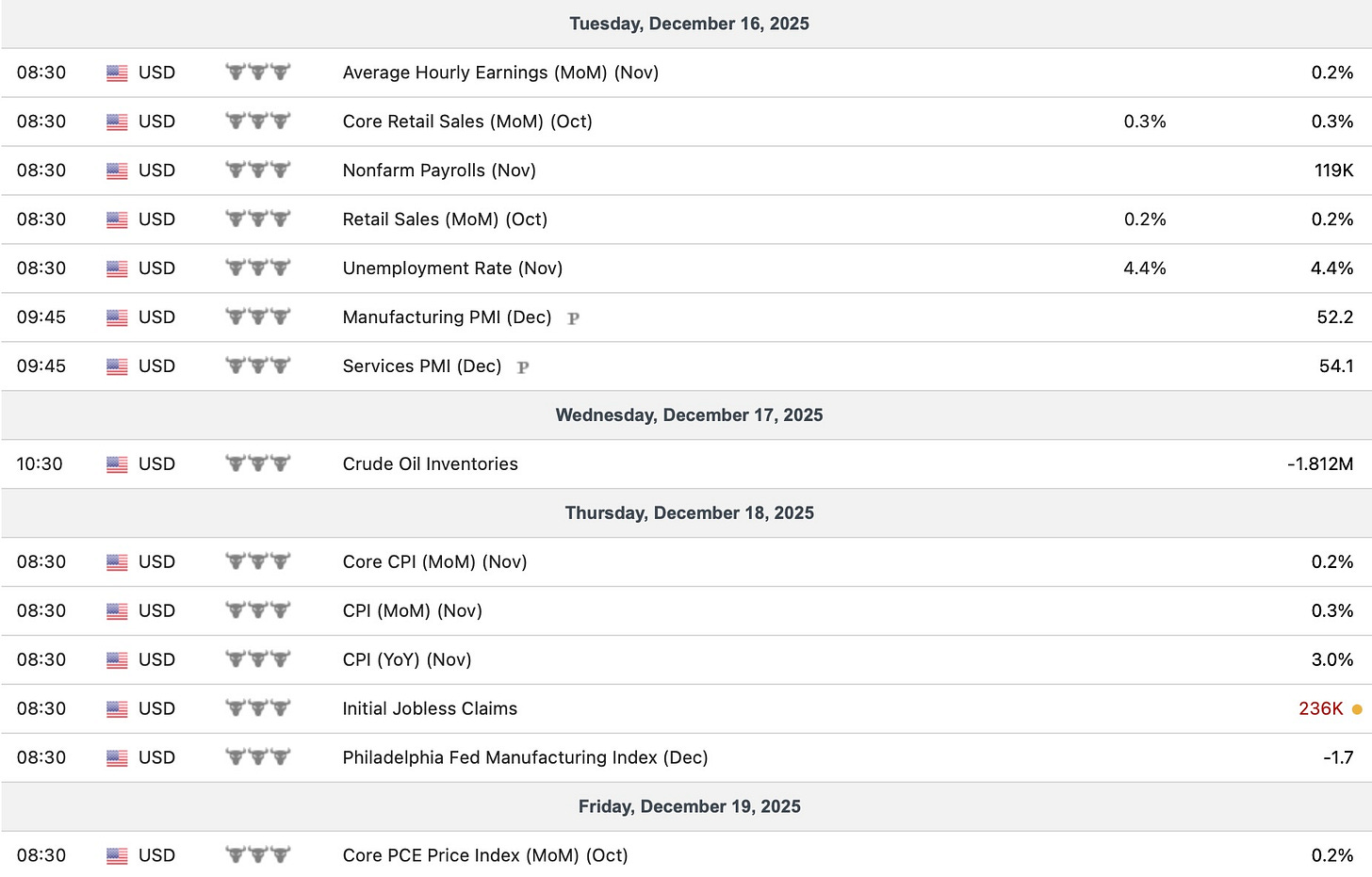

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, 2025 is nearly rounding off to a close & this is the last week of ‘significant’ economic data into year-end & on Tuesday, we’re expected to get the well-anticipated November jobs report & then on Thursday, we have CPI #’s & finally on Friday to round off the week, we have PCE #’s too.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 170.77% return whilst in the same period, the Q’s have returned 71.58% / Spooz has returned 62.01% / Dow has returned 49.82% & Small-caps have returned 44.56%, so nice outperformance against all the indices whilst having a 82.0% win rate, averaging a 26.02% return on realized gains / winners & a 15.15% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

We recently published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as we get ready to head into 2026 after coming off a strong ‘25 & for those whom would like to read & prep for ‘26, I included the report just below:

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all.

For those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (For now, Part Quatre coming soon), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

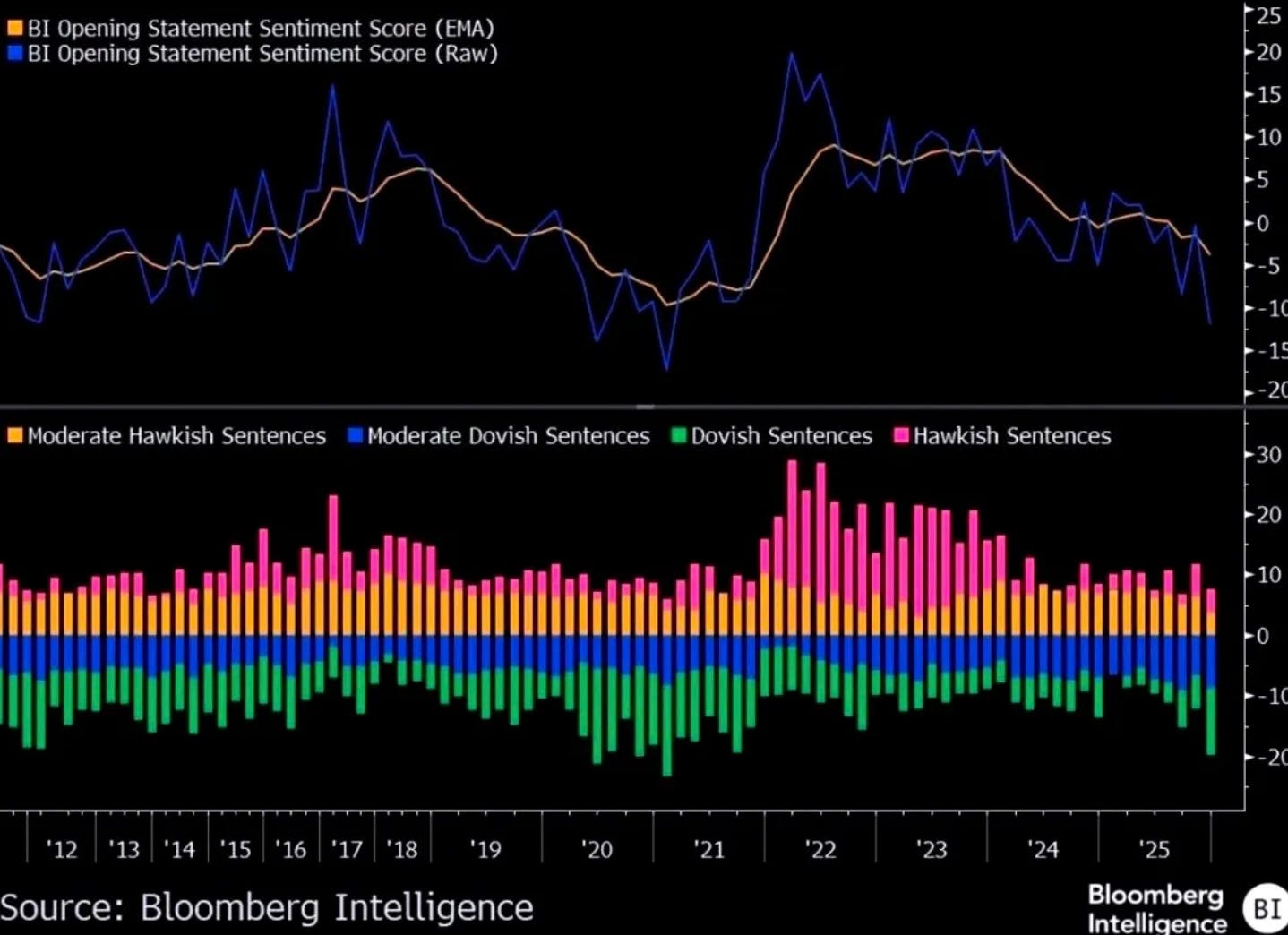

Before we jump into the week ahead, to take a look back at this past week, again, the biggest event of the week was FOMC & despite the ‘Hawkish Cut’ consensus, Powell instead surprised with a Dovish stance & Bloomberg actually categorized the FOMC presser as the most dovish since 2021:

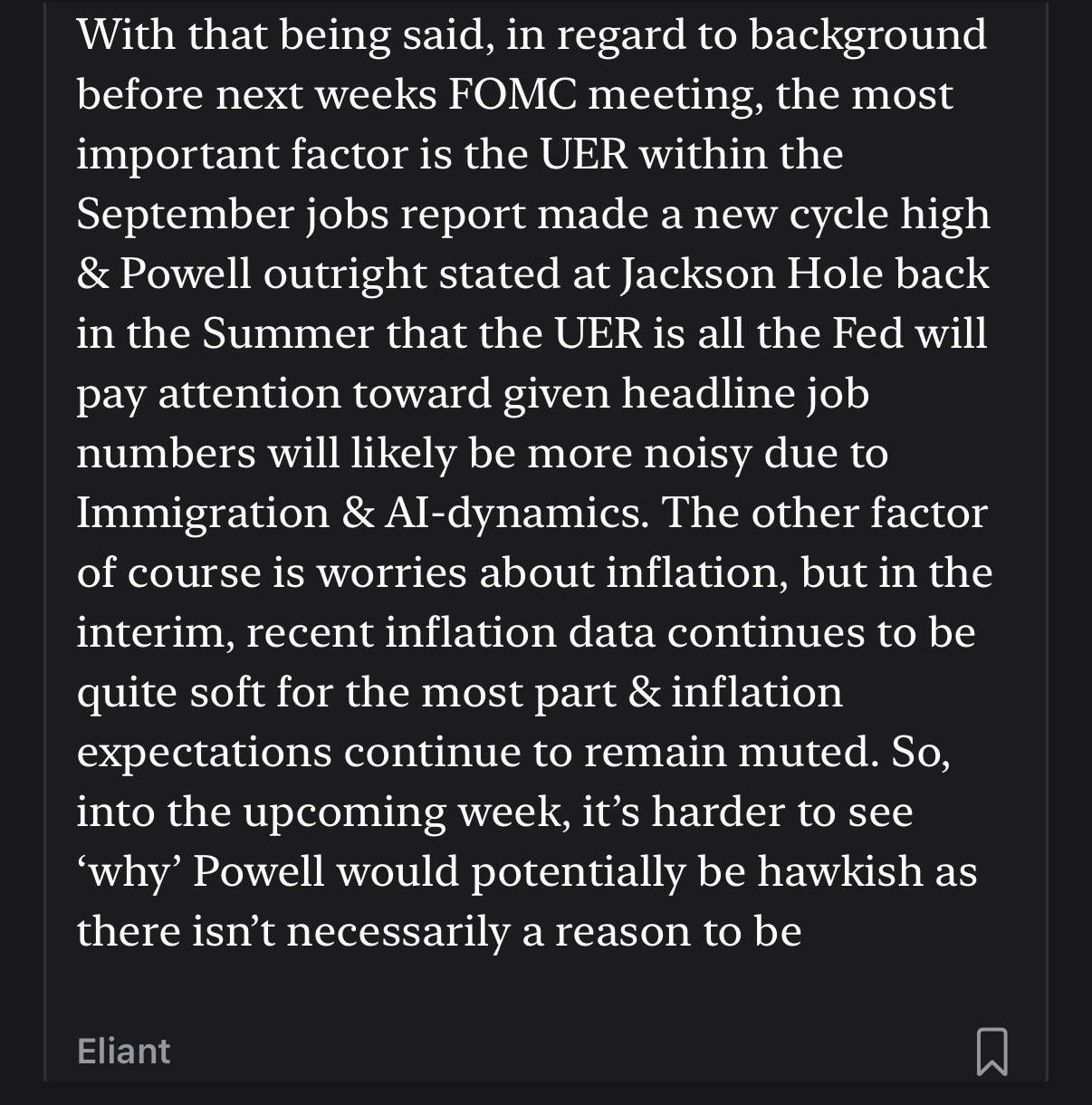

Going into the meeting, we instead took the opposing view & made our view pretty clear that despite the ‘Hawkish Cut’ consensus, we really didn’t necessarily see a reason for Powell to be hawkish. In September, the UER made a new cycle high & at the Jackson Hole meeting in the Summer, Powell made it fairly clear that the Fed will be paying much more attention toward the UER rather than the headline job number given how skewed the number can be due to Immigration dynamics (Tightening of labor supply / Lower breakeven for job growth) along with AI-dynamics as well. The other added point related to jobs is with the UER making a new cycle within the September jobs report, this was PRIOR to the Govt. having gone on shutdown & with the shutdown, weakness within the economy was to be expected (We’ll know how much of an impact following the November Jobs Report this upcoming week), but generally speaking, downside risks to the labor market these last two months with the Govt. on shutdown had grown. The other factor of course was related to inflation & recent data for the most part has overall been much tamer than expected along with longer-term inflation expectations continuing to remain muted despite the chatter from certain Fed members whom continued to emphasize inflation risks.

So essentially, downside risks to the labor market were apparent whereas concerns over inflation weren’t entirely justified given longer-term expectations continued to remain muted / well-anchored despite recent hysteria & recent data as well has been softer than anticipated & as a result, our view was Powell would likely lean more dovish under those circumstances assuming the Fed continued to do as they’ve done since the December 2023 pivot: Prioritize growth over inflation.

Sure enough, our view ended up being fairly spot on.

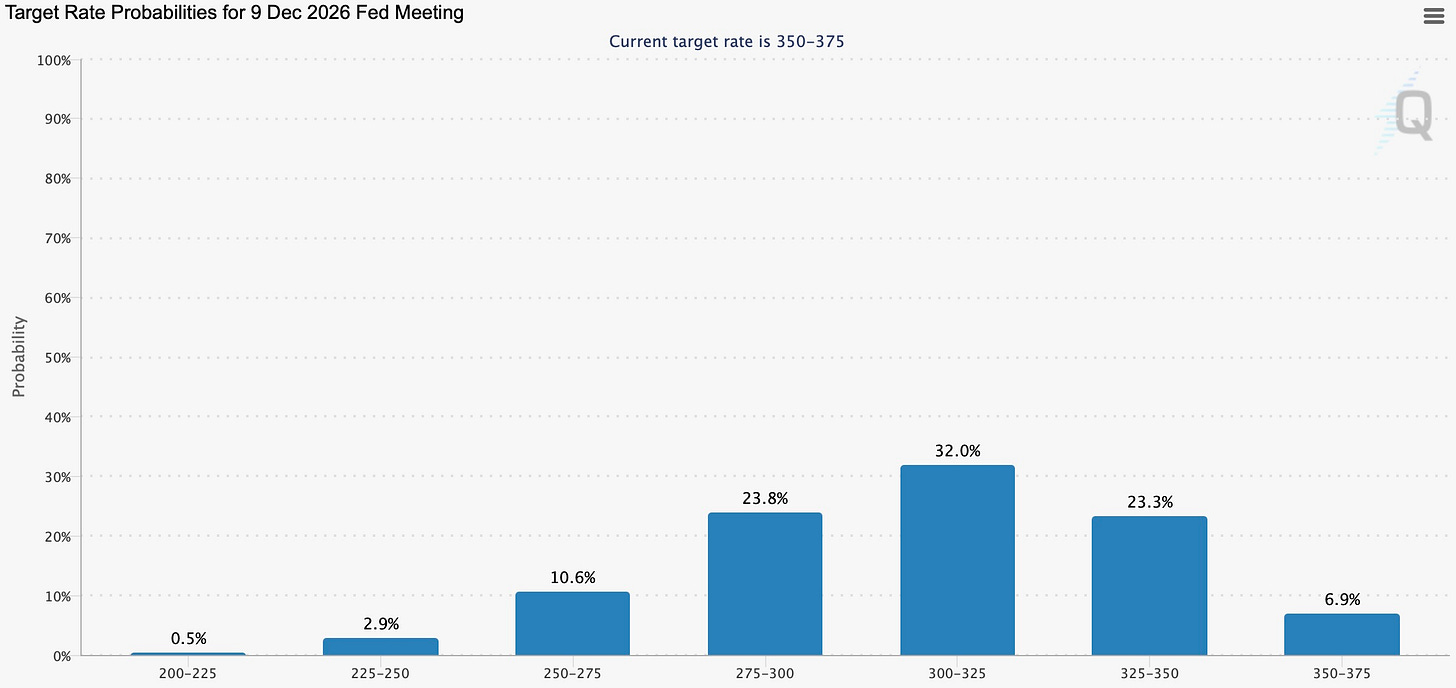

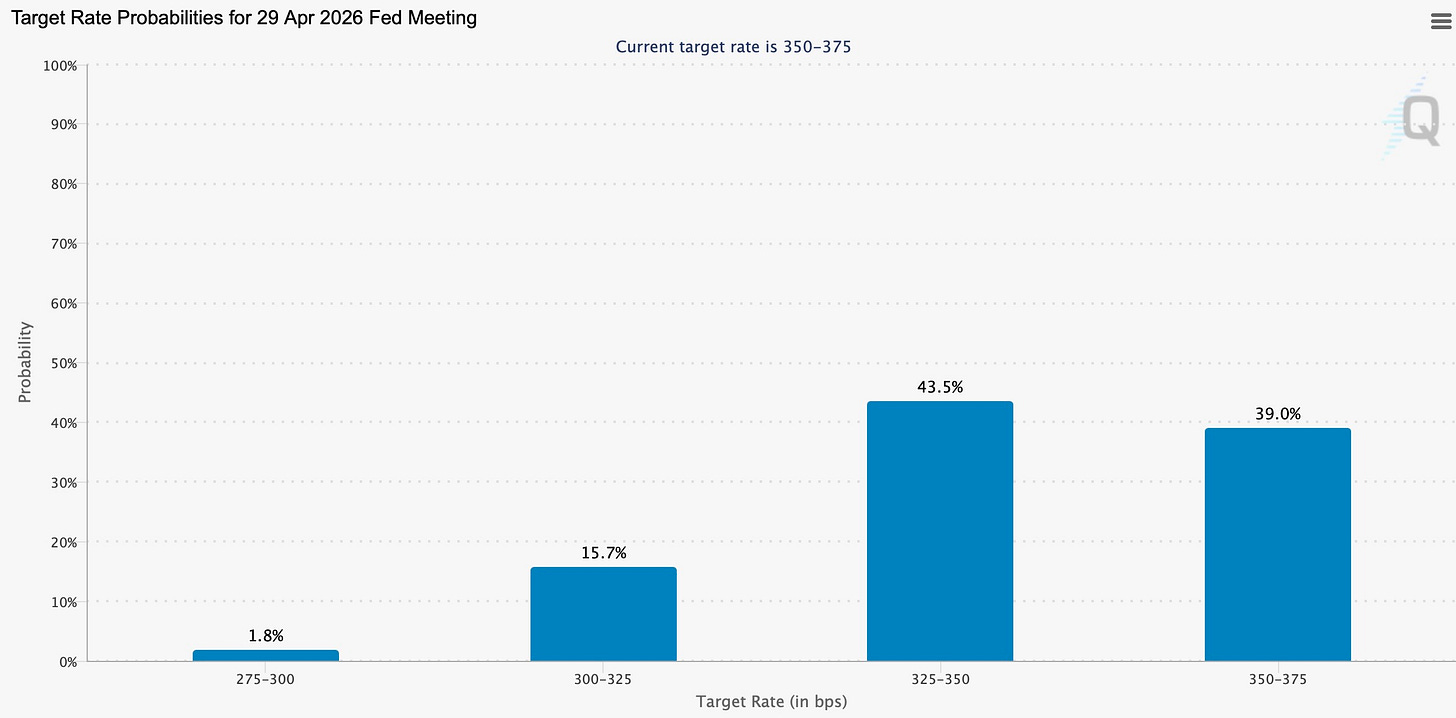

Following the FOMC meeting in terms of specific results, the Fed did indeed cut by 25bps & the dot plot was essentially left unchanged & as of now, markets are still pricing in just 2-cuts for 2026 (Was a 50/50 coin-flip between 3-4 cuts just a couple weeks back).

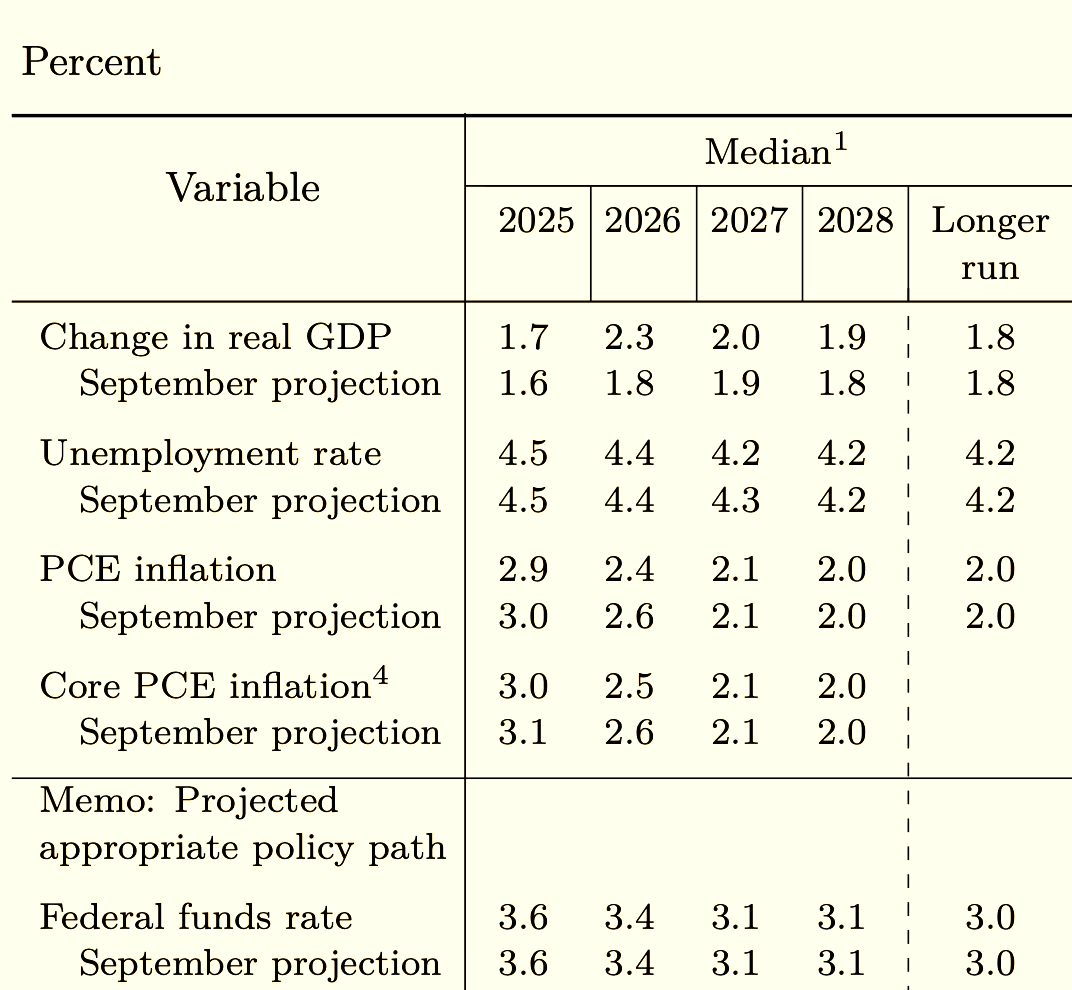

In regard to the Fed’s projections for 2026, it’s quite Goldilocks:

- Growth revised higher

- Inflation revised lower

- Unemployment rate held steady

Turning to Powell’s speech, the takeaway was straightforward and decisively dovish. Throughout his remarks, Powell repeatedly emphasized downside risks to the labor market whilst continuing to downplay inflation concerns. He framed tariffs as a likely one-time price effect rather than a source of persistent inflation, noted that services inflation continues to cool, and argued that recent goods inflation is largely tariff-driven. Importantly, he also pointed to long-term rates as signaling little concern about inflation over the long run.

Taken together, the message was clear: growth and labor market risks remain as the Fed’s primary focus, whilst inflation pressures outside of tariffs continue to ease. Powell even suggested that, absent new tariff announcements, goods inflation should peak in the first quarter, reinforcing the view that inflation risks are fading rather than re-accelerating. Powell also noted that the Fed will receive a significant amount of new data before the January meeting which more so emphasizes the importance of upcoming labor market data & leaves the bar in the interim for sustained hawkishness high whereas as we potentially progress through 2026, if we do see the economy rebound into Q1 which is well anticipated, we could see concerns surrounding inflation rise into the 2H of the year, especially given the administration’s stimulative plans ahead of midterms.

- How did markets respond following FOMC?

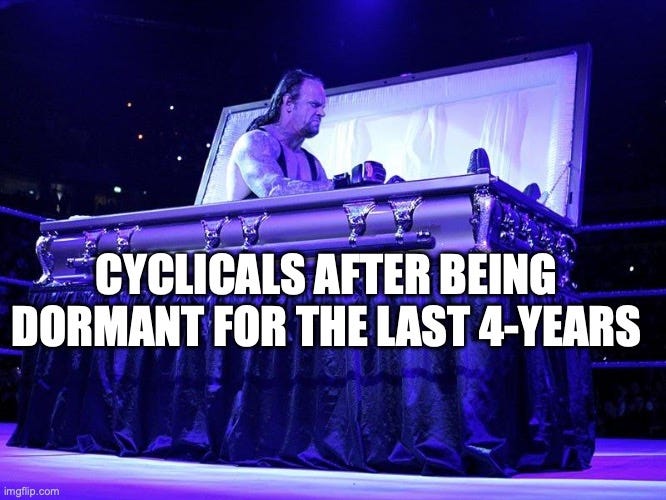

Small-caps & Cyclicals (Real-Economy) drastically outperformed:

- RSP:

New ATHs / Breaking out of 1+ year base.

- /RTY:

New ATHs / Breaking out of 4.5+ Year base.

- Transports:

Encroaching ATHs & potentially working out of a 4.5+ Year base.

- KRE:

Broke out of a 3+ year downtrend.

- DBC (Commodity Index):

3+ Year rounded bottom base / Encroaching neckline.

What’s the takeaway? Goldilocks. You have a Fed remaining accommodative that doesn’t want further deterioration within the labor market & a further uptick in the UER will make the fed cut additionally / Inflation, as of now at least, isn’t an issue & the Fed is in the stance of either they remain on pause if labor market dynamics improve & or they continue easing if conditions worsen & or recent slowing growth concerns potentially amplify; We’ll call it a ‘Fed put,’ just as it has been since the December of 2023 pivot.

With that being said, as we’ve been highlighting for the last couple of months, Small-caps & Cyclicals tend to outperform in ‘Goldilocks’ conditions & of course, as we’ve emphasized all year over & over & even since late 2023, yes, this is bullish for hard assets.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

Fat Pitch into 2024?

Coming into 2023, both Gold and Silver were hot topics on assets that may thrive this year given their relative performance that sparked a lot of interest when both the dollar and yields peaked late last year in October. Both Gold and Silver had quite the moves off those lows & a lot of the euphoria/ excitement heading into 2023 seemed to be front-runne…

The question here is just a matter of IF these potential 4+ year breakouts actually materialize & or stick:

And finally, to round off the FOMC commentary, coming into FOMC, no cuts were expected for the remainder of Powell’s term & now we’re back to at least pricing in one more cut following Powell’s dovish speech:

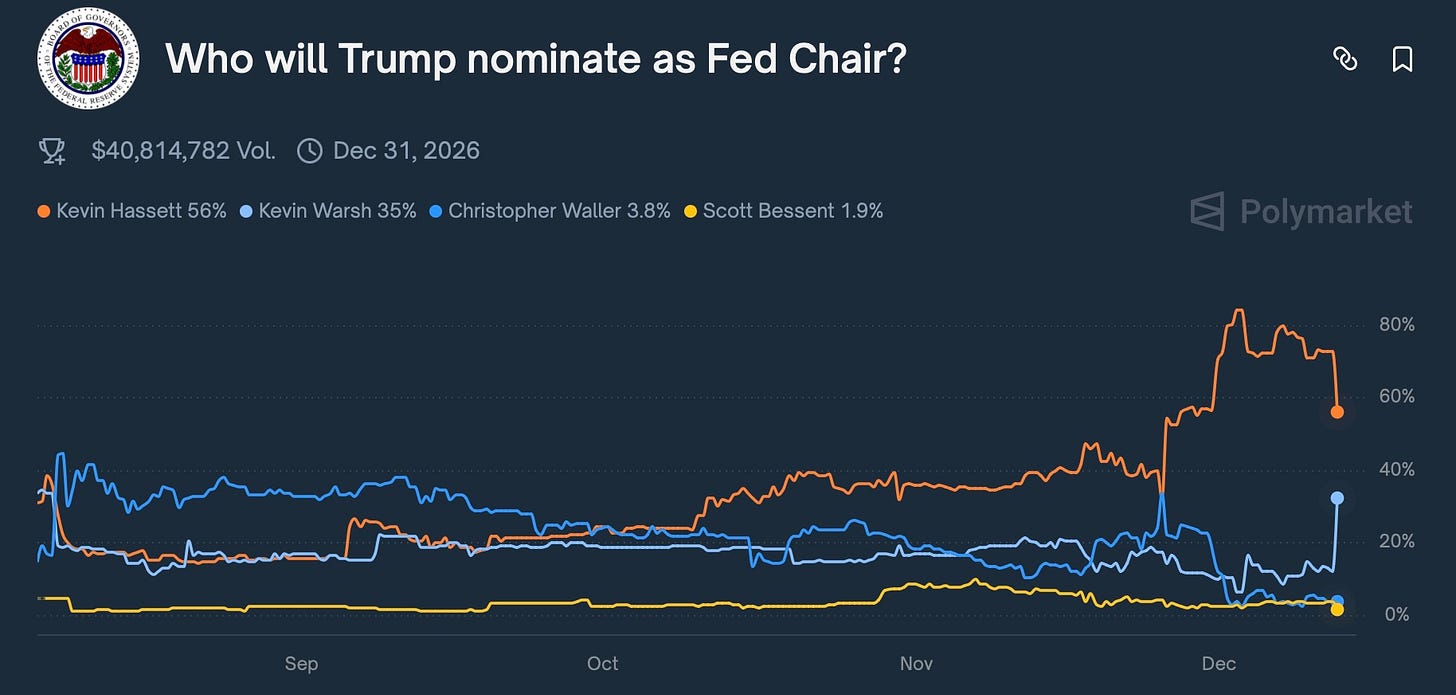

Moving along & before we jump further into the week ahead, with FOMC now out of the way, attention will shift back toward whom is Trump going to select for the next Fed chair.

As of now, it’s essentially been narrowed down to just Hassett & Warsh although Hassett still remains as the current favorite.