The Week Ahead 7/20/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful 2H of ‘25.

This past week was a relatively quieter week all around in terms of economic data as inflation data was mostly relatively tame whereas hard-data / soft-data once again came in better than expected & more so the bigger headline of the week was the initial speculations of Trump looking to fire Powell (Trial balloon) which Trump then came out & denied which caused the indices to pair back the initial losses leading the Q’s to be the best performing of the indices on the week, closing higher by 125bps & achieving a new ATH whereas the Dow was the ‘worst’ performing of the indices although essentially closed out the week flat.

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a relatively quiet week ahead / not necessarily much event risk but Powell is expected to speak on Tuesday & it’ll be interesting to see if anything new is said given this past weeks inflation data, but otherwise, on Thursday we have the standard jobless claims report along with a few other minor scattered data-points throughout the week, but otherwise, it should be a relatively quieter week overall.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 139.35% return whilst in the same period, the Q's have returned 58.89% / Spooz has returned 49.33% / Dow has returned 36.08% & Small-caps have returned 26.12%, so nice outperformance against all the indices whilst having a 81.8% win rate, averaging a 23.30% return on realized gains / winners & a 14.48% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

In April, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed… it’s been pretty spot on.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

We also published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

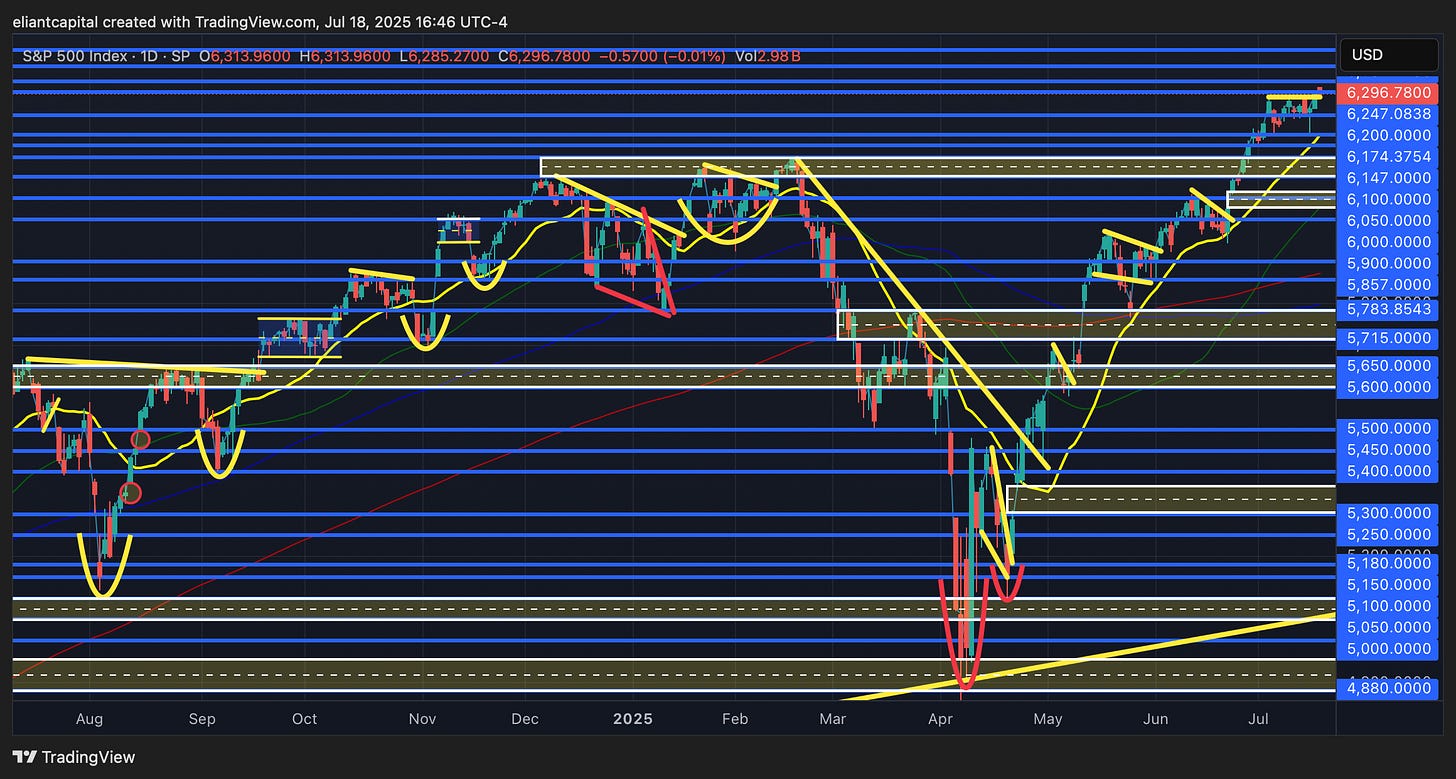

- SPY

To jump right into Spooz, well, yet another new ATH was achieved this past week as each & every dip continues to remain shallow & bought. Initially coming into the week, the indices declined on the news of Trump threatening both the EU & Mexico with 30% tariffs, but once again, the dip was bought as the trend has continued to remain as such. The other ‘slight’ volatility came from the speculations that Trump was looking to fire Powell, which then Trump came out to then deny the rumors thus Spooz & the general indices ended up pairing back the losses & Spooz ended up closing out the week higher by 65bps.

Now, despite Spooz & even the Q’s sitting at ATHs, the % of stocks above the 20D remains at 57% & the ‘slight’ reset of conditions has more so been triggered by the recent deterioration in breadth & it also essentially signals that conditions aren’t necessarily overly extended on the upside (In the shorter-term) given the indices have been more grindy whereas majority of the upside vol has instead been within individual names.

In regard to Spooz more specifically, again, Spooz in itself went on to achieve a new ATH above 6300 this past week but still ended up closing out the week just below 6300. Into the upcoming week, we don’t have much data in terms of significance & really in the shorter-term, the bigger potential event risks looming is the August 1st deadline in terms of trade-deals / tariffs expected to be implemented & then the other looming potential risk being the firing of Powell (Although Trump denied this past week, it seems fairly clear that it was a trial balloon).

With Spooz having closed out this past week just below 6300, again, 6300ish is where bears have tried to make a stance in terms of selling pressure as Spooz has now consolidated for 3-weeks just below 6300 but has failed to firm up above in each instance… the clear LIS for bears in terms of trying to protect against further upside remains (6300 / 6290ish), but if we were to see Spooz see followthrough to the upside & emerge out of this near 3-week consolidation to the upside, there isn’t necessarily much stopping Spooz from seeing range expansion upwards toward the 6400 / 6500ish range above.. especially considering hard-data has continued to hold in much better than feared & inflation data thus far from this past week was more tame than expected as well (granted, next month will be more important in terms of tariffs impacting inflation data or not).

On the flip side, if we were to see Spooz continue to reject near 6300ish, I do think we could see Spooz potentially go on to get a firm test of the 20d below near 6200ish (Maybe driven by sell-the-news ERs season & or general headline volatility), but ultimately, I continue to think the interim LIS remains around 6175 / 6145ish below (Coincides with prior ATHs) & as long as that general area does remain supportive (highlighted demand zone), do think in the interim that bulls will continue to maintain their current edge / dips will continue to remain shallow & bought whereas if we were to see Spooz rollover further / prior ATHs fail to come in as support, I could see Spooz rolling over towards 6050ish (assuming prior ATHs fails to come in as support) which essentially coincides with the Ceasefire bull-gap established a month back & in general, I do think the prior range before this recent breakout to new highs (6050 / 5950ish) will likely serve as a medium-term broader support, whilst important MAs (200d / 50d / 100d) sit just below as well for added confluence, and will continue to keep indices more bifurcated in the medium-term, and of course the other added factor to keep in mind is that many Individuals / HFs / PMs have been itching for any sort of dip to ‘let them in’ to this market so barring a surprise shock (still maintain that hard-data rolling over > tariff headlines), do think that dips will still likely continue to get bought until proven otherwise.