The Week Ahead 7/6/25

Hello All,

I hope you’re all enjoying the long holiday weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful 2H of ‘25.

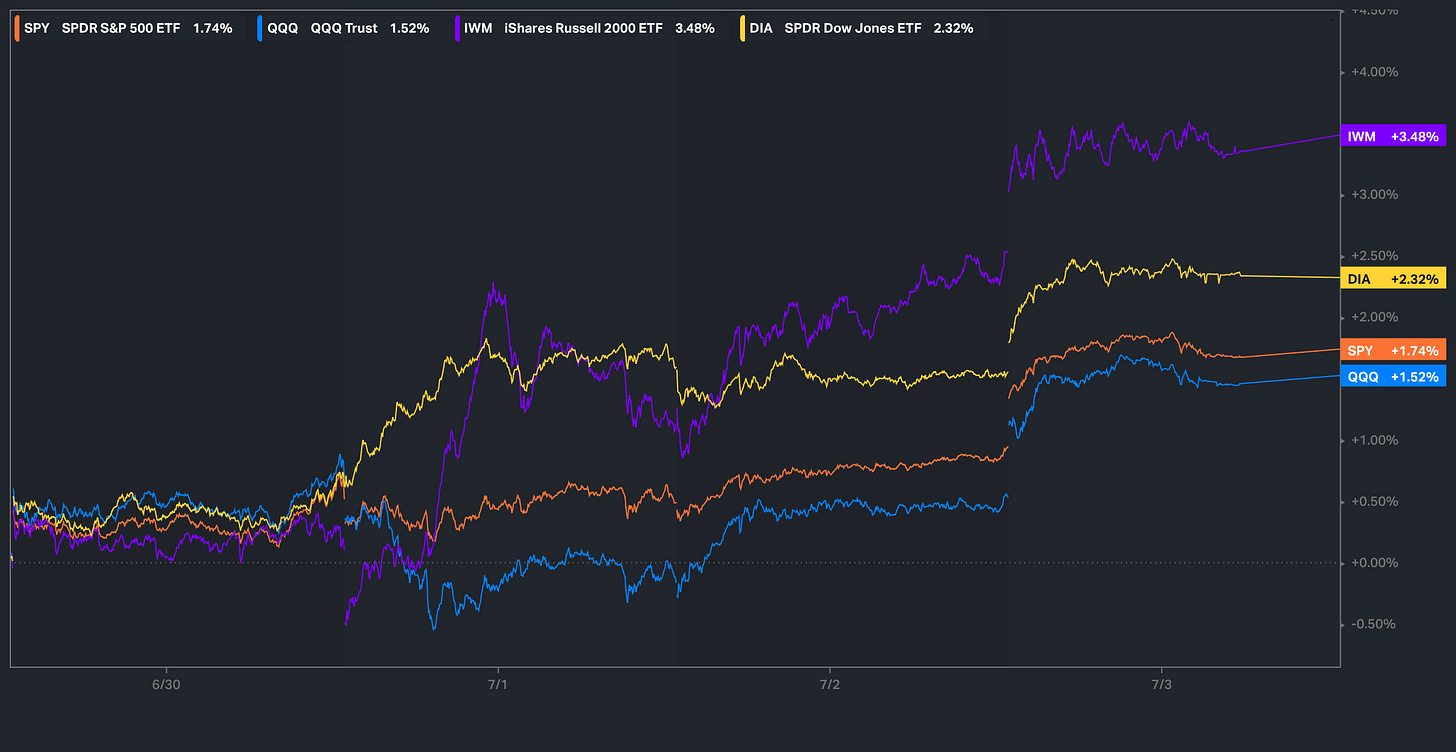

Looking back at this past week, it was relatively quieter in regard to economic data & to round off the shortened week on Thursday, NFP #’s ended up coming in better than feared which led the indices to finish off the week on a high-note & earlier on in the week, there was a bit of factor-unwind / de-grossing within the indices which caused for YTD winners to get sold & YTD losers to get bought thus Small-caps along with the Dow were the best performing of the indices whereas the Q’s were the worst performing of the indices although still ended up closing out the week higher by just over 150bps.

- Economic Data for the Coming Week:

In regard to economic data as we get ready to head into the upcoming week, it’s a generally lighter week all around with just a few bond auctions scattered throughout the week, along with standard FOMC minutes and Jobless Claims. But on the 9th, the tariff delay exp. enacted in April post-Liberation Day is finally expiring, so all eyes will be on exp. day and whether or not more deals are achieved with other countries and or another possible extension is granted to give countries one more window to achieve a last-minute deal (Trump did state the U.S. will start collecting tariffs August 1st, so it more so seems like that’s the small window for other countries to act and strike a deal with the U.S.).

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 136.32% return whilst in the same period, the Q's have returned 57.34% / Spooz has returned 48.68% / Dow has returned 37.59% & Small-caps have returned 26.55%, so nice outperformance against all the indices whilst having a 81.2% win rate, averaging a 22.91% return on realized gains / winners & a 14.48% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

In April, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

We also published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

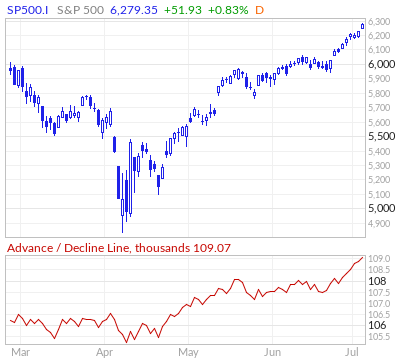

To jump right into it, Spooz once again achieved another new ATH this past week as Spooz ended up rounding off the week to close just below 6300, and the majority of the contribution was driven by an expansion / broadening of breadth, along with continued excitement revolving around dovish sentiment / rate-cut expectations. Lastly, to round off the week, the administration’s BBB was finally passed, and the feared NFP report on Thursday also came in better than expected, with prior months having been revised up as well… another example of hard data continuing to hold in better than most have anticipated.

As shown below, with Spooz continuing to break out and churn to new ATHs, we saw a bit of acceleration to the upside within the advance / decline line, which again signals that participation within this rally continues to remain quite healthy. The general theme of last week was a bit of rotationary action across the board (in part likely driven by de-grossing earlier on in the week), but the general broadening out of breadth kept indices firmly bid throughout the entirety of the week.

And given the broadening in breadth this past week, we did see quite the jump within the percentage of stocks above the 20D, with now 76% of stocks remaining above, working towards overbought / extended territory, so some general consolidation and or even a potential cooldown within equities to reset conditions wouldn’t be of too much surprise.

Into the upcoming week, it’s a fairly light week in regard to economic data but it’s also the week where the tariff delay expiration has finally come to an end.

A reminder of stated reciprocal tariff rate %’s:

Trump recently had an interview and discussed the topic of tariffs & a couple of standout points were as follows below:

- Trump: countries will start paying tariffs on August 1st (Seems like a last minute window to give countries the opportunity to try and negotiate the tariff % lower & or to work out a better deal with the U.S.).

- Trump: plans tariffs ranging from 60% to 70% to 10% to 20% (As Bessent has said prior but if a country negotiates in good-faith with the U.S., a lower tariff rate % will be reflected as a result but if a country doesn’t, than a higher tariff rate will be reflected… general point being, it’s in each & every country’s best interest to negotiate in good faith & to try and strike a deal with the U.S.).

So, since April when the Liberation Day event occurred, what have we learned?

- The administration does in-fact have a pain point.

- The administration isn’t trying to engineer a recession.

- The administration is weary of unwarranted bond volatility.

- The administration will in-fact negotiate & nothing stated is set in stone.

- U.S. negotiating leverage has drastically gone down (Every country knows the U.S. achilles heel; Bonds).

In regard to expectations, the Vietnam deal achieved this past week was a bit of a surprise in terms of forward expectations for other countries:

- Essentially, 20% tariffs on Vietnam products being sent to the U.S. & 40% tariffs on any transshipping (A dagger at China). What was surprising is the market didn’t necessarily react negatively as I arguably thought the deal wasn’t ‘great’ but I guess it wasn’t terrible either considering tariffs were 46% prior. Nevertheless, tariffs having jumped up from 10% baseline to 20% on Vietnam & this is after the fact of Vietnam having completely dropped tariffs against the U.S. more so likely emphasizes that the administration is likely sticking with their same calculation of the Liberation Day reciprocal tariffs (Which as we know was an improper way to calculate the rate %), but the administration sees this as a ‘fair deal’ given 20% is a lot lower than 46%.

In regard to other countries, I think the general conclusion here is countries whom do act in good-faith will have a tariff rate in the 10-20% range (10% if trade deficits were already low prior…ex: South America as the U.S. doesn’t trade much) whereas higher tariff rates as a threat in order to work out a better deal could be warranted but won’t likely stick & will more so be used as short-term posturing.

The one last factor to note into next week is I would argue the market only really cares about how the situation resolves in regard to trade with China / EU / Japan… could argue Canada & Mexico but don’t necessarily think they’re nearly as big of a factor.

And circling back but post-Liberation day, many questioned how this market would rally & we stated that given the initial pause implemented by the administration, further softening of rhetoric is all the market needed to continue to rally… and since, there’s only been two official trade-deals made (U.K. & Vietnam) yet Spooz is 150-handles above the February highs… softening of rhetoric & underinvested individuals goes a long way & I do think markets are much more acclimated to the tariff headlines so the same general surprise factor isn’t there as it was in April when the administration initially came out with the stated tariff rate %’s.

And one quick note on the notion of underinvested: Institutional clients have been net-sellers for 8 straight weeks now… point being, there continues to be a lot complacency in regard to upside although nets have come up from the April lows but are still well off the prior February highs from earlier on in the year.