The Week Ahead 3/30/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 as we nearly look to wrap up Q1 & get ready to head into Q2.

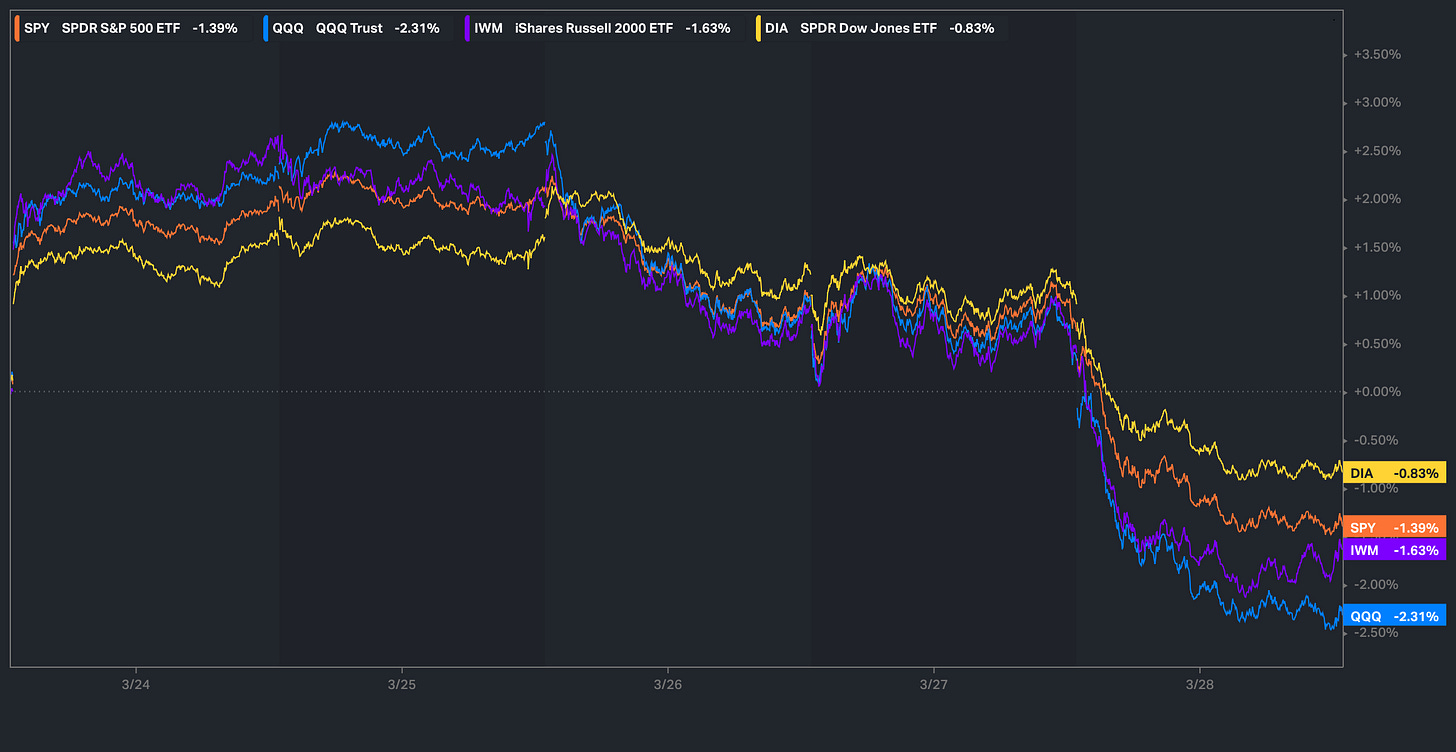

This past week was relatively lighter in respect to economic data & as the week progressed, majority of the losses were attributed to the unwind within the Semi / AI trade due to bearish notes out of TD Cowen / Downgrade from Goldman on the entire AI complex & sure enough, it led the Q’s to be the worst performing index on the week whereas the Dow was the “best” performing index on the week, granted, it still closed the week out lower by just under 85bps.

- Economic Data for the Coming Week:

In respect to economic data for the upcoming week, we do once again have a plethora of jobs data which will be interesting given recent slowdown / recession worries continuing to amplify… we of course also have Liberation day on the 2nd of April & no one really knows that to expect… there’s been walk-backs & then reversals of the walk-backs & in general, it likely boils down to whether or not this is an event where uncertainties simmer down / we see some sort of clarity which would be generally positive for the indices & would likely lead to another countertrend rally & or if the uncertainties persist / no resolve on clarity in terms of policy & that likely would be a contributor for the indices to then go ahead & work lower & ultimately make new local lows.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 107.01% return whilst in the same period, the Q's have returned 32.61% / Spooz has returned 31.83% / Dow has returned 27.08% & Small-caps have returned 13.40%, so nice outperformance against all the indices whilst having a 80.2% win rate, averaging a 19.96% return on realized gains / winners & a 14.10% loss on realized losses / losers.

Looking forward to the future as we progress through ‘25.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

To recap this past week, it was fairly quiet in respect to economic data, but the headline & general volatility within the indices remained… the week initially kicked off with quite the gap up amongst indices due to the following headline below… the headline was essentially seen as a bigger walk-back by the administration leading up into Liberation day, but the early week upside ended up being rather short-lived.

Following into Wednesday of this past week, there were a few specific negatives in regards to the AI / Semi trade simultaneously released as there was a note out of TD Cowen (Bearish comments on AI Infrastructure / Recycled comments about MSFT cancelling Data-center Lease) / Goldman downgrading the AI complex & lastly, the Alibaba CEO stating that the recent excitement revolving around data-centers is a bubble… hence in return, we saw Semis / AI Infrastructure names post quite the unwind this past week which more so led & contributed towards general risk-off action amongst all of the indices. The one interesting part about all of this is the TD Cowen note was nearly identical to the one in February & Microsoft went ahead & denied the claims & here we are again with a very similar headline, but the market more so remains in shoot first ask questions later mode.

As the week progressed further, we did get an update from Trump in regard to tariffs as he stated he plans to impose 25% tariffs on all cars not made in the US whilst also stating that he will be doing tariffs on pharmaceuticals and tariffs on lumber as well. Trump stated auto tariffs are going into effect on April 2nd and will start being collected on April 3rd. The markets initially didn’t react TOO negatively to the headline although I think the following headline below likely contributed towards the “positiveness” within the recent tariff headlines:

Trump: “We're going to make it all countries, and going to make it very lenient. I think people are going to be very surprised. It'll be, in many cases, less than the tariff that they've been charging us for decades."

Trump once again more so continues to reiterate that the U.S. will be lenient on reciprocal tariffs (stated U.S. would be flexible the prior Friday before this past Friday) & then the bigger surprise stated was that the tariffs will be less than what the U.S. has been getting charged for decades. I think the market more so viewed this as a “less harsh” outcome as at first, reciprocal tariffs were supposed to match Country X % & the U.S was essentially matching the tariffs (reciprocal) but in this case, Trump stated tariffs will be less than what the U.S. has been getting charged (complete walk-back of the meaning of reciprocal).

Naturally, there was retaliatory comments out of both the EU & Canada & Trump responded as below:

Fairly simply stated but if Europe & Canada retaliate, it’ll only be that much worse in regard to reciprocal tariffs from the U.S… Trump likely firing a warning shot at both Canada & EU, although if the reciprocal tariffs were implemented, I’d be shocked to not see both Canada & EU scramble to make a deal given the likely economic pain it will cause them both if they don’t move quick although as the week rounded off on Friday, we did see positive comments out of Carney (Canada) in regard to the U.S. being cordial / be willing to listen & negotiate & then in respect to the EU, there was a headline stating the EU has identified concessions (compromises or trade-offs) to try and establish a deal before Liberation day.

In respect to economic data, again, it was a relatively quieter week in that aspect, although to round off the week, we did have PCE #’s which headline came in unchanged at 2.5% whereas Core ticked up slightly & came in above expectations & the bigger concern from Fed officials more so boils down to the lack of progress in inflation this past year… we did also see slowing of consumer spending hence the market more so shifted to slowdown / recession worries as despite the firm / stubborn PCE print with Core ticking higher as well, we saw bonds instead catch a bid as the market more so looked through the interim noise on inflation & instead continues to shift focus towards a slowdown / potential recession as the bigger risk here at this given moment.

Continuing on into Friday, shortly after market open, consumer sentiment data was released & it was notably weak as concerns about a slowdown / recession were more so reinforced as current sentiment levels are back near the ‘22 lows. At the same time, inflation expectations surged, but as we have discussed prior, it's difficult to place too much weight on these surveys, as they've become increasingly partisan and disconnected from reality as recent hard data continues to outperform expectations, while soft data like sentiment surveys has been poor—making these surveys more noise than signal for now… even Powell stated that UMich surveys are likely to be outliers.

Heading into the upcoming week, as we all know but Liberation (Tariff) Day is on April 2nd (Wednesday), but besides that, we do have a plethora of job data this week which will be quite important given markets continue to shift towards slowdown / recession worries & the avg. % in regard to recession probabilities for ‘25 has surged to 40%… the uncertainties / lack of clarity revolving around policy continue to weigh in on markets as hard data in general has continued to hold in better than expected despite survey data being quite awful, but again, hard to give TOO much weight to surveys given how partisan they have become…

Lastly, over the weekend, we did get a negative headline out of the Washington Post as shown below:

The general gist of the article suggested that individuals around Trump have tried to convince Trump to take a more relaxed / sensible approach & more so easing into tariffs whereas Trump is ready to go big on % all at once… there has been tons of contradictory headlines / noise from news outlets these past couple of months & more recently, Trump has shown he’s willing to be constructive / willing to negotiate & make a deal whilst implementing the “leniency” that some of his surrounding peers have suggested, but into this week, it simply boils down to either interim uncertainties / lack of clarity continuing to persist & or we see some uncertainties resolve / concrete plan out of the administration which provides general clarity on U.S. trade / tariff policies.