The Year Ahead '26

Hello All,

The Year Ahead is finally here. It’s a deep dive into the setup for ‘26, laying out potential frameworks, outlook, and the themes that matter most as we head into a pivotal year.

A link to all extensive write-ups can be found below for those interested:

- Year Ahead ‘24, link

- Year Ahead ‘25, link

- Migrant Crisis ‘23, link

- Under-performers to Potential Out-performers ‘23, link

- Change for Argentina ‘23, link

- Gold / Silver Potential Fat Pitch ‘23, link

- Rate Cut Beneficiaries ‘24, link

- Under-the-Radar Name ‘24, link

- Germany’s Transformative Fiscal Plan ‘25, link

- Hard Assets in an Era of Soft Money ‘25, link

- STD Channels, link

- Educational Write-Up (Part 1), link

- Educational Write-Up (Part 2), link

- Educational Write-Up (Part 3), link

Before we jump into the year ahead, let’s look at how 2025 actually unfolded.

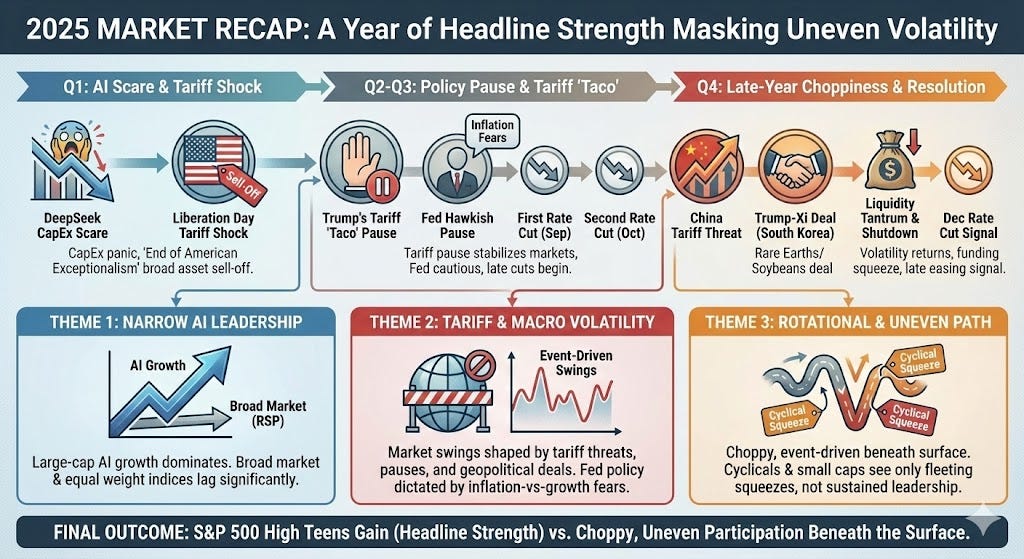

On the surface, it’s been a strong year with the S&P 500 up close to the high teens, but beneath that the path was choppy and uneven. The year opened with the DeepSeek scare, which rattled confidence across AI-linked names not because of competitive disruption, but because investors briefly panicked over the possibility that hyperscalers would need to slash CapEx and broader AI spending. That shock fed directly into the sharp swing around Liberation Day, a move driven by the announcement of extreme reciprocal tariffs and the immediate worries about how those tariffs might hit growth, margins and global supply chains.

The so-called growth scare that followed was not driven by a soft patch in labor or activity data. It was driven entirely by the anticipation of tariffs and the fear that implementation would meaningfully slow growth, disrupt supply chains and tighten financial conditions. Markets began to price in a more adverse macro path, and rather than rotating into higher quality or cash, participants sold virtually all US assets at once. Equities, bonds and even the dollar came under pressure as positioning washed out and liquidity evaporated, creating one of the rare moments in the year where there truly was nowhere to hide (End of American Exceptionalism).

The macro backdrop began to stabilize once Trump effectively ‘tacoed’ on tariffs by stepping back from the most extreme proposals and announcing a 90-day pause on new measures. The idea of an immediate tariff-driven inflation shock began to fade, which allowed markets to breathe, but the Fed itself did not move quickly. The first cut did not arrive until September, followed by another in October, and only recently has a December cut been solidified. For most of the year the Fed remained firmly on pause, holding rates steady out of concern that aggressive tariff implementation could reignite inflation rather than dampen it.

Through all of this, AI has continued to accelerate and has remained the dominant equity theme of the year. Market leadership has been narrow, with a relatively small group of large cap growth and AI exposed companies doing most of the heavy lifting while the broader market has stayed muted. Equal weight indices such as RSP have drastically underperformed the S&P 500, highlighting how weak participation has been beneath the surface. Cyclicals, small caps and many value sectors only saw intermittent squeezes rather than sustained leadership, and most of those moves faded once the immediate catalysts passed.

Later in the year & more recently, the China tariff threat reappeared and triggered another bout of volatility as investors tried to handicap the risk of a new escalation. The tension eased after Trump and Xi met in South Korea and agreed to a temporary deal. China committed to allow rare earth exports to flow more freely and to step up purchases of U.S. soybeans, whilst the United States cut the tariff related to fentanyl precursors to 10% from 20%. Equities responded positively as the overhang from an immediate tariff spiral was reduced, even if uncertainties continue to remain around the longer term relationship.

And finally, into the final stretch of the year, recently markets had to digest a liquidity tantrum as the Fed initially refused to validate expectations for a December cut. Funding conditions tightened, risk appetite faded and equities stalled until policymakers finally signaled that easing was imminent. At the same time, a government shutdown that lasted roughly two months weighed on confidence and added an additional layer of uncertainty to an already sensitive tape.

All things being said, 2025 has been a year where headline index strength masked a market that was rotational & event driven. AI has kept pushing ahead, cyclicals and equal weight benchmarks lagged although theres been pockets of outperformance & China remained as the main external shock absorber and macro volatility shaped almost every swing in risk assets.

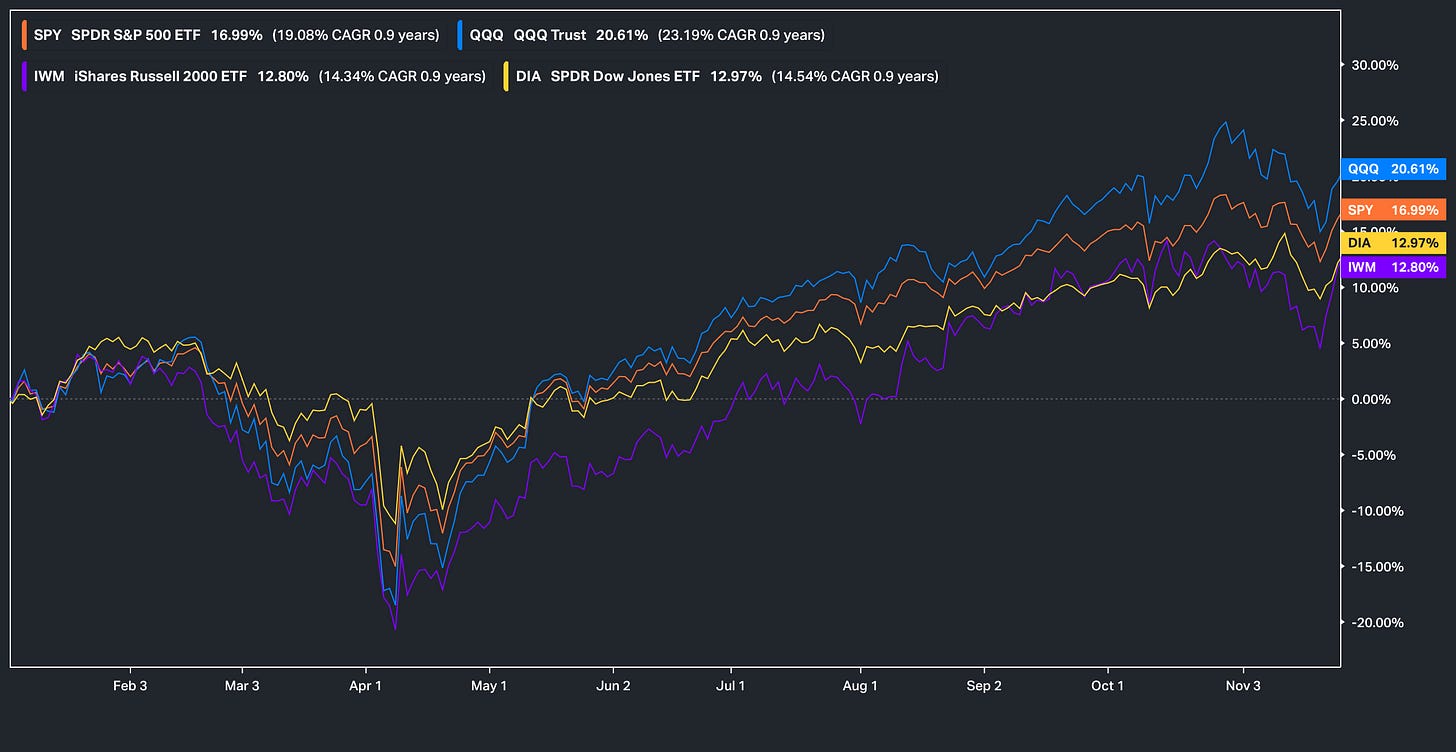

Despite the volatility, we had a pretty great year in ‘25 & since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 165.03% return whilst in the same period, the Q’s have returned 71.77% / Spooz has returned 61.52% / Dow has returned 46.41% & Small-caps have returned 40.83%, so nice outperformance against all the indices whilst having a 82.6% win rate, averaging a 26.30% return on realized gains / winners & a 14.58% loss on realized losses / losers.

In looking ahead into 2026, 2025 set the stage for what could be an even more consequential year in 2026, not just in terms of policy but in terms of personnel. The dominant question is who Trump ultimately selects as the next Fed chair, with Hassett and Waller viewed as the current favorites. If Hassett is chosen, does that effectively lock in an extension of the debasement trade with a chair who is likely to lean more aggressively into easy money, financial repression and explicit support for growth and asset prices. If Waller is selected instead, even though he is broadly dovish, does that introduce a comparatively more conservative and rules based approach to monetary policy, one that still cuts but pushes back against the most extreme forms of fiscal monetization and currency debasement.

At the same time, there are open questions around the durability of the current tariff regime. Do the courts end up striking down parts of Trump’s tariff program on constitutional or procedural grounds, and if so, how does that reshape the inflation and growth outlook. It is also a midterm year and Republicans are currently lagging materially in the polls, so does the administration lean into even more populist measures to shore up support. Do we see another round of tax cuts. Do stimulus checks make a return as a way to directly target the lower end of the income distribution and turbocharge consumption ahead of November.

The United States remains in an easing cycle & in 2026 Trump will essentially have consolidated control over both the Fed board and the Treasury. Does that combination lead to an even tighter fusion of fiscal and monetary policy where the central bank is effectively pressured to validate ongoing deficits and support higher nominal growth. Outside the United States, Europe is already moving down a more explicitly fiscal path, China is leaning harder into stimulus to offset structural drags and defend growth, and Japan is pursuing a more pro fiscal posture as well. Does 2026 become the year where the entire world is effectively running it hot, with most major economies embracing some mix of loose fiscal settings and accommodative monetary stances.

On the real economy side, the labor market is still in a normalization phase shaped by both immigration and AI adoption. Does that normalization continue through 2026 in a relatively orderly way, with wage pressures easing at the margin and participation stabilizing, or do we start to see more meaningful displacement in specific sectors as automation and AI deployment ramp. Growth itself will likely hinge on whether the administration can truly stimulate the US consumer. Do stimulus checks and tax relief meaningfully lift spending for the lower end of the distribution. Do ongoing data center buildouts and Mag-7 capital expenditure plans continue at the current pace or even accelerate, providing a durable investment floor for the economy.

Finally, there is the two sided risk around growth and inflation. Does the current slow down narrative quietly evolve into outright recession fears if tariffs bite, credit conditions tighten and policy missteps accumulate. Or alternatively, does growth remain more buoyant than expected because of aggressive fiscal and monetary support, in which case the combination of stimulative policy and resilient activity begins to reintroduce meaningful inflation pressures. In other words, does 2026 end up being a year where the main question is no longer whether the Fed will be supportive, but whether macro policy globally has tilted so far toward stimulus that the inflation genie risks slipping out of the bottle again.