The Week Ahead 1/4/26

Hello All,

For starters, I wanted to wish you all a Happy New Year & start to ‘26 as we get ready to kick the new year off. Wishing you all plentiful & outlier returns & I truly appreciate the trust and engagement from you all & looking forward to an even better year ahead in 2026.

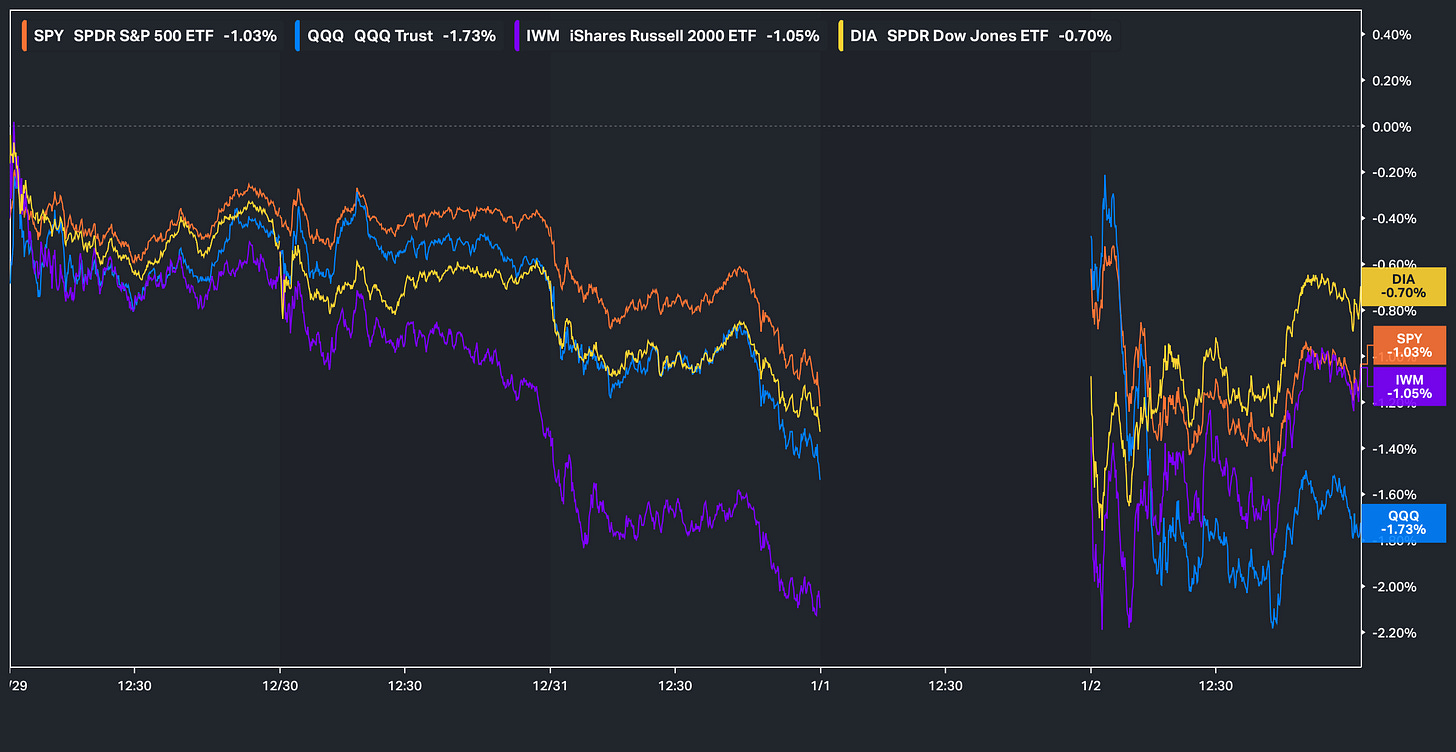

Looking back at this past week, it was a shortened one due to the holidays & action in general was quite lackluster along with volumes remaining subdued due to the holidays as well as the lack of economic data, but the Dow ended up being the ‘best’ performing of the indices on the week although still closed lower by 70bps whereas the Q’s were the worst performing of the indices, mostly attributed to the underperformance within the Mag-7 to round the week off, & the Q’s ended up closing lower by just over 170bps on the week.

- Economic Data for the Coming Week:

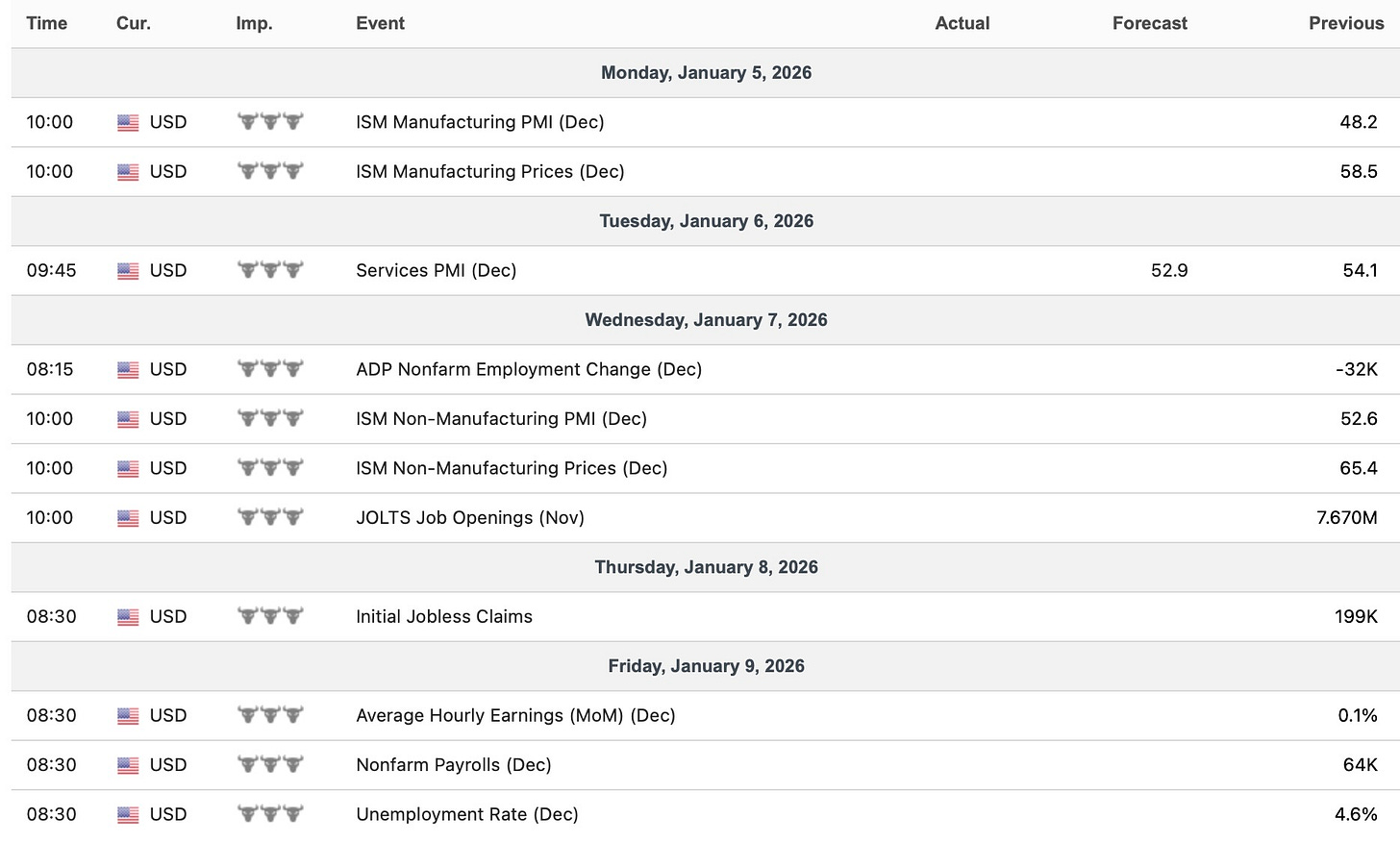

In regard to economic data into the upcoming week, we’re finally kicking off 2026 back into full swing with a mix of datapoints scattered throughout the week but most importantly, we have the December jobs report on this upcoming Friday & the bigger question revolving around the report will be if the UER makes yet another new cycle high & or if it instead starts to top out around these levels & then the feared economic slowdown slowly starts to shift toward a potential re-acceleration given the set of positive fiscal impulses into Q1.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 174.06% return whilst in the same period, the Q’s have returned 71.67% / Spooz has returned 62.83% / Dow has returned 49.60% & Small-caps have returned 42.14%, so nice outperformance against all the indices whilst having a 81.4% win rate, averaging a 26.08% return on realized gains / winners & a 15.12% loss on realized losses / losers.

Looking forward to the future & continued success as we kick off ‘26.

We recently published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as 2026 kicks off after coming off a strong ‘25 & for those whom would like to read the report, I included it just below:

Earlier in 2024, we launched a series titled Educational Pieces, covering a wide range of topics, many of which were suggested directly by you all (4-Part Series).

For those who may have missed the first installment, it covered topics including:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

A link to the original Educational Piece can be found here .

Given the positive feedback and how useful many of you found the first installment, we followed up with Educational Piece: Part Deux earlier in 2025 & for those who may have missed, a link to the piece can be found here & we then went on to release Educational Piece: Part Trois which can be found here.

And finally, the most recent installment, Educational Piece: Part Quatre, can be found here.

‘Risk management is the silent prerequisite for compounding & true wealth is built not by chasing the highest returns but by ensuring the survival necessary to realize them.’

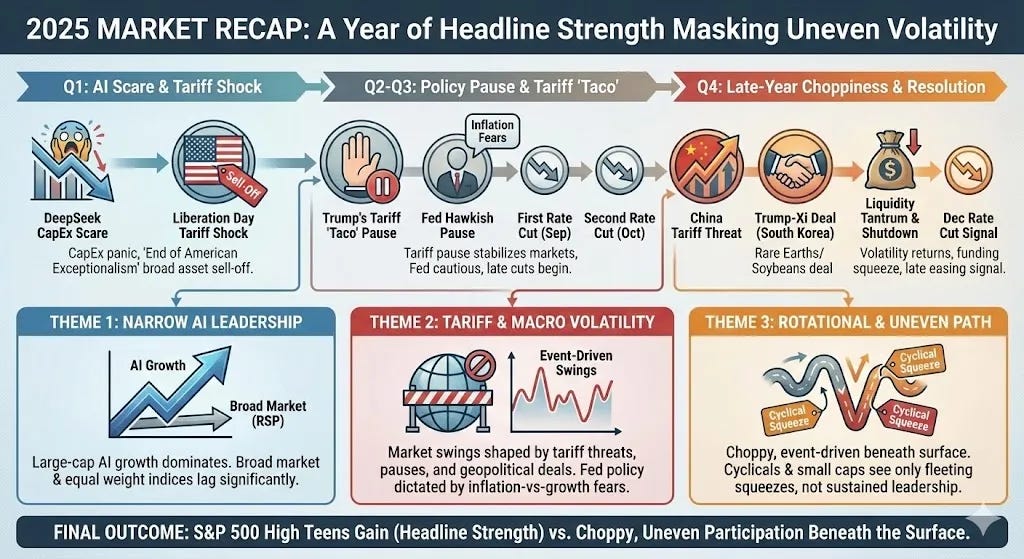

Before we jump into the week ahead, to briefly take a look back at 2025, whilst headline performance was strong as the indices all returned double-digit percentage gains on the year, the journey was anything but smooth & the year initially kicked off with a rough start. The markets were defined by sharp rotations and episodic volatility. The year initially began with the DeepSeek scare, which unsettled AI-exposed equities not due to true competitive threats, but from fears that hyperscalers might rein in CapEx and broader AI spending. That fragility then resurfaced around Liberation Day, when the announcement of aggressive reciprocal tariffs triggered a swift risk-off move, driven by concerns over growth, margins, and the resilience of global supply chains.

The growth scare that defined much of 2025 was not rooted in deteriorating labor markets or weakening activity data, but in policy anticipation. Markets reacted to the threat of aggressive tariffs and the fear that their implementation would slow growth, disrupt supply chains, and tighten financial conditions. As markets began to price in a more adverse macro path, positioning unwound abruptly leaving investors (HFs / Discretionary) very underweight equities & assets. Rather than rotating defensively, capital fled broadly across U.S. assets, with equities, bonds, and even the dollar selling off simultaneously. Liquidity thinned, correlations spiked, and for a brief window the market experienced a rare “nowhere to hide” moment that challenged the narrative of American exceptionalism. Stability only began to return once Trump stepped back from the most extreme tariff proposals, announcing a 90-day pause that eased immediate recession fears. Even then, the Fed remained cautious (Worries of Tariff-Inflation), holding policy steady for most of the year and delaying rate cuts until September and October, with a December cut only solidified very late in the cycle.

Throughout this volatility, AI remained the dominant and most durable equity theme, but leadership was exceptionally narrow. A small cohort of large-cap growth and AI-exposed stocks carried index performance, whilst participation beneath the surface stayed weak. Equal-weight benchmarks such as RSP materially lagged the S&P 500, and cyclicals, small caps, and value saw only brief, catalyst-driven squeezes rather than sustained trends. Late in the year, renewed China tariff threats sparked another volatility spike before easing following a Trump-Xi meeting and a temporary trade détente, lifting risk sentiment once again. The final stretch of the year was marked by a liquidity tantrum as the Fed initially resisted validating December easing expectations, compounded by a prolonged government shutdown.

In sum, 2025 was a year where headline index strength masked a market defined by rotations, policy shocks, and uneven participation, with AI as the primary constant and macro volatility shaping nearly every swing in risk assets.

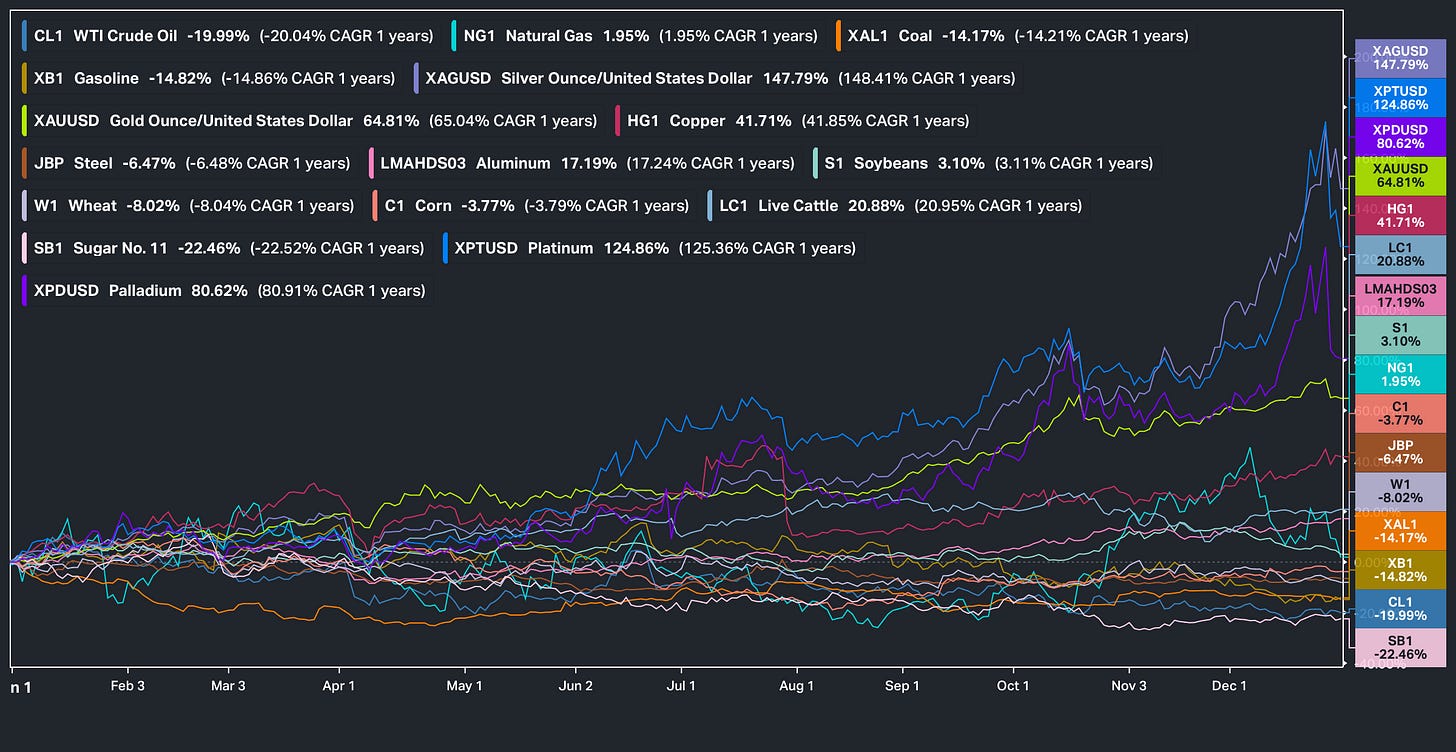

With that being said, despite AI dominating majority of the headlines in 2025, Hard Assets, specifically metals, turned out to be the best performing sector on the year then followed by Semiconductors whilst Real Estate, Consumer Staples, & then finally Bitcoin were among the worst performing sectors / assets on the year.

In respect to commodities, again, Metals were among the best performing of the group with Silver specifically being the best performing commodity on the year then followed by Platinum whereas Gasoline, Crude & Sugar were among the worst performing of the commodity group.

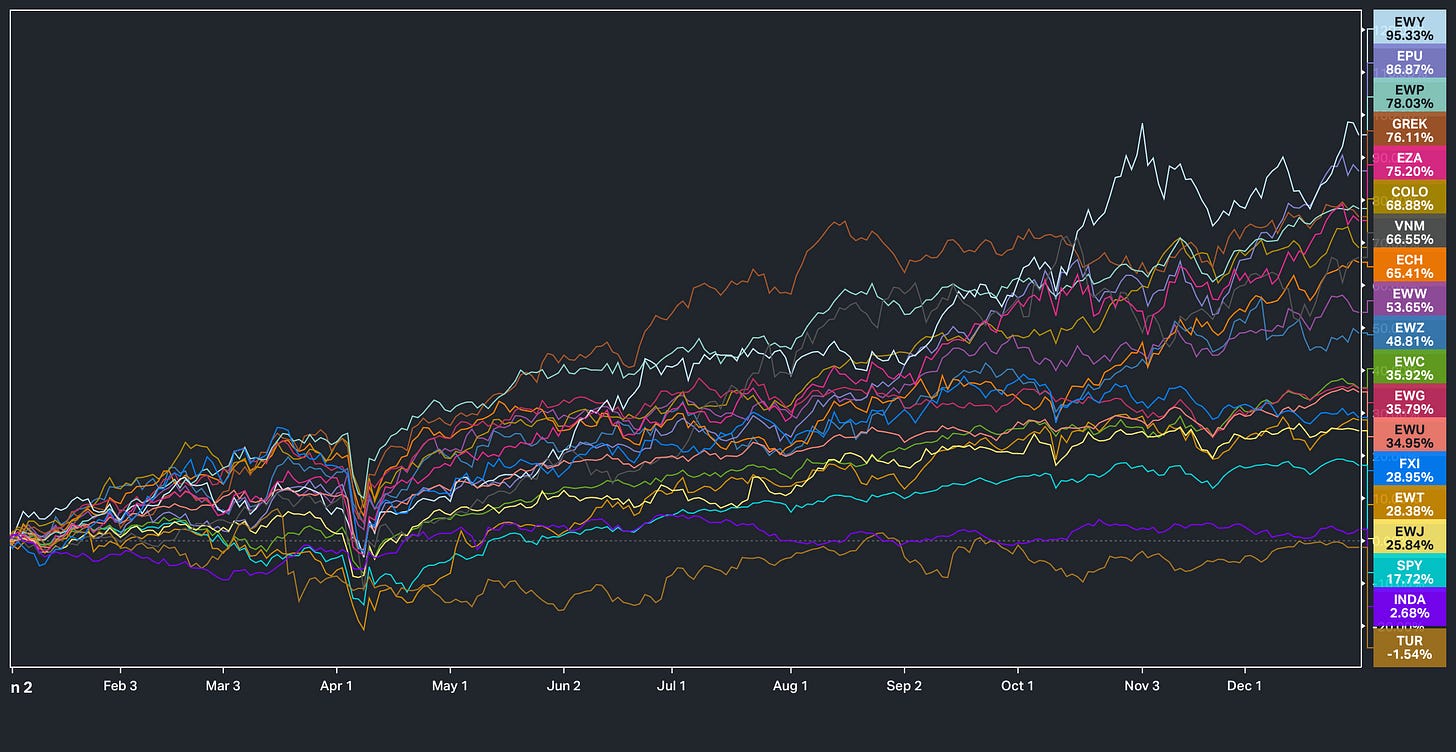

And then finally, following the challenged ‘American Exceptionalism’ mantra earlier in the year, it led to quite the outperformance amongst the Rest-of-World over U.S. equities as SPY for example, despite having closed higher by 17.7% on the year, was amongst the 3rd ‘worst’ performing country on the year with India & Turkey being the two worst performers.

On the other side of the spectrum however, South Korea closed higher by 95% on the year & was the best performing country YTD with Peru being a close second, closing higher by just under 87%.

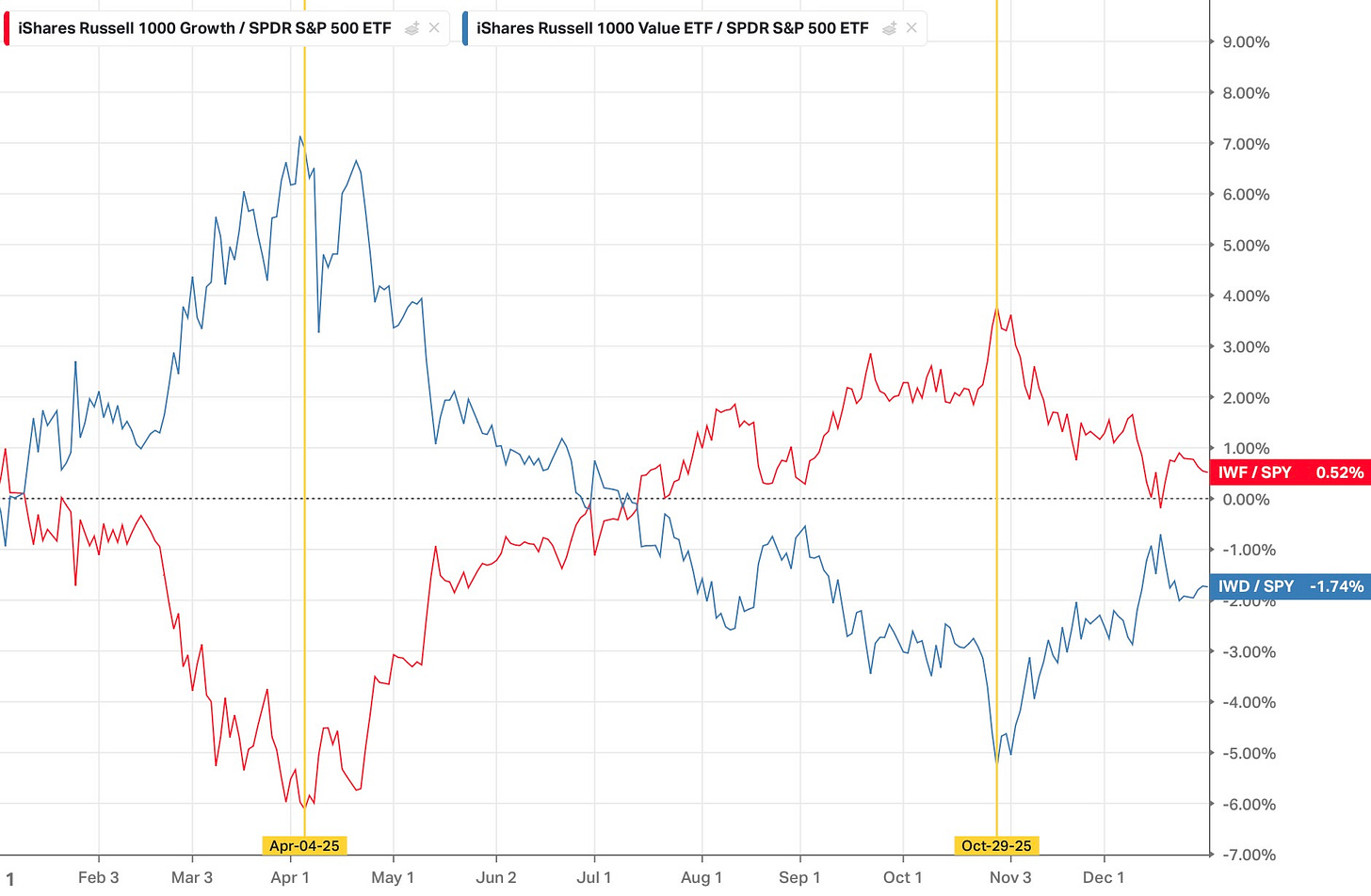

The last defining point worth touching on in recapping 2025 was the dramatic rotations that took hold. As the year initially kicked off, Value-oriented names outperformed Growth but that dynamic then topped out at THE Liberation Day bottom where Growth then went on to outperform Value for a sustained period but the dynamic then once again broke in late October in which Value-oriented names went on to outperform Growth & the dynamic essentially lasted into year-end as there generally wasn’t much risk appetite for Growth / Higher-beta / Momentum-driven names.

Moving along into the indices, despite Spooz closing out 2025 near the highs, underlying metrics in the shorter-term have started to encroach oversold territory as the % of Stocks Above the 20D for example is hanging around 41% after being nearly 75% just a couple of weeks back following the December FOMC meeting.

On a more broader time however, 53% of stocks still remain above the 50D which more so emphasizes that conditions, excluding the shorter-term, lean more neutral rather than overbought & or oversold.

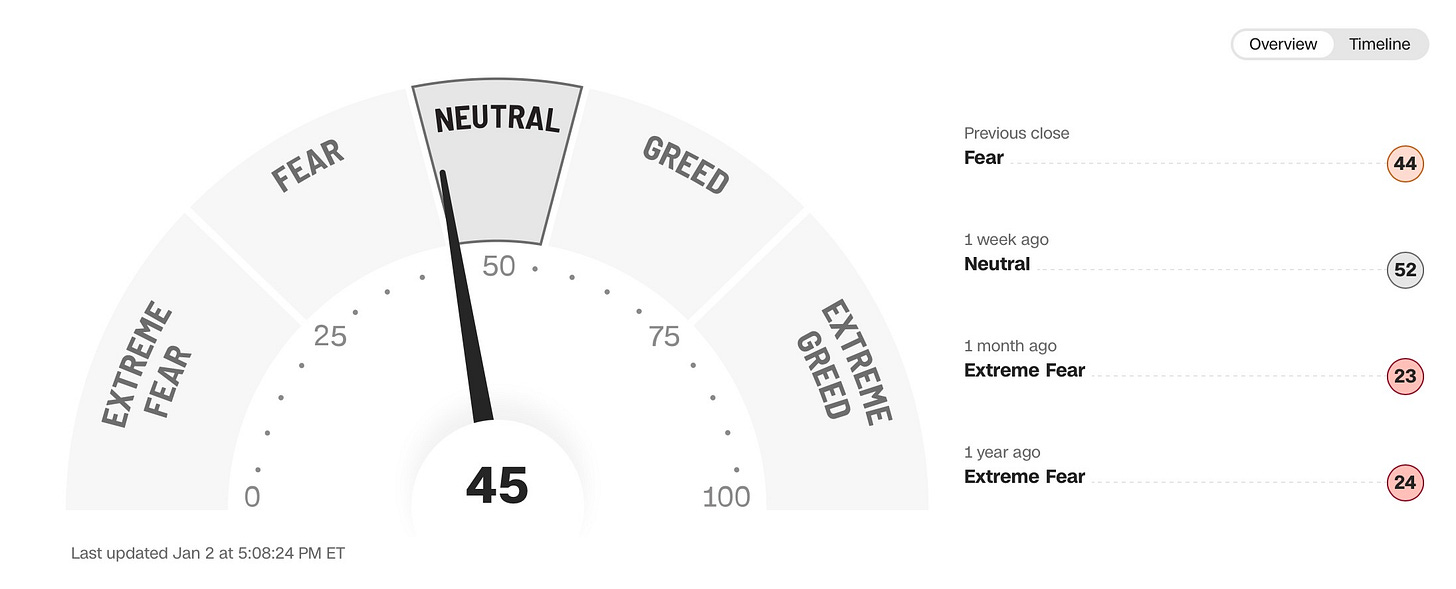

Having said that, even with Spooz & the general indices still sitting near the highs, the fear-greed index continues to paint a much more ‘tame’ dynamic as the fear-greed index is sitting just barely within ‘neutral’ territory which more so underscores the dynamic as we had highlighted above that underlying metrics still aren’t necessarily overbought & if anything, are instead more neutral on a broader timeframe (Shorter-term nearing oversold).

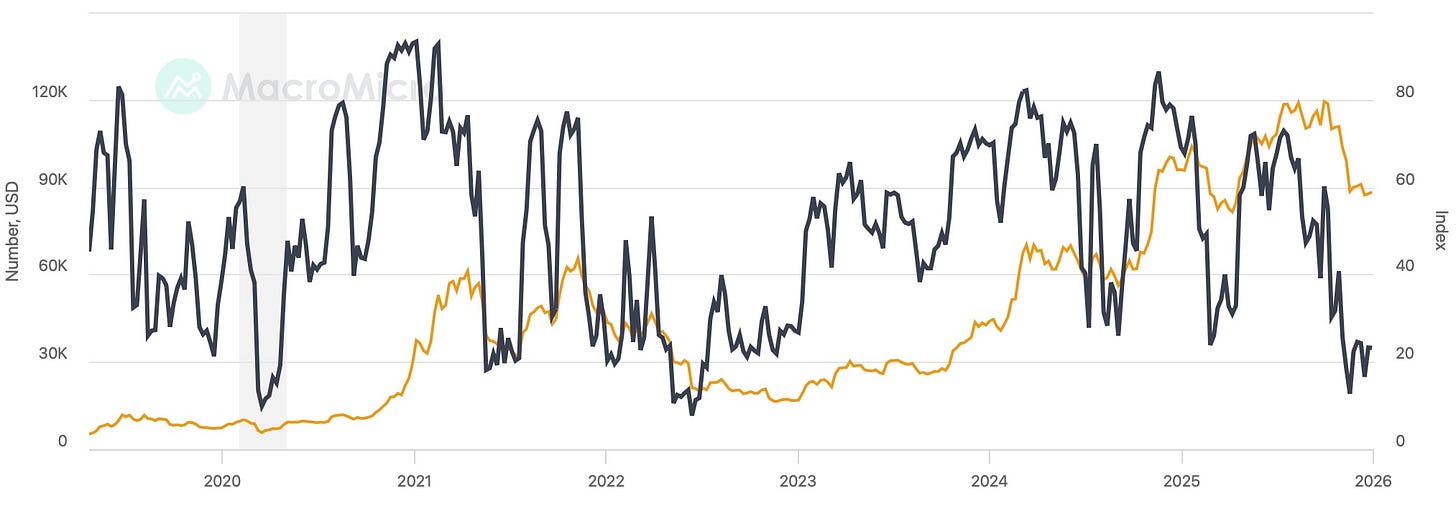

And finally, the last interesting dynamic worth highlighting is the recent & continued underperformance by Bitcoin (Crypto in general) & the recent unwind / correction has led to the Fear-Greed index to nearly encroaching the ‘22 Bear Market lows which more so highlights the carnage within Higher-beta / Momentum-driven names as well despite the indices being hardly off the highs:

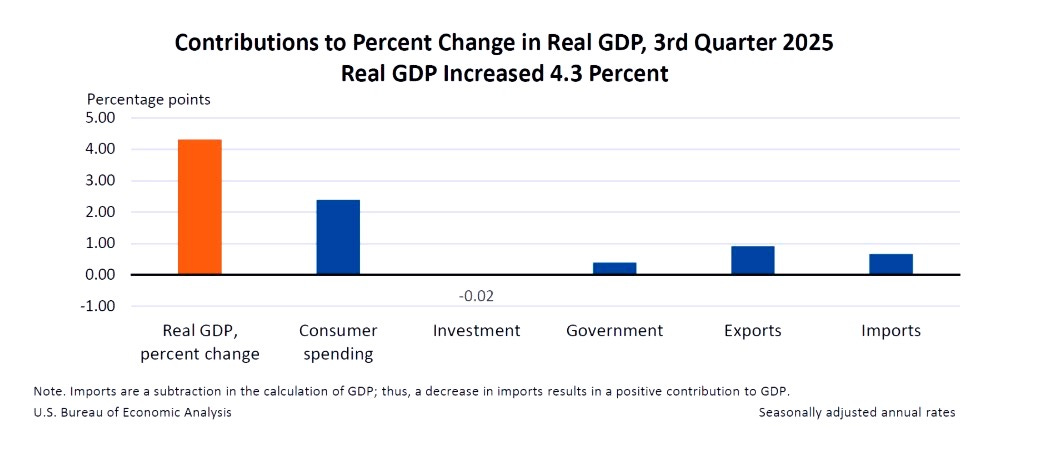

And before we jump into the remainder of the week ahead, to just briefly take a look back at these past couple of weeks in respect to economic data, although there isn’t necessarily much to recap, the one datapoint worth highlighting was the strong Q3 GDP report which came in at 4.3% vs. the 3.3% estimate. The biggest driver was consumer spending (+3.5%) along with a recovery in government spending whilst investment was the weak outlier.

The biggest conclusion however from the report is the narrative of AI CapEx being the ‘only’ reason that the U.S. economy is growing just isn’t the case & as 2026 kicks off, consensus in general is for CapEx spending to slow, but the question of the matter here is, what if it doesn't?

Moving along, into the upcoming week, again, economic data is back into full swing but the biggest report on the week will be the December jobs report on Friday & the question surrounding the report is if we see yet another new cycle high within the unemployment rate & or if it instead starts to fizzle out & revert back lower & then recent slowdown / recessionary concerns slowly start to shift toward potential re-acceleration expectations driven by the generally positive Q1 fiscal impulse / rebound in economic data following the government re-opening.

Nevertheless, a cut for January is priced as a 15% chance, so generally speaking, it isn’t expected but rate-cut expectations are still pricing in one more cut before Powell’s term comes to an end by the April FOMC meeting & then one additional cut into year-end. What's not priced in at all in 2026 is Trump getting his way, as again, only 2-cuts are priced in for the entirety of the year (Trump wants to lower rates every single FOMC meeting).

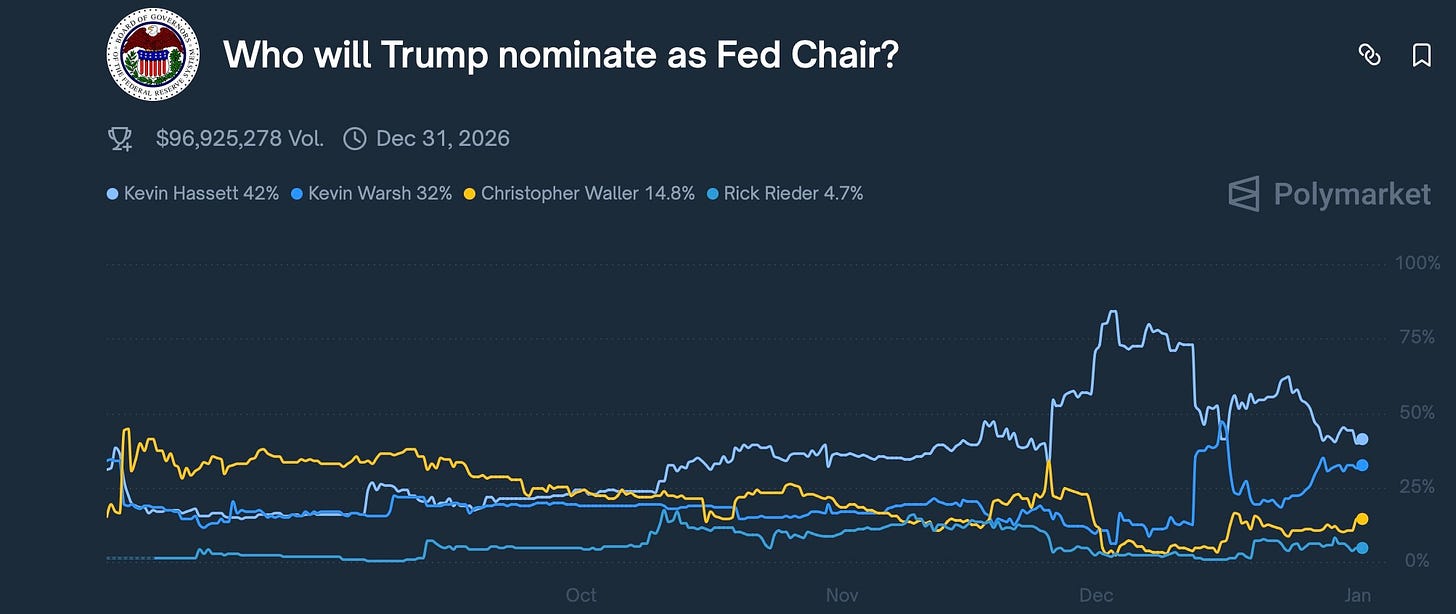

And speaking of markets not pricing in Trump getting his way, whats expected in January of the new year is the announcement of the new Fed chair, which as of now, Hassett still remains as the current favorite with Warsh as a close second then followed by Waller as the 3rd favorite.