The Week Ahead 4/20/25

Hello All,

For starters, Happy Easter & I hope you all are enjoying the long weekend and getting some time away from the screens.

In looking back at this past week, it was a fairly quiet week in respect to economic data, but volatility once again showed up due to continued uncertainties & retaliatory efforts amongst the recent trade-wars. The week initially started out on a positive note as the U.S. issued exemptions for Semiconductors & Electronics from the 145% China tariffs thus making them subject to only 20% so quite an ease up in respect to policy, but as the week progressed, China issued a ban on rare earth exports to the U.S. whilst also halting Boeing purchases & in return, Trump fired back by banning Nvidia from selling H20s to China.

As a result, we ended up seeing the Q’s fade the initial gains from earlier on in the week, as at one point, the Q’s were up nearly 150bps on the week & instead following the H20 ban, the Q’s closed out the week lower by just over 230bps. The only positive performing index on the week was small-caps & the worst performing index was the Dow which was mostly driven by the large decline in UNH following their surprise earnings miss.

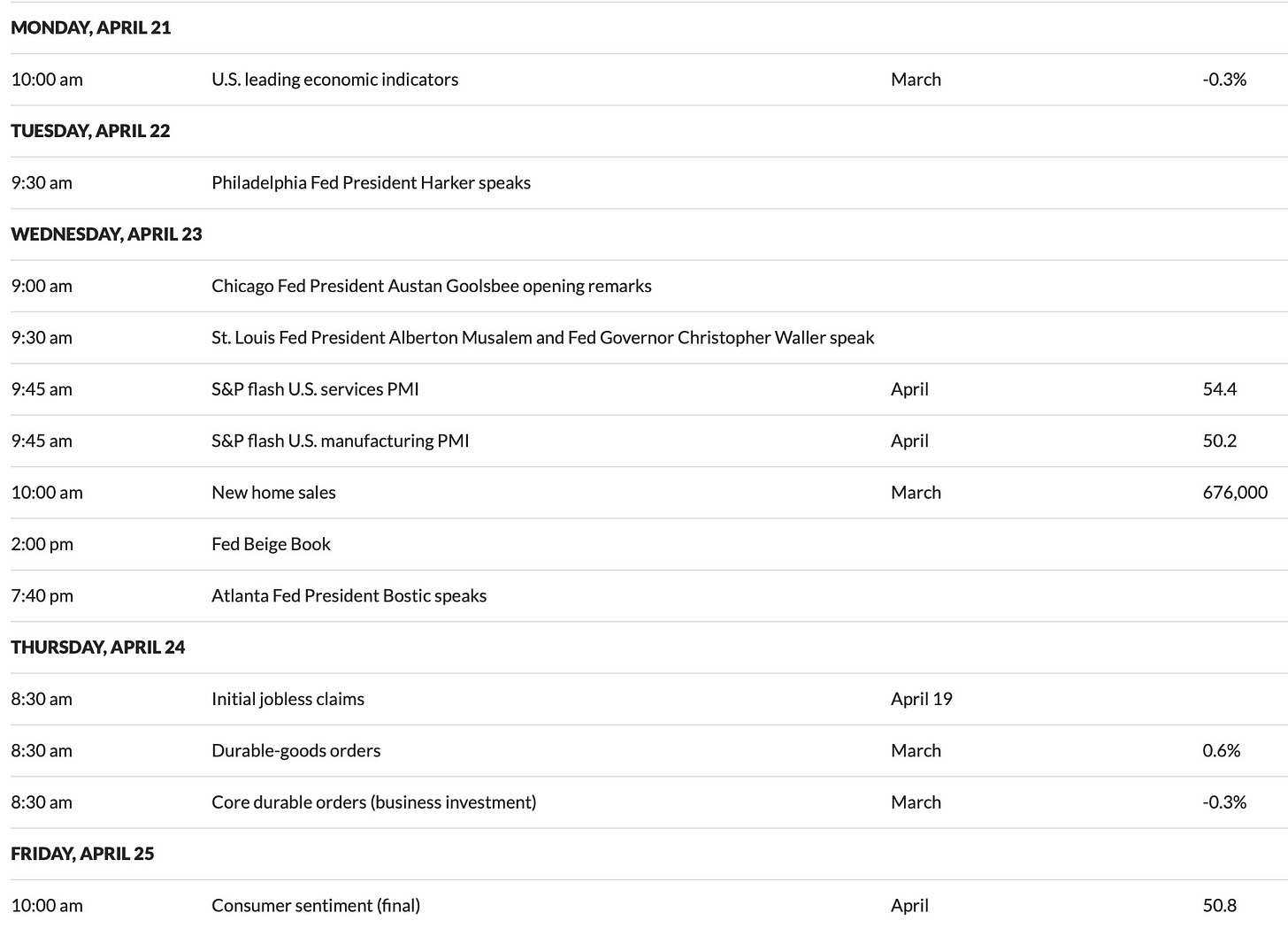

- Economic Data for the Coming Week:

In respect to economic data as we get ready to head into the upcoming week, its a fairly light week in terms of significant economic datapoints, but nevertheless, we do have a couple of bond auctions scattered throughout the week along with some Fed speakers / standard Jobless Claims report on Thursday & some sentiment surveys, but the bigger point of significance continues to revolve around the U.S. negotiating with other countries & or trade deals being worked out, which thus far, there hasn’t been an official trade deal announced since the 90-day delay announced the other week.

- STD Channels on Indices for Perspective: Monthly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 105.45% return whilst in the same period, the Q's have returned 25.58% / Spooz has returned 24.89% / Dow has returned 19.66% & Small-caps have returned 5.49%, so nice outperformance against all the indices whilst having a 79.5% win rate, averaging a 19.97% return on realized gains / winners & a 14.38% loss on realized losses / losers.

Looking forward to the future as we progress through ‘25.

This past week, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

The prior week to this past week, as we all know, but Spooz ended up bottoming right off the ‘22 highs which also coincided with the 50% retrace from the ‘22 bear market bottom / recent high made near 6100ish in February & from trough to peak thus far, it produced just over a 600-handle rally from those respective lows… question from here more so boils down to whether or not those lows get retested and we potentially go on to make lower lows & or if we have seen THE low for ‘25 & the general indices may establish a higher low here before working higher into Q2 / remainder of year.

In zooming out further, again, the low made the prior week from this past week was textbook in regard to technicals as it coincided with the ‘22 highs / 50% retrace & the last order of confluence being the support TL dating back to the Covid ‘20 lows. A very “hindsight” bottom at the end of the day, but certainly nothing we weren’t already expecting & again, the question more so boils down to whether or not those lows get retested leading to new lows (200wk just below these prior local lows) & or if Spooz / general indices form a higher low before then working higher.

In taking a closer look at Spooz, we ended up starting the week off strong due to the select exemptions of semiconductors / electronics from 145% tariffs, but that initial gain in equities faded as the week progressed due to retaliatory efforts out of China leading Trump to respond by issuing a ban on Nvidia from selling H20s to China & than the hawkish comments out of Powell on Wednesday also contributed to last weeks losses as Spooz ended up closing out the week lower by 150bps.

As we get ready to head into the upcoming week, we don’t have much data of significance, & it’s a fairly quiet week in that aspect as we just have a couple of bond auctions scattered throughout the week along with some Fed speakers / Standard jobless claims report & a couple of other minor datapoints, but otherwise, once again we have another week where the biggest factor at this moment boils down to trade-deals & or further progress on negotiating being worked out. There was a comment out of Hassett this weekend that suggested we will see a “flurry of action on trade next week” so we’ll see if something actually materializes & or some deals get made. The other interim factor in which Trump has been focused on is a Russia / Ukraine ceasefire which looks to be in good progress as Zelenskyy stated Ukraine is ready to mirror Russian actions on a ceasefire, & Putin agreed to a ceasefire so we’ll see how those actions develop into this week.

In respect to Spooz as we get ready to head into next week, the big question here is if a higher low gets established before Spooz goes on to continue higher & or if we’re headed back to the lows to retest the prior local lows & then go on to make new local lows. As of now, bulls have continued to make a stance near 5300 / 5250ish & bears haven’t been able to manage a firm close below 5250ish & I think as long as that general area does remain supportive, we can see Spooz break out of this wedge / flag to the upside to retest the highs near 5450ish. If we were to see a firm reclaim above 5450ish, I do think we can see a further sustained move upwards to fill the initial Liberation Day gap in the 5500 / 5575ish range above (gap-fill)… & then from there, I could see Spooz digesting the recent upside move & or very much so rejecting & backtesting lower (retest 5450ish & to flip to support) before then trying to resume higher to work upwards to backtest the 200d near mid-5700s which is likely a bigger pause spot for a countertrend rally in Spooz if it were to continue to extend further.

On the flip side, if we were to see bears continue to maintain pressure below the 5300 / 5250ish range and manage a sustained / firm close below 5250ish, I do think Spooz is likely at risk of filling back to the downside to work lower to test 5150 / 5100ish which is the range that coincides with this prior Thursday to this past weeks low… granted, would likely need further amplification in respect to headlines / news-driven to produce that sort of downside move, but certainly not totally improbable given how unpredictable the administration has been.

Again, we’re kind of at a fail here / form a higher low and then work higher & or fail here & fail to make a higher low thus suggesting we go on to work lower and unwind the 90-day delay move (again, likely would be headline / news-driven).

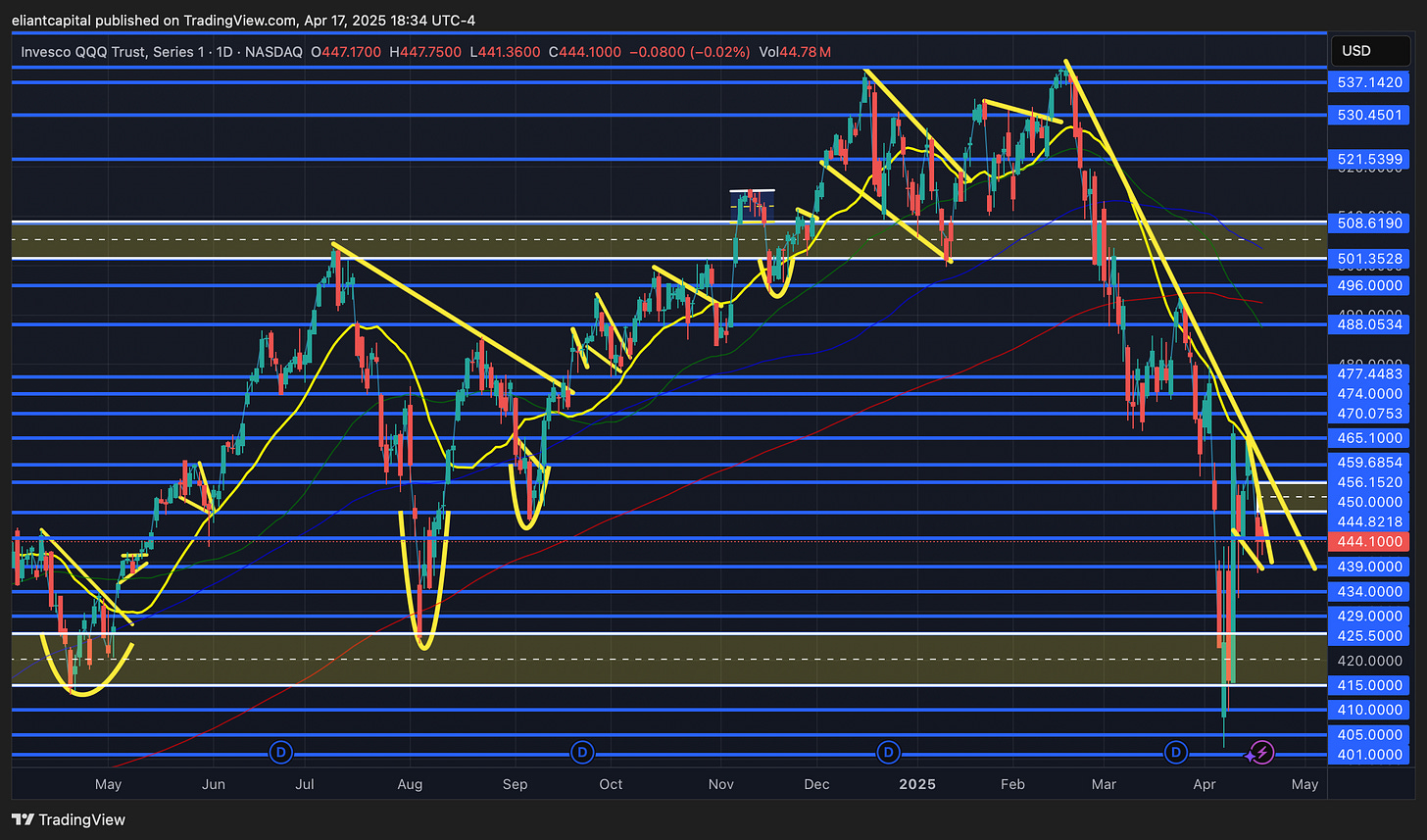

- QQQ

In zooming out on the Q’s, despite the weakness this past week, not too much changed on the bigger picture & the question from here on all of the indices is whether or not a higher low gets made & or is established before the Q’s then go on to resolve higher & or if we see a retest of the recent local lows / make new lower lows which would then likely precede a test of the 200wk on the respective indices (Spooz / Q’s / Dow / Small-caps already below 200wk).

In respect to this past week, initially, tech saw upside as the week kicked off due to news of semiconductors / electronics being exempt from the 145% tariffs & only being subject to 20% tariffs instead… the market viewed that as a de-escalation with China from the U.S. but as the week progressed, China issued a ban on rare earth exports to the U.S. along with halting purchases from Boeing & in return, Trump responded by banning Nvidia from selling H20s to China… meanwhile, on April 9th Trump stated Nvidia could persist with selling H20s to China so this is a bit of a walkback of the walkback. As a result, Nvidia will end up taking a one time 5.5B hit this quarter, but the damage more so circles back to being told a couple weeks back that Nvidia is allowed to sell H20s & now since China issued retaliatory efforts towards the U.S. in response to the 145% tariffs, Nvidia is now no longer able to sell H20s to China. As a result, the Nasdaq ended up being the second worst performing index on the week as the Q’s ended up closing lower by just over 230bps.

Besides the recent trade-war ramifications, we do also have tech earnings full steam ahead… Netflix kicked it off this past week as they reported on Thursday & in general, it was a pretty great quarter whilst also re-affirming & even raising guidance… granted, Netflix is Tariff / China proof, so it doesn’t come of too much surprise. Nevertheless, expect Netflix to continue to be a crowded long along with Spotify as well, as again, they aren’t subject to the Tariff / China trade-war ramifications. Do think the general theme of this quarter will likely be Q1 beats but issuing cautionary / softer guidance given the administration is essentially handing out “freebie” cards this quarter in terms of its “OK” to set lower expectations for the remainder of the year given the uncertainties surrounding policy. This is a pretty big general consensus, but I think the reactions will be more important to pay attention to rather than the actual earnings itself… we’ve already seen several instances this quarter of stocks trading higher on softer / cautionary guidance given the names were already bombed out into the print, so the expectations into earnings this quarter in terms of negative reactions comes down to reporting worst than what is currently feared whereas if its in-line & or even slightly better than feared, we’ll likely see a positive resolve in terms of the reaction post-earnings.

As we get ready to head into the upcoming week, we did end up seeing the Q’s reject the 20d this past week, but the resolve lower has been fairly orderly / Q’s are essentially set up in a flag / wedge… do think we need to see the Q’s remain supportive above 439 / 434ish which coincides with the low / backtest made this prior Thursday during the 90-day delay week… if we were to see the Q’s sustain above 439 / 434ish & remain supportive, do think that would essentially establish a higher-low on the Q’s leading to this interim flag / wedge breakout to fill the bear-gap just above & ultimately start to work back higher towards these recent highs in the mid-460s.

On the contrary, if we were to see 439 / 434ish just below falter as support, it does leave the Q’s at risk of unwinding the entirety of this recent upside move & filling back lower toward the low-420s / 415ish general area (coincides with early ‘24 lows & just above the ‘22 highs, so in general, expect it to remain a more firm support).