The Week Ahead 5/11/25

Hello All,

For starters, to all the Mothers & Wives out there, I hope you all have a fantastic Mother’s Day weekend & know that you’re greatly appreciated. Mothers play a pivotal role & I hope this weekend brings well-deserved recognition and celebration.

To everyone else, I hope you’re also enjoying the remainder of your weekend and getting some time away from the screens as well.

In regard to this past week, it was a relatively muted week altogether for the indices as they essentially closed flat / slightly lower on the week & the only event of significance was FOMC which proved to be a nothing-burger as Powell more so continued to highlight the same risks for both inflation & the labor market & the bigger focus has since shifted to the trade-talks underway between the U.S. & China in Switzerland as we get ready to head into the upcoming week… de-escalation or no mutual agreement to de-escalate being the ultimate question.

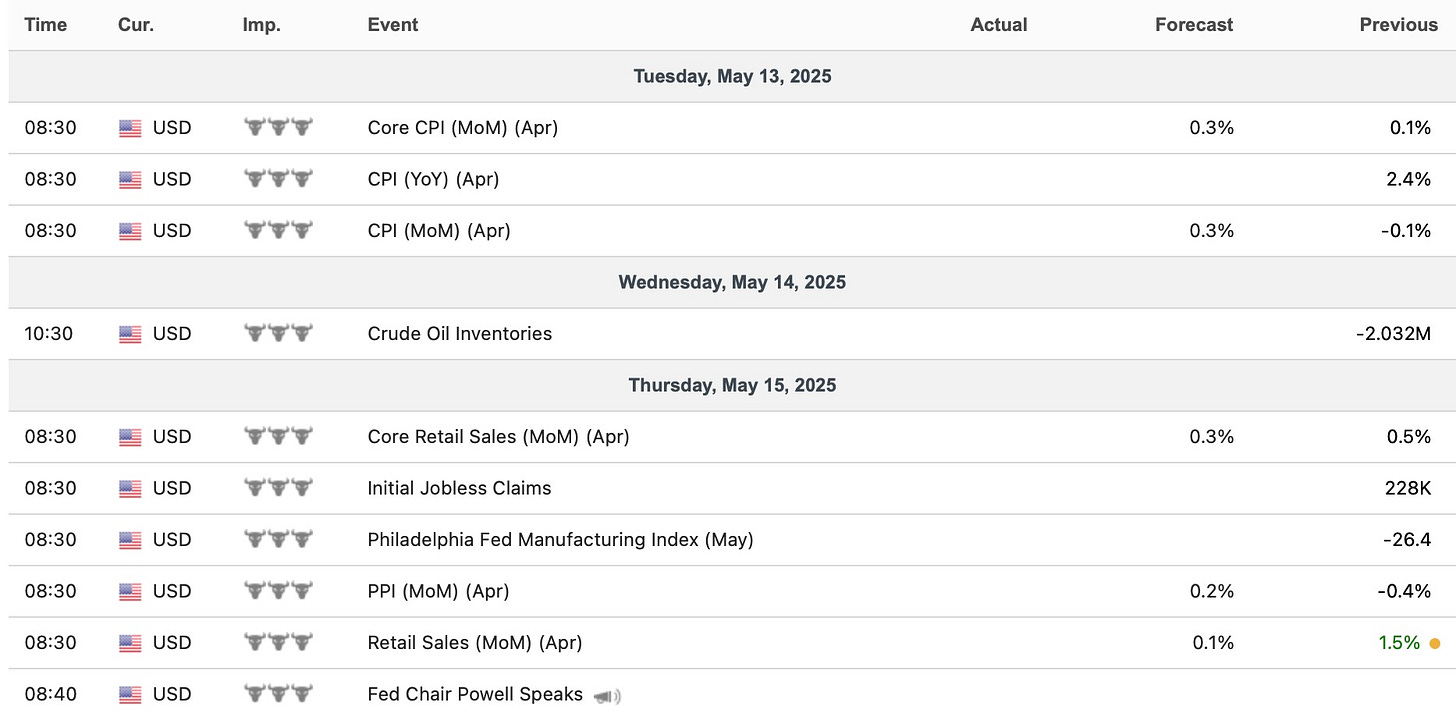

- Economic Data for the Coming Week:

As we get ready to head into the upcoming week, U.S. / China trade headlines will likely dominate throughout the week, but in regard to economic data, we do have a bit of inflation data with both CPI & PPI #’s into the upcoming week along with retail sales taking place later on in the week as well. General theme surrounding data this year is that hard data has continued to hold in better than expected & the well-anticipated weakness continues to be projected into these next few months if policy doesn’t ease by the administration.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 114.78% return whilst in the same period, the Q's have returned 37.99% / Spooz has returned 33.89% / Dow has returned 26.16% & Small-caps have returned 13.60%, so nice outperformance against all the indices whilst having a 80% win rate, averaging a 21.26% return on realized gains / winners & a 14.48% loss on realized losses / losers.

Looking forward to the future as we progress through ‘25.

A few weeks back, we wrote about hard assets & the structural framework behind hard assets given recent events & future outlook along with some historical perspective as well… you can check it out below for those whom may have missed.

Hard Assets in an Era of Soft Money

As global central banks quietly rearm their stimulus arsenals and fiscal deficits spiral past the point of discipline, the foundations of the global monetary order are beginning to crack. Amid this shift, one question looms larger than ever: Are we on the verge of a new commodity supercycle?

Recently, we wrote about the recent developments out of Germany given the infrastructure plan that was announced earlier on in the week & covered the setup in detail along with potential beneficiaries & for those who would like to go & read, the article can be viewed here.

Lastly, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

Last week was a relatively quieter one in respect to economic data & the only event of significance was FOMC which turned out to be a total nothing-burger. Not much new was said by Powell & the general message / summary was that the Fed remains in wait-and-see mode as risks are both apparent for upside risks to inflation along with downside risks to the economy. Powell has remained stern on respecting the dual mandate despite Trump continuing to heckle at Powell stating that ‘inflation is non-existent’ & the Fed is going to be too late, but until there is more clarity on the inflation picture (administration walks back policy / one-time price shock is apparent) & or the labor market materially weakens, the Fed will likely continue to remain in wait-and-see mode.

The other ‘BIG’ news this past week was the U.S. finally reached their “first” deal with the UK… the only thing is, the U.S. was never running a deficit with the UK despite the entire point of reciprocal tariffs being to reduce trade deficits as the U.S. currently runs a surplus with the UK… can we even call it a real first deal?

In respect to markets, it was a relatively quieter week & lower volume week all around as the indices mostly remained contained within a range / it was a balance week as recent overbought conditions start to get worked off from consolidation / chop as the % of stocks above the 20d still is sitting at the historical high-end of the range given the recent reversion we have seen these past few weeks.

The other important chart to note in respect to Spooz more specifically is the current divergence between the Advance / Decline line. As of now, as we all know but Spooz is well below the February highs but the interesting phenomenon is the Advance / Decline line continues to make new highs which essentially suggests an improvement to overall market breadth & a positive divergence is currently taking place which essentially is showing that this recent rally has been broad participation which tends to lead to a more bifurcated / supportive market… something to be mindful of as its quite an interesting divergence to say the least.

To round off this past week after market close on Friday, Lutnick had an interview and it was actually quite informative on current thinking in respect to tariffs… the general gist of it was that tariffs ARE going to come down on China to a more “humane” level & he essentially suggested tariffs can come back down to 34% (Liberation Day levels) IF China gets the fentanyl situation under control, as otherwise, the 34% tariff + the 20% fentanyl tariff will continue to remain in place (54% tariffs in total)… so, essentially back to where we started. The one other added note is Lutnick stated the U.S. has ZERO plans to decouple from China & Bessent reiterated those same comments a couple weeks back as well…

For a shorter TLDR:

And finally, as we all know but over the weekend, we do have talks between the U.S. & China taking place in Switzerland & pending how those talks go, they likely will hold a bigger weight on the indices in terms of the direction we go from here into these next few weeks… nevertheless, on Friday, Trump stated 80% tariffs on China sound about right, but at the end of the day, it’s up to Bessent… maybe Trump set the expectations of 80% so 50% sounds even better?

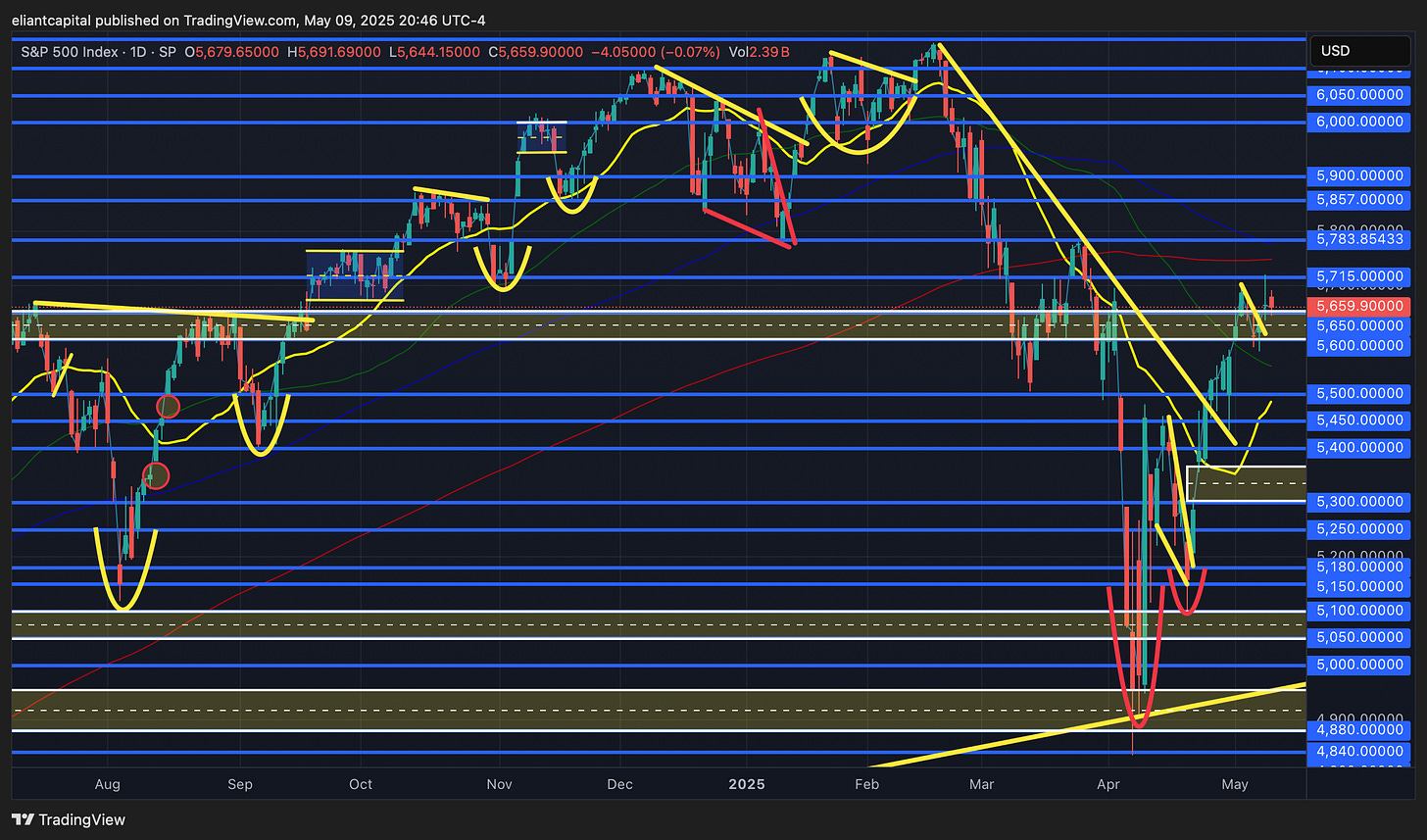

- SPY

In looking back at this past week, it was a relatively quieter week all around in respect to economic data & FOMC in itself ended up being a nothing-burger too as not much new was stated by Powell (Fed still remains in wait-and-see mode & the dual mandate continues to be respected). In respect to Spooz, the indices mostly remained contained within a balance / range for the entirety of the week & the overall picture hasn’t changed too much, as currently, Spooz still remains pinched between the 200d above & 50d just below.

In regard to this past week, we did see Spooz break out of this interim flag to the upside but 5715ish continues to be a bigger area of resistance & sellers have continued to make a stance above 5700ish & with the 200d / 50wk sitting just above, that likely continues to remain as a firm bear LIS. Nevertheless, as long as the bull-gap from a couple weeks back continues to remain supportive (5570/5550ish), I do think indices in general will continue to remain bifurcated & positive developments / hard data continuing to hold in could even push Spooz higher to get the official test of the 200d above in the mid-5700s. I do continue to think that the bigger overall LIS for bulls remains around the bull-gap near 5350ish (U.S. softening rhetoric against China a few weeks back) & it likely will remain as a bigger LIS for the remainder of the quarter although hard data deteriorating will likely push Spooz to fill that bull-gap below if it were to materialize, but for now, I could arguably see Spooz remaining rangebound between 5800ish / 5350ish for the time-being to digest this recent upside move (of course markets remain very headline driven so things can flip on a dime).

On the contrary, if we were to see the bull-gap near 5550ish from a couple weeks back falter as support, I could see Spooz working lower towards 5500 / 5450ish (coincides with Negative GDP Headline low from the other week & 20d for added confluence) & that likely will remain a bigger interim pivot, but if it were to falter as support, again, I could see Spooz rolling over to test the ‘U.S. softening rhetoric against China’ bull-gap below near 5350ish from a few weeks back, which as we mentioned just above, it likely remains a bigger pivot for the remainder of the quarter & hard-data weakening materially would be a bigger catalyst for that bull-gap to fill entirely (which just hasn’t been the case as hard data continues to hold in thus far).

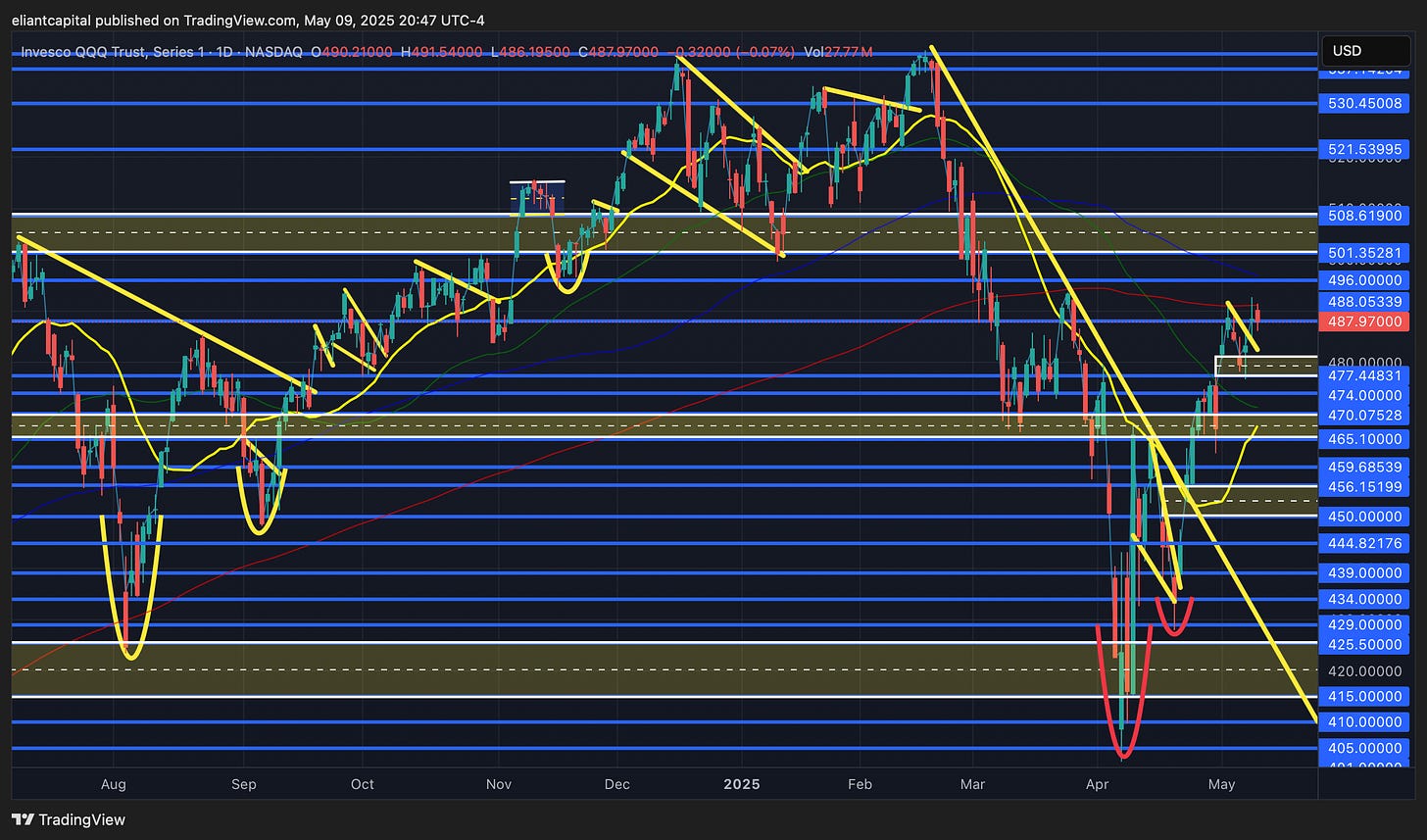

- QQQ

Looking back at this past week in respect to the Q’s, again, it was a quieter week all around as the Q’s ended up closing the week out just slightly lower, -25bps, so nearly flat on the week. The bigger thing to note about this past week is we did see the Q’s test the 200d in two instances & thus far, each instance the Q’s failed to overcome the 200d, but granted, the Q’s essentially remained within a tight balance all week as recent overbought conditions continue to get worked off so some consolidation in general is warranted. Nevertheless, do continue to think that in the shorter-term, 479 / 474ish on the Q’s will remain as an important pivot / support zone & bulls will remain with edge as long as it remains supportive & if we were to see the Q’s continue to consolidate & remain constructive / base above the 50d below, do think we could see an upside impulse in the Q’s if we were to break out of this interim consolation to the upside to start to push higher towards 496 / 501ish (if can firm up above the 200d / likely would coincide with a further upside chase in Mag-8 given how negative positioning remains) which would essentially be a backtest from below of the early January Deepseek lows & would likely be a general pivot that creates some pause for the Q’s on this recent extension of a rally if it were to continue.

On the contrary, if we were to see the Q’s continue to fail at reclaiming the 200d above & we start to roll-over to the downside out of this recent balance, the initial pivot & or Bull LIS sits just below near 470 / 465ish (coincides with 50d & 20d / Negative GDP Headline low from a couple weeks back) & faltering below would negate the recent trend of higher lows and higher highs which has remained intact since the bottom established in early April. If we were to see that pivot of confluence falter as support, we likely will see the Q’s continue to roll-over towards the “Softening of rhetoric on China” bull-gap from a few weeks back near 456ish & in general, that likely remains as one of the more important bull-gaps / pivots for the remainder of the year.