The Week Ahead 4/13/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 & I wish you all a successful Q2 ahead.

Last week was quite the week within indices & a historic one to say the least, but initially, indices kicked off the week with a decline as uncertainties revolving around tariffs persisted as there was no resolve over this prior weekend… as the week progressed, not only did uncertainties persist / zero deals were officially made, but we also had an escalation from China following the U.S. given the U.S. increased tariffs on China to 104%, so naturally, China retaliated by issuing 84% tariffs on the U.S.

On Wednesday, the entire rhetoric changed as on Tuesday night, we had a bit of a bond freakout in markets as bonds had declined 10% within 2 days which is a historic move in itself, but fears were encroaching into credit markets & that ultimately led the administration to panic… as a result, the administration issued a 90-day delay (China tariffs increased to 124%, but all other countries whom didn’t retaliate remained delayed at 10%). The point of the delay was to allow for more time to negotiate with other countries as the administration stated that 70+ countries are willing to negotiate but the administration ran out of time before tariff implementation day (Wednesday) which ended up leading to the announcement of Wednesdays delay.

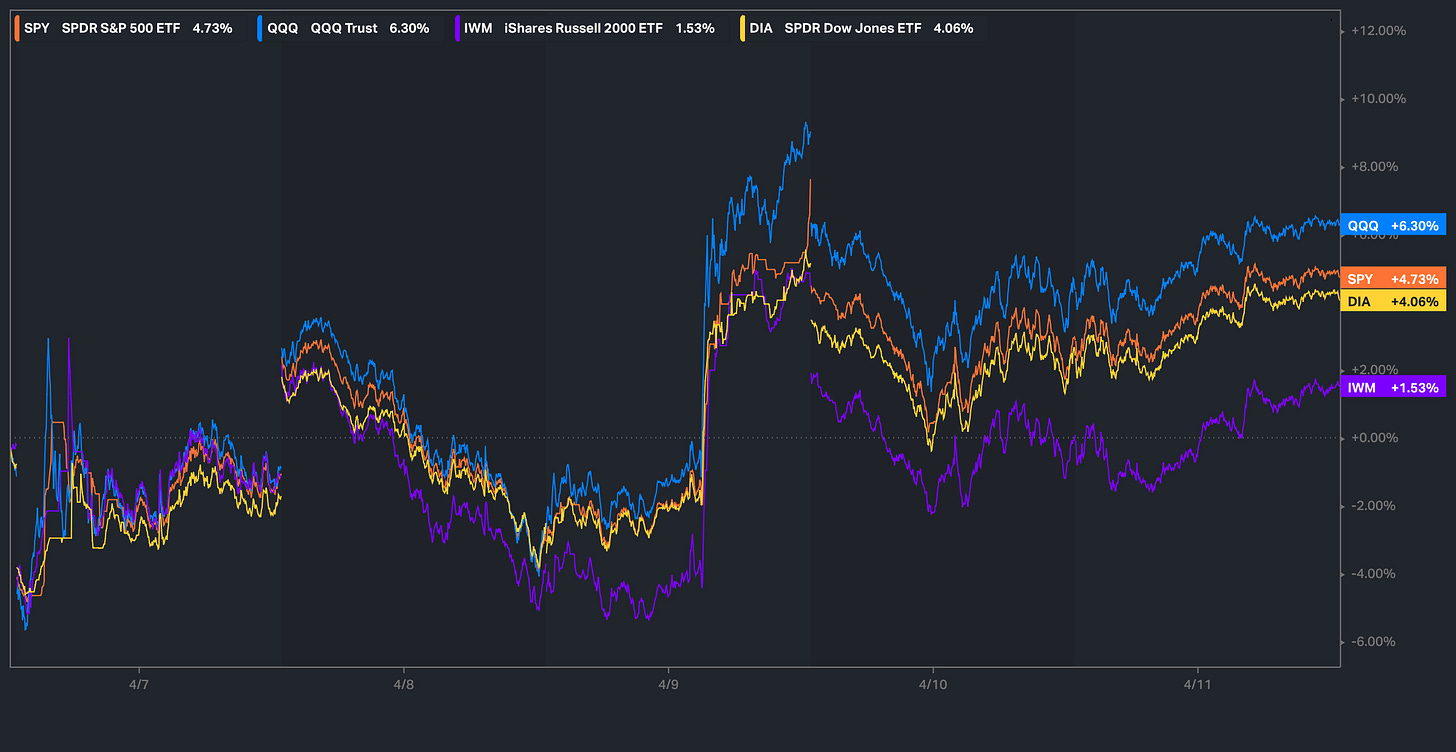

As a result, we saw a historic rally within the indices as the Q’s closed up around 12% on 90-day tariff delay day & to finish off the week, the Q’s ended up being the best performing index closing up just over 600bps whereas small-caps were the worst performing index closing up just over 150bps.

- Economic Data for the Coming Week:

As we get ready to head into the upcoming week, in respect to economic data, it’s a fairly quiet week ahead as we just have retail sales along with Powell expected to speak on Wednesday & then just the standard jobless claims report on Thursday (Markets closed on Friday for Good Friday)… of course tariff headlines / U.S. negotiating with other countries is likely to take all of the spotlight as it should given the uncertainties still revolving around policy, but policy does seem to be easing from here given the pivot from the administration this past week & it more so seems like we may have reached “peak” escalation fears this past week.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 104.33% return whilst in the same period, the Q's have returned 28.49% / Spooz has returned 26.68% / Dow has returned 22.88% & Small-caps have returned 4.30%, so nice outperformance against all the indices whilst having a 80.2% win rate, averaging a 20.01% return on realized gains / winners & a 14.16% loss on realized losses / losers.

Looking forward to the future as we progress through ‘25.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

A historic & volatile week within Commodities / Bonds / FX & most importantly Markets as the S&P officially hit the bear-market threshold of a 20%+ drawdown from highs which just so happened to mark the bottom of the week for all of the indices in which majority closed 8-10%+ off the low made Monday.

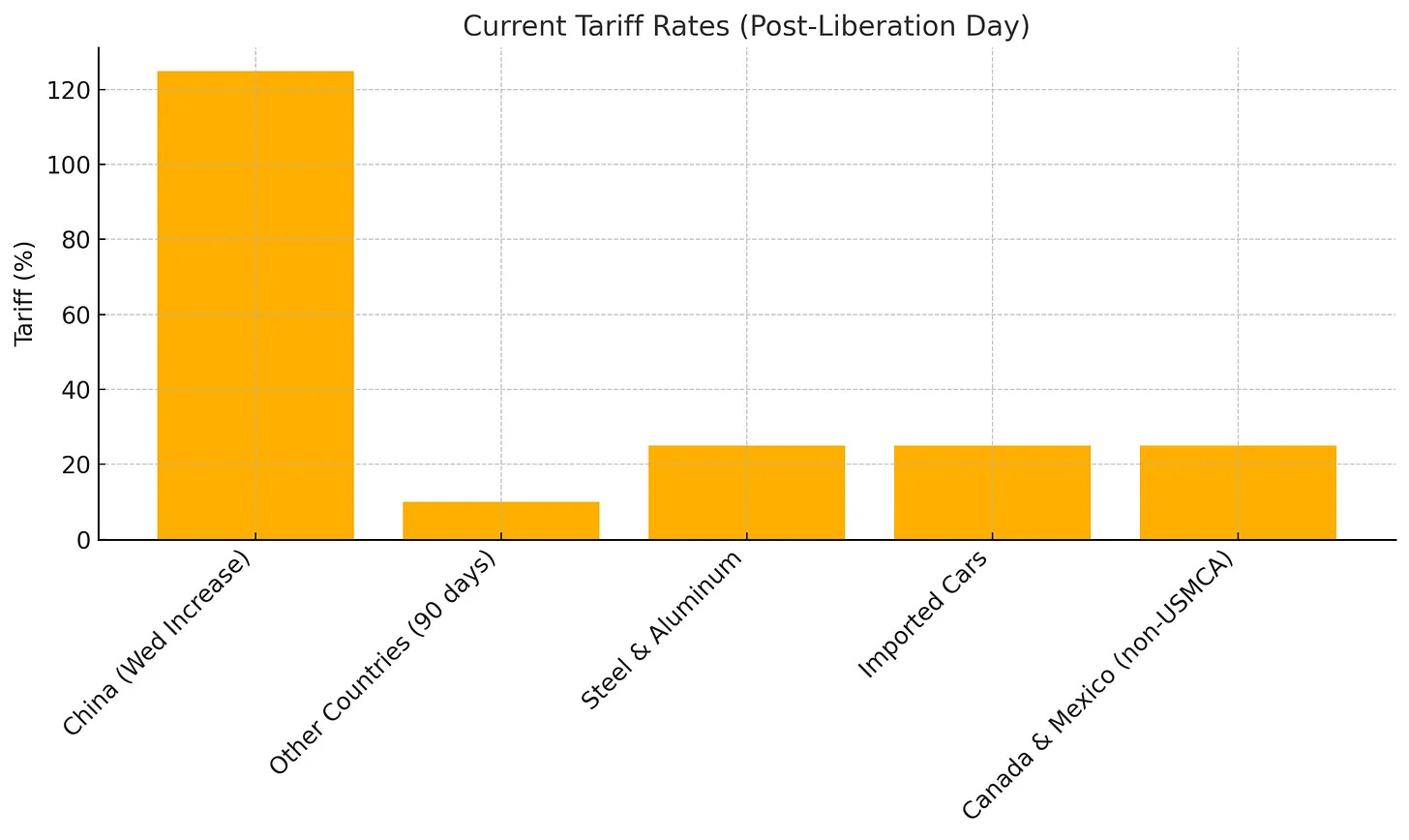

The volatile action was driven by a plethora of headlines, but the biggest day of them all was Wednesday which is when reciprocal tariffs were officially implemented BUT due to the volatility within bonds on Tuesday night (10%+ decline in two days), we saw the administration pivot from their aggressive reciprocal tariff stance by issuing a 90-day delay of reciprocal tariffs whilst bringing all tariff rate %’s lower to 10% for now in the interim & than lastly, China tariffs were increased to 125% from 104%… (+20% from initial so actual rate is 145%).

In respect to the terms of the 90-day delay, again, the U.S. implemented a sharp increase in tariffs on China, raising them to 125% from 104% (again, actual % is 145% due to initial 20%). For the next 90 days (starting from this prior Wednesday), a 10% tariff will apply to imports from all other countries, excluding Russia, North Korea, and Belarus. Tariffs on steel and aluminum remain at 25%, as do tariffs on imported cars. Additionally, Canada and Mexico will face a 25% tariff on goods that do not qualify under the USMCA trade agreement.

What caused the 90-day delay? Again, the bond market more so forced the administrations hand given the magnitude of the move in such a short period of time… Trump himself stated he was even watching the bond market.

10%+ decline in bonds within a few days:

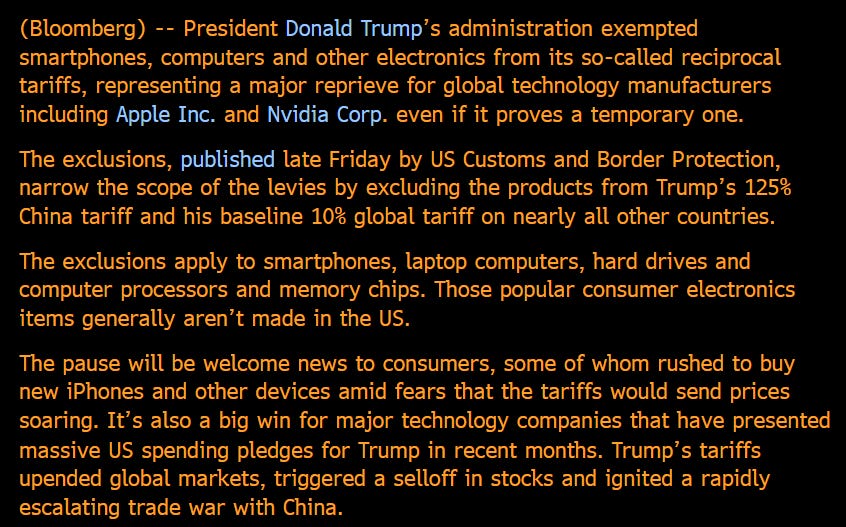

To round off the week, late Friday night, U.S. Customs and Border Protection announced the exemption of smartphones / computers / & other electronics from the new reciprocal tariffs which excludes the items from the 125% China tariff and 10% global baseline tariff since they’re largely made outside the U.S. The exemption helps avoid price spikes for consumers and is seen as a win for major tech firms that have supported Trump’s policy goals (Mag-7 & Semiconductors).

How about the indices?

Well, despite last weeks historic move off the lows & strong close out on the week, there is still only 14.06% of stocks currently sitting above the 50D… yes, thats how extended we were to the downside.

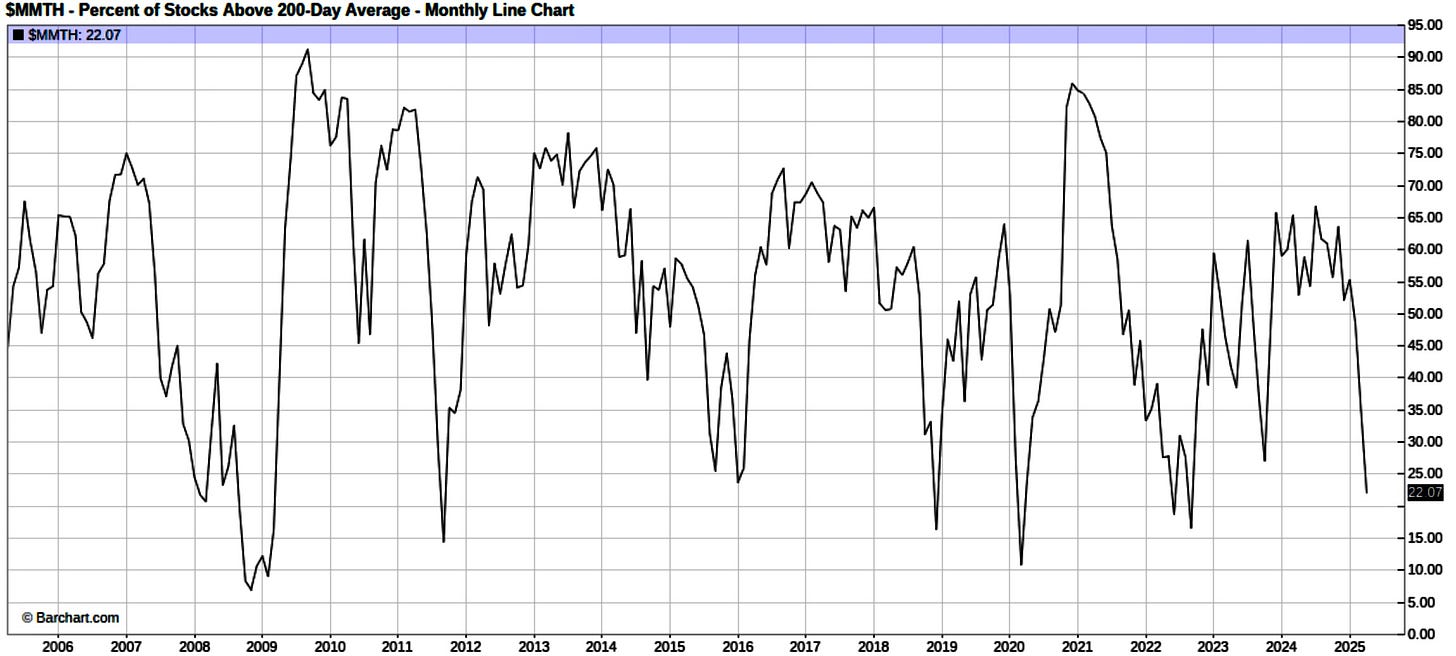

In terms of % of stocks above the 200d, we’re currently sitting around 22% after peaking around 14% earlier on this week… essentially reiterates & looking back historically that once again, we were VERY extended to the downside & any sort of positive headline was going to send the indices crashing upwards.

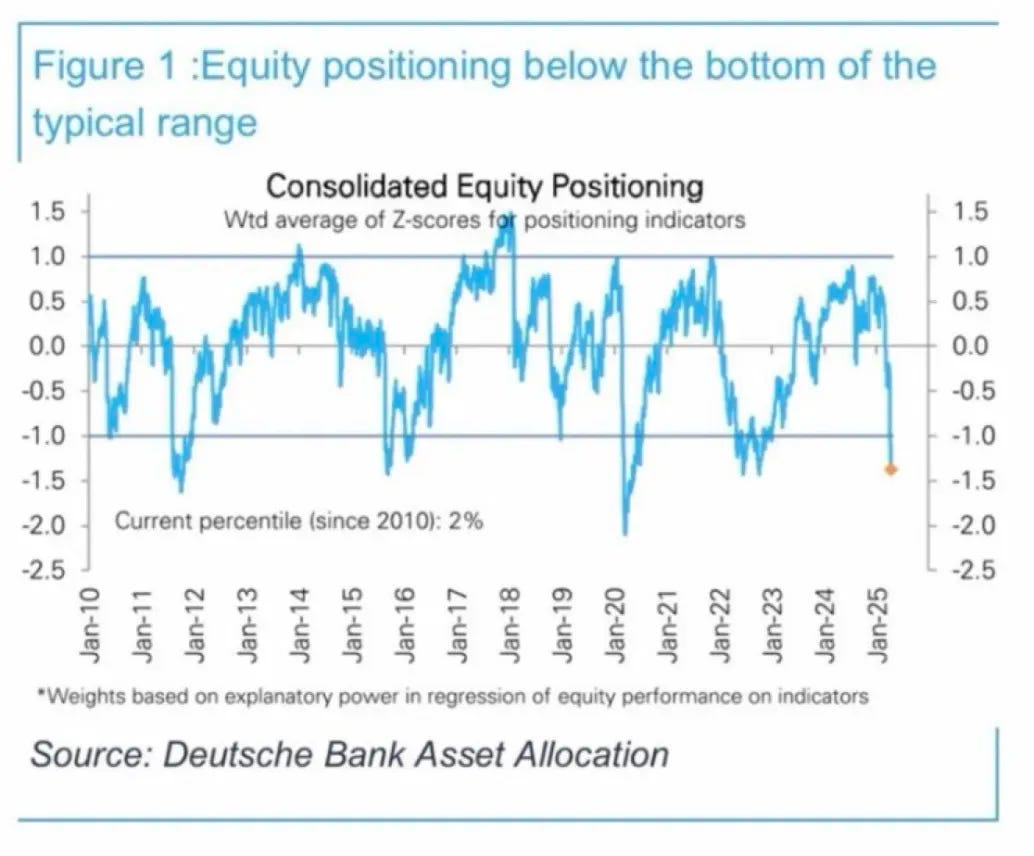

Lastly, in terms of positioning, not much needs to be said but per Deutsche Bank, equity positioning is quite light historically dating back to these prior years…

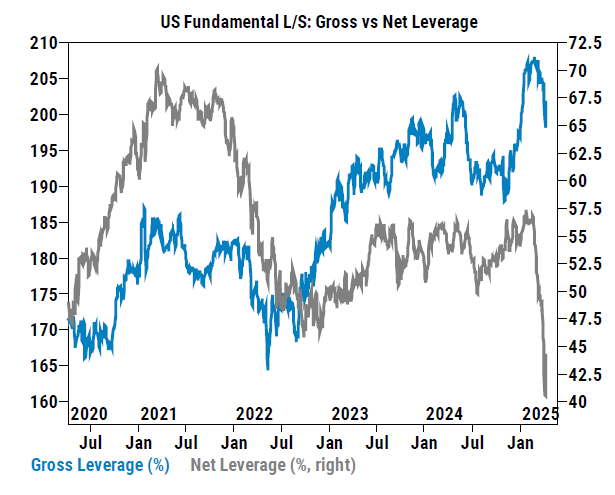

HFs also have seen quite a bit of pain recently due to the large degrossing of longs (net leverage) whilst still maintaining elevated gross leverage (essentially means longs have been unwound but shorts are being maintained)… quite pessimistic positioning to say the least.

- SPY

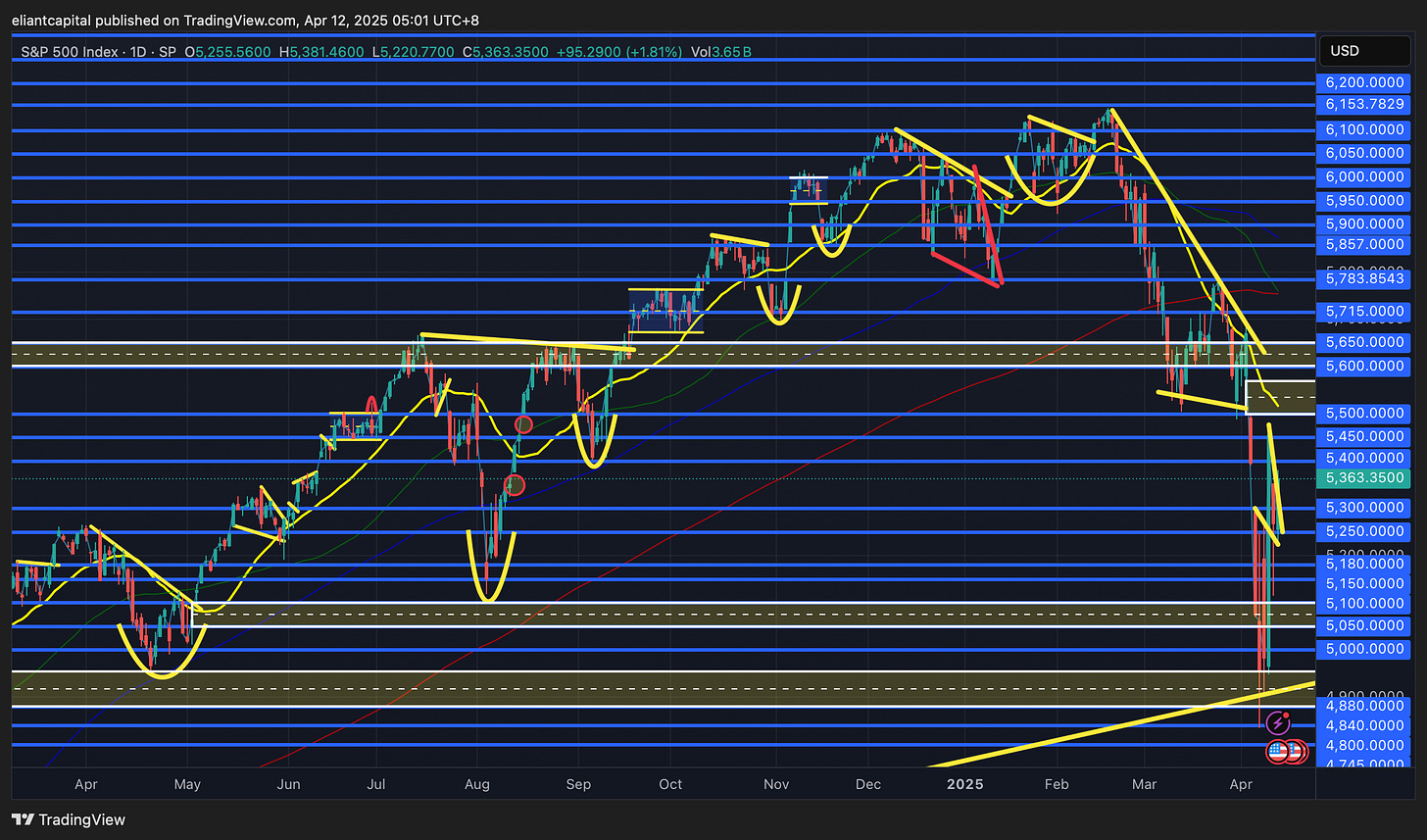

Quite a textbook week in regard to technicals as Spooz pretty much bottomed to the tick off the 50% retrace from the ‘22 bear market bottom / recent high made along with the ‘22 highs for added confluence… doesn’t get much better.

Trump himself even stated it was a great time to buy on Wednesday… hours before the 90-Day tariff delay was issued:

And well, it turned out to be fairly good timing as Spooz tapped the support TL dating back to the Covid ‘20 lows along with the added confluence of the ‘22 highs backtest & 50% retrace as we just mentioned above. A “hindsight” bottom at the end of the day, but certainly nothing we weren’t already expecting.

In looking at Spooz a bit closer as we get ready to head into next week, again, it’s a shortened one as markets will be closed for Good Friday, but markets in general did have a fairly good round off to the week as bonds posted quite the intraday reversal off the lows along with general supportive comments from the Fed in regard to stabilizing markets if need be & then further speculation that de-escalations were coming & sure enough, Trump issued exemptions on essentially all high-end manufactured goods / tech in China from the 145% reciprocal tariffs, so markets should take that quite positively into early next week.

Due to the 90-day tariff delay headline on Wednesday, we did see quite the move up in Spooz & then on Thursday, we nearly ended up giving back the entirety of the move before then bouncing another 200-handles off those respective lows (we covered half the hedges we bought Wednesday near 5400s on Thursday about a minute from the low of day near 5100 which was great timing on our part). Nevertheless, again, once we finally saw some stabilization in bonds, it led to a sustainable bid off the intraday lows which allowed Spooz to push higher above 5300s & close out the week in the mid-5300s… very constructive action altogether. Into this coming week, if we were to see downside & or a cooldown of excitement, I’d like to continue to see 5300 / 5250ish remain supportive in the interim as realized volatility continues to simmer down ( as otherwise, Spooz is likely at risk of filling back to the downside to work lower to test 5150 / 5100ish which is the range that coincides with Thursday’s low from this past week… granted, would likely be headline & or news-driven to produce that sort of downside move, but definitely harder to see given the weekend exemption news & even the constructive action we saw this past Friday in indices.).

In respect to upside, as of now, Spooz is more so wedging / flagging into this coming week & a breakout should precede a move upwards towards the initial Liberation Day gap in the 5500 / 5575ish range above (gap-fill)… from there, I could see Spooz digesting the recent upside move & or very much so rejecting & backtesting lower before then trying to resume higher to work upwards to backtest the 200d near mid-5700s which is likely a bigger pause spot for a countertrend rally in Spooz if it were to continue to extend further.