Will the Hard Data Finally Crack?

Hello All,

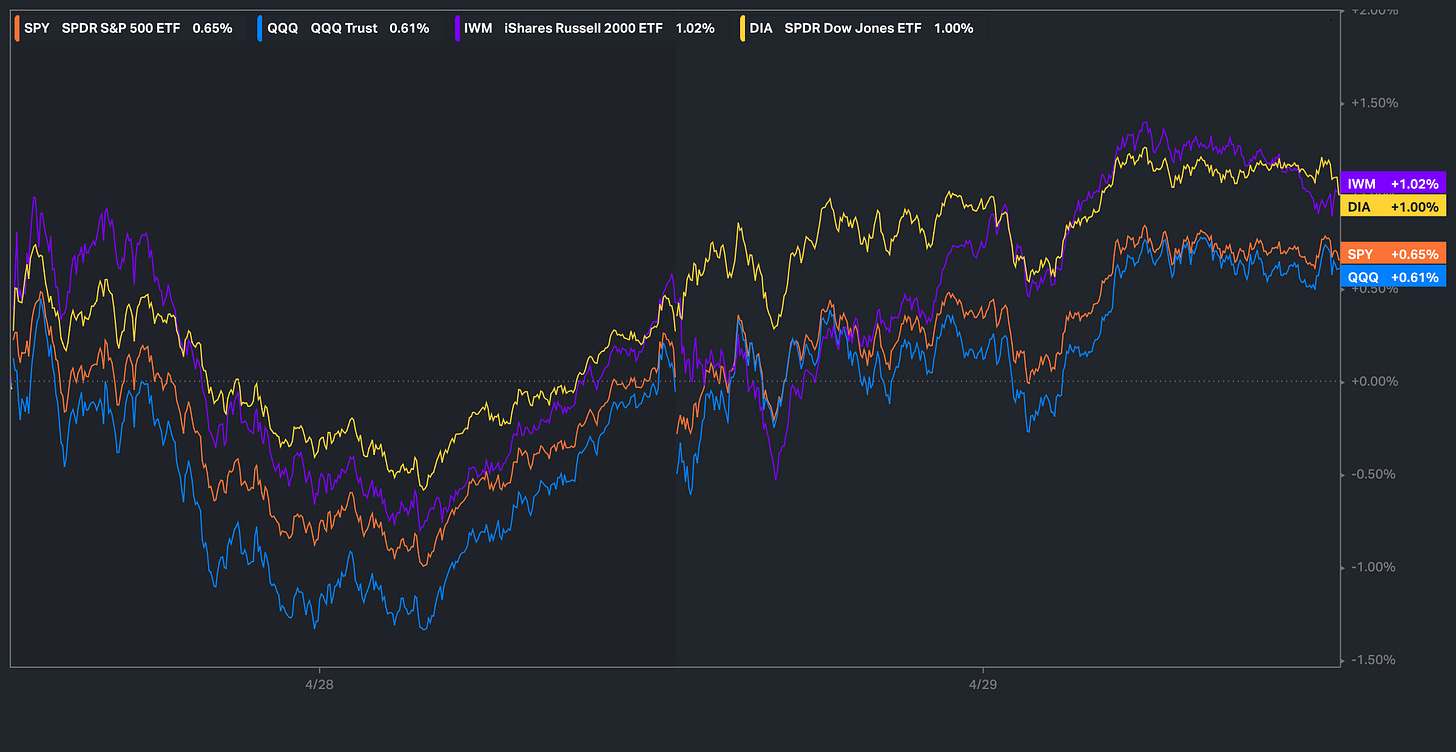

It’s been a relatively quiet week to start in respect to headlines & data, but today, we finally saw Spooz & Small-caps go on to fully retrace & fill the initial Liberation Day gap from early April… that now leaves the Dow as the only index to have not filled the initial Liberation Day gap from early April & speaking of which, Small-caps & the Dow have been the best performing of the indices on the week thus far whereas Spooz & the Q’s are slightly laggards comparatively.

A couple weeks back, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

It’s been a relatively quieter week in respect to headlines & there isn’t too much to recap but I included the most important below:

- Trump: India is coming along great, I think we have a deal on tariffs.

Fairly clear that India will likely be the first deal announced… likely followed up by either South Korea & or Vietnam.

- US Treasury Secretary Bessent: Deregulation will kick in during third and fourth quarters.

Our anticipation has been for deregulation to kickoff in back half of ‘25 & Bessent more so comfirmed that today. Between tax-cuts / deregulation & stating “trade-talks are going well” every single day, the administration has been in full “pump” mode but do think hard data could test them & or a lack of progress in terms of deals being announced as markets potentially grow impatient for updates… just like they did this past Monday before the administration then came out and softened rhetoric against China before leading to this recent rally.

- US Treasury Secretary Bessent: I don't anticipate supply chain shocks.

I found this statement to be quite bold from Bessent… I am good friends with a few longshoremen on the West Coast & they have told me work is completely dead & there is essentially a 2-3 week window before supply chains are completely halted… maybe Besssent is optimistic as Walmart & other retailers said they wuill resume shipments from China but then it makes you wonder if retailers are sensing a rollback from the administration & the short-term hit is worth it, but in the interim, it does also mean that costs will be passed on to the consumer but of course does remove some interim inventory risk… we’ll likely have more color these next couple of weeks.

- US Treasury Secretary Bessent: We will speak to at least 17 partners over the next few weeks.

The White House made it clear that they are dealing with 18 major trading partners in terms of trying to strike a deal & thats where the focus is… assuming this is the actual case, I could see the remainder countries all being met with the same terms of 10% reciprocal tariffs across the board with some countries likely being fully exempt if the U.S. gets something in return.

- WH Press Sec. Leavitt: On Wednesday, Trump will host CEOs.

Unsure of the specifics in regard to the CEOs that Trump is hosting, but nevertheless, would imagine the CEOs ask for some sort of reprieve & or complain to Trump which maybe causes the administration to issue some concessions / continued softening of rhetoric etc…

- Japan Economy Minister Akazawa: There is no change to our stance, we are demanding full removal of US tariffs.

Japan essentially demanding full removal of U.S. tariffs before trying to strike a deal & is essentially trying to corner the U.S… similar as to China. Pressure clearly remains on the current administration to either lower tariff rate %’s or remove them completely so we’ll see who blinks first.

In respect to data, it’s been a relatively quieter week thus far but we did have JOLTs today which showcased job openings falling to 7.2 million—the lowest since September 2024 and well below the 7.5 million expected, but despite this, layoffs declined to 1.56 million, the lowest since June 2024, indicating employers are holding onto workers. Hiring rose modestly by 41,000 to 5.41 million, and voluntary quits ticked up slightly, reflecting lingering worker confidence in job prospects. Not necessarily a weak report & this report has more so been the same story these past few months… job openings continue to fall but layoffs continue to decline alongside with it & we’re more so in a standstill.

In terms of the remainder of the week, tomorrow we have GDP along with PCE #’s & then on Friday, we have NFP #’s which is more so the bigger datapoint of the week.

- SPY

As we look to round off April with tomorrow being month-end before we head into May, it’s been quite a wild month to say the least but in respect to the monthly on Spooz, we are closing out with a hammer & the bottom wick as we’ve covered previously lines up exactly with the Covid ‘20 Support TL / Backtest of late ‘21 & or Early ‘22 highs with the entire peak to trough of the decline coming in just under 22%… quite the low to say the least.

Shorter-term, markets are continuing to inch towards overbought territory as the percentage of stocks above the 20d works back to the high-end of the range, so still think its worth being mindful & as we’ve reiterated these last few days / end of this last week, do continue to favor downside hedges on Spooz / Russell into the Summer given the general anticipation of hard data set to potentially weaken & comparatively to just a few weeks ago, protection is much cheaper up here & as we noted this past Friday, but we did uncap our hedges / cover the short-leg to reduce our overall basis on the long-leg given we sold the short-leg at a much higher VIX just a couple weeks back.

As we head into the remainder of the week, we do have some Mag-7 earnings ahead & the general theme this earnings season has been better than feared across the board. In respect to data, tomorrow we have GDP & ADP #’s shortly before market open & then shortly after market open, we have PCE #’s. Inflation has been a bigger concern for the Fed as of late given recent uncertainties surrounding tariffs & policy, but headline PCE is expected to drop off to 2.2% tomorrow after coming in at 2.5% this prior month… if you recall but the Fed’s target is 2% so we’re essentially right there. Nevertheless, the upcoming prints these next couple of months will be what the Fed is paying attention to given the overhang of current tariffs in place hence that won’t likely show up in data (assuming the current tariff rate %’s stick) until these next few months. Still don’t think inflation is too big of a concern & maintain that it’ll likely be a one-time price shock & the bigger risk factor at hand remains the economy.

In respect to Spooz as the week has kicked off, again, it’s been a relatively quieter week altogether as Spooz currently sits higher by just over 60bps & today, we finally filled the entirety of the initial Liberation Day gap from early April. As of now, the 50d is sitting just above near 5600ish & if Mag-7 reports well into the remainder of the week along with hard data continuing to hold in, I could see Spooz extending further into the 50d above & ultimately if bulls were to reclaim, I could see another impulse higher towards 5715s to just nearly backtest the 200d which would likely be a bigger pause for markets as well. As we’ve been talking about these last few weeks but nets remains low / HFs remain generally UW stocks after degrossing near the lows earlier on in April & the markets have more so undergone a wall-of-worry climb… barring a headline / collapse in hard data, don’t necessarily see why this can’t persist, but still worth remaining on guard given hard data weakening remains the bigger risk at hand here.

If we were to see Spooz backtest / retrace lower, in the interim, I would like to see 5450ish supportive which was a stubborn resistance this past week & also marked the high of the 90-Day delay rally, so it would be a general positive if it did flip to support, but on a more bigger picture, I still would like to continue to see the bull-gap from this past Wednesday protected with the bigger LIS essentially being 5350 / 5340ish below on Spooz & as long as that does remain protected, do think bulls will remain with edge to continue to work higher & or at least cap interim downside to allow for some digestion of this recent upside move before either basing & continuing higher & or rolling over if hard data starts to weaken / trade-war uncertainties continue to amplify after this recent cooling. If that bull-gap were to falter as support, do think we can see Spooz continue to rollover towards 5300 / 5250ish to fill the entirety of the bull-gap & that very well could mark another higher-low, & the bigger picture view continues to circle around this past Monday’s low near 5100ish as the ultimate LIS for bulls as faltering below would likely lead to a full unwind of the 90-Day Delay move which would more so be driven by weaker hard data & or a walk-back of the recent walk-back by the administration which doesn’t seem likely at this moment as it seems fairly clear that they want to de-escalate, but of course, wildcards always remain.

To reiterate once again, but do continue to think the biggest risk-factor from here more so revolves around hard data weakening & the tariff slowdown effects filtering through the economy as 65% tariffs & 145% tariffs on China haven’t meant a thing as the market understands the higher %’s as a negotiating ploy and nothing more, but again, damage has already been done to the economy and credibility & continue to think Summer hedges are worth having on Spooz / Russell.

- QQQ

As we look to round off month-end in respect to the Q’s, again, similar as to Spooz but the Q’s have put in a monthly hammer & the bottom wick coincides with the backtest of the early ‘22 highs before the bear market kicked off… quite the low to say the least.

As the week has kicked off, we have continued to see the Q’s followthrough to the upside, and again, the Q’s currently sit just below the 50d… if we were to see the Q’s firm up above the 50d & go on to reclaim, do think we can see the Q’s extend higher towards upper-480s to try and backtest the 200d above, but that would likely need to be driven by stellar quarters out of the remainder of Mag-7 this week. If we were to see the Q’s backtest / retrace lower before trying to break higher, bulls would like to see 465 / 459ish supportive & turn into a S/R flip zone (prior resistance turns to support) along with the bull-gap just below from this past Wednesday continuing to remain protected as well.

On the contrary, if we were to see the Q’s reject the 50d just above, again, bulls ultimately need to defend the bull-gap below from this past Wednesday near 456ish (Bull LIS), but if that were to falter, we likely will see the Q’s retrace lower to fill the entirety of the bull-gap into 450ish which could set up for another higher low & on the bigger picture, 439 / 434ish continues to remain a bigger area of interest / demand below in terms of separating the Q’s from unwinding the 90-Day delay rally & or continuing to remain supportive of the recent higher low / higher high trend.

/DXY

The dollar has had a relatively quieter week altogether & is essentially flat on the week & we did most of the recapping earlier on in respect to the week thus far, but the one factor that the dollar continues to face is credibility remaining in question as despite the recent rally in the indices along with hard data continuing to hold in, the dollar still can’t seem to catch a meaningful bid. Slowdown / Recession fears for the U.S. continue to remain in focus & as of now, individuals seem to be in two camps. If hard data doesn’t start to soften around these incoming reports, it’ll be the next month… & the other camp is if hard data doesn’t soften these incoming reports, it may not soften at all. As we’ve stated previously but it’s clear damage has already been done to the economy and the biggest loser from all of this is small businesses IF the current tariff policies stay intact as if they do even if softened a tad, small businesses will still take a hit & weigh in on the economy thus this is also likely weighing in on dollar weakness as well. I do still think the situation could be somewhat comparable to ‘22 in terms of a well anticipated slowdown / wealth effect taking a hit due to decline in stocks yet by the time a technical recession is completely confirmed, we’re already on the way out likely driven by tax cuts / deregulation / deficits blowing out further / supportive fed etc…

In terms of the remainder of the week, tomorrow we have GDP #’s before market open which are expected to come in at 0.4% & then shortly after market open, we have PCE #’s in which headline is expected to decline to 2.2% down from 2.5% the prior month & just shy of the Fed’s target of 2%. To round off the week, we have NFP #’s on Friday & as of now, jobs are expected to come in at 130k & the UER is expected to remain unchanged… again, it’s clear the economy has slowed but we’ve yet to see it show up meaningfully in hard data so these next few months will likely be a bigger test for that trend.

In respect to the dollar specifically, again, despite the rally in U.S. equities, the dollar has still been unable to firm up / properly find its footing… do still think we could’ve found an interim bottom in the 97s the other week given the look below and fail of the Summer ‘23 lows but until the dollar can reclaim 100.5s on the upside to start to push back higher towards 102 / 102.8s, each & every pop will likely continue to get sold given the structural change in U.S. credibility these past few months. If we were to see this past weeks lows near mid-97s falter, it likely would be quite negative for U.S. indices in general & signal that mid-90s is next up on DXY.

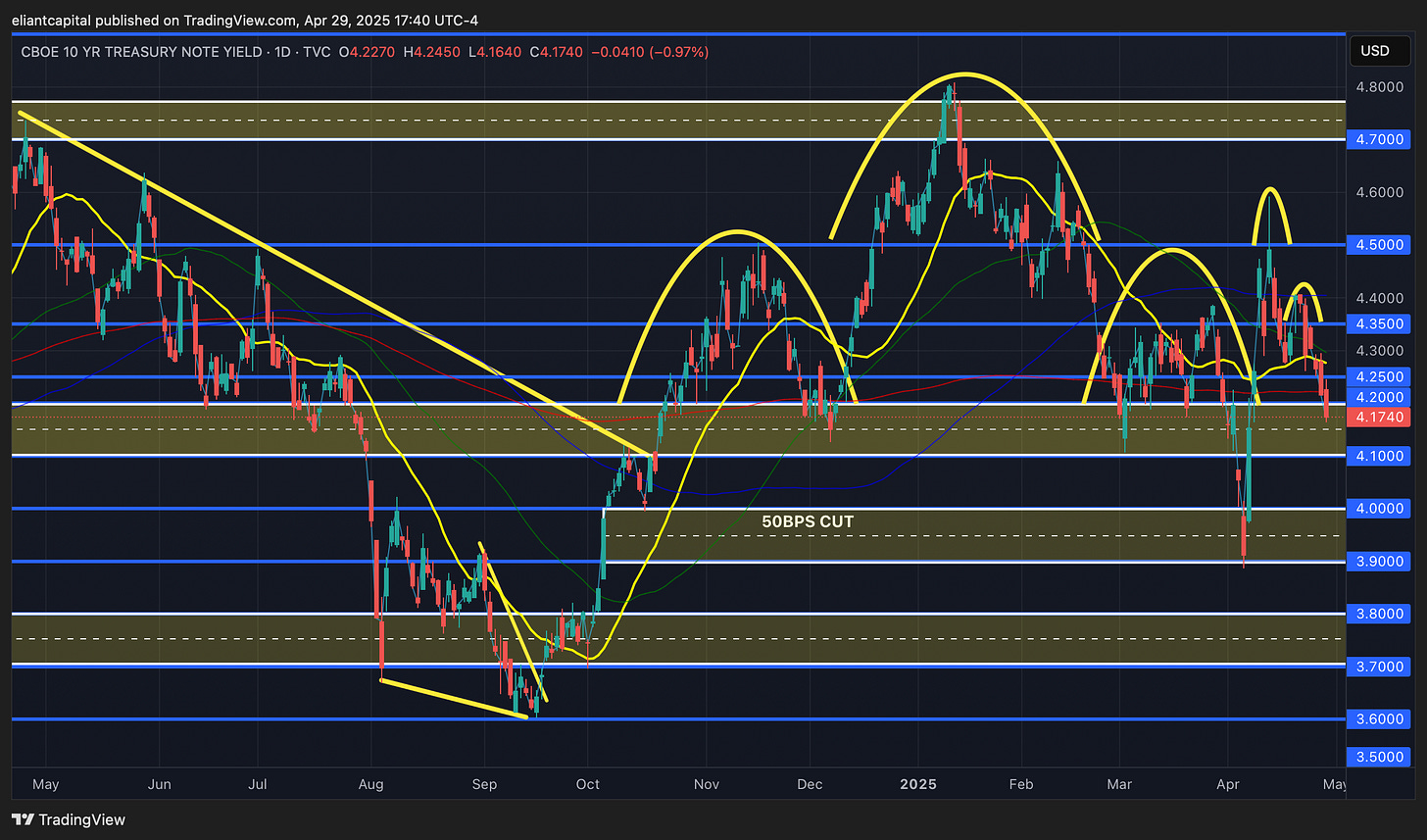

/TNX

Bonds have had a fairly good week as fears of a slowdown / recession & anticipation of hard data weakening continue to amplify but as we’ve continued to highlight, despite the efforts for fiscal austerity, the deficit is going to keep exploding higher which likely will continue to remain as a weight on bonds / cap upside & between DOGE cuts being a total nothing-burger (looking like only around 50B will be saved after aiming for 2T) / administration adamant on tax cuts, the setup for meaningful upside in bonds continues to diminish… especially with current tariff rate %’s in place, even if it does end up being a one-time price shock as at the end of the day, inflation expectations have still soared.

The opposing side is it is fairly obvious the economy has slowed since January, & the biggest factor at this given moment is IF these policies surrounding tariffs do stick as small businesses will end up taking the most heat thus exerting pressure on economy whilst the larger / big businesses will be able to hold it out & push through. These next few months & even into the remainder of the week will be quite important for hard data considering things have held in very well, but if hard data does start to rollover, we could see a bit of a flush in yields / maybe even panic from Fed to be supportive along with admin already blowing out deficits / issuing tax-cuts and deregulation to bolster economy & that pop in bonds will be a short.

In the interim, again, the 10Y has had a nice trend of lower highs as we have marked out & we did end up getting the flush below 4.25 / 4.2ish & pending data into the remainder of the week but if the bond rally were to extend, I could see 10s making their way back to the 4.1 / 4.0 range before pausing whereas if this flush below 4.25 / 4.2ish turns out to be a false breakdown, I could see 10s retreating right back higher towards 4.35s… still think bonds are in no-mans land nevertheless & on the bigger picture, do still continue to view bonds as a range-trade (3.65 / 3.8 low-end & 4.75 / 5.0 high-end) & we’re more so stuck in the middle-ground as of now hence don’t think there is much to do at this moment.