The Week Ahead 7/13/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful 2H of ‘25.

This past week was generally a quieter week all around as economic data in general didn’t have much of significance & interim focus more so entirely shifted back towards recent tariff headlines following the tariff delay exp. (has since been pushed back to the 1st of August), but otherwise, the indices had a relatively quieter week although all essentially closed lower but the Dow was more so the only outlier in terms of clear underperformance as DIA closed lower by just over 100bps whereas Spooz / Q’s & Small-caps mostly had in-line performance although Small-caps did lag both Spooz & the Q’s just slightly & finished off the week lower by just over 60bps.

- Economic Data for the Coming Week:

In regard to economic data as we get ready to head into the upcoming week, besides the continued concern revolving around tariff headlines, arguably the bigger points into the upcoming week will revolve around both CPI & PPI #’s on Wednesday & Thursday respectively given tariffs *should start to filter through into inflation data & the question here is how big are the effects, if at all & will it be a one-time price shock & or provide persistent & sustainable inflation?

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 136.48% return whilst in the same period, the Q's have returned 56.89% / Spooz has returned 48.39% / Dow has returned 36.18% & Small-caps have returned 25.77%, so nice outperformance against all the indices whilst having a 81.6% win rate, averaging a 23.26% return on realized gains / winners & a 14.48% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

In April, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed… it’s been pretty spot on.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

We also published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

This past week turned out to be a relatively quieter one after initial fears of tariff delay exp. on the 9th, but instead, Trump ended up pushing back the expiration until the 1st of August… likely to give countries a last minute 3-week window as the U.S. tries to issue higher tariff rates from a negotiating standpoint to get other countries to jump at the U.S. & ultimately try and strike a deal.

And on this subject, despite the tariff letters that were sent out this past week by the U.S., Lutnick had a couple of standout headlines:

- US Commerce Secretary Lutnick: Trump left flexibility on tariff rates in letters.

- US Commerce Secretary Lutnick: If countries are good to us, they may get another rate.

Essentially, Lutnick is reiterating that the letters sent out with tariff rates this past week are flexible and not set-in-stone & are more so being implemented to kick off negotiation & IF ‘Country X’ does act in good-faith when negotiating with the U.S., the U.S. will soften rhetoric / tone & give a more realistic tariff % rate instead of the initial tariff rate sent out within the trade-letters.

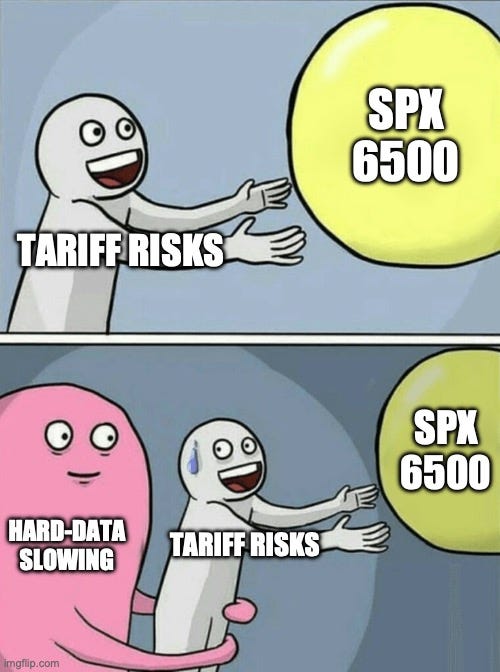

Now, having said all that, I would still argue that at this stage, markets have been more acclimated by the tariff headlines & recessionary data / surprise weak hard-data is a bigger risk than tariff headlines & is more so the obstacle that could stop the indices / derail this market in terms of a potential larger correction.

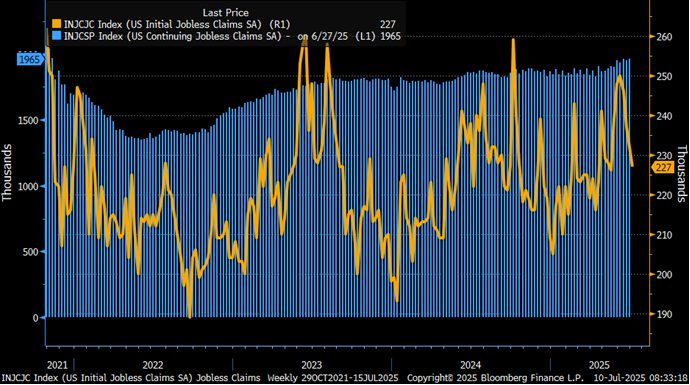

And while although this past week was generally quieter in regard to economic data as well, jobless claims did reach a 2-month low & it’s interesting as just a few weeks ago, there were concerns as claims spiked toward 250k, but as we highlighted at the time, that move was largely driven by seasonality effects & sure enough, claims have since reversed lower and fully unwound that spike. However, there does continue to be chatter about continuing claims making new cycle highs & it essentially suggests that individuals are having a hard time finding another job whereas in the same instance, individuals aren’t getting laid off either hence hard-data in general continues to hold in better than most have anticipated.