The Week Ahead 7/27/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful remainder 2H of ‘25.

This past week was a relatively slower one as there wasn’t necessarily much in terms of economic data of significance / news flow, but nevertheless, earlier on in the week we did see resolve between the U.S. & Japan with a deal having finally been reached & following the news, it propelled both Spooz & the Q’s to new ATHs as the slow churn / grind higher continued on throughout the week & Spooz did end up being the best performing of the indices, closing off the week higher by 151bps, whereas Small-caps were the ‘worst’ performing of the indices yet still closed higher by 94bps.

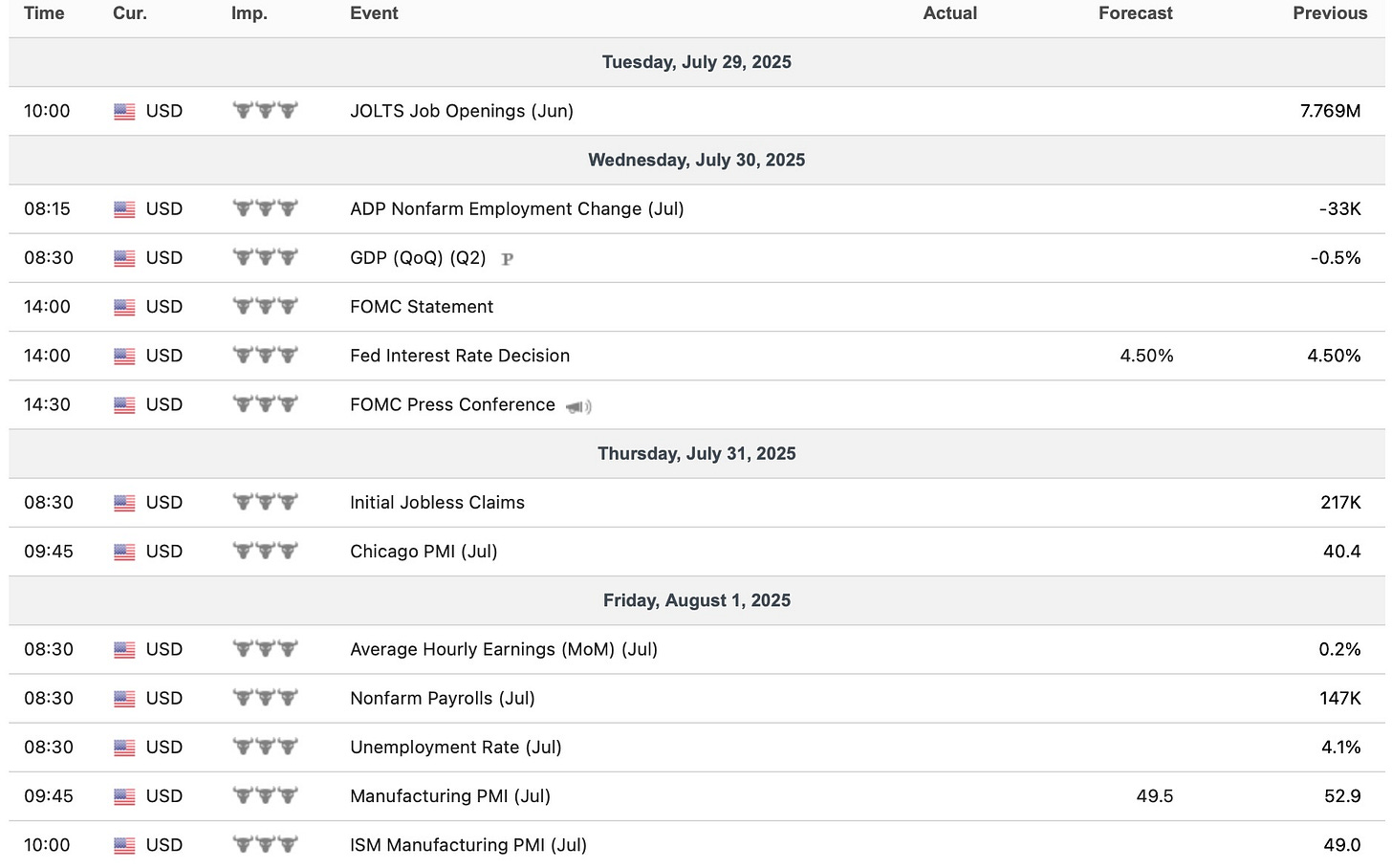

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s quite a jam-packed week to say the least as we have QRA earlier on in the week / FOMC / PCE #’s / NFP #’s & a plethora of other labor market / economic datapoints in between too.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 142.01% return whilst in the same period, the Q's have returned 60.34% / Spooz has returned 51.60% / Dow has returned 37.91% & Small-caps have returned 27.29%, so nice outperformance against all the indices whilst having a 82.1% win rate, averaging a 23.70% return on realized gains / winners & a 14.48% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

In April, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed… it’s been pretty spot on.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

We also published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

Part Trois coming soon.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

To talk a bit about this past week, again, it was a relatively quieter one to say the least, but nevertheless, there still was a few standout headlines:

- BESSENT: BY Q1 2026 GOING TO SEE GDP GROWTH AT 3% OR MORE

From the short-lived attempt at an economic detox to the administration now continuing to emphasize they plan to ‘run it hot’ as they look for growth to outpace spending to ultimately lower the Deficit-to-GDP.

- TRUMP ON CHINA: XI HAS INVITED ME TO CHINA

- BESSENT SAYS AUGUST 12 TARIFF DEADLINE LIKELY TO BE EXTENDED

Self-explanatory but it’s clear relations between the U.S. & China continue to improve given the Xi invite & in addition, Bessent reiterated that the China Tariff expiration likely will be extended in order to preserve negotations & continue talks on further.

How long until we get the Trump & Xi handshake? Later this year & or potentially in September sounds about right.

- US Treasury Secretary Bessent: We could see 1-2 rate cuts this year.

Since when did the Treasury speak on monetary policy… maybe of whats to come?

- And finally; Trump: I am mulling a rebate checks for low-income Americans.

Again, intially coming into the year the administration was adamant on committing to austerity / creating an economic detox, but instead, we’re right back to continuing to blow out deficits further & now floating the idea of potential stimulus checks… ‘21 here we come.

- SPY

To jump into Spooz, well, yet another new ATH was achieved this past week as each & every dip continues to remain shallow & bought & Spooz & the general indices have more so continued this slow churn / grind higher pattern. The biggest news from this past week was a deal with Japan was finally reached & over the weekend, Trump is expected to meet with the EU to try and finalize a deal in which Trump specifically said it’s 50/50 at this stage, but nevertheless, the general summary from this past week in terms of important trade partners in which the market specifically cares about is the trade-war is nearly wrapped up… Again, Japan deal reached / Progression with the EU over the weekend & then per Bessent, China’s August 12th expiration plans to be extended to allow for further progression in talks & because of the developments from this past week, August 1st tail-risk has drastically deflated hence indices continued to just grind higher as the week progressed with Spooz & the Q’s closing out at new ATHs.

And whilst on the topic of new ATHs, RSP (Equal-Weight S&P) is inches away from a new ATH… Why does this matter? It’s another signal that participation within the rally continues to remain healthy & there isn’t necessarily a ‘lack of breadth.’

And earlier on this past week, an interesting note is that RSP/SPY had a 99th percentile move which is quite rare & in looking at the RSP/SPY ratio, it broke out of the respective downtrend from earlier on in the year & if the breakout were to stick, you can expect general rotation within markets to continue (more demand for value / lower-beta / cyclicals) vs. higher beta & momentum names.

BUT, despite both Spooz & the Q’s achieving a new ATH with RSP being inches away from making a new ATH as well, the % of stocks above the 20D STILL only remains at 60% which once again reiterates that in the shorter-term, conditions aren’t necessarily overly extended on the upside & more so remain just above neutral.

Moving on to Spooz more specifically, but Spooz ended up closing out the week at fresh ATHs whilst also being the best performing of the indices, closing higher by just over 150bps & again, the indices in general have continued to remain in this slow churn / grind higher pattern as each & every dip has continued to get bought due to the recent bifurcation within markets as we’ve continued to see underlying rotation under the hood. Our expectation has been that if Spooz were to extend out of the prior 3-week consolidation to the upside that we’d likely see Spooz melt higher towards the 6400 / 6500ish range above & well, Spooz pretty much rounded off this past week closing just a few ticks below 6400 so fairly on target. Nevertheless, into the upcoming week we do have a plethora of event risks & economic data yet vol / straddles are priced quite low so not much is necessarily expected but IF we can get through the week unscathed in terms of surprises, it’s not hard to see Spooz rounding off summer finishing off towards 6500. Again, August 1st tail-risk has dramatically deflated so that essentially leaves us with QRA / FOMC / PCE #’s & finally NFP #’s on Friday… plenty of event risks which we’ll discuss more about later but arguably the biggest events to pay attention to will be QRA & then of course NFP #’s on Friday.

On the flip side, if we were to see Spooz retrace in the interim, 6300ish was a firm resistance for nearly 3-weeks before it finally broke to the upside so bulls would like to see 6300ish flip from prior resistance to support (also pretty much coincides with the 20d as well) & on the medium-term picture, if Spooz were to falter below 6300ish / 20d, I could see Spooz pulling back further towards 6175 / 6145ish (Coincides with prior ATHs) & as long as that general area does remain supportive (highlighted demand zone), do think that bulls will continue to maintain edge / dips will continue to remain shallow & bought whereas if we were to see Spooz rollover further / prior ATHs fail to come in as support, I could see Spooz rolling back over towards 6050ish (assuming prior ATHs fails to come in as support) which essentially coincides with the Ceasefire bull-gap established just over a month back & in general, I do think the prior range before this recent breakout to new highs (6050 / 5950ish) will likely serve as a broader support, whilst important MAs (200d / 100d) sit just below as well for added confluence, and will continue to keep indices more bifurcated, and of course the other added factor to keep in mind is that many Individuals / HFs / PMs have been itching for any sort of dip to ‘let them in’ to this market so barring a surprise shock (still maintain that hard-data rolling over > tariff headlines), do think that dips will still likely continue to get bought until proven otherwise.