The Week Ahead 3/23/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 as we nearly look to wrap up Q1.

Last week was a fairly quiet week in respect to economic data & headlines, but we did finally have FOMC & to all surprise, the markets more so closed out the week well contained within the range in which they opened up at on Monday. The Dow & the Q’s were “best” performing indices on the week, granted, the Dow essentially closed flat, whereas the Q’s still closed out the week lower by 67bps & the worst performing index on the week was small-caps as they closed the week out lower by 85bps.

- Economic Data for the Coming Week:

Looking ahead into the upcoming week in respect to economic data, the biggest event of the week is PCE #’s on Friday & as of now, headline PCE is expected to remain unchanged from the prior month at 2.5% whereas Core is expected to rise to 2.7% YoY vs. 2.6% the prior month. Other then that, we have a mix of economic data throughout the week including PMIs / Jobless Claims & GDP revisions along with some other sporadic datapoints in between too.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 108.62% return whilst in the same period, the Q's have returned 35.77% / Spooz has returned 33.40% / Dow has returned 28.05% & Small-caps have returned 15.29%, so nice outperformance against all the indices whilst having a 80.5% win rate, averaging a 19.84% return on realized gains / winners & a 14.13% loss on realized losses / losers.

Looking forward to the future as progress through ‘25.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

To recap this past week, it was generally a bit of a quieter week in respect to market-moving headlines / economic data & arguably the biggest headline came on Friday out of Trump:

Trump: There will be flexibility on tariffs. Basically it's reciprocal.

Probably the most constructive headline we’ve had out of the current administration in regard to April 2nd / Liberation day… Trump stating the U.S. will have flexibility on tariffs is a bit of a walk back along with the statement of reiterating that tariffs are reciprocal… So if Country X doesn’t enact / removes tariffs against the U.S. & or reduces %, the U.S. will match that… plenty of room to negotiate as well, as once again, Trump stated there was flexibility on the subject.

In terms of economic data, again, it was a bit of a quieter week but we did have retail sales on this prior Monday which did come in a tad softer than expected, but the bigger factor / story was the surge in control group (+100bps) as it directly feeds through GDP… more so one of the more positive economic datapoints.

Last week was also FOMC week & nothing necessarily groundbreaking happened… the Fed held dots at 2 cuts for ‘25 & the decision was mostly due to the uncertainty revolving around tariffs as there was initial speculation that the Fed may include 3 cuts for ‘25 but that wasn’t the case. Another big factor which was a bit unexpected this meeting was QT was tapered significantly from 25B to 5B… essentially a near end / pause to QT. Heading into the meeting, majority consensus was calling for a hawkish Powell & that just wasn’t the case… BUT, the Fed did revise growth expectations lower along with inflation expectations up, and again, it was more so attributed to recent uncertainties surrounding tariffs whereas long-term inflation expectations remain well anchored & hard economic data in general continues to come in better than expected. The Fed still remains in “wait & see” mode & would still like to see further confidence that inflation is on its last leg / disinflation is resuming before initiating further rate cuts.

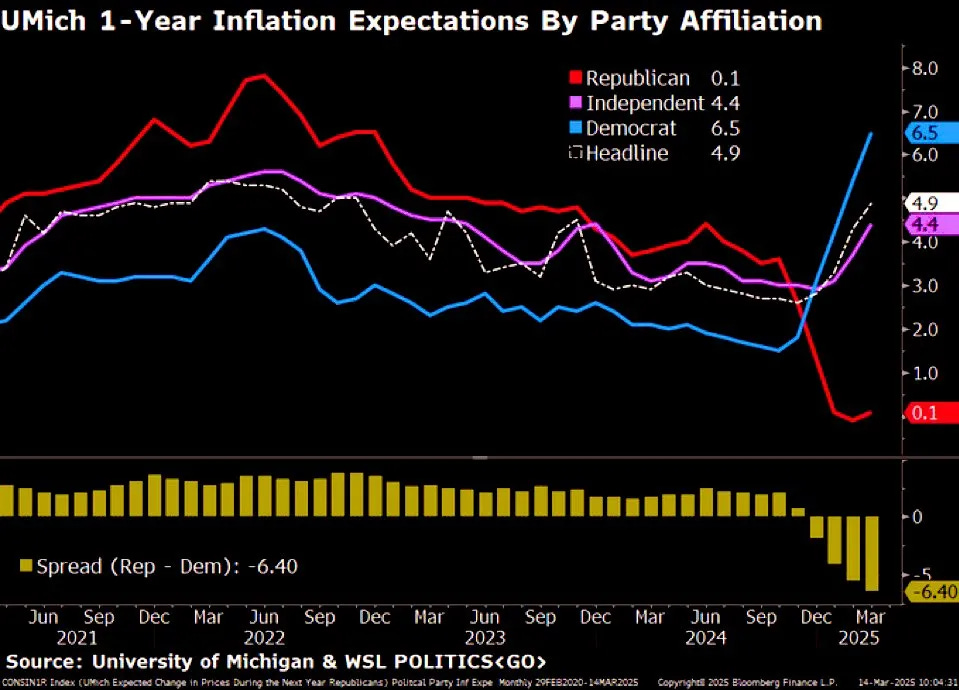

One of the other bigger pieces of the meeting was Powell once again calling inflation “transitory” whilst also completely dismissing recent survey data… the other week, we had a UMICH survey which showed a large rise in 1-YR inflation expectations & it more so shows how partisan these surveys have become given the large skew between both Republicans & Democrats. Powell then even went ahead to refer the survey as an outlier & once again reiterated that the relationship between surveys & actual hard data hasn’t been tight at all & or more so hasn’t had much of a correlation. Again, Powell was generally received as dovish whereas the FOMC statement / dots were received as slightly hawkish.

Well, since we’ve made it through FOMC, what’s next? Into this week, the biggest event of the week is PCE #’s on Friday & given the read-throughs from the prior CPI & PPI reports as components within the reports that feedthrough PCE came in hotter than expected, it has led to PCE estimates being revised up & as of now, headline PCE is expected to remain unchanged at 2.5% whereas Core YoY is expected to tick up to 2.7% vs. 2.6% prior.

The other bigger event, although not next week, is once again April 2nd / Liberation day which is when reciprocal tariffs are supposed to be enacted. There has been a plethora of uncertainties in this market given the lack of clarity from the current administration, but as we mentioned earlier, Trump did waver a bit on Friday by stating that the U.S. will remain flexible on tariffs (open to negotiating). The one interesting aspect in terms of measuring recent uncertainties can be seen with the chart below & not much else needs to be said… the question being, what happens if the uncertainties aren’t warranted / we see a quicker resolve & or some clarity around policy? Probably not bearish risk assets.

- SPY

In looking back at this past week in respect to Spooz, the one cautionary signal is the continued failure by bulls in terms of looking to reclaim & work into the bear-gap above… the bear-gap was initially established two weeks ago (10th of March) when we had the big gap-down due to the uncertainties post Trump’s Fox business interview & ever since, the gap has now been tested 3 times & the bulls have failed each time to work up into the gap & fill it above… I would argue the bear-gap along with the 200d sitting just above is the bear’s edge at this given moment.

A counter-point for the bulls is since Spooz bottomed a couple weeks back, higher lows & higher highs have continued to be established… question from here being if a higher high once again gets established & takes us up into the bear-gap above.

To zoom out a bit on the weekly, I do still think it’s worth noting that this most recent local low in Spooz coincided with the midpoint of this regression channel dating back to ‘18 & in general, do still think its a fairly big area to pay attention too… especially considering the reaction we have seen thus far off the pivot point (170 handle rally off the midpoint of the regression channel).

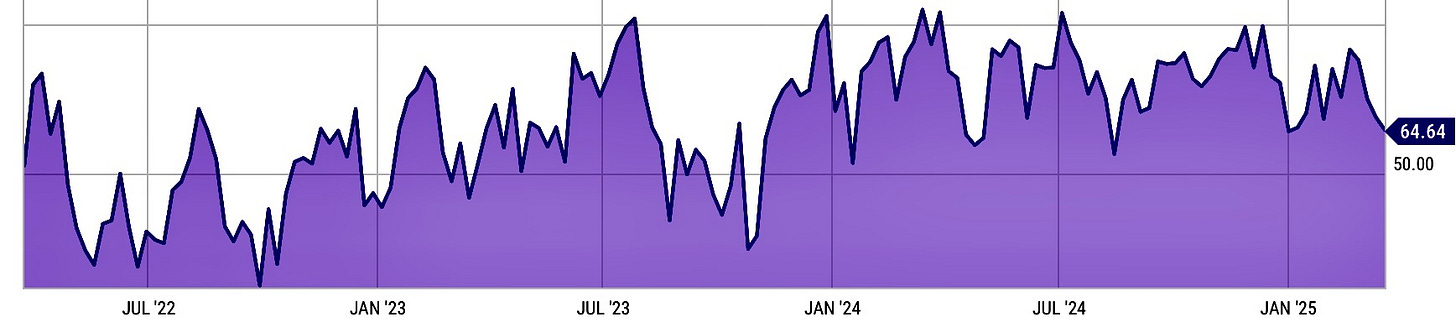

One relative datapoint I thought was worth mentioning is the recent decline in the NAAIM exposure index… not necessarily a surprise given the degrossing we have seen amongst equities. NAAIM is essentially sitting right around the ‘24 lows & the bigger key here is NAAIM went from 100+ to 64 in a month, which more so reiterates the recent deleveraging that we have seen (Again, what happens if recent uncertainties turn out to be unwarranted / Liberation day goes smoothly & economic data in general continues to hum along… certainly not a consensus scenario but one probably worth thinking about and remaining open-minded).

As we look ahead into next week, again, we have seen Spooz form higher low after higher low since the rebound off the lows a couple weeks back but again, we do need to see bulls firm up above 5700ish to start to fill the bear gap above & ultimately look to reclaim the 200d as I do think we could see Spooz rally towards 5850 / 5900ish above in a continued countertrend rally… from there, the question more so boils down to if thats the spot to look to degross longs / start getting short & or if the path to new ATHs will emerge.

On the contrary, if we were to see recent uncertainties persist revolving around tariffs & this recent rebound more so plays out as a bear flag (after the constructive action this past week, it doesn’t necessarily look to be that way, but still worth remaining open-minded), I do think we could end up seeing Spooz flush lower to retest the September ‘24 lows near 5400ish & thats assuming things escalate fairly aggressively from here… certainly not impossible given how markets have reacted to recent headlines, but in general, if uncertainty in markets persist, do expect volatility to persist right there with it as well.

- QQQ

Heading into this upcoming week, the Q’s are in a similar position as is to Spooz, but as of now, the Q’s failed on the upside in three instances this past week at the highlighted bear-gap above from a couple weeks prior as bears continue to remain firmly in control & ultimately, to get some sustainable upside, the Q’s need to look to enter & firmly reclaim the bear-gap above sooner than later.

One of the bigger positives as of late is the Q’s did end up finding support off this TL that initially was established in the beginning of ‘24 & has acted as support in three other instances prior whilst the Q’s have also broken out of their respective downtrend that kicked off back in February… now its more so a question of if the Q’s are bear-flagging before resuming back lower & or basing before starting to trek back higher & reclaim key MAs above.

As we talked about above, but the key thing for bulls is we do need to see bulls find a way to work up into the bear-gap above to start to work back up towards the 200d (494ish), where ultimately if firmly reclaimed, I do think we could see the Q’s try and stage a rally up towards the 501 / 508ish range above as more so a backtest of this recent bigger breakdown that led to this extended decline. From there, it’s more so a question of if the Q’s potentially pause / try & digest the recent snapback & if the Q’s then continue on to trek higher & start to work back towards ATHs & or if it turns out to be a lower high within a potential bigger respective downtrend.

On the contrary, if we were to see bulls continue to fail at the bear gap just above & remain under pressure with each and every pop continuing to get sold, it ultimately may lead the Q’s to flush towards the earlier on September ‘24 gap just below these prior local lows near 456ish… not necessarily a base case, but again, if the Q’s continue to fail at the bear-gap above & buyers can’t sustain an upside pop, I don’t think it can necessarily be ruled out & it’s still worth remaining openminded… especially with how reactive / headline driven this market has become & it evidently goes both ways.

In respect to Mag-7, although action has been quite lackluster as of late & has more so remained a drag on the Q’s, MAGS did close out the week with a double weekly hammer… buyers have clearly stepped in at this support TL dating back to late ‘23 & now its more so the followthrough to the upside that is needed into these coming weeks to provide that relief / countertrend rally to work off these recent oversold conditions

A double weekly hammer is quite a rare & strong signal & I included a couple of interesting statistics below on the subject:

- Historically speaking / prior backtests show that 6-month returns after a double weekly hammer average between 10–25%, especially if volume increases and broader trend indicators confirm a reversal.

- Quant-focused backtesters have shown that stocks posting two consecutive hammer candles on weekly timeframes after a downtrend outperform the baseline market by 1.5x to 2x over the next 3–6 months, assuming the trend reverses.

Is Lag 7 about to turn into “We’re Back” 7?

One of the Mag-7 names with a clear risk-reward is AMZN. Again, similar double weekly hammer setup as to MAGS, but the double weekly hammer also coincides with the upward parallel channel that has remained intact since late ‘22 when it was initially established & the highlighted demand zone just below also coincides with the ‘21 highs so quite a bit of supportive confluence.

Risk on the setup essentially being a firm loss of the channel / highlighted demand zone below along with the 100wk (complete invalidation of the double weekly hammer), with interim and extended targets above for a 2.74 risk-reward ratio (long against 175 to target 252).

If wanted to express via options, for a bit of a short-term bet to play a rebound, 5/25 205/225C spreads for around 5.00 with max risk being the premium paid & max gain being around a 4X as a fairly good expression to capture a shorter-term rebound.

A bit of a bonus, but after this past week, AMZN is now trading at a cheaper valuation comparatively to WMT… not quite sure I agree with that view.

- IWM

Small-caps are a bit of a different story as unlike the Q’s & Spooz, small-caps don’t have a bear-gap above (slight positive edge for bulls). As we’ve discussed prior but the other edge small-cap bulls currently have is as of now, small-caps produced a look below and fail of the 200wk (very constructive look) whilst also backtesting the 2+ year base breakout which is initially what kicked off the ‘24 rally… fairly simple, but this general area of confluence is essentially the Bull’s LIS & as long as it remains supported, a countertrend rally / reversion of some sort is likely.

The biggest event of the upcoming week is PCE #’s on Friday & as of now, headline PCE is expected to remain unchanged at 2.5% whereas Core is expected to tick up to 2.7% YoY vs. 2.6% the prior month… not necessarily unexpected & is currently a wide consensus given the past CPI & PPI reports as components within those reports that feed through PCE came in hotter than expected which has caused upward revisions for this PCE report, so in general, the bar is a bit higher for an upside beat & lower for a surprise to the downside.

In terms of this past week, Small-caps did have a bit of a softer close & arguably are trying to breakdown in this bear-flag formation, so in general, it’s an important week ahead as maybe Friday’s breakdown leads to a false one… & or maybe we’ll see followthrough to the downside… likely remains data-dependent along with the general uncertainties still revolving around tariffs / Liberation day (reciprocal tariff day on the 2nd of April).

If we were to see small-caps produce a false breakdown of this interim bear-flag & revert back higher, we still need to see IWM go on to firmly reclaim the 20d above (rejected twice this past week). If we were to see small-caps reclaim the 20d above, we should see IWM retreat upwards towards 209 / 212ish above to fill the gap from earlier on in March before potentially pausing & resuming lower & or if data abides / growth scare & or fears continue to simmer down along with disinflation resuming, we likely could see the small-cap rally sustain & have holding power.

On the contrary, if we were to see this most recent rebound in small-caps fail / IWM sees followthrough to the downside out of this interim bear-flag, we likely will see IWM go on to backtest the 200wk / August ‘24 lows once again & if those lows were to fail to hold, we likely would see further reversion in small-caps down towards the low / mid-190s which essentially coincides with the early ‘24 lows & really marked the bottom for the year in ‘24… I would be a bit surprised if we were to see that outcome / those lows below cave in as we likely would need to see some sort of surprise in markets whether it be weak economic data to stir up recession fears & or recent uncertainties regarding policy continuing to persist with no resolve in sight… (again, not base case, but still is worth always remaining open-minded).

- DIA

The Dow ended up being the “best” performing index on the week, granted, it ended up closing the week out essentially flat / lower by 8bps. For obvious reasons, not too much has changed on the overall picture, but as of now, similar to small-caps but DIA started to briefly break below this interim bear flag as it rejected the 200d above in a few instances this prior week… fairly simple, but if we were to see bulls firm up above the 200d, I do think we could see DIA push further to the upside towards 425 (20d) / 430ish before then pausing & or deciding where to go from there. If the countertrend rally were to extend, again, the biggest question as we’ve discussed is if it will be a rally to sell into / degross longs & start to look to add shorts & or if the trek to new ATHs continues… still continues to depend on recent uncertainties regarding policy getting resolved / economic & or labor market data continuing to hold up as well.

On the contrary, if we were to see DIA continue to reject the 200d like we did this past week / failing to firmly reclaim & sustain above 420ish, we likely will see this interim bear-flag play out potentially leading to either a higher low & or a retest of the local lows from a couple weeks back, but IF we were to see those local lows below falter as support, the next bigger line of support is around 402 / 400ish which coincides with the September ‘24 lows.

Still is a bit make or break here for indices… Spooz & the Q’s both have respective bear-gaps above whereas the Dow & Small-caps are both struggling to sustain upside & are potentially working on interim bear-flag breakdowns… an important next two weeks for markets ahead.