Q1 Roundoff

Hello All,

As we round off Q1, I wanted to do an update/recap on how the year has gone thus far. I started this substack a little over eight months ago & it has been a fun journey in the markets since. Markets have been a rollercoaster in-between with the ups/downs, although most recently, these past few months, markets have mostly only been up. There have been plenty of extremes in between & I’m sure there will be lots more that come this year.

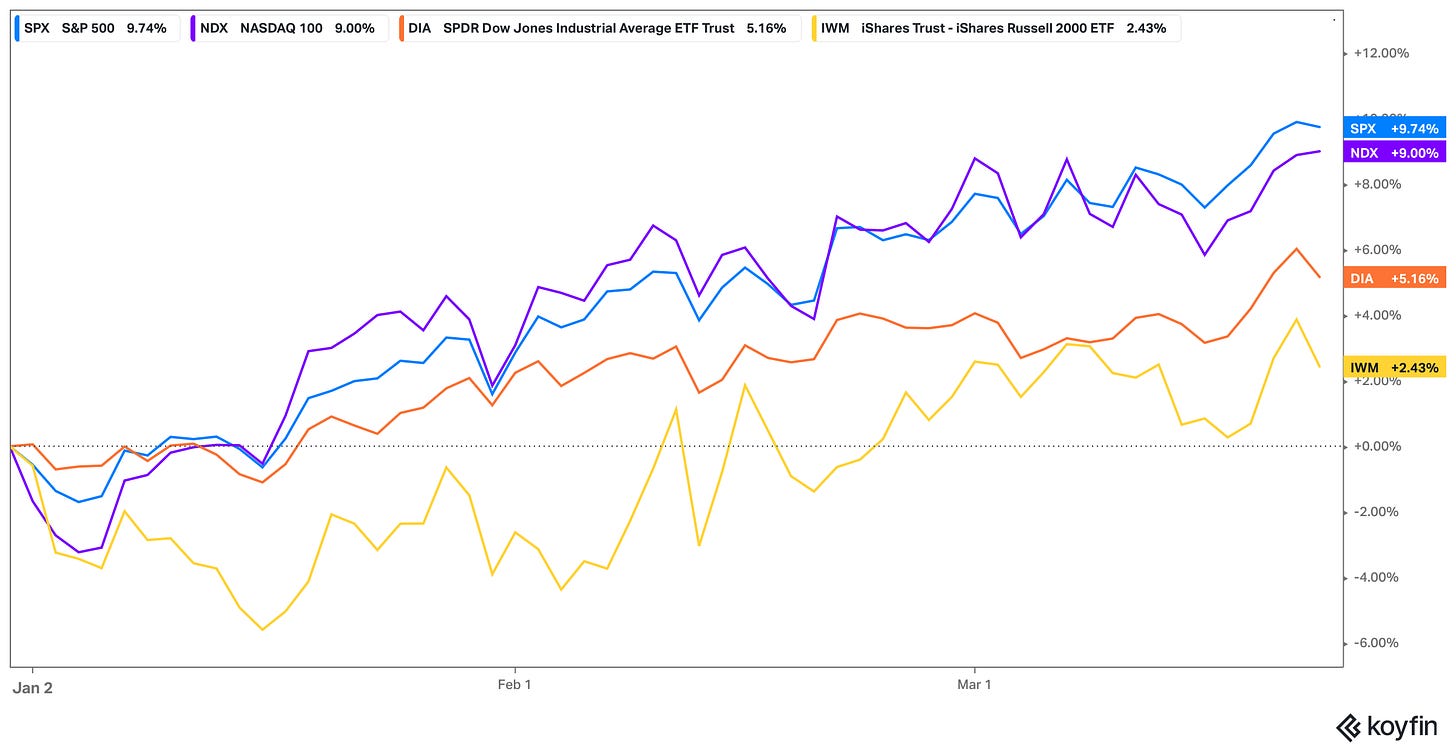

The indices have had a strong start to the year as the momentum names have stayed strong in their path upwards and we have continued to see some broadening out within the indices as the year has progressed.

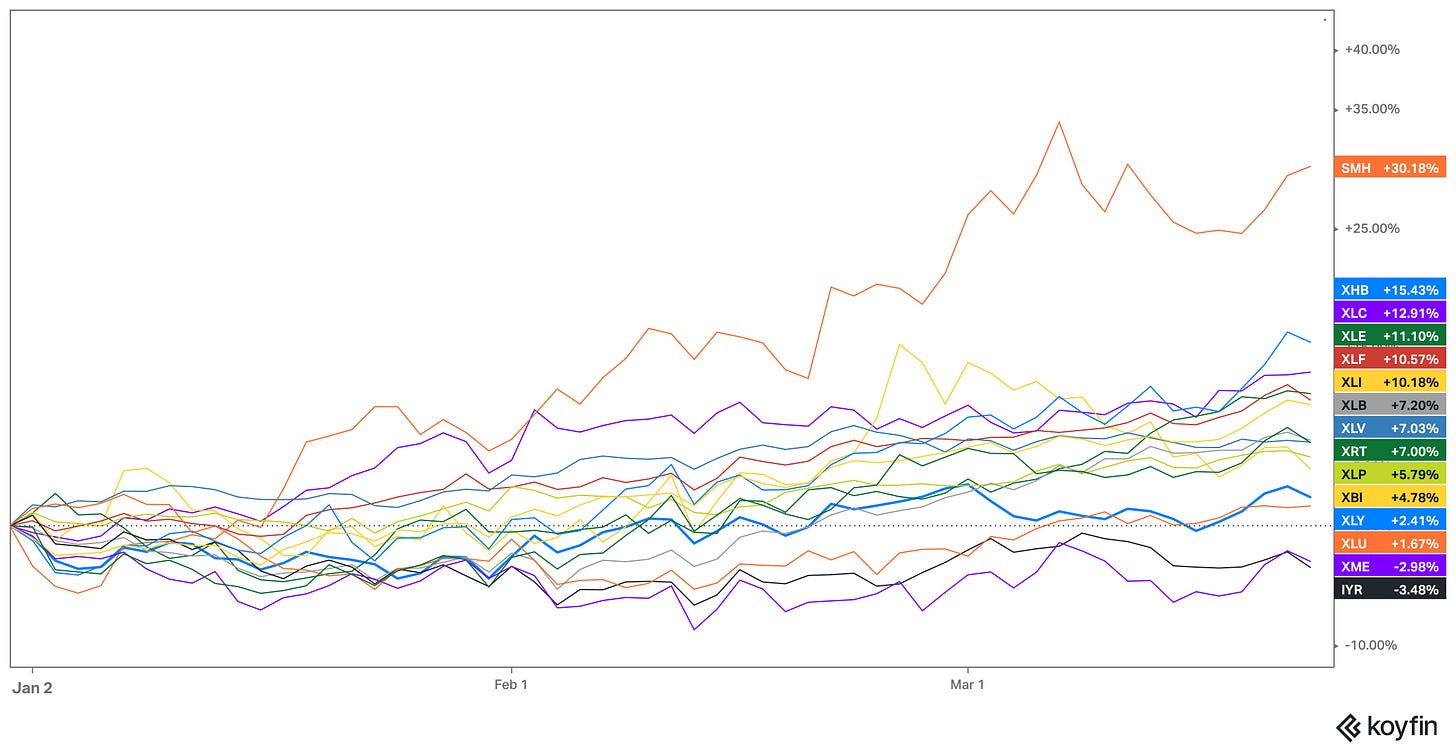

A look at how the market has done in terms of best / worst performing sectors as we round off Q1… no surprise to see semiconductors taking the lead given how strong momentum has been this year.

Spooz & Q’s have continued to remain in this grind up pattern continuing to respect the 20d the entire way up with all breaks below resulting in false breaks before resuming back in the uptrend.

Small-caps & the Dow have been similar… more so just grinding higher / choppy patterns & for the most part respecting the 20d.

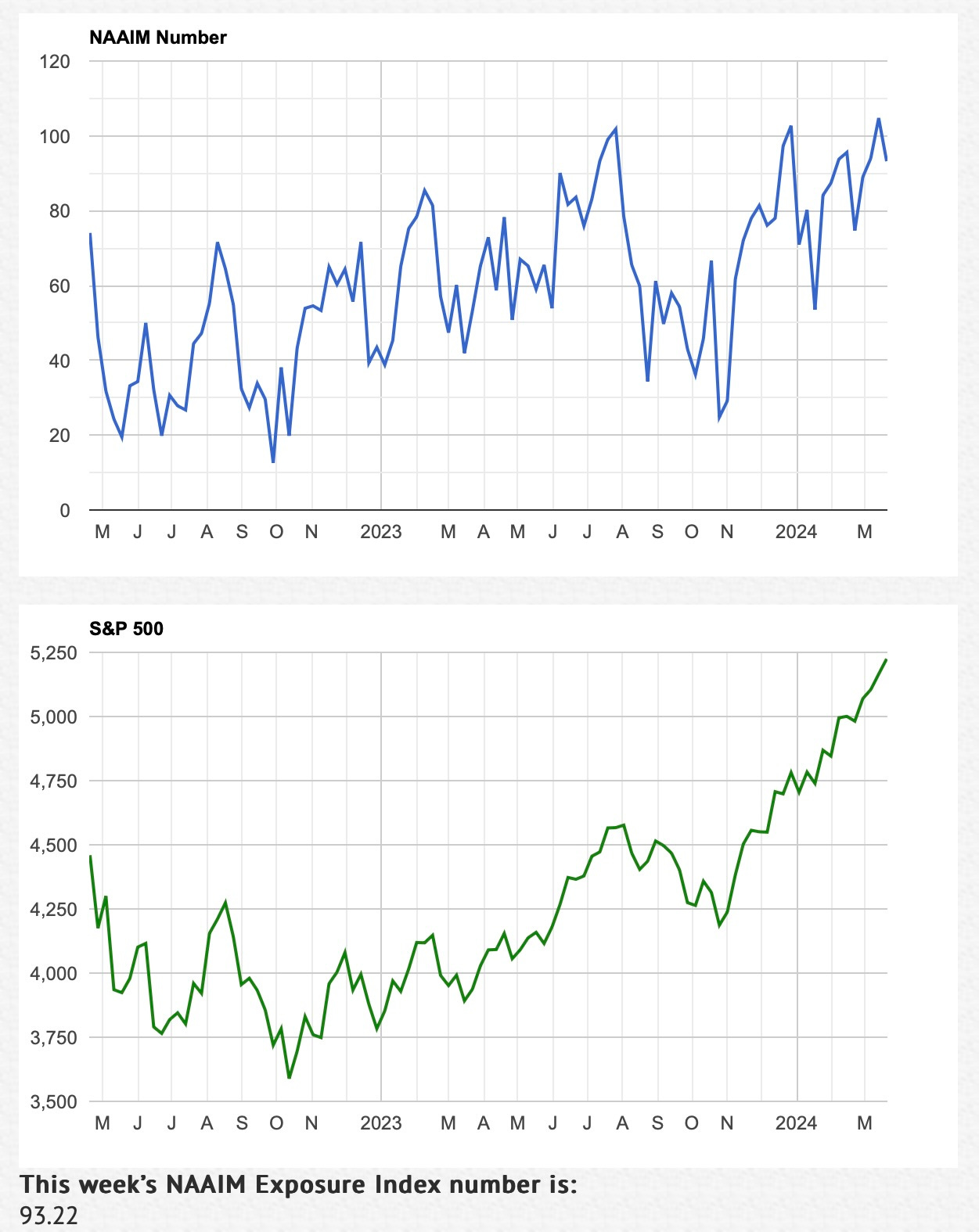

NAAIM exposure index is sitting just above 93 as we round off Q1… elevated, although not at the highs as we head into Q2.

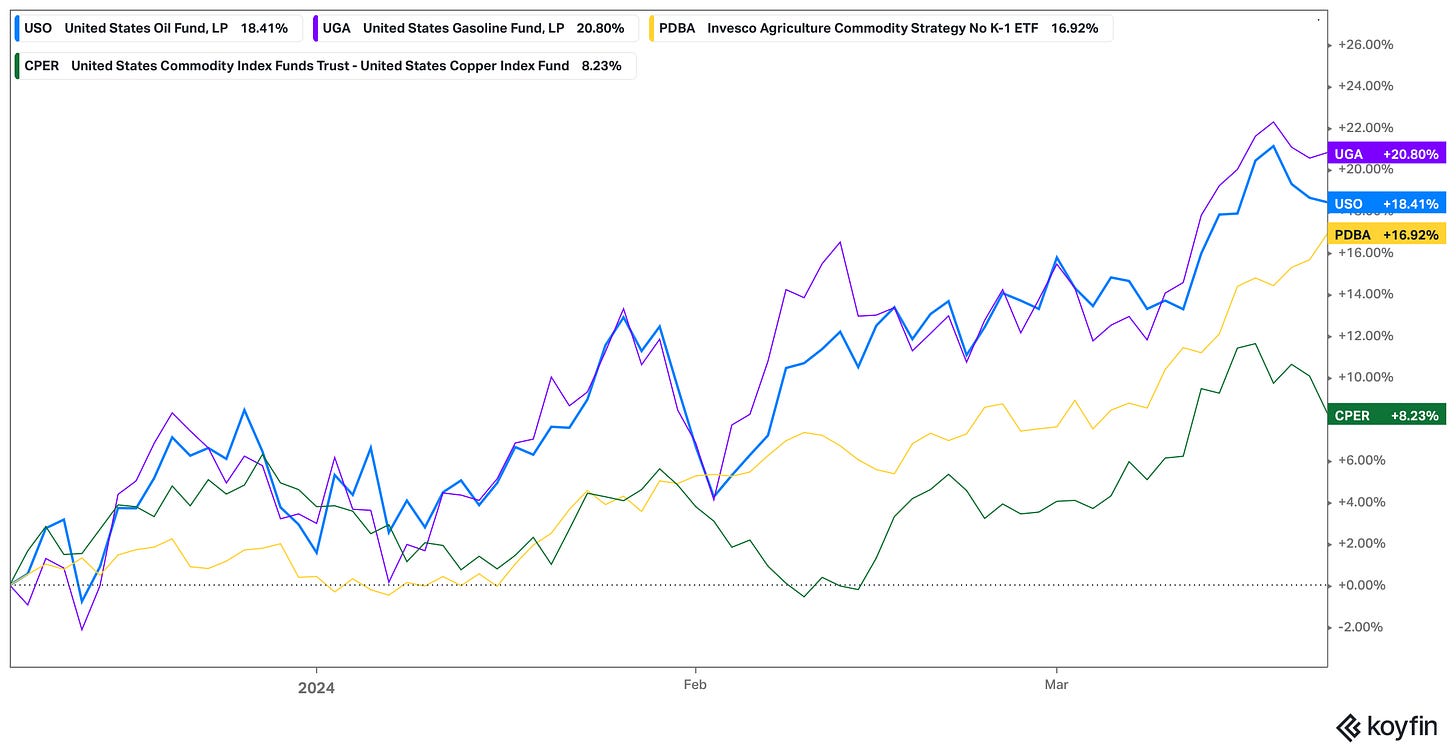

Inflation has seemed to have bottomed out around 3%… biggest question remaining from here into the remainder of the year for the Fed is whether or not these past inflation prints were due to seasonal effects, and or if they were due to the re-acceleration in the economy / global economies / easing of financial conditions, thus driving commodities higher along with core still remaining sticky / unch for the most part.

Commodities themselves ever since bottoming in December of last year are up quite a bit off their lows.

Speaking of commodities, Crude is closing off Q1 at a pretty pivotal spot.. up against this DT dating back to the Russia / Ukraine war top.

The 10Y has more so remained rangebound for the year… The Fed seems to be betting on a spike in the unemployment rate and or for these past inflation prints to be attributed due to seasonal effects… if we see continued hot inflation prints, do have to wonder if the Fed adjusts the goal posts / revises the inflation target up… likely wouldn’t be good for bonds, which in result may finally break this range to the upside if we don’t start to see some cracks in the economy and or inflation doesn’t resolve its recent trend to the downside.

2024 has been off to a great start & we are coming up to nearly 9 months since I have started this substack back at the end of June / beginning of July last year. I have done quite a few individual write-ups on themes that I thought presented an opportunity at that given moment, along with just general trade ideas / market commentary / tactical ideas, which I publish 3X a week. Below is a look at how the individual write-ups have done regarding the names included in the write-ups compared to the markets. Let’s take a look below.

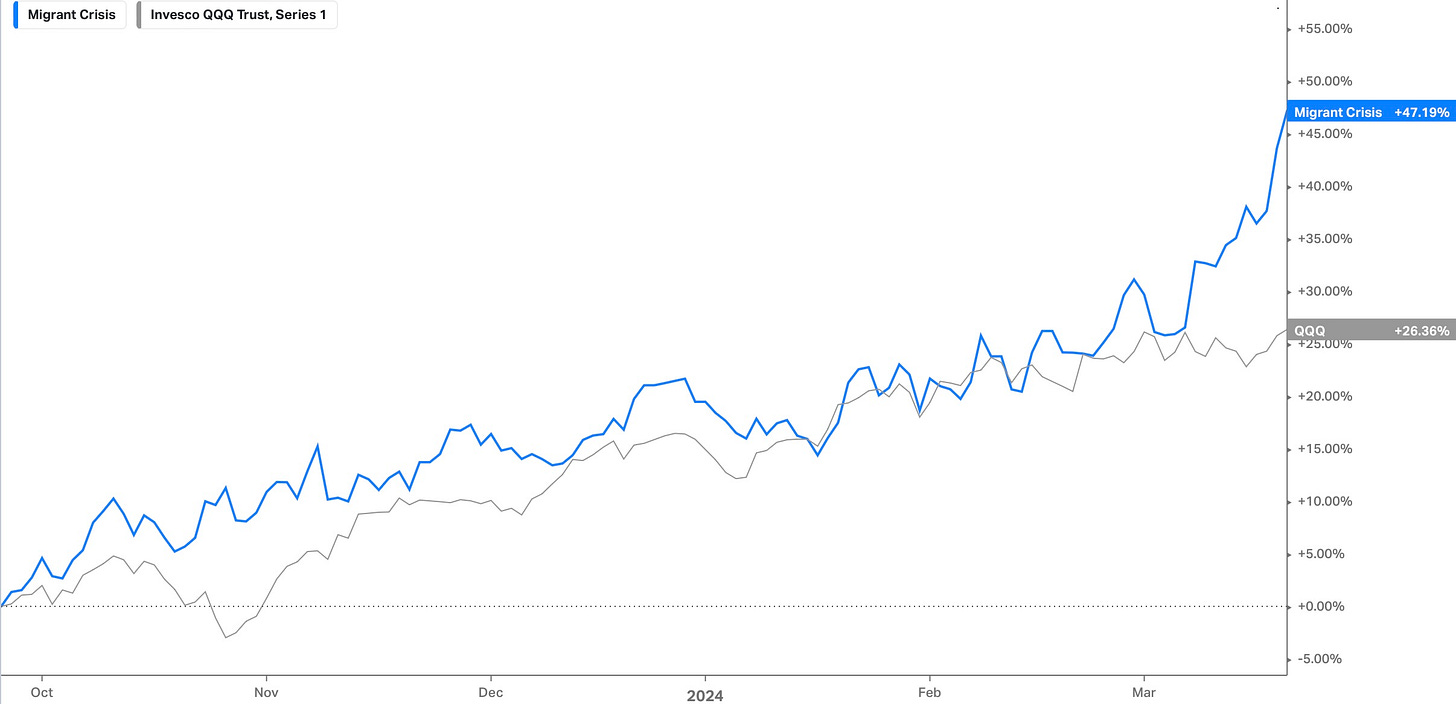

- Migrant Crisis, link

The migrant crisis was an opportunity I saw back in late September / Early October of last year, which inclined me to write about it / configure a basket of names that would likely benefit the most from the situation. I don't think too much needs to be said… issues continue to get worse & it continues to be an area of focus with it being an election year, as this theme likely only continues to heighten as the border situation worsens. This has continued to become a clear political issue that has yet to have been resolved. One upcoming, more significant catalyst for the group is the border crisis funding bill (Which STILL hasn't been passed), along with most of the names in general thriving under heightened political circumstances, especially as it narrows down and we get closer to elections.

There has been a pretty big outperformance in the Migrant Crisis basket against the Q's, which has been the best-performing index due to the AI frenzy / Crowding in tech. A basket with no exposure to AI whatsoever outperformed the best index by 20%+… not too bad.

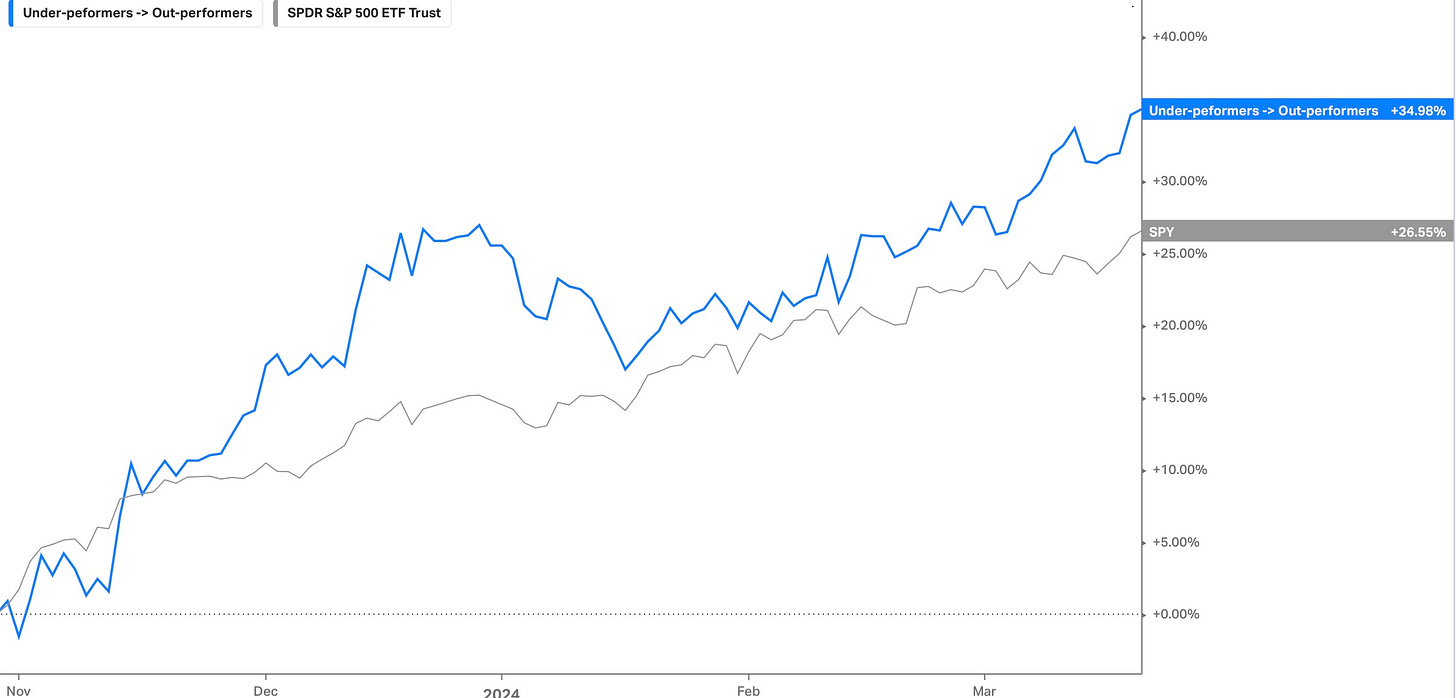

- Under-performers to Potential Out-performers, link

Under-performers to Potential Out-performers was timely written & allocated too towards the end of October last year. The idea was essentially going long names that under-performed due to the concentration in ‘23 that we saw with particular names, leading to many good names coming under continuous pressure all year, thus leading to this opportunity. Another factor that went into this basket, more so in the timing of allocating to it, was watching for a top in the 10Y, given how much pressure some of these names were under due to the parabolic rally in yields. Many thought I was quite crazy, and it wasn’t necessarily easy going long some of these names back at the end of October of last year, given the way things looked, but big money is made fading big extremes.

Continued outperformance against Spooz along the way, & likely many of the names mentioned within the piece were picked up at hard/generational bottoms that won’t be seen for quite some time or even ever.

- Change for Argentina, link

At the end of November of last year, Javier Milei was the new president-elect for Argentina. Immediately, I thought this was an opportunity to get long Argentina equities given how pivotal of a change this was, and that it was likely to be received very well by Argentina stocks… a shoot first, ask questions later type of setup. I included a wide variety of sectors to be diversified and capture all aspects of Argentina along with names that were most likely to benefit the most. I have been quite vocal about Argentina on Twitter since the day Javier was elected, as it really was such a pivotal moment for Argentina, which is shown below by the relative outperformance of the basket of Argentina equities versus Spooz.

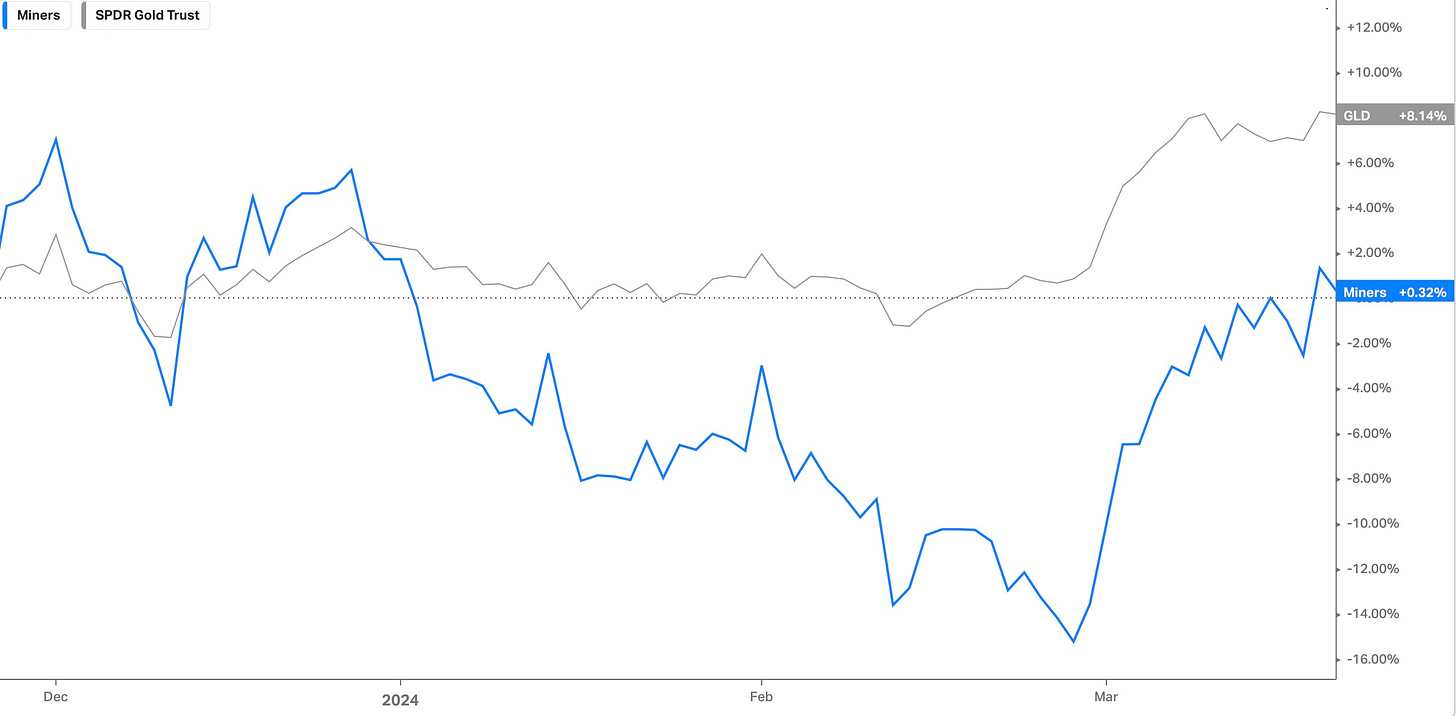

- Gold / Silver Potential Fat Pitch, link

Gold / Silver fat pitch…

Flat on the basket since allocating to and has been a pretty volatile basket, given some of the names have a good bit of beta. Relative to Gold, the basket of names has underperformed… primarily due to the beta / volatile action factor in the metals. So far in ‘24, the metals have shined, with Gold having broken out a decade+ long C&H pattern along with Silver in the process of breaking out of a decade+ long base dating back to the ‘11 top. Between the Fed reiterating real rates need to come down… The Fed itching to cut rates… Inflation resurgence recently underway… Fed raising the inflation target… Geopolitical issues… tightening cycle over… there seem to be a lot of potential tailwinds this year for the metals to finely shine & it should be an interesting year for the basket as a whole with some big potential returns if we see the miners play catch-up.

Do think many of the miners are likely at cyclical lows & there is a big catch up trade over these coming months.

The correlation of real rates / gold… correlation clearly broken with Gold breaking out of this decade+ long C&H pattern… have to wonder what happens when real rates start to reverse… likely just another added tailwind.

Silver still arguably looks like one of the more explosive setups in commodity land for the remainder of the year :

A breakout to the upside & the miners likely have some BIG upside ahead these coming months.

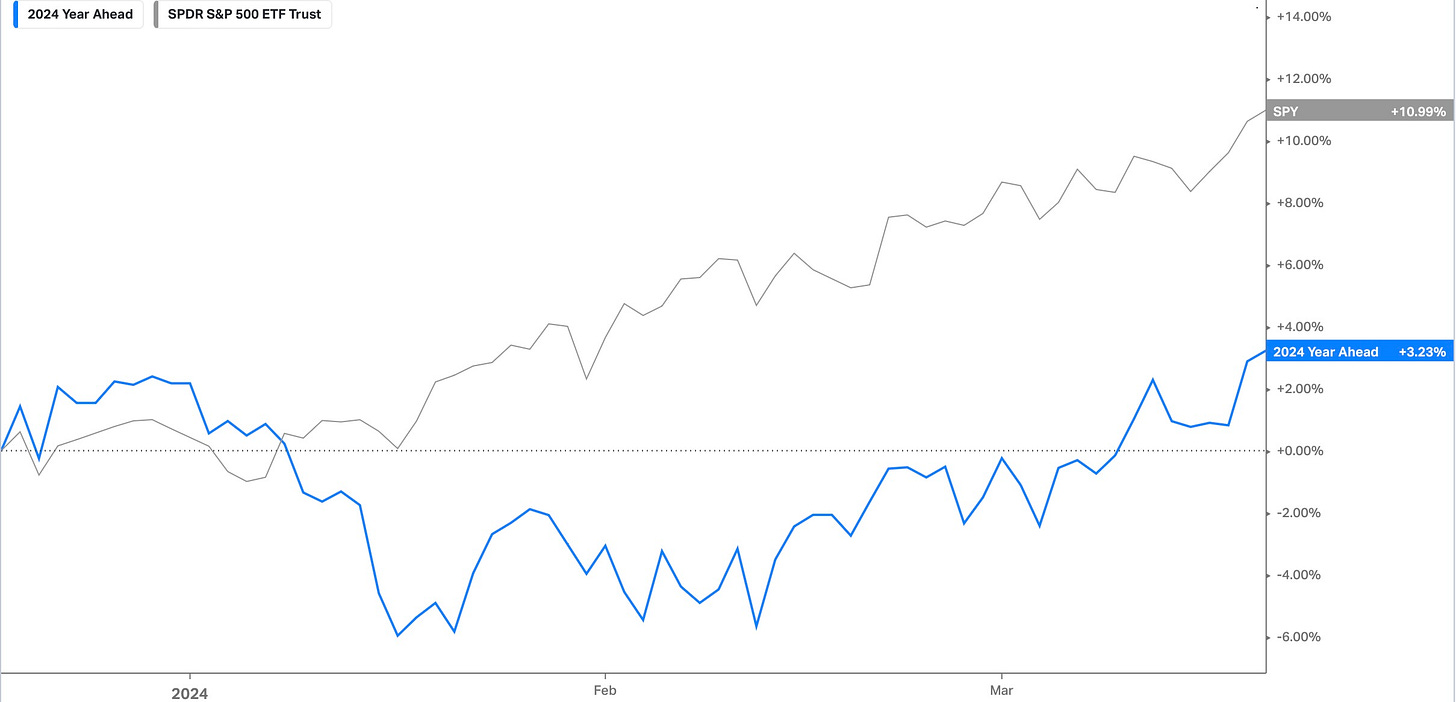

The Year Ahead, link

Relative performance from the year ahead names comparatively to Spooz… underperforming thus far as the majority of the gains from this year have come from the Semis & MAG 7, EX- Tesla…

Basket is more so comprised of a mix of sectors / themes that I do think are poised to perform well for the remainder of the year, especially considering the regime we seem to be headed towards.

Lastly, since starting this substack, there has been a # of trade ideas, both winners and losers, with a current hit rate of 79.9%. Relative overall performance of everything together including trade ideas / Individual names / tactical ideas / baskets is 48.81%, comparatively to Spooz which is up 20.85%, QQQ which is up 24.87%, IWM which is up 13.82%, and DIA which is up 17.43% in the same period.

The next write-up / topic I plan to cover is essentially the topic of the Fed cutting rates / companies in which have suffered the most due to the hiking cycle in which are then most likely poised benefit as we see pressure ease thus helping overall fundamentals of the business / balance sheet improve etc…

2024 is shaping up to be nothing short of an exciting year. I appreciate you all for the support and am looking forward to the rest of 2024 with you all. I wish you all a healthy and successful rest of 2024 as we head into Q2.

~ Eliant