Which Way Powell?

Hello All,

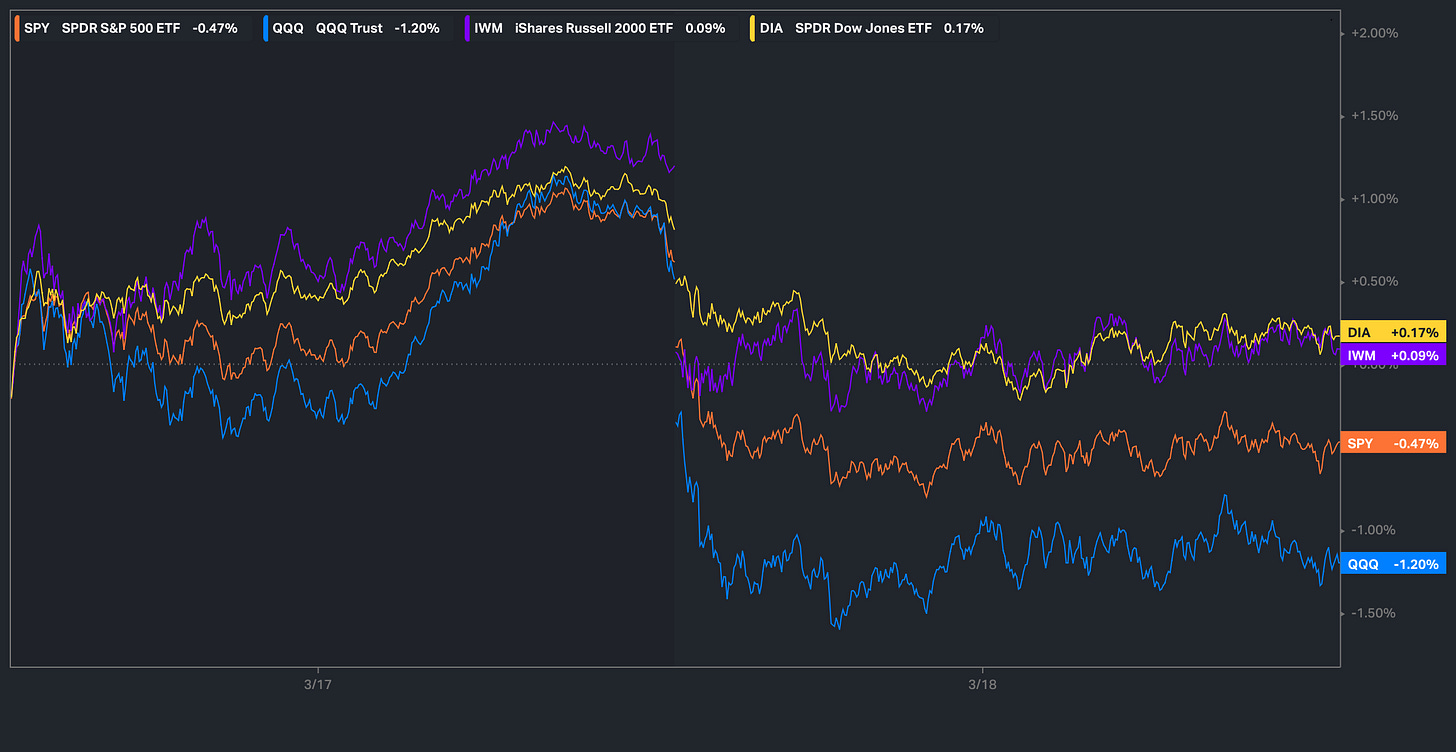

It’s been a fairly quieter week in respect to headlines & economic data, but tomorrow, we have finally reached the long-awaited FOMC day… thus far, the Dow & Small-caps are the only two positive of the indices on the week, granted, they’re essentially flat whereas the Q’s are once again the under-performer on the week which has mostly been driven by the lackluster action amongst Mag-7.

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

A bit of a quieter week in respect to market-moving headlines, but we did have a few headlines out of Bessent this morning:

US Treasury Secretary Bessent: There is no reason for there to be a recession.

US Treasury Secretary Bessent: For some countries, the April 2 tariff may be low.

US Treasury Secretary Bessent: On April 2, Each Country Will Get a Tariff Number

Nothing really new being said here… the administration has explicitly said several times that it isn’t necessarily pushing for a recession but a “detox” to clean up some of the irresponsible / unnecessary fiscal spending & in regard to tariffs, April 2nd has been the day for reciprocal tariffs to be enacted… from there, its a matter of if / when deals will be reached & or if / when things may escalate further… hence, the recent uncertainties regarding policy has still persisted as there hasn’t been a “concrete” plan from the administration.

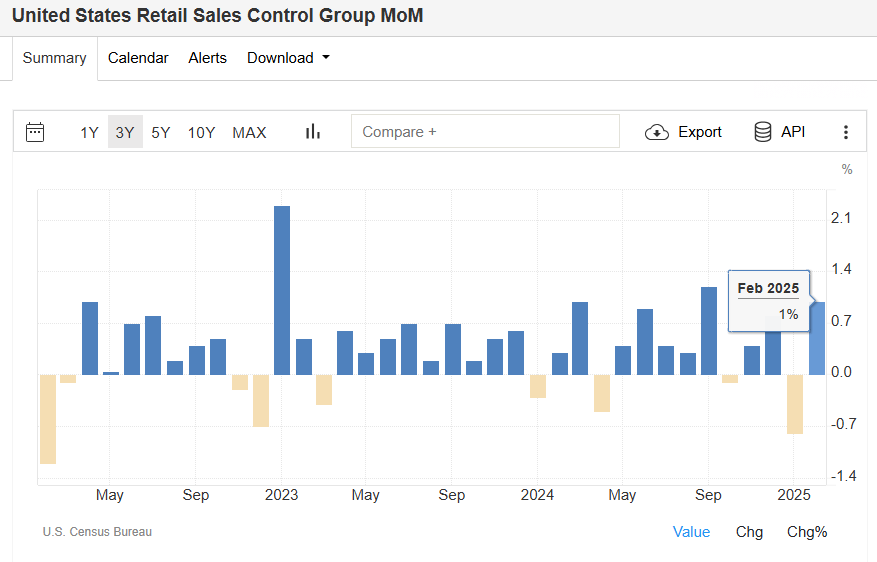

In respect to economic data, yesterday, we had retail sales which did come in a tad softer than expected, but the bigger factor was the surge in control group (+100bps) as it directly feeds through GDP, so was more so one of the more positive economic datapoints.

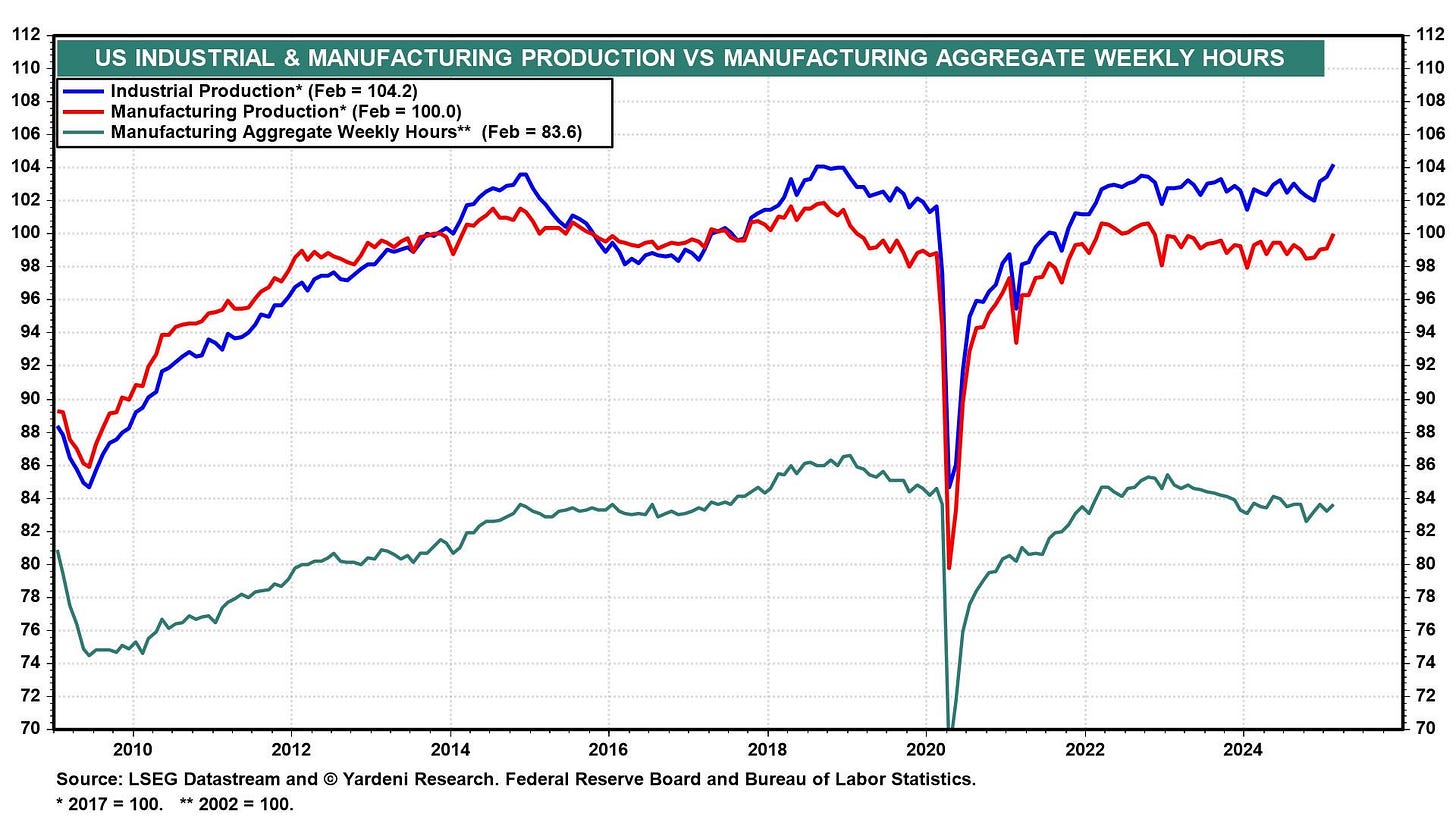

Today, we had a mix of housing data along with industrial production, but the big headline today was industrial production having reached new ATHs… granted, some of this likely due to recent uncertainties revolving around tariffs & some front-running…

Heading into tomorrow & the remainder of the week, we have finally reached FOMC day & the big question more so boils down to whether or not we see Powell’s tune start to shift back towards a more dovish lean, as in January given the uncertainties in regard to the inflation rebound / questions revolving around a potential second wave, Powell more so tried to keep a middle ground, but recent inflation data along with this past PCE report was a bigger positive for the Fed, although I would imagine Powell would like a bit more confirmation that disinflation is resuming before fully committing to guidance on another rate cut, which as of now, the next rate cut is projected to materialize in June & 3 cuts are expected for the entirety of the year.

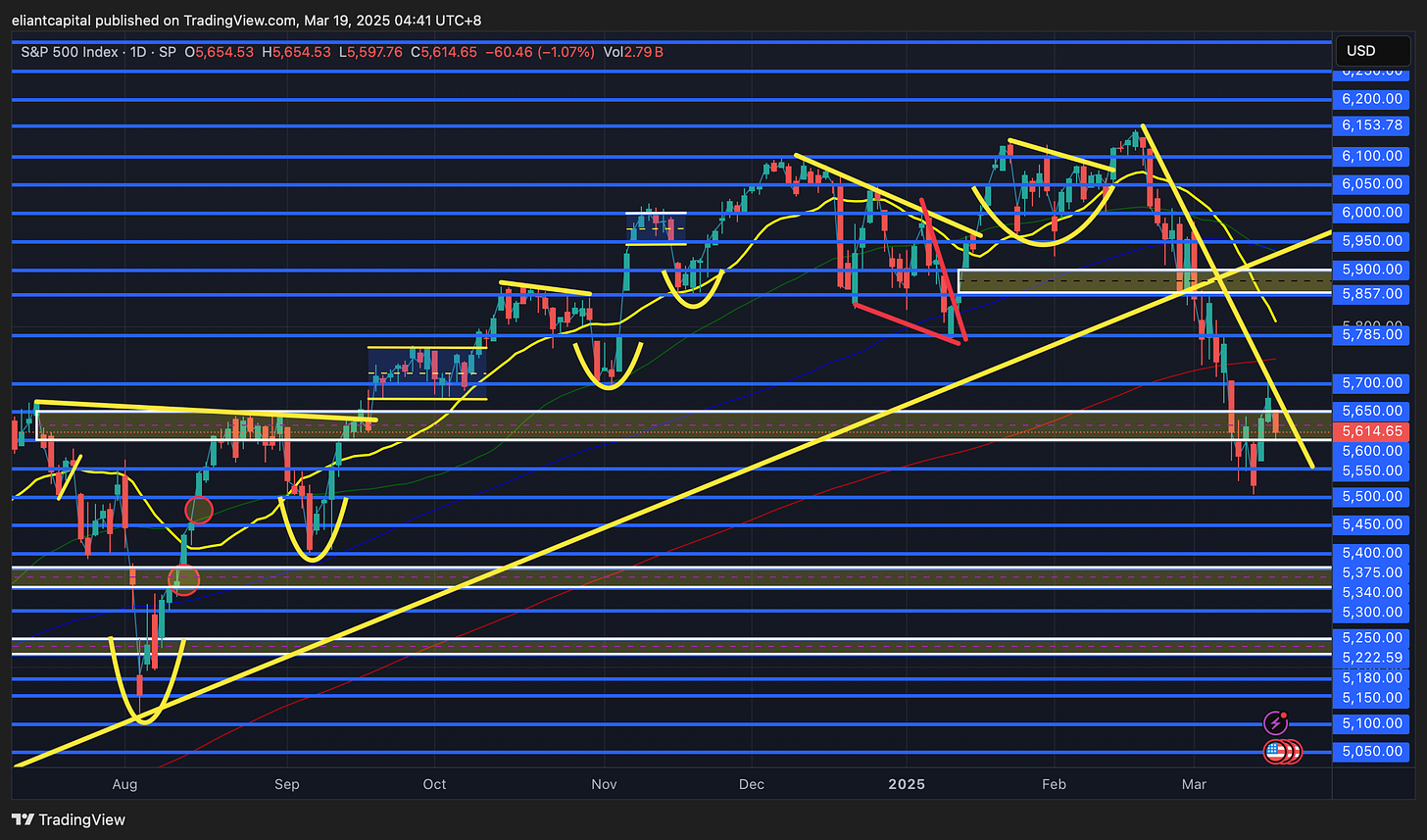

- SPY

In regard to Spooz, we did have quite the rally in the general indices yesterday as even Spooz briefly jumped above 5700, but today, the entire rally from yesterday & Friday’s late day close rally got faded as well. If we were to see Spooz form a higher low here and push back towards 5700ish / go on to reclaim the 200d above, I do think we could see Spooz rally towards 5850 / 5900ish above… from there, the question more so boils down to if thats the spot to look to degross longs / start getting short & or if the path to new ATHs will emerge… again, it likely will boil down to uncertainties regarding policy & or if things have cleared up or more so stayed the same… of course FOMC will play a role tomorrow as well.

On the contrary, if we were to see recent uncertainties persist / this recent rebound more so shifts into a bear flag, I do think we could end up seeing Spooz flush lower to retest the September lows near 5400ish & thats assuming things escalate fairly aggressively from here… certainly not impossible given how markets have reacted to recent headlines, but in general, if uncertainty in markets persist, do expect volatility to persist right there with it as well.

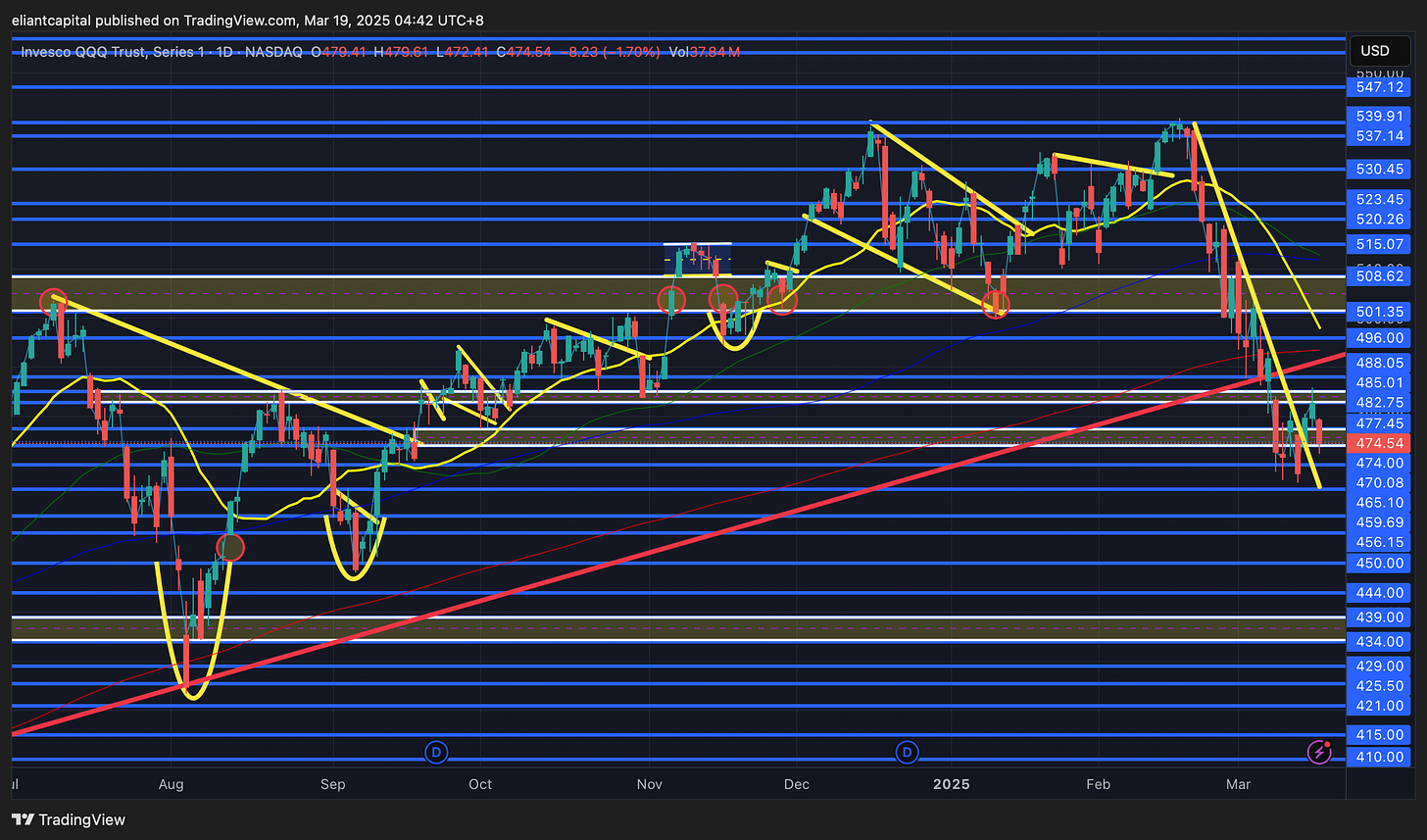

- QQQ

As of this past week, the Q’s ended up finding support off this TL that initially was established in the beginning of ‘24 & has acted as support in three other instances prior & the bigger question from here is if the Q’s can build a base leading to a sustainable rally as the trend of higher lows & higher highs remains & or if we see that TL below finally falter and cave in…

Earlier on this past week, we did see the Q’s fill the gap from this past September in ‘24 & as of now, the Q’s have found support / demand in that general area & do continue to think that 465 / 470ish on the Q’s is a fairly important pivot. The Q’s did have a bit of a lackluster day today as Mag-7 continues to struggle to find its footing, but if the Q’s can continue to maintain the 465 / 470ish demand zone below, I do think we can see the Q’s start to work higher to backtest the 200d near 493ish & if it were to be reclaimed, we likely would see the Q’s work a bit higher towards 496 / 501ish above before potentially pausing / digesting the recent snapback & then more so the question remains whether or not this is a lower higher within a potential bigger respective downtrend & or if the trek to new ATHs persists.

On the contrary, if we were to see bulls fail to continue to get followthrough to the upside / recent weakness in Mag-7 persists, it may lead the Q’s to flush towards the earlier on September ‘24 gap just below these prior local lows near 456ish which just nearly coincides with the September ‘24 higher low bottom as well after forming the bigger bottom in August ‘24 (Carry trade unwind bottom)… not necessarily a base case, but after todays weak rally, I do think it should be considered despite the Q’s still remaining well within oversold territory as overall index strength has still been pretty lackluster across the board.

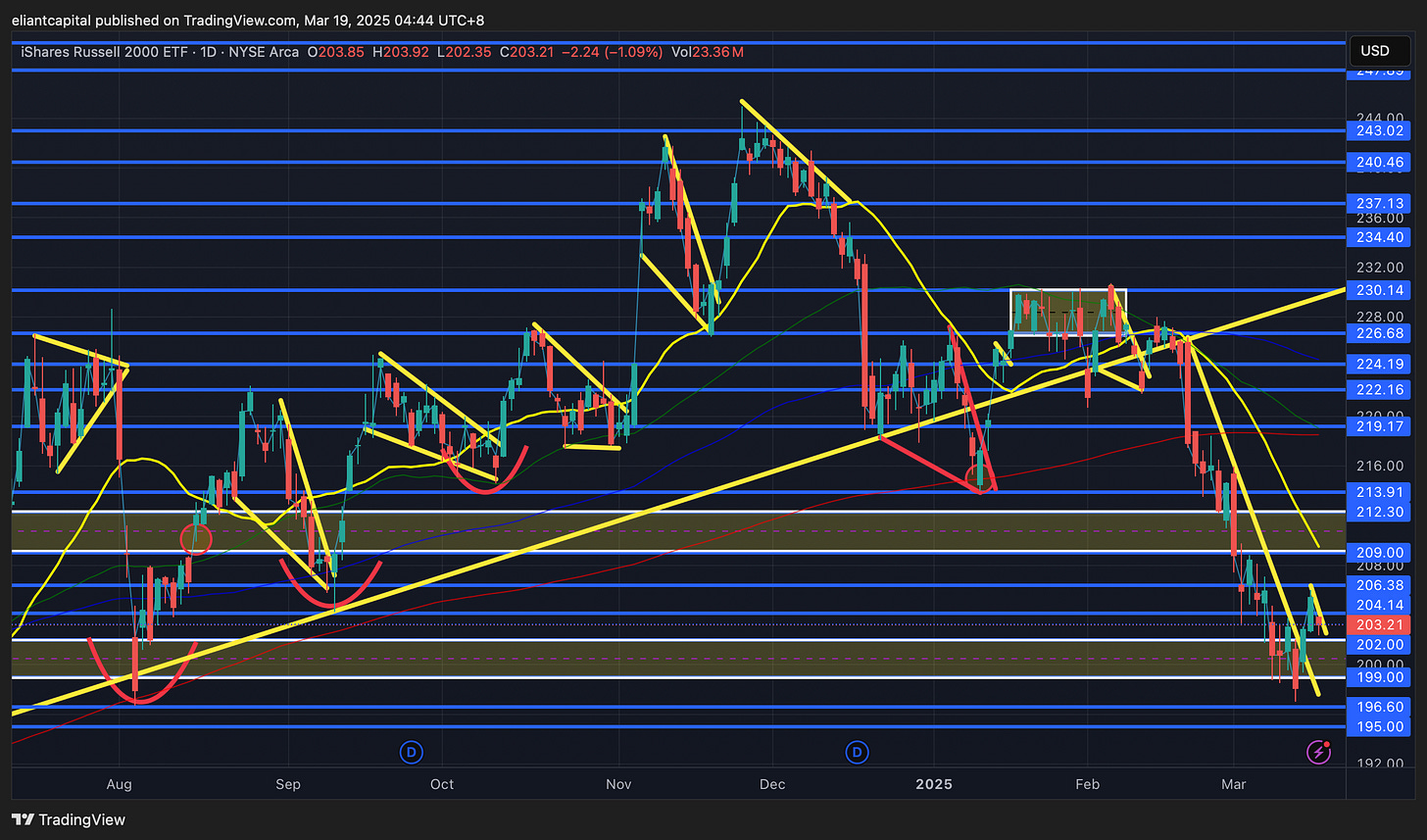

- IWM

Small-caps have held in fairly well on the week along with the Dow as they’re currently the only indices positive on the week whilst Spooz & the Q’s are both red.

Small-caps continue to find support right off the 200wk whilst coinciding with the backtest of the 2+ year breakout in which led to the big rally in small-caps in ‘24: The ultimate S/R flip (prior resistance flipping to support).

As the week has kicked off, IWM broke out of the respective downtrend that has remained in place since this downtrend initially kicked off back in Mid-February & is now arguably flagging above the downtrend… we do have FOMC which is a bigger catalyst for small-caps to potentially breakout to the upside, but in general, the look below and fail of the 200wk from this past week is still a very constructive look. If we were to see the recent rebound off the lows persist / rally gets followthrough to the upside post FOMC, I do think small-caps will go on to retreat upwards towards 209 / 212ish above to at least backtest the 20d before potentially pausing & resuming lower & or if data abides / growth scare & or fears continue to simmer down along with disinflation resuming, we likely could see the small-cap rally sustain & have holding power. The biggest weight on markets remains around the recent uncertainties regarding policy along with the sporadic headlines within markets as that has continued to weigh on the overall sentiment as each brief pop has continued to get sold.

On the contrary, if we were to see this most recent rebound in small-caps fail & IWM starts to revert back lower below the 200wk / August ‘24 lows, we likely could see selling persist in IWM towards mid-190s, but I would be a bit surprised if we were to see that outcome given how constructive small-caps look after this past week… we likely need to see some sort of surprise in markets whether it be weak economic data to stir up recession fears & or recent uncertainties regarding policy continuing to persist with no resolve in sight… (again, not base case, but still is worth always remaining open-minded).

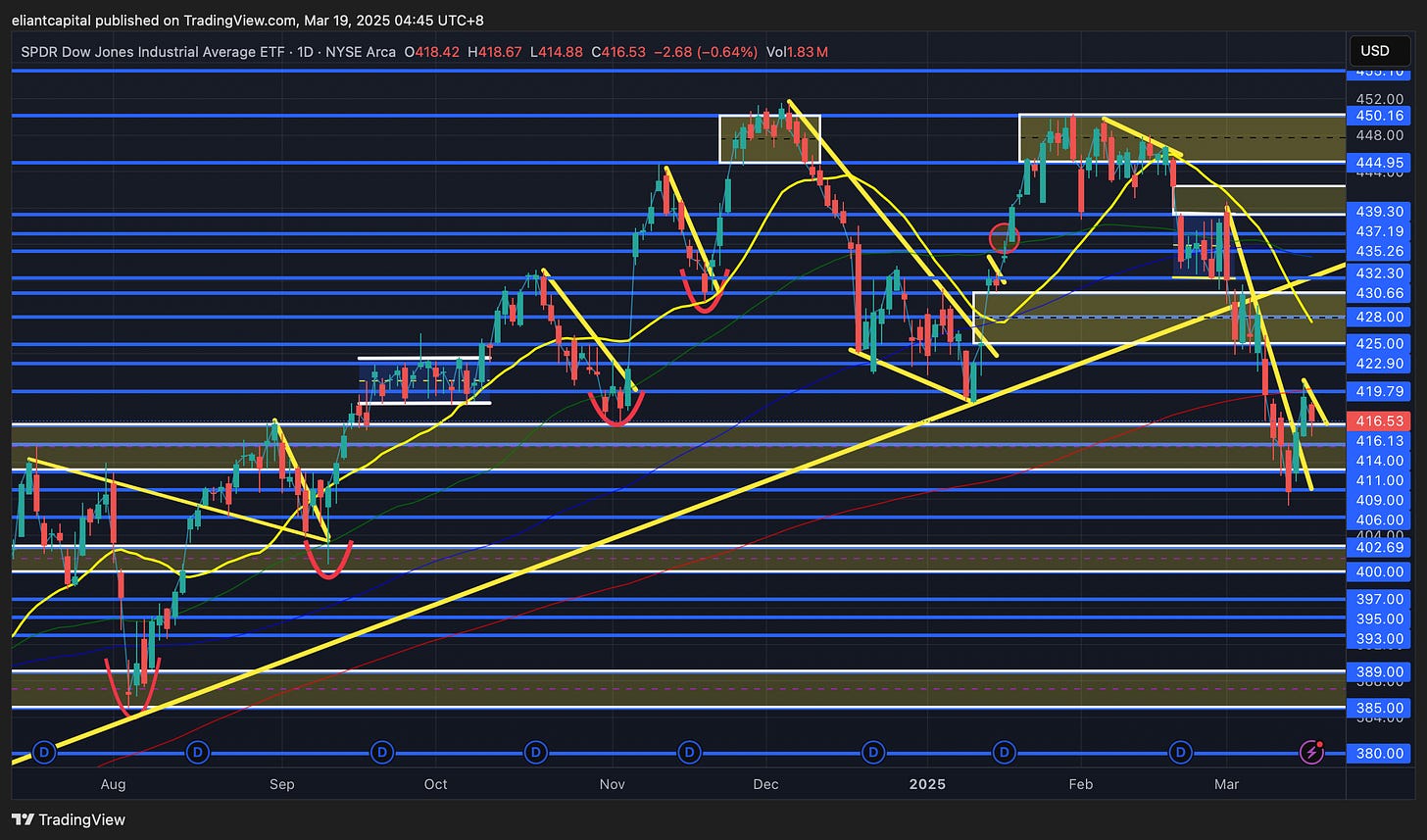

- DIA

Thus far, the Dow has been the best performing index on the week, granted, it currently sits up just 17bps on the week so essentially flat / trading slightly higher. Not too much has changed for the overall picture, but as of now, DIA found some support this past week right off the Summer ‘24 highs (416 / 411 zone) & in general, I do expect this area to remain as an important pivot as it has potential to be a S/R flip (prior resistance flipping to support). DIA did have a nice rally yesterday, but did end up faltering on the upside & rejecting the 200d from below… clear pivot that bulls need to reclaim, as otherwise, bears will still remain firmly in control. If we were to see DIA form a higher low / break out of this interim flag & go on to reclaim the 200d above, I do think we could see DIA push further to the upside towards 425 / 430ish (20d within range) before then pausing & or deciding where to go from there. If the countertrend rally were to extend, again, the biggest question as we’ve discussed is if it will be a rally to sell into / degross longs & start to look to add shorts & or if the trek to new ATHs continues… still continues to depend on recent uncertainties regarding policy getting resolved / economic & or labor market data continuing to hold up & of course, FOMC tomorrow as well.

On the contrary, if we were to see DIA continue to reject the 200d above & fail to firmly reclaim 420ish & this more so turns into a potential bear flag before resuming lower, the next bigger line of support is around 402 / 400ish which coincides with the September ‘24 lows… a bit make or break here for indices in general as you could argue all of them are within bear flags & or you could argue all of them are trying to base / find some support & potentially establish a higher lower before resuming higher.

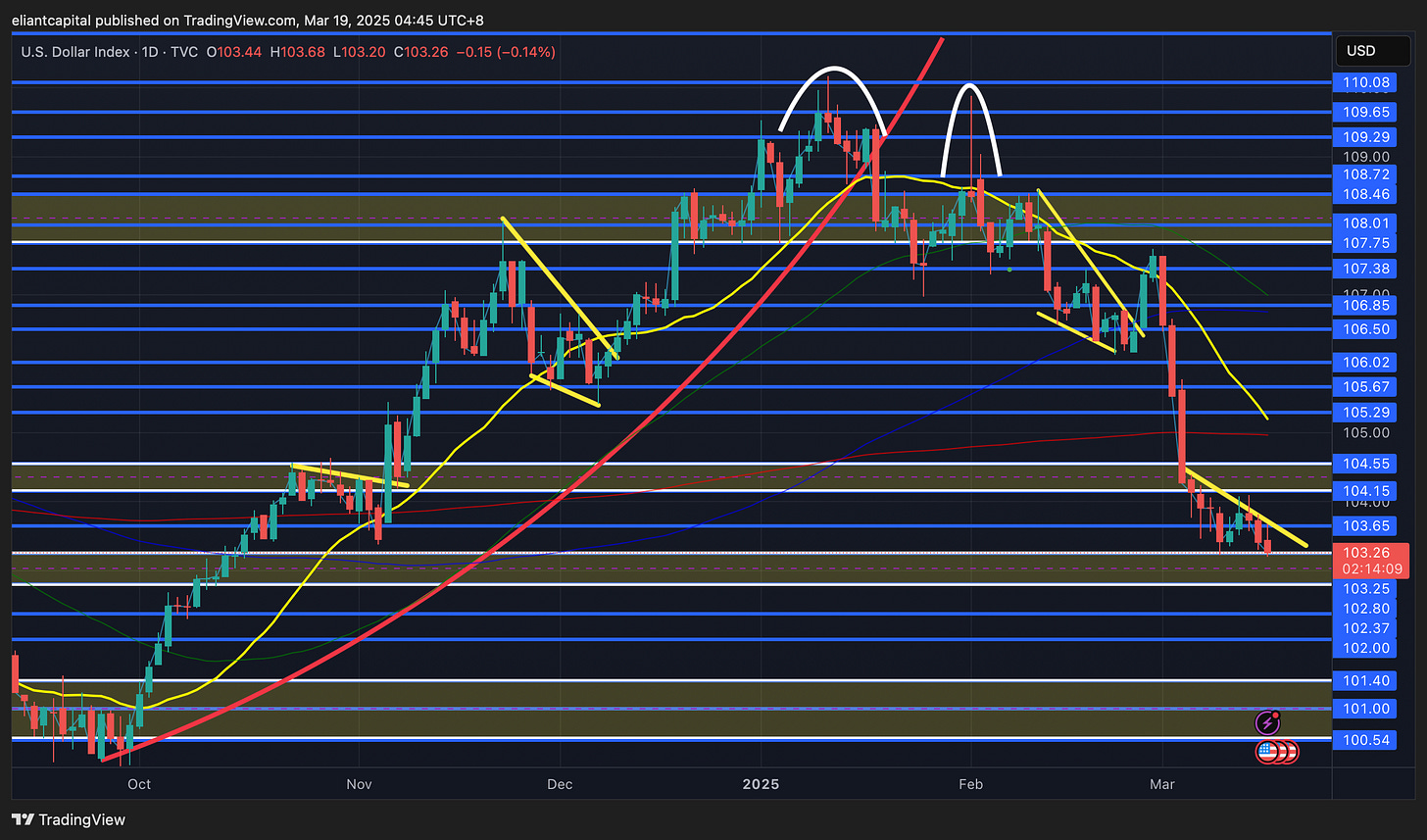

/DXY

The weakness in the dollar has persisted as the week has kicked off & we finally got news out of Germany:

Germany’s Parliament has approved a significant borrowing increase, allocating €500 billion for infrastructure and defense, along with changes to debt regulations.

The big infrastructure & defense bill was finally approved today & as a result, we did see the Euro rally higher today as it now sits above the 200wk… this is a pretty pivotal spot for the Euro & as highlighted below but each time the Euro has overcome the 200wk, it has been very short-lived, so it would be a HUGE character change if we were to see this rally in EURUSD sustain above the 200wk.

This week thus far has been fairly quiet in regard to headlines… yesterday, as we talked about earlier, but we did have retail sales which at first glance were a tad softer than expected, but control group surged +1% which directly feeds through GDP & is more so a pretty positive datapoint for the general economy / consumer… in respect to tomorrow, we have finally reached FOMC day & the big question as of now is will Powell be hawkish / try to keep a middle-ground / come in dovish?

For starters, I pulled some quotes from Powell’s speech from the other week:

So what’s the takeaway… the first quote shows that Powell is recognizing that inflation has been gradually reduced broadly since January… & if you recall in January, but that was a time when the majority consensus was calling for a second wave of inflation / overheating economy etc… only took two months for that narrative to fade. The next quote shows that Powell isn’t solely focused on the hysteria revolving around tariffs & just below that, Powell acknowledges that one-time price spikes aren’t appropriate to react to (ahem… this is in regard to one-time price spikes from tariffs). Lastly, Powell then recognized the recent slowdown in consumer spending, but did reiterate in that speech that the economy in general is fine.

So… let’s recap a bit on what has changed since the January meeting… Well again, in January, there was worries of an overheating economy along with potential for a surge / rebound in inflation & since, the entire narrative has shifted to growth / recession worries & now there is hardly any talks of inflation. As we all know, but the Federal reserve / Powell has been very vocal on being supportive of the labor market & if data were to deteriorate, the Fed would have no issues with “pivoting” & or coming in as supportive for the labor market / economy. How has economic data been since January? Well, it probably depends who you ask as surveys have been awful but hard data excluding housing has generally been fine… not overheating data like January, but also not necessarily recessionary data either. This past FOMC in January, Powell tried his best to keep a middle-ground for the entirety of the speech & more so took the “wait & see approach.” Again, economic data has certainly slowed / come off the highs since which more so has been attributed to recent uncertainties regarding policy along with the recent market correction which attributes to the negative wealth effect, & in regard to inflation, as of now, disinflation looks set to resume… we’ve recently had softer than expected inflation reports (CPI / PPI / PCE). So, if Powell tried to keep a middle-ground in January with arguably “overheating” data & questions surrounding the inflation picture & NOW… we have slowing economic data along with the recent inflation picture having improved substantially since January (excluding surveys)… why wouldn’t Powell lean “slightly” dovish? I have seen the arguments that Powell may be hawkish due to policy surrounding tariffs which may be the case, but Powell himself has referenced tariffs as “short-term noise" & he more so is focused on the bigger picture which looks to be that disinflation is back to resuming.

I’m not necessarily expecting this FOMC meeting to be groundbreaking / Powell to be overly hawkish like others are calling for… I more so think Powell acknowledges recent data (economy has slowed down a bit due to recent uncertainties revolving around tariffs and disinflation does look to be resuming) which allows the Fed to have room to work with / lean slightly dovish & the Fed will likely remain data-dependent & IF we get a couple more prints showing progress on the inflation front, I do think the Fed could end up cutting in May… although probably a tad bit of a tougher feat given the next PCE report is supposed to uptick given the readthrough from the components of this past PPI report.

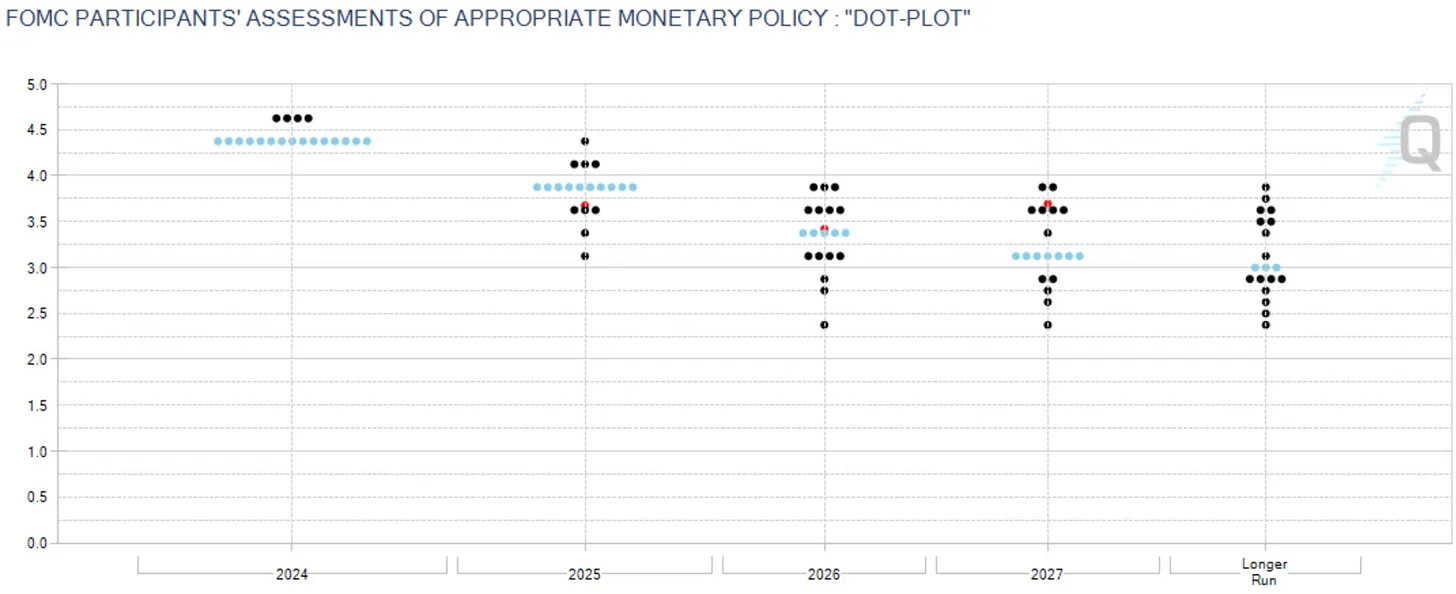

Another topic for tomorrow is the dot plot…

As of now, respective target rates expected:

2025: 375-400

2026: 325-350

2027: 300-325

Essentially, 3 cuts are expected for ‘25 / 2 cuts are expected for ‘26 & 1 cut is expected for ‘27… seems fairly reasonable / not necessarily expecting any surprises here & again, do think recent data allows the Fed to have a bit more of a dovish lean / room to work with given recent uncertainties regarding policy amplifying growth & recession fears whilst inflation looks set to continue resuming lower which has likely been a bigger tailwind with recent discussions amongst the federal reserve.

If anything given how the dot plot can be skewed amongst members, I *could see a slightly hawkish dot plot, but then Powell easing those fears a bit his speech, but in general, not expecting too big of surprises here… more so expect the Fed to generally maintain market expectations / no shocks to the market.

In respect to the dollar, a more dovish leaning / accommodative Fed could lead the dollar to ultimately flush to the 200wk near 102.2s in the interim, but if we were to see the dollar continue to to be supported following data & FOMC tomorrow above the highlighted demand zone just below in the 103.25 / 102.8 range, I do think that signals that the dollar is likely going to retrace a bit higher to work off the recent oversold conditions… we likely would see a rally back towards 104.15 / 104.5s above & if the rally were to extend, potentially a backtest of the 200d near 105ish, where ultimately, that may turn out to be another lower high thus leading to a continued resolve lower in the dollar then leading to new local lows.

/TNX

Again, we have finally reached FOMC day & we outlined some expectations above, so I won’t repeat, but in general, a continued recent theme with bonds is the lack of performance despite recent volatility within markets… & its in part been driven by both Germany & Japan bonds. In respect to FOMC, again, do think recent data should allow for the Fed to be more accommodative & it more so seems likely that Powell edges with a dovish lean instead of trying to maintain a middle ground as he did in January… mostly attributed to recent data showing that disinflation looks to be resuming / the economy has cooled off from the “overheating” levels in January & policy in general still has created uncertainties within markets which has caused for the recent 10%+ correction off the highs.

The 10Y still does look fairly 50/50 here, but as long as 4.35s on the 10Y continues to cap upside / provide a lack of followthrough, I do think this *could be a lower high before the 10Y starts to resolve back lower… maybe a dovish leaning Powell is the trigger or surprise soft economic data from here on out, but as of now, would rather maintain a neutral stance on bonds as we’re kind of in the “midrange” for now.