The Week Ahead 6/29/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good ‘25 thus far & I wish you all a successful remainder of Q2 as we nearly wrap up & prepare to head into the 2H of the year.

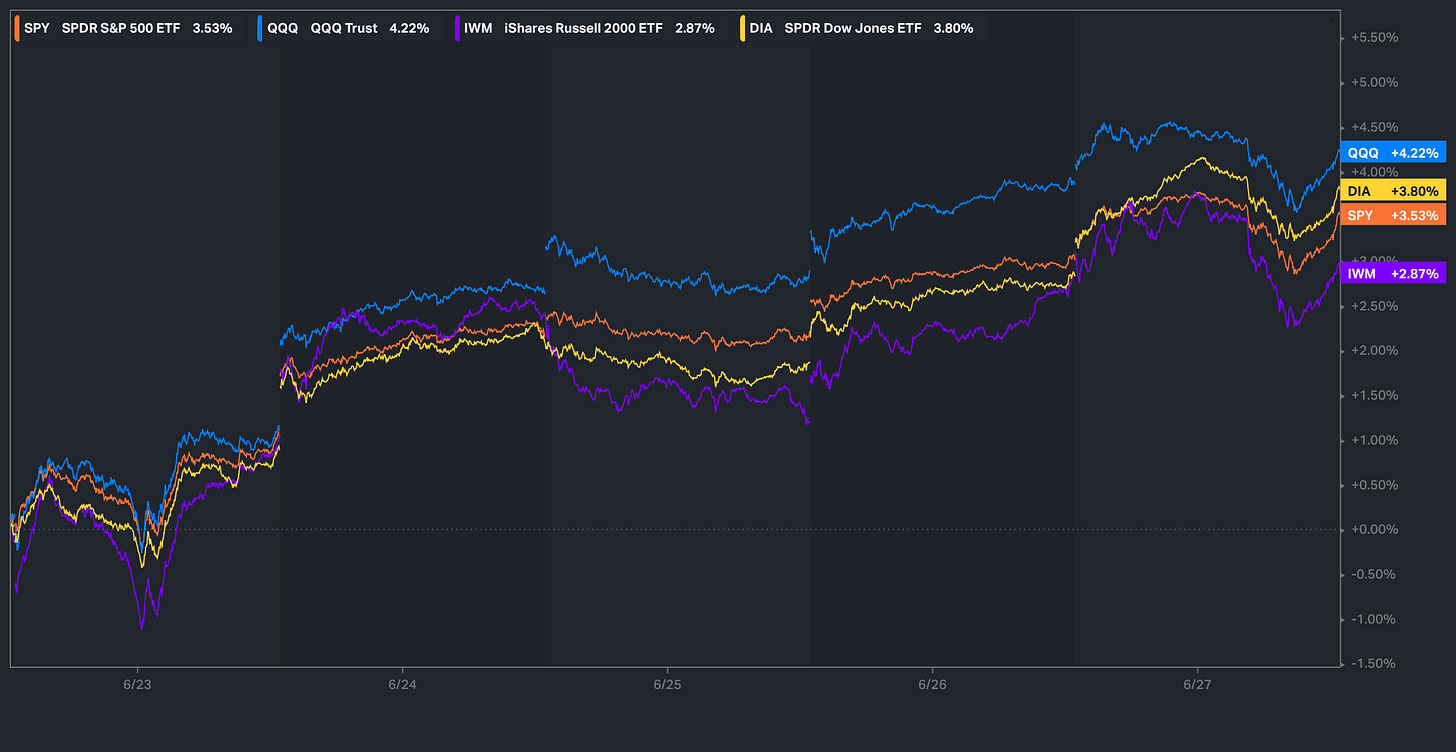

Last week ended up being quite the week for the indices as initially coming into the week, fears & or headline-driven hysteria following the U.S. having joined in on the attack against Iran led indices to dip earlier on in the week & then following the retaliation by Iran, it ended up marking the bottom on the indices for the week as the attack more so was an escalate-to-de-escalate for Iran to save-face & as the week progressed, focus shifted towards the dovish comments by the Fed (Waller & Bowman suggesting July rate-cut on table) along with Trump looking for Powell’s replacement already & because of the excitement around dovishness / rate-cuts, indices continued to trek higher & both Spooz & the Q’s went on to make new ATHs although the Q’s led the indices on the week by closing higher by 422bps whereas Small-caps were the weakest of the indices although still closed higher by 287bps on the week.

- Economic Data for the Coming Week:

As we get ready to head into the upcoming week, for starters, it is a shortened week as markets will close early on Thursday for a half day and markets will remain closed on Friday for the holiday. In regard to economic data, we have a full slate of jobs and labor market data scattered throughout the week, and most importantly, we have NFP #’s on Thursday. The other major event unrelated to economic data is the administration’s BBB (Big Beautiful Bill) which they hope to get passed by the Fourth of July. We will see how that ends up shaping up.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 133.15% return whilst in the same period, the Q's have returned 55.16% / Spooz has returned 46.32% / Dow has returned 34.47% & Small-caps have returned 22.24%, so nice outperformance against all the indices whilst having a 81% win rate, averaging a 22.68% return on realized gains / winners & a 14.48% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

In April, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

We also published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.