The Week Ahead 2/16/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25.

We once again saw volatility persist this past week as the headline driven volatility continued as the uncertainties revolving around tariffs & policy in general remains… majority of the uncertainties initially stemmed from a Fox Business interview with Trump to kickstart the week over this past weekend & as the week progressed, the tariff headlines continued as the U.S. went back & forth with both Canada & Europe, although as we reached towards the end of the week, there was some positive progression between the U.S. & Canada which did end up leading to a snapback rally on Friday to round off the week.

Despite the snapback rally on Friday, the indices still had another rough week with the Dow being the worst performing index as it closed lower by just under 300bps whereas small-caps ended up being the “best” performing index on the week, although still managed to close out the week lower by just over 160bps.

- Economic Data for the Coming Week:

As we head into the upcoming week, its a fairly light week in regard to economic data as we just have retail sales on Monday along with the standard jobless claims report on Thursday, but the biggest event of the week is FOMC on Wednesday & no rate cut is currently projected for this meeting & as of now, the first rate cut of ‘25 is expected to take place in June & three cuts are still expected for the year… after initially markets were pricing in hardly one rate cut for the entirety of the year just in January.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 107.79% return whilst in the same period, the Q's have returned 35.44% / Spooz has returned 33.13% / Dow has returned 26.75% & Small-caps have returned 14.52%, so nice outperformance against all the indices whilst having a 80.7% win rate, averaging a 19.91% return on realized gains / winners & a 13.76% loss on realized losses / losers.

Looking forward to the future as progress through ‘25.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

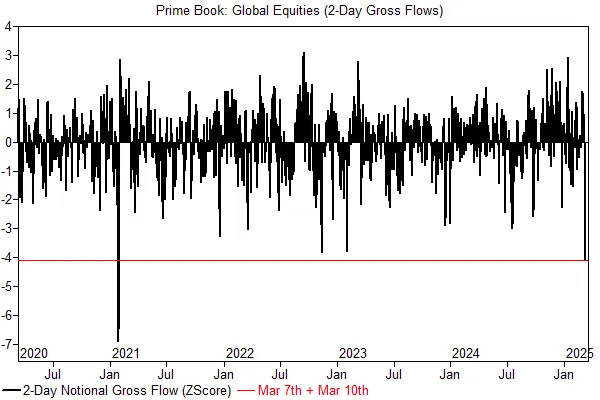

To recap this past week, we had quite the kickstart to the week with some volatility which mostly stemmed from continued uncertainties in regard to policy as Trump was interviewed on Fox Business & more so reiterated similar points: Tariffs may go up further / The economy is in a transition phase / Trump isn’t concerned with the stock market / The administration wants interest rates down etc… as a result, we had quite the deleveraging day on Monday & it ended up being the largest 2-day degrossing we have seen in the markets over the last 4-years.

It was once again another week with a plethora of headline volatility as well… a few standouts:

- Trump: I have instructed secretary of commerce to add additional 25% tariff, to 50%, on all steel and aluminum coming into the United States from Canada.

Earlier on in the week, tensions between the U.S. & Canada escalated as Trump started he planned to add an additional 25% tariff until…

- Trump: Looking at backing down on the 50% duties on Canada.

A fairly quick walk back as the flip-flopping continues…

- Ontario premier: Meeting with Lutnick productive

Temperature has dropped, Ontario Premier

So, some negative headline volatility in the beginning of the week given the heated discussions / the U.S & Canada going back & forth, but as the week progressed, the U.S. & Canada did make some progress in talks as read from the headlines just above & this week specifically will be more important as talks between the U.S. & Canada are supposed to continue… maybe a deal & or settlement will finally be reached.

In regard to economic data, inflation fears from earlier on in the year continue to simmer down as both CPI & PPI #’s came in softer than expected but the one cautionary flag was the read-through from PPI given certain components feed through PCE & they generally came in hotter than expected which caused PCE estimates to be revised up & more so acted as a bit of a headwind for bonds despite the generally positive inflation data.

In respect to markets, it’s been fairly clear that markets are oversold & are due for a potential countertrend rally & in regard to markets being extended to the downside, as of now, only 37% of stocks remain above the 200D… nearly back to levels not seen since the late ‘23 bottom.

In looking at Spooz below, we officially hit the 10% drawdown from ATHs mark, but the bigger piece of the puzzle is Spooz made its way back to the midpoint of the regression channel dating back to ‘18 which in general should be a fairly big area to pay attention too & as of now, it’s exactly where Spooz bottomed this past week.

Heading into this upcoming week, we have finally reached FOMC week & the big question more so boils down to whether or not we see Powell’s tune start to shift back towards a more dovish lean, as in January given the uncertainties in regard to the inflation rebound / questions revolving around a potential second wave, Powell more so tried to keep a middle ground, but recent inflation data along with this past PCE report was a bigger positive for the Fed, although I would imagine Powell would like a bit more confirmation that disinflation is resuming before fully committing to guidance on another rate cut, which as of now, the next rate cut is projected to materialize in June & 3 cuts are expected for the entirety of the year.

- SPY

In regard to Spooz, again, we officially hit the 10% drawdown from highs this past week & coincidentally, it ended up marking the bottom in the markets (for now at least). Given the progression headlines between the U.S. & Canada late last week, we ended up getting a snapback rally on Friday as Spooz closed the day up over 200bps, but despite the rally, Spooz still closed the week out lower by 215bps… mostly attributed to the large drawdown day on Monday.

It still seems fairly clear that the markets are looking for any sort of headline to rally on & if we were to see more positive developments between the U.S. & Canada this week alleviating some of the recent uncertainties regarding policy, that should be further fuel for a countertrend rally to unleash & do think a countertrend rally could take Spooz back towards 5850 / 5900ish above… from there, the question more so boils down to if thats the spot to look to degross longs / start getting short & or if the path to new ATHs will emerge… again, it likely will boil down to uncertainties regarding policy & or if things have cleared up or more so stayed the same (this past week, it did seem like we nearly reached the breaking point & individuals surrounding the admin are getting antsy for a settlement).

On the contrary, if we were to see Friday’s rally unwind as the uncertainties surrounding policy persists, maybe we end up seeing Spooz flush lower to retest the September lows near 5400ish & thats assuming things escalate fairly aggressively, but in general, am anticipating a countertrend rally & IF this is indeed a bear market (I’m not sure I would call it a bear market as it has been self-induced by uncertainties surrounding policy & any sort of clarity will likely be taken as a bigger positive by marketst), but bear markets have some of the most violent countertrend rallies out there.

- QQQ

The Q’s had quite the snapback this past Friday, although still ended up closing the week lower by just over 230bps, but as of now, the Q’s did find support off this TL that initially was established in the beginning of ‘24 & has acted as support in three other instances prior & if the Q’s can get followthrough to the upside this coming week, we should see confirmation of a breakout out of the steep downtrend that kicked off back in Mid-February thus unleashing a countertrend rally.

Earlier on this past week, we did see the Q’s fill the gap from this past September in ‘24 & as of now, the Q’s have found support / demand in that general area & do continue to think that 465 / 470ish on the Q’s is a fairly important pivot & given the Q’s still remain well within oversold territory, although it doesn’t need to be said, the Q’s are due for a snapback rally & if we were to get followthrough to the upside into this upcoming week after the rally from this past Friday / break out of the steep downtrend, I do think that starts to set the stage for the Q’s to at least go on and backtest the 200d above near 493ish & if it were to be reclaimed, we likely would see the Q’s work a bit higher towards 496 / 501ish above before potentially pausing / digesting the recent snapback & then more so the question remains whether or not this is a lower higher within a potential bigger respective downtrend & or if the trek to new ATHs persists.

On the contrary, if we were to see bulls fail to get followthrough to the upside & Friday’s rally fully unwinds, it may lead the Q’s to flush towards the earlier on September ‘24 gap just below these prior local lows near 456ish which just nearly coincides with the September ‘24 higher low bottom as well after forming the bigger bottom in August ‘24 (Carry trade unwind bottom)… given Fridays rally & the Q’s still remaining well within oversold territory, this certainly isn’t a base case, but do still think bulls need to see some followthrough to the upside to solidify a potential countertrend rally.

In respect to a countertrend rally, again, it really does all boil down to the recent & continued uncertainties regarding policy & whether or not a universal settlement on tariffs can be reached & or if we haven’t quite reached that point just yet… does continue to feel like participants are getting antsy on that end & as we rounded off this past week, there was headlines out of Canada stating that things are moving the right direction & there is supposed to be more talks between the U.S. & Canada this week & IF some sort of deal can be reached & or solidified for longer than a day, that should be bigger fuel for quite the snapback rally as some of the recent uncertainties regarding policy start to clear up.