Tariffs Tamed, But the Debt Beast Awakes

Hello All,

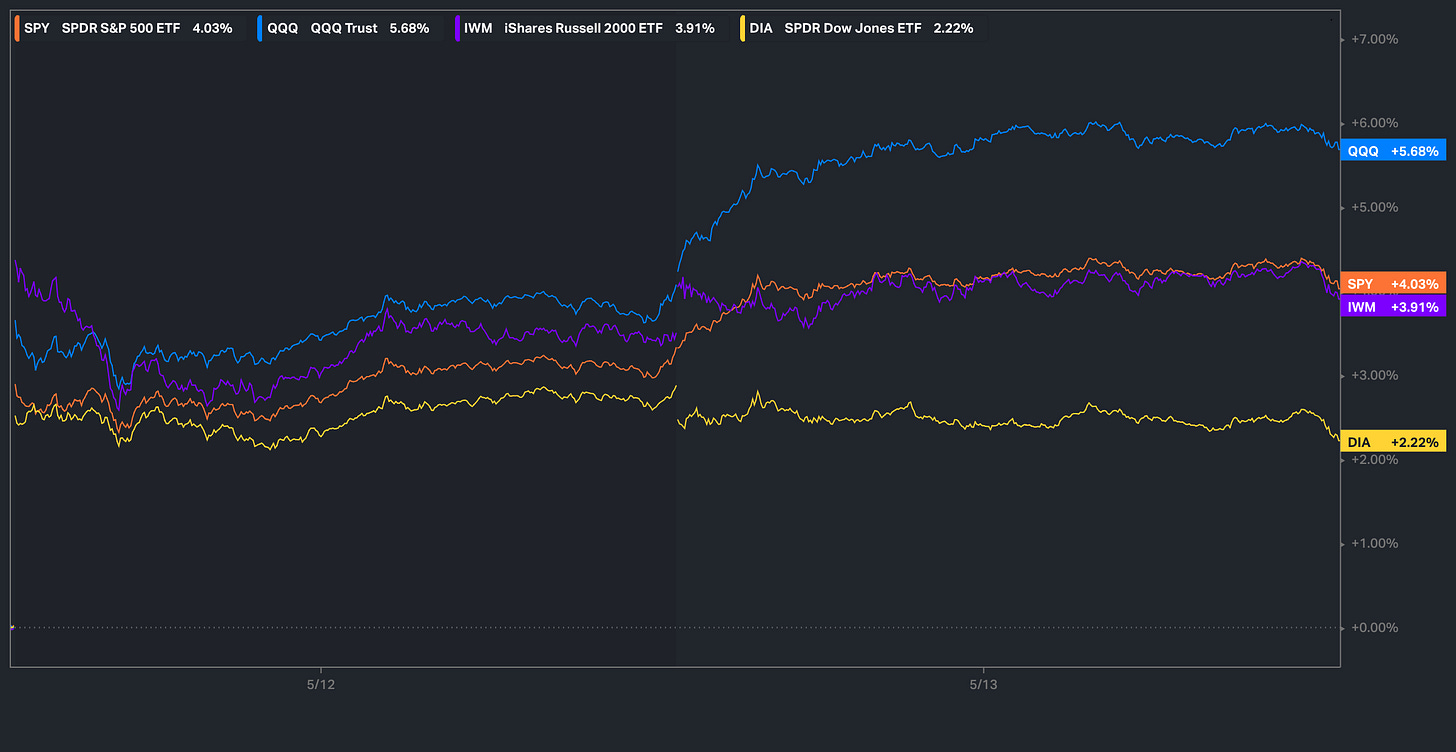

It’s been quite an eventful week in respect to headlines as the U.S. & China came to a mutual agreement to issue a 90-day pause whilst also having significantly reduced tariff rate %’s down to 10% on each-other. As a result, we saw large gap-ups across the board yesterday as the tariff decline has now been entirely unwound & Spooz & the Q’s more specifically aren’t too far off their ATHs & thus far, the Q’s have been the best performing index on the week, +568bps, whereas the Dow has been the worst performing index on the week although still sits higher by 222bps (big drag due to weakness in UNH / healthcare in general).

A few weeks back, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

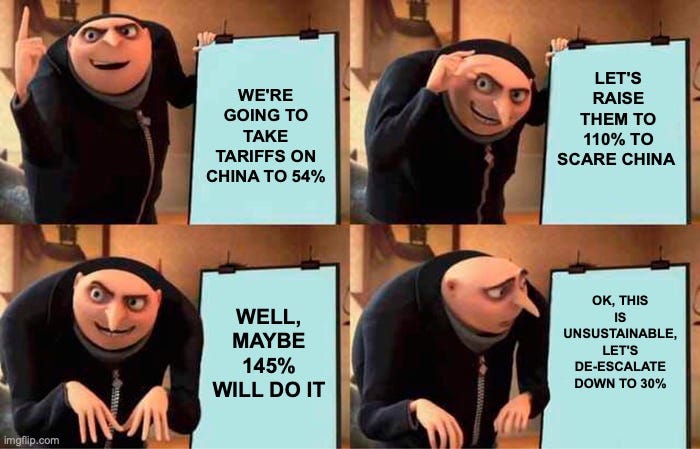

To briefly talk about yesterday, over the weekend, as we all know but the U.S. & China had discussions on trade in Switzerland & talks went much better than feared & exceeded market expectations. Both the U.S. & China agreed to issue a 90-day pause whilst also bringing down current tariff rate %’s to 10% on each other (+20% for fentanyl still remains so 30% on China), but given Trump had stated this prior Friday that “80% on China sounded right”, again, the outcome more than exceeded market expectations & it more so was an entire walk-back of all the Liberation Day framework.

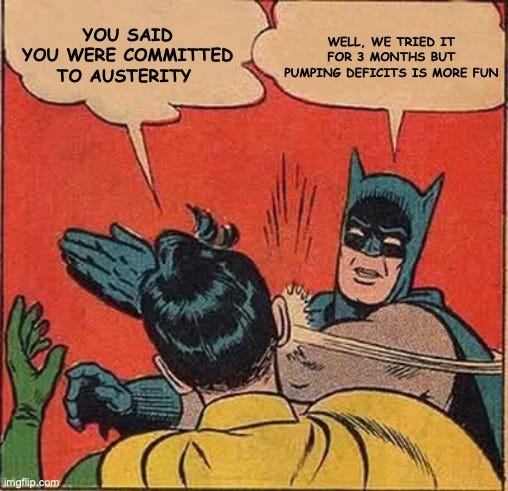

To summarize in meme format:

Another point to note is many individuals have been confused on why the rally in markets has been so persistent off the lows as the wall of worry continues to get climbed, but besides the stated obvious of HFs being UW equities after de-grossing near the lows, at the end of the day, this was a self-induced tantrum by the administration… they overplayed their hand / they got punched in the gut & because of that, a walk-back to more “humane” levels even as Lutnick said this past Friday was needed. Because of this total U-turn by the administration, hard data should continue to hold in better than expected / persistent inflation doesn’t look like too much of a worry here although inflation in general likely continues to remain bifurcated above 2% & lastly, focus will continue to shift back towards the Deficit / Tax-Cuts / No Fiscal Responsibility… it’s almost like we’re back in ‘24 again.