The Week Ahead 4/27/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 & I wish you all a successful remainder Q2.

We had quite the week in the indices this past week… as the week initially kicked off, markets sold off quite aggressively due to the lack of progress in terms of deal-making, but on Tuesday, the U.S. went forward with an attempt at de-escalating the situation with China as Bessent called the situation unsustainable & then Trump followed up by confirming & stating that the 145% tariffs aren’t going to stick & will come lower & the softening of rhetoric / de-escalation attempt by the U.S. led to surge within U.S. equities after initially declining by 300bps on Monday…

The Q’s ended up being the best performing index on the week as they closed higher by just over 660bps whereas the Dow was the laggard on the week although still ended up closing higher by just over 250bps after initially declining 300bps on Monday so quite an impressive reversal off the lows nonetheless.

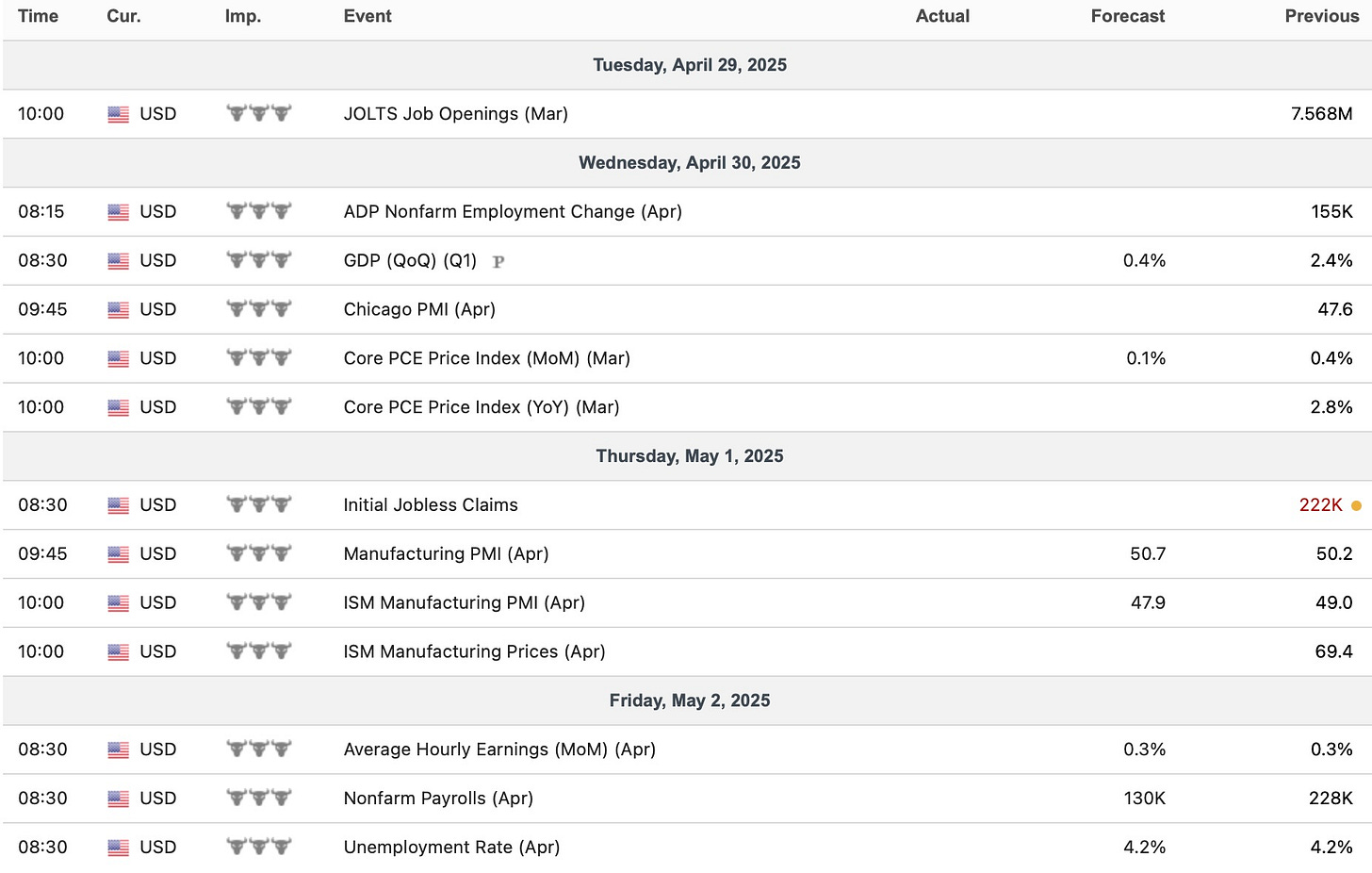

- Economic Data for the Coming Week:

As we get ready to head into the upcoming week, we have a plethora of Job data along with GDP & PCE #’s as well & as the softening of rhetoric kicked off this past week in respect to tariffs, the focus is likely going to continue to shift towards hard data & whether or not the well-anticipated weakness actually materializes or not.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 110.61% return whilst in the same period, the Q's have returned 33.63% / Spooz has returned 30.64% / Dow has returned 22.67% & Small-caps have returned 9.82%, so nice outperformance against all the indices whilst having a 79.7% win rate, averaging a 20.01% return on realized gains / winners & a 14.38% loss on realized losses / losers.

Looking forward to the future as we progress through ‘25.

This past week, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

As we nearly look to round off April into this upcoming week, it’s been quite a chaotic month to say the least & in regard to this past week, earlier on in the week on Monday, bulls made a clear higher-low & as the positive news flow / softening of rhetoric continued as the week progressed, it led indices to post continuous followthrough days to the upside thus leading Spooz to post a 400+ handle reversal off Monday’s low unleashing a total lockout rally. On top of the lockout rally, we did see Spooz post a clear break of the respective downtrend that initially kicked off back in February & as of now as we get ready to head into the last week of April / into May, the biggest question here is whether or not the breakout to the upside sustains as the general indices continue to climb a wall of worry & or if it proves to be a false break, which as of now, the indices are generally overbought on a shorter-term timeframe so some digestion / consolidation at the minimum is a more likely outcome barring another positive headline (U.S. dropping tariff rate % on China / U.S & China situation de-escalates confirmed).

In zooming out in regard to the monthly, Spooz has formed quite the candle & as we’ve covered previously but the April low coincided with the 50% retrace from the ‘22 Bear Market low to the recent highs made in February along with the perfect retest of the late ‘21 / early ‘22 highs & lastly, the support TL dating back to the ‘20 Covid lows… a perfect order of confluence & Spooz hasn’t looked back since.

As we get ready to head into the upcoming week, we do have a plethora of job data along with Q1 GDP #’s & PCE as well… as we’ve mentioned these last couple of weeks, but do expect the general focus to shift towards hard data these next few months given the damage that has been done to the U.S. economy (especially small-businesses) along with U.S. credibility in general as well. In Q1, hard data held fairly well… jobless claims continued to be muted & really the only “weak” data we had was related to housing which makes sense given elevated rates & uncertainty regarding policy & the U.S. economy as well, but in respect to the job market, data held in all quarter & IF we were to start to see the effects from tariffs, it should start to show up in hard data these next few months which *could potentially lead hard data → soft data, but there hasn’t been any significant signals thus far… it’s more so just anticipation at this point after the recession that majority called for in Summer of ‘24 proved to be a growth scare as we had originally called for & to fade that narrative.

In respect to Spooz, again, quite the reversal off Monday’s lows which did mark a higher-low & as we closed out this past week, Spooz has started working its way into the initial Liberation-Day gap (5500-5575ish). Earning reports in general have been better than feared / majority ER reactions have been positively skewed given how beaten down stocks were into this ERs season so its not of too much surprise, but nevertheless, we are currently at the range highs (5100 / 5500ish) & the question here is whether or not these range-highs remain respected & Friday’s breakout proves to be a false one & or if indices in general continue to climb the recent wall of worry. As we mentioned earlier, but the indices in general are quite overbought so some shorter-term consolidation / digestion wouldn’t be of too much surprise given the magnitude of the rally off this past weeks lows, but if we were to see Spooz backtest, I would like to continue to see the bull-gap from this past Wednesday protected with the bigger LIS essentially being 5350 / 5340ish below on Spooz & as long as that does remain protected, do think bulls have edge to continue to work higher & or at least cap interim downside to allow for some digestion of this recent upside move before either basing & continuing higher & or rolling over if hard data starts to weaken / trade-war uncertainties continue to amplify after this recent cooling. If that bull-gap were to falter as support, do think we can see Spooz continue to rollover towards 5300 / 5250ish to fill the entirety of the bull-gap & that very well could mark another higher-low, & the bigger picture view continues to circle around this past Monday’s low near 5100ish as the ultimate LIS for bulls as faltering below would likely lead to a full unwind of the 90-Day Delay move which would more so be driven by weaker hard data & or a walk-back of the recent walk-back by the administration which doesn’t seem likely at this moment as it seems fairly clear that they want to de-escalate, but of course, wildcards always remain.

In terms of upside, again, on Friday we entered the initial Liberation-Day gap which fills up to 5575ish & do think that could be shorter-term resistance as thats typical with a gap-fill, but above that, do think we could see Spooz extend the rally to potentially backtest the 50d near 5620ish & more positive news flow / hard data continuing to hold could lead Spooz to even extend further to backtest the 200d near 5730ish… Nets remains low / HFs remain generally UW stocks after degrossing near the lows & for the entirety of this past quarter, so this recent rally from this past week has certainly been a pain & arguably “hated” for many.

On Friday, we did make one change by uncapping our put-spreads (covering the short-leg) & the point of it is because we sold the short leg against the long leg at a MUCH higher VIX & since VIX has collapsed off the highs & indices are back towards the upper-end of the range, it felt like a good time to uncap those spreads and just keep the long leg whilst reducing our overall cost-basis on the hedges. In a way, we kind of took profits on the hedges but on the short leg whilst leaving the long-leg to remain protected. For those that are looking for a hedge, do still think the 520 / 490ish range in terms of downside on Spooz for July / August timeframe isn’t a bad idea up here, especially with VIX back near 25 & the same goes for small-caps in the 185/175ish range (In terms of picking strikes) as again, do think the biggest risk-factor from here more so revolves around hard data weakening & the tariff slowdown effects filtering through the economy as 65% tariffs & 145% tariffs on China haven’t meant a thing as the market understands the higher %’s as a negotiating ploy and nothing more, but again, damage has already been done to the economy and credibility & it’s worth having dated hedges / downside bets because of that.

- QQQ

In zooming out on the Q’s, shockingly enough, the Q’s are green on the month & similar as to Spooz, but the Q’s ended up bottoming right off the late ‘21 / early ‘22 highs in what was essentially a perfect backtest of the breakout.

In respect to this past week, again, all of the indices respectively made their low on Monday (higher-lows established) & the positive news flow / softening of rhetoric against China more so led to continuous followthrough to the upside as the week progressed which led the Q’s to breakout of the respective downtrend that initially kicked off back in February earlier this year. The question from here is whether or not this breakout sticks & or if it proves to be a false-break / look above and fail of the established range, but in the shorter-term as we mentioned with Spooz, but the indices in general are quite extended on the upside so some digestion / consolidation allowing for the Q’s to base higher & keep establishing higher lows / higher highs & keeping that general trend intact would be the best outcome for bulls.

Into this next week & into May, but if we were to see the Q’s continue to followthrough to the upside & confirm the breakout out of the respective downtrend, it should lead the Q’s to backtest the 50d above near 477ish & ultimately on a backtest / digestion of this recent rally, bulls would like to see 465 / 459ish supportive & turn into a S/R flip zone (prior resistance turns to support).

On the contrary, if we were to see this recent breakout prove to be a false one, bulls ultimately need to defend the bull-gap below from this past Wednesday near 456ish (Bull LIS), but if that were to falter, we likely will see the Q’s retrace lower to fill the entirety of the bull-gap into 450ish which could set up for another higher low & on the bigger picture, 439 / 434ish continues to remain a bigger area of interest / demand below in terms of separating the Q’s from unwinding the 90-Day delay rally & or continuing to remain supportive of the recent higher low / higher high trend.